Contents

How to Improve the Expense Reconciliation Process to Close Books Faster

Mohammed Ridwan

•

•

For every expense, teams maintain extensive documents like purchase orders, goods received notes (GRN), invoices, etc. With each increasing expense, the finance team has to spend more and more time on spend management — maintaining these documents, syncing data across accounting systems, ensuring proper approval, categorizing accurately, etc.

This manual process is time-consuming and prone to errors like missing receipts, employee fraud, unrecorded expenses, data entry typos, etc.

As a result, teams have inconsistent data across company systems and spend more time fixing these issues than focusing on their core activities. So, when finance teams strive to improve budget allocations, streamline expense tracking, and enhance financial reporting, they find themselves dedicating substantial time to addressing discrepancies among different financial databases and systems.

This blog will cover improving the expense reconciliation process and replacing manual and old methods with an improved solution.

What is Expense Reconciliation?

Expense reconciliation is a process that matches the actual expenses with the corresponding book entries. It involves comparing two sets of financial records, such as bank statements, credit card statements, receipts, etc., to identify and rectify discrepancies between them.

So, for every expense, you have an entry at an external source and in the internal systems. You match them together to ensure the accuracy of financial reporting, compliance with accounting standards, and prevention of errors or fraud.

However, companies rely on outdated systems — entry-level accounting tools, spreadsheet-based solutions, or legacy ERPs, which cannot handle end-to-end reconciliation processes. These compel finance teams to spend valuable time on manual tasks like data entry and receipt management, hindering reconciliation efficiency and increasing the risk of errors in financial data.

Hence, submitting and tracking expenses becomes cumbersome for employees, while finance teams face manual verification and reconciliation challenges. Managers struggle with delayed approvals, and the overall process becomes susceptible to errors, affecting accuracy and compliance.

How to Reconcile Expenses Faster

Invest in spend management software to reconcile expenses faster. With spend management software, you can track and monitor each transaction on a centralized platform in real time.

The automated process makes reconciliation simpler and faster by providing a single source of information and enabling advanced controls. You can create customizable approval workflows and specify spending rules to suit complex hierarchies and ensure compliance with company policies.

Especially with Pluto, each expense triggers the approval workflow and notifies employees to upload the receipt through WhatsApp. The accounting system integration syncs data across the financial systems to provide a consistent and accurate database.

Here is how switching to Pluto helps you reconcile efficiently and close your books of accounts ten times faster:

1. Easy to Identify Discrepancies

In a traditional manual reconciliation process, identifying discrepancies involves sifting through piles of paperwork or navigating complex spreadsheets.

With Pluto's automated system, this cumbersome task is simplified. The platform's alert system actively flags potential issues, promptly notifying users of duplicate receipts. It not only streamlines the identification of irregularities but also introduces a proactive layer of fraud prevention.

You can visualize and interact with discrepancies directly on the centralized platform, turning what used to be a tedious task into a more intuitive and efficient process.

2. Speed and Accuracy

Automation, real-time tracking, receipt capture (via optical character recognition (OCR)), approval workflows, and robust controls accelerate reconciliation cycles on Pluto.

You need not spend a minute on a manual redundant task. The platform captures and extracts invoices from emails and WhatsApp on a centralized platform. The trigger-based workflows ensure prompt approvals without any friction. Matching documents for three-way and four-way matching simplifies with all the documents on a single tool.

Therefore, the inherent accuracy of financial data, coupled with efficient discrepancy identification, ensures speed and reliability in the reconciliation process.

3. Real-Time Tracking and Visibility

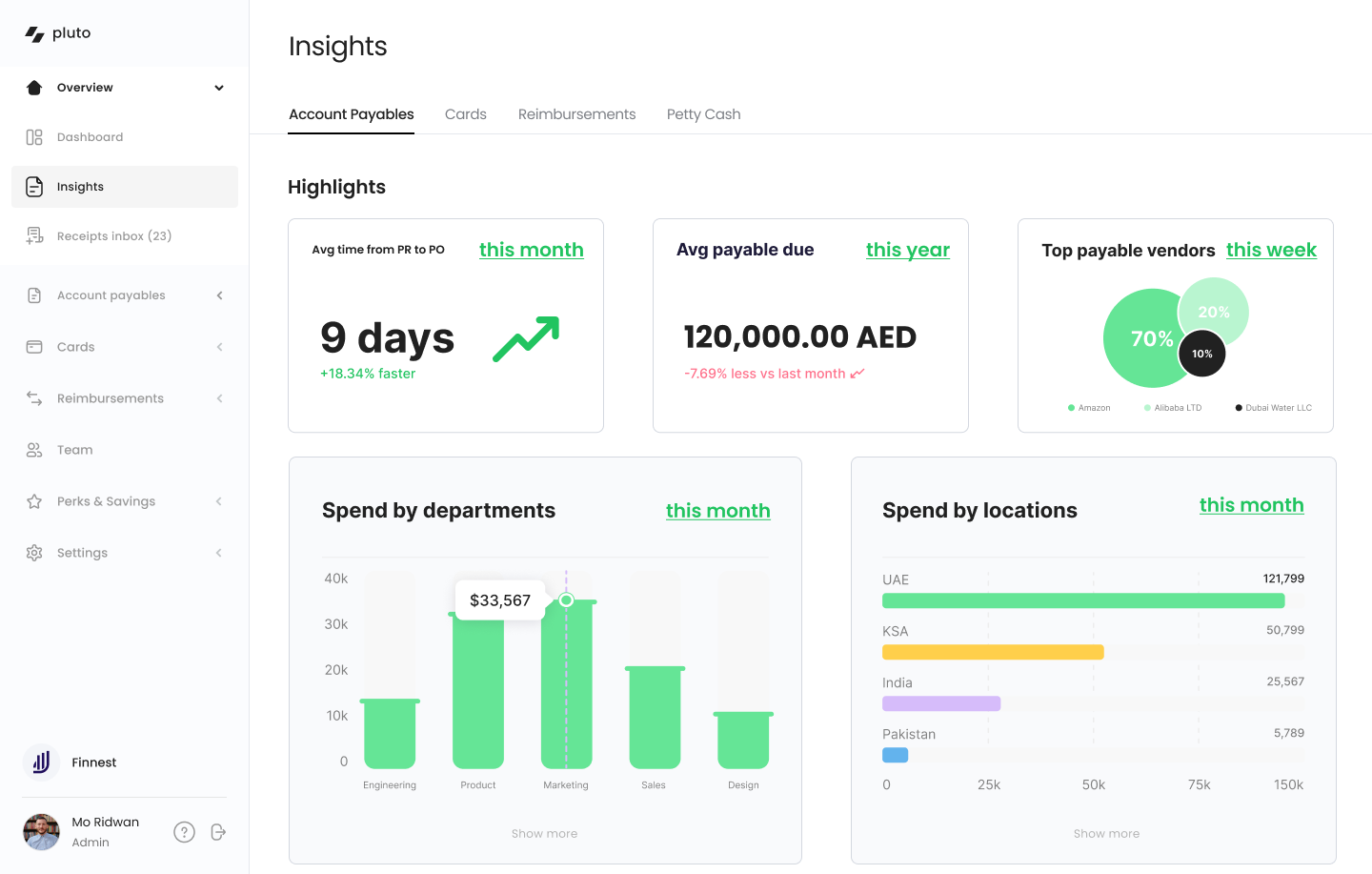

Unlike conventional tracking methods, Pluto offers real-time insights through its centralized dashboard. This furnishes internal teams with immediate visibility into transactions, guaranteeing proactive adherence to company policies.

The agility provided by real-time tracking enables timely data-driven decision-making based on the latest and most accurate data.

4. Better Data Sync for a True Picture

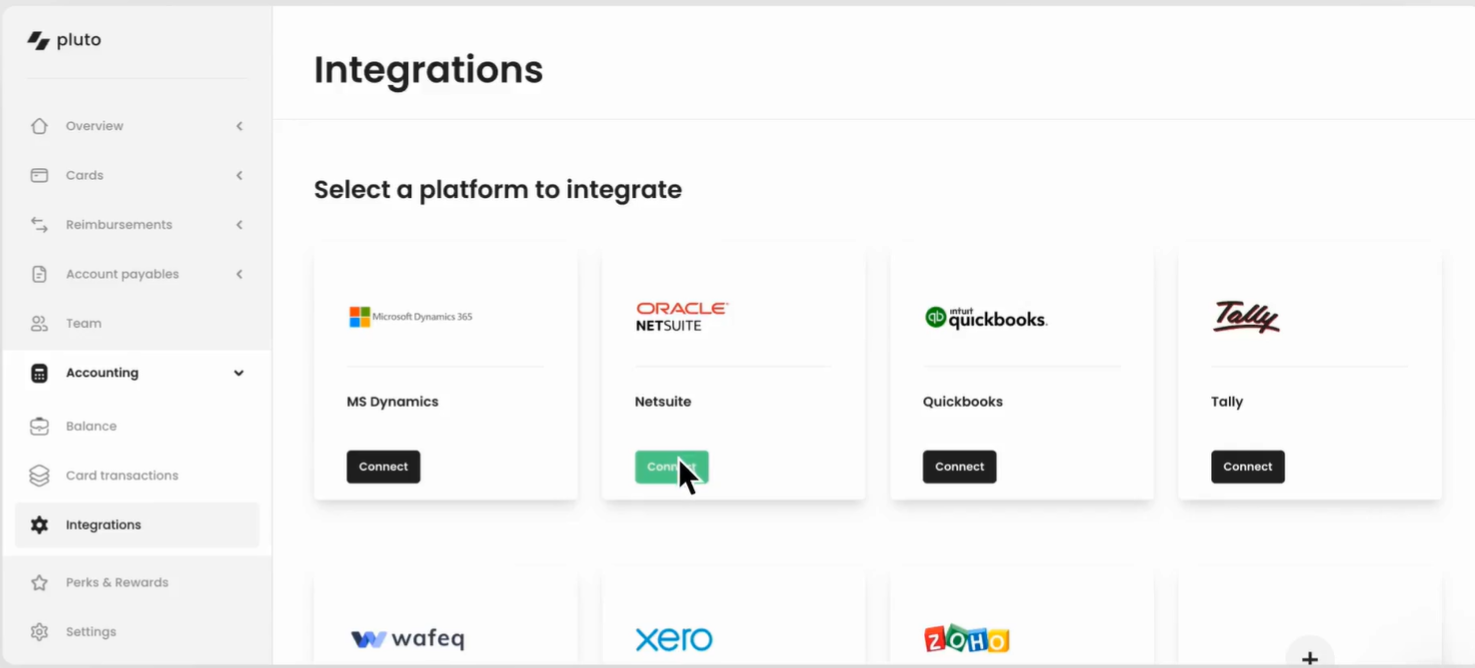

Manual data entry is prone to errors and delays, leading to discrepancies in financial records. Pluto's seamless integration with major accounting systems like Xero, Zoho, QuickBooks, Netsuite, and Dynamics ensures that the financial data is up-to-date and aligns with the organization's accounting records. This synchronization eliminates the need for manual adjustments and corrections, providing a true and accurate picture of the organization's financial status.

5. Enhanced Controls Over Processes

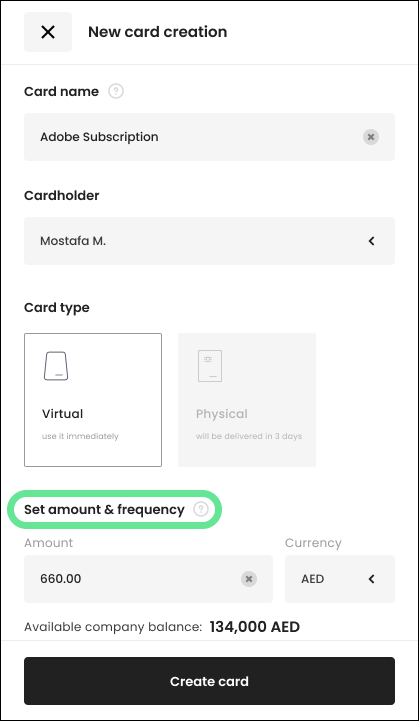

Building intricate approval workflows is simplified with Pluto. You can set up approval processes using simple if-then rules without the need for complex coding. Devise custom workflows that align perfectly with your company policies, creating a seamless and controlled process.

6. Traceable Audit Trail

Pluto maintains a traceable audit trail of all financial transactions and activities. It provides a comprehensive record of changes made to financial data. From the initiation of a transaction to any subsequent modifications, the traceable audit trail ensures transparency and accountability. This trail helps you avoid fraud and trackback discrepancies without friction.

Also, you can lock transactions post-approval, which adds an additional layer of security and integrity, facilitating smoother audits.

7. Save Time and Money

Automating financial processes, including procurement, expenses, and payables, significantly reduces manual steps in reconciliation.

Pluto's ability to capture general ledger and tax codes from expenses automates data entry. It reduces the time spent on routine reconciliation tasks. This efficiency allows finance teams to allocate resources more strategically, focusing on higher-value initiatives rather than repetitive manual tasks.

Timely financial insights help finance teams support decision-making processes with precision and confidence, fostering a data-driven financial ecosystem.

Internal Controls Strengthen Expense Reconciliation

Expense reconciliation burdens finance teams with time-consuming manual efforts and the constant threat of challenges like duplicate receipts and policy violations. These complexities lead to prolonged reconciliation cycles, hindering financial efficiency.

However, the actual progress happens when you strengthen internal control over financial reporting (ICFR), which is the anchor for successful automation in finance.

When you embrace ICFR strategically, it bolsters internal controls, protects against risks and fraud, and sets the stage for smooth automation. The impact goes beyond just easing manual work; it promotes precision, reliability, and transparency in financial workflows.

In simple terms, ICFR mitigates risks tied to financial inaccuracies. Read how to improve your ICFR framework for enhanced reconciliation processes.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

.jpg)

•

Vlad Falin

What is Spend Management? Importance, Benefits & Process

In the realm of business operations, effective spend management is crucial for maintaining a healthy financial bottom line. Businesses grappling with inefficient spending control face risks that can substantially impact their financial stability.

For example, poor invoicing practices that cause a delay in payment can lead to contract management issues or, even worse, a lost client for your business. It also might cause issues with some of your preferred suppliers if they feel they’re not being paid on time.

Making a slip-up that disrupts a subscription can mean your company lacks access to critical software or tools until the issue is fixed.

A poor expense report system means charges incurred on your business trip might result in many follow-up questions, so your accounts payable team is on the same page with purchase orders. A system without real-time visibility for spending data is not ideal for any organization and does not make it easy to reduce spend.

Intelligent spend management helps prevent these issues. A business uses spend management to comprehensively track and review organizational-wide spending and purchase orders down to the last dirham.

In this post we will deep dive into spend management and discuss the best ways to properly manage it.

What is spend management?

Spend management refers to the systematic process of tracking, analyzing, and controlling an organization's total expenditure. It encompasses all aspects of business spending, including invoicing, contract management, subscription services, and expense reporting.

The goal of spend management is to enhance financial stability by providing real-time visibility into all financial transactions and purchase orders. This comprehensive approach enables businesses to identify inefficiencies, reduce unnecessary expenses, and maintain strong relationships with suppliers and clients.

The Importance Of Spend Management

Effective spend management is crucial for a company's financial health and operational efficiency. Neglecting careful expenditure tracking or allowing excessive indirect spending can lead to significant revenue loss, risking even the most well-planned business strategies. Managing costs and enhancing efficiency becomes challenging when financial processes are time-intensive and complex.

A report by McKinsey highlights the critical nature of this issue, noting that external spending on suppliers typically represents 40-80% of a company's total expenses. This statistic underscores the vital importance of meticulous spending control. Furthermore, the process of reviewing and optimizing expenditures can have a substantial impact on employee workloads, indicating the far-reaching effects of spend management.

Adopting robust spend management practices enables companies to achieve greater financial stability and avert potential crises. Implementing a system that tracks and monitors all financial transactions ensures that expenditures are fully accounted for, reducing the likelihood of wastage. In summary, efficient spend management is not just about cost control; it is a strategic approach that influences every aspect of a company's operations and contributes significantly to its long-term success.

{{cta-component}}

Advantages Of Digital Spend Management

In this day and age, using an online tool to keep track of your expenses should be a no-brainer. Let’s have a look at some of the main advantages.

1. Insight Into Everyday Expenditures

Where is every dirham your company makes going? If you don’t know, digital spend management will dramatically strengthen financial accountability, budgeting, and expenses. In addition, reporting on where company funds are flowing makes it much simpler to see how different department heads oversee budgets. Read more on how to improve internal control over financial reporting.

2. Stronger Financial Controls

Spend management tools like Pluto, allow you to not only monitor your spending in real-time but also set the limits on the go. In addition to that you can issue cards for departments or individuals, and even focus them on a particular type of usage, such as specific vendors only.

3. Budget optimization

Effective spend management is a great solution to ensure a better-looking budget. Analyzing and managing spending makes it simple to find and cancel unneeded services, negotiate lower prices with new supplier contracts, and never have to pay a late fee again. It will also significantly help your board of directors as they’ll have a simplified, streamlined budget to review and discuss at the start of the year.

Common Spend Management Challenges

It’s easy to pursue spend management practices that hurt your business’s bottom line if you’re not careful. Many ‘traditional’ best practices might not fit companies with remote-first work policies, engage in cutting-edge industries, or have an unorthodox structure.

If your company has a dynamic structure, spend management becomes all the more important to help you keep up with the competition and get the most value out of every dirham spent.

Keep these potential challenges in mind as you pursue spend management practices.

1. Relying On Old Spending Data

Be wary of relying on old budgets or financial data when managing more spend. It’s challenging for leadership to identify problem areas with cash inflows or outflows, when they only have outdated information.

2. Over reliance On Manual Mapping

Having to go back at the end of the month to match spending to budgets manually can take an inordinate amount of hours and opens the door to errors and mistakes that can throw off a spend management policy.

Pluto helps to automatically match spend to budgets in real-time, ensuring accounting and finance teams have accurate updates.

3. Harnessing Too Much Technology

Modern financial software can dramatically help your company’s day-to-day operational flow. However, if these solutions do not work together, chaos can ensue which leads to data migration and processing errors. Pluto integrates with your accounting tools, cutting the data flow time significantly.

4. Outdated Processes

The post-COVID world of remote and digital work means your employees might be scattered across the globe and in different time zones. Having to arrange shared corporate cards manually or coordinate team spending with employees in different locations can be tricky. Pluto offers unlimited virtual cards, which allow you to provide a payment channel for any employee anywhere in the world.

How To Improve Your Spend Management Process

Optimizing your spend management process might seem tricky at first glance. Fortunately, small and large businesses often rely on the same core strategies to optimize spending.

1. Rely On Spend Management Software: Pluto can help automatically track expenses, keep abreast of budgeting, and help manage strategic sourcing. CEOs and CFOs then have relevant, real-time data at their fingertips to see where their company is financially.

2. Focus On A Few Payment Methods: Do you have too many company cards in your pocket? It might be time to streamline purchasing methods to help simplify your spend management strategy. For example, your business can dramatically improve expense tracking by asking employees to only use company cards for business expenses instead of asking for their personal cards to be reimbursed.

3. Have An Organized Approval Process: You can clarify your spending process (you might want to check our post on how to create a corporate card policy) by ensuring employees have a clear hierarchy of how and by whom purchases need to be approved. If your team is unclear, they might complicate the payment process by not filing the right reports, which means your financial team could be left in the dark about purchases.

6 Efficient Spend Management Strategy Tips

Your company needs to optimize its spend management strategy to ensure the final results lead to reduced procurement costs, improved efficiency, and streamlined workflows.

Spend management best practices also help improve vendor relationships and communication, procure the optimal goods and services your business needs, and even help you earn volume and early payment discounts due to more effective and simplified financial practices.

Keep the following steps in mind for the best results regardless of your organization’s industry or size.

1. Calculate Expenses

Do you know exactly where employees spend company funds? If not, you’ll need to build a comprehensive list of company expenses, suppliers, and entities where funds are going.

This might quickly become a challenge if you’re in charge of a large business. If so, look to designate specific team members to review employee salaries, utilities, marketing, training, and all other day-to-day expenses to have the most detailed list.

You can’t improve what you do not measure. You can use Pluto to get a firm grip on your expenses. Pluto allows you to monitor and control your expenses so you clearly see how much was spent in which category.

2. Confirm Data

You’ll want to ensure all accrued expense data is accurate and can be cross-checked with receipts and inventory records. Ensuring transaction data is precise, and expense lists are free of duplicates, spelling mistakes, and other mistakes makes the entire spend management process more efficient.

Take this step extremely seriously if your company spend practices have relied on more manual processing methods. Standardization ensures that multiple currencies, formatting differences, and other nuances are accounted for when looking at spend analysis data.

(Goes without saying that when using Pluto this is all pre-done for you!)

3. Categorize Information

While optimal spend management brings all expenditures under a single umbrella to review, your team will still want to categorize expenses into various groups to make reviewing and making adjustments across different departments simpler.

It’s usually best to categorize expenses in multiple ways to understand where money is going. Pluto allows you to categorize expenses both through specialized cards or just by tagging, so everything is nicely grouped together when it is review time.

4. Review Expenses

A well-thought-out process of calculating, verifying, and categorizing spending information will simplify your entire review process when you’re looking at spend data.

You should immediately be able to spot expenses that are anomalies or recurring spending that might be able to be cut out from the start.

Pluto’s dashboard can give you a high level but also a detailed view, so you can clearly identify trends and separate expenses.

5. Devise A Strategy

You’ll want to move decisively once you’ve identified potential changes to spending habits and department budgeting approaches.

It might seem difficult at first glance to start reducing budgets, cutting out vendors, or make other dramatic changes to your company’s budget and expense habits. Rely on good change management practices and your leadership team to cultivate employee and stakeholder buy-in to any adjustments.

6. Practice Good Data Forecasting

Keep updating your expense data as you make a budget and spending adjustments. Doing so keeps your team on top of where funds are going and can help forecast different spending scenarios and how they might impact your business’s bottom line.

Keeping data and information updated becomes particularly important if your expenses grow to ensure financial operations run smoothly. Don’t forget to cultivate supplier relationships if you work with different vendors for optimal inventory management.

Should You Rely On Spend Management Software?

Manually processing expense claims, keeping up with petty cash, and tracking company credit cards can quickly turn inefficient, hinder your company’s financial management, and inhibit the overall procurement process.

In contrast, the right spend analysis solution can aid real-time expense tracking, provide easy-to-read charts and graphs of high-level expenses, and capture and store financial-related documents, so your finance team members are not scrambling to find a receipt or report.

Pluto has a multitude of features including procurement software and account payable that will help you with spend management and make spend control much easier.

1. Flexibility

Pluto allows you to create cards for various purposes, edit spending limits on the go and monitor your expenses in real time. This allows you to scale up or down depending on what your business needs at any given moment.

2. Powerful Analytics

With Pluto, you will be able to track spending patterns and areas of high expenditure and get real-time insights into your business finances. The powerful analytics will help you make better decisions about where to allocate your resources.

3. Ease Of Use

The main bottleneck of many spend management platforms is that the employees do not use them - as it is just too time-consuming. Not with Pluto! The sleek and user-friendly interface makes expense management a breeze.

4. Simplified Reimbursements

Receipt upload and reimbursements can be quite a burden for the team. Pluto allows you to take pictures of receipts with your phone and just add them to your reimbursements list. With the use of categories and tags, you will be able to both submit and review them in record time!

Key Takeaways For Company Spending

Spend management remains an essential component of all organizations regardless of size. Accountability for every dirham flowing in and out ensures your company maximizes revenue and remains growth-focused, no matter the budget.

You can take the first step today by relying on Pluto and processes to establish control over budgets, track spending, manage payments, cut costs, and boost your financial team’s day-to-day operations and processes.

•

Vlad Falin

How To Manage Your Company Spending In 2024?

When it comes to growing a business, many executives focus on increasing profits and growing revenue as the way to achieve their goals.

However, one aspect of growth that is sometimes overlooked is the expense management of your organization, and how to make it more efficient.

Without proper spend management strategies, your efforts to grow the company revenue could be easily sabotaged by overstuffed budgets, inefficient spending, and a lack of expense tracking that hurts your bottom-line when tax season comes around.

That’s why this article will discuss the importance of managing your company spending, and how to do it efficiently!

The Importance Of Company Spending Management

Business spend management is a combination of strategies and business tools used to track, analyze, and manage business spending, in particular in regard to supplier relationships.

When companies are unable to track and control their spending in real-time, they may expose themselves to financial leaks and lose revenue in the long run.

The majority of a company's costs come from external expenditures, which account for 40-80% of its total costs. A lack of efficient spend management can have disastrous effects on your business; the statistics speak for themselves.

As a result, businesses that understand and wish to mitigate this risk need to use spend management software to do the heavy lifting. Not only does the software offer cost-saving opportunities, but it also prevents overspending.

A spend management solution becomes particularly crucial when it comes to tax reporting, as the expense documenting process simplifies the tax reporting, which makes it easier to receive tax breaks and avoid hefty penalties.

For the United Arab Emirates region, corporate income tax (or CT for short) will be applied to business activities starting on the 1st of June 2023. You’ll be charged 9% for taxable income exceeding AED 375,000, but 0% if your annual taxable income falls below that threshold. As such, keeping track of your expenses and managing spending will be even more important than ever.

Benefits of Expense Management

The importance of spending management is not limited to enterprises with large expenses, but also to small and medium-sized businesses looking to improve profitability, scalability, and sustainability.

There are several benefits to spend management automation, regardless of your business size. These benefits include:

An in-depth analysis of all spending

Saving money for your business requires analyzing all aspects of it in order to find cost-cutting opportunities or other areas of improvement.

Pluto gives you a general overview of your operations in terms of costs, as well as an in-depth analysis of your spending, making it much easier to find what you are looking for.

Maintaining an efficient budget

When it comes to proper spend management, your budget is crucial. But building a proper budget requires that you have both an eagle-eye view of your business, as well as attention to the smaller details. This is made much easier through the use of spend management software.

Control over company spending in real time

It’s much harder to make efficient decisions about your spending when you are basing them on data that is already outdated.

With Pluto, you’ll be working with real-time data to ensure your decisions are based on current information.

An easier time identifying and eliminating out-of-policy and fraudulent expenditures

It’s harder to reduce out-of-policy spending when you can’t track it effectively. Pluto will help you automatically detect fraudulent and out-of-policy employee expenses and alert you to them.

Payables can be tracked and processed easily

If you are managing your expenses properly and using the right account payable software to do so, you won’t have an issue keeping track of your payables, as well as have a better overview of your spending.

Better negotiations with your suppliers

You can make better decisions when it comes to your supply contracts and purchases when you have real-time data of your expenses.

Using Pluto's unified spend management dashboard, finance teams can always see where money flows. Pluto's procurement software enhances the visibility of financial transactions, enabling more informed decision-making for procurement and sourcing processes.

Budgeting is the key to delivering on your promises, growing your team, enhancing your product offerings, and weathering inevitable economic downturns.

The Problem with a Manual Spend Management Process

Trying to manage business spending without proper oversight and strategies in place is like putting all your home expenses on a credit card without checking the statement every month. You might not know what you are facing until it’s too late.

If you don't implement intentional spend controls, you may still be profitable, but you won't know when your situation will change or how close you are to the edge.

The importance of spend control becomes more obvious to companies, especially growing ones, after they face a tight situation or a disruption to their business. As a result of these problems, businesses can experience budget overruns, erratic cash flows, supply chain management issues, and deteriorating customer relations.

But traditional spend management techniques are limited, which is where the aid of software comes into place. If you limit yourself to manual spend management strategies, you might face the following issues:

- Outdated spending reports: Traditional methods of managing spend tend to produce spending data that is at least a month old. As a result, finance teams have difficulty identifying and correcting unnecessary spending before the damage is done.

- Overspending: Overspending and budget noncompliance are a consequence of finance teams being unable to track real-time spend. Costs like these can quickly add up to cause trouble for tax authorities as well as overspending.

- Inefficient strategies due to lack of real-time data: If you lack real-time data and work only based on reports that are outdated, you might be missing the forest for the trees. This could have the effect of optimizing your spending rather than improving your overall business process efficiency. In order to cut costs and optimize operations, real-time spend data is essential.

- Manual entry errors: Data entry errors skyrocket if your finance team has to move data between multiple software programs and map employee spending manually. As a result, financial reporting could be delayed.

- Issues with remote working and compliance: Employees who work remotely need to pay for other business expenses quickly and in accordance with compliance requirements. The traditional spend management system, with its shared corporate cards and lengthy approval processes, simply cannot keep up.

- Strained resources: It takes finance teams a long time to manually align expenditures to budgets after the expenditures have been made. This takes up many productive hours and, of course, can lead to errors when entering data.

How To Manage Company Spending

Managing your company spending is both a science and an art, but much more the former than the latter.

Each business will have its own unique challenges to overcome when it comes to spending, but there’s still general strategies you can adopt that will fit most situations.

Create a Budget that Accounts for the Future

When it comes to budgeting, you shouldn’t just think about the expenses in front of you, you also have to consider potential unexpected expenses.

If you limit yourself to budgeting for the present, you’ll have a hard time dealing with expenses that can pop up out of nowhere.

Your budget should be realistic, but also reviewed frequently to ensure it is still appropriate for your business as it grows and evolves.

Creating a good budget will require that you examine your current and past expenses, take a look at your spending habits, and consider your potential expenses as your business grows.

This will give you an opportunity to review your existing processes, expense policies, and track expenses that you might not be thinking about.

Use Zero-Based Budgeting

It’s not uncommon for organizations to focus on past expenses and budgets when creating a new one.

However, businesses and the environments around them change, and so budgets need to change as well.

That is where zero-based budgeting comes in. This technique creates a new budget from scratch for each budgeting period. The budget is then compared to past budgets and weighed against current expenses.

In a company, zero-based budgeting can be used to keep your expenses under control. Your budget needs to be a living breathing element of your operation, and as such you need to constantly evaluate it to find realistic cost-cutting opportunities and areas that can be made more efficient when it comes to expenses.

Report and Track Your Expenses

Any expenses incurred should be documented and filed as soon as possible. This way, your business expenses are accounted for when filing its tax return. This is one area where the use of spend management software becomes crucial, as it dramatically simplifies the process of reporting and tracking your expenses. Pluto helps to categorize said expenditure, further assisting you when it comes to tax season.

Use a Spend Management Platform to Automate Processes and Digitize Expenses

As your business grows, you’ll find that using a spend management tool to track your expenses saves you a lot of time and money. In addition to tracking expenses, it tends to offer many other features, such as the ability to track invoices, payments, and credits all in one place.

Furthermore, Pluto gives you the ability to assess your expenses on the go, thanks to mobile apps and online dashboards.

It is easier to keep track of your expenses and receipts by digitizing them. Employees can do this by taking pictures of their receipts as soon as they receive them. These images can then be uploaded and tracked through Pluto.

Automating your approval workflows and processes will help to reduce, if not outright eliminate, human error.

Key Spend Management Software Features

Using spend management software is almost mandatory if you want to make your spend tracking and reporting as efficient as possible.

When looking to choose a platform, consider the following features:

Complete Control Over Spending Data

If your finance teams don’t have complete control over spending, real-time data cannot be of much use to your business.

Pluto allows your business finance managers to streamline and automate processes with superior customizability and control over workflows.

This freedom allows admins to change or optimize workflows as business/processes scale.

Real-time and in-depth spend analytics

Managing company funds efficiently is the essence of spend management. In order to do that, you need to keep track of your employee expenses as they occur.

Pluto records employee expenditures in real time and provides you with a reliable picture of what they are spending.

You can control expenses by using real-time expense tracking without restricting your employees’ work.

Additionally, Pluto provides your finance team with insights and analytics based on all the data it gets. A feature like this is crucial for proper management, especially if your goal is to cut costs and optimize spending through automation.

Your finance team will struggle to drive meaningful change without detailed analytics, requiring them to go through reams of data and make sense of it.

Reports on expenses provide an overview of your expense history, making it easier to track down individual purchases. Maintaining accurate records, limiting expenditures, and avoiding fraud are all made easier with this functionality.

Easy to Use

The most advanced software in the world is worthless if no one wants to use it. Simplicity and ease of use of essential business software, such as spend management, should therefore be a priority.

You might find, for instance, that employees don't use your spend management software if they find it clunky and difficult to use. This can result in a manual spend reporting process that is time-consuming and error-prone.

A lot of time is spent by businesses storing and processing invoices, receipts, and purchase orders.

Pluto makes it easy to retrieve and keep track of essential documents, including matching documents to authenticate transactions, for record keeping and due diligence.

An all-in-one platform

Your spend management platform should be a centralized solution for all your spending needs. Keeping all company spending in one place, in real time, is more efficient (and more secure) than using multiple smaller tools.

Pluto has it all:

- Unlimited virtual cards

- Spend management platform

- Real-time analytics

- Real-time spend control

Essentially, anything that will allow you not only manage your expenses, but really take you spending under control and make sure that everything is at it's maximal eff

Key Takeaways

Managing your company spending is a crucial aspect of company growth that is sometimes overlooked. Proper spending management strategies can help you find cost-cutting opportunities, gain a better overview of the health of your business, and simplify your tax reporting to avoid penalties.

When it comes to developing effective spending management strategies, you should focus on creating a budget that can evolve with your organization, reporting and tracking your expenses in real time, and using a spend management platform to automate and simplify your expense tracking and reporting.

•

Vlad Falin

How IT & Procurement Teams Should Evaluate Spend Management Products

In today's fast-paced business world, managing expenses can be a daunting task for IT and procurement teams.

To help you out, we compiled a list of features and functionalities that you should consider when picking your spend management platform.

Spoiler alert, Pluto has them all.

PCI DSS Level 1 Provider

One of the essential features that should be given high importance is the product's PCI DSS Level 1 compliance.

The Payment Card Industry Data Security Standard (PCI DSS) is a set of guidelines and security requirements designed to safeguard payment card data.

The standard was developed by major credit card companies, including Visa, Mastercard, American Express, Discover, and JCB, to ensure that all companies that handle payment card data maintain a secure environment. PCI DSS compliance helps to prevent fraud and data breaches, protecting both the company and its customers.

PCI DSS Level 1 is the highest level of certification a company can achieve for PCI compliance.

It requires companies to undergo a rigorous independent audit to ensure compliance with all 12 of the PCI DSS requirements, including network security, access control, and vulnerability management.

Achieving PCI DSS Level 1 certification demonstrates that a company has a comprehensive and effective security program in place to protect payment card data.

When evaluating corporate spend management products, IT and procurement teams should look for products that have achieved PCI DSS Level 1 compliance to ensure that the product meets the highest security standards.

This will help to ensure that the company's payment card data is adequately protected and that the company is meeting its compliance obligations. By prioritizing PCI DSS Level 1 compliance, IT and procurement teams can help to safeguard their company's reputation and financial well-being.

Being PCI DSS Level 1 compliant is essential for any organization that handles corporate card information, as it provides a high level of security and assurance that the organization is taking all necessary measures to protect its customers’ data.

Pluto Card is proud to be PCI DSS Level 1 compliant. This means that our customers can trust that we have taken all necessary measures to secure their data and protect it from unauthorized access.

We also partner with vendors who are held to the highest security standards, such as PCI or SOC2 compliance.

Passwordless Login

Passwordless login is a secure and convenient way for users to access their accounts without the need for a password. It is an effective way to protect against unwanted access to your account, as passwords can be easily compromised or stolen. By tying your Pluto access with a company email account provided by your organization ensures that when your employees lose access to their company email address they also lose access to Pluto.

At Pluto Card, we understand the importance of passwordless login, and we offer this feature to our customers. With our passwordless login feature, our customers can access their accounts quickly and securely, without the need for a password.

Activity Log And Audit Trails

Activity logs and audit trails are crucial for ensuring strict auditing everywhere. An activity log records all user activity within an application or system, while an audit trail provides a record of all changes made to data within the system.

Pluto Card offers a 7-year audit log, which means that our customers can track critical changes made to their data over a seven-year period.

Data Access

Employees that are using our platform have only as much access as they need, and we have infrastructure redundancy built into Pluto, which means that all compute and data is run in multiple geographies.

Business continuity is paramount at Pluto - to this end, we ensure data redundancy with redundant backups in multiple geographies as well.

In addition, at Pluto, your application data is always encrypted in transit, and at rest.

Continuous Security Scans

Pluto also provides a continuous security scan, which tackles multiple dimensions, including code or dependency vulnerabilities, infrastructure, and public endpoint scans.

Our customers can be assured that we take security very seriously and are always on the lookout for any potential security threats.

In the event of a security incident, we have an immediate incident response plan in place and will notify impacted customers without undue delay of any unauthorized disclosure of customer data.

24x7 Customer Support and Dedicated Account Manager

In addition to these security features, Pluto Card also provides 24x7 customer support.

We understand that our customers need support around the clock, and we are always available to help with any questions or issues that may arise.

Data Infrastructure, Redundancy and E2E Encryption

We also provide infrastructure and data redundancy, which means that our customers’ data is highly available and secure, even in the event of a system failure or outage.

Data is always encrypted in transit, which means that it is always protected during transmission between servers or devices.

Finally, another crucial feature that IT and procurement teams should consider when evaluating corporate spend management products is data residency and retention policies.

Pluto Card offers an audit trail for changes to customer data, so we can track who did what.

Additionally, we have a data residency promise of 7 years, which means that we retain customer data for that period of time.

This can be important for compliance with regulatory requirements, such as tax or financial reporting.

Conclusion

In conclusion, when evaluating corporate spend management products for your enterprise, it’s essential to consider the security features that the product offers.

PCI DSS Level 1 Compliance, passwordless login, activity logs and audit trails, and data residency and retention policies are all critical features that can help ensure the security and integrity of your organization’s financial data.

Pluto Card offers all of these features, along with 24x7 customer support and infrastructure and data redundancy, making it an excellent choice for organizations looking for a secure and reliable corporate spend management solution.

For more information visit Pluto and book a demo.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use