Contents

Top 6 Spend Management Software for Businesses in the UAE (2023)

Mohammed Ridwan

•

•

Managing business spend is a key concern for most companies. The use of spreadsheets, paper receipts, paper vouchers and handwritten notes makes processes inefficient, time-consuming, and resource-intensive. It also reduces the finance team’s visibility over the company’s spend.

The lack of control over spend causes stress within finance teams, who lag behind due to lack of visibility. Moreover, the cash chaos leads to unspoken internal resentment wherein CFOs think that their teams aren’t providing the necessary key financial insights they require.

A spend management platform can solve this problem. But not every software offers the same functionalities and benefits. You need to select the one that has a good UX and in-depth offerings, enables more reporting, is flexible and scalable, integrates with your ERP, supports the complexities of your business, and has robust security. It should also fit into your organizational structure.

To help you choose the most suitable one for your organization, this article will cover the top 7 spend management software to manage your corporate spending.

- {{finance-teams-time="/components"}}

What Is Spend Management Software?

A spend management software is a tool that helps manage corporate spend, i.e., all non-payroll expenses. It does this by:

- Simplifying capture, storage, and retrieval of receipts and documents to reduce the risk of misplaced receipts

- Deploying approval workflows to ensure that business spending follows the company's approval hierarchy

- Providing real-time visibility into business expenses, helping to identify any irregularities

- Generating alerts when an expenditure violates company policies

- Automating employee reimbursement processes to reduce delays in employees getting paid

- Maintaining a complete audit log, including spending approvals and changes

- Easily sync with your ERP/accounting tool for streamlined month-end close

- Managing petty cash expenses by tracking and recording small, miscellaneous expenses in real-time

- Facilitating payment capabilities to handle outgoing financial transactions

- Integrating corporate cards for real-time expense tracking and control spending

- Facilitating procurement processes for the purchase of goods and services

- Handling invoice management to ensure timely payment and record-keeping to foster healthy vendor relations

Hence, spend management software provides financial visibility and control.

Top 7 Spend Management Software

These are the top 7 spend management software to consider:

1.Pluto

Pluto is a spend management platform for enterprises that transforms your finance processes with automation to provide more visibility and control. It brings together the spenders, savers, and sourcers of your business to offer a complete revolution from a chaotic spend management system to a seamless collaborative workflow. It is the fastest way to manage your finances, including account payables and employee reimbursement.

Key Features:

- Custom approval workflows that adapt to the company's hierarchy for timely and accurate approvals

- Facilitate intricate multi-layer workflows to adapt to complex hierarchies to support seamless purchase requests and automate purchase orders

- Unlimited corporate cards with budget controls to maintain expenses within corporate policies

- Offers zero-balance cards, which get funded once the expense is approved.

- Card-specific policies to make branch & subsidiary-level reimbursements easy

- Ability to add comments and document the conversation along with other transaction details to maintain a comprehensive audit log

- View-only access available for external accountants to review financial data without making changes

- Automated receipt capture through OCR, with the ability to support bulk upload via WhatsApp and emails

- Alerts in case of duplicate receipt uploads to avoid fraud and compliance issues

- Custom expense reports to overview business expenses and spending trends

- Integration with accounting platforms like Netsuite for advanced general ledger (GL) coding, tax tracking, vendor syncing, etc.

- Secure document storage with a 5-year audit log and bank-grade encryption

Pricing:

Pros:

- Enables branch & subsidiary-level spend tracking (not offered by other platforms)

- WhatsApp integration to make receipt upload easy

- Offers up to 2% cashback on all non-AED transactions

- Independent PCI DSS Level 1 Certification

Cons:

- Slightly longer on-boarding due to corporate card offering

- Integrates with all other major ERPs except Tally

2.Procurify

Procurify simplifies spend management by accelerating the approval and reconciliation process. It helps to track the business spending with real-time tracking and breaking down data silos. With a core focus on simplifying invoice payments and management, it helps businesses in vendor and spend management.

Key Features:

- Ability to approve requests based on attached receipts and leave comments for clarification

- Custom budgets for different departments or projects

- OCR to auto-extract invoice data with a dedicated centralized invoice box and automatic matching with purchase orders

- Detailed reports based on different departments, categories, or other relevant parameters

- Tailored expense request forms to capture specific information relevant to the organization's needs

- Compatibility with multiple currencies, streamlining international expenses

- Storage of all expense-related documents, including receipts, invoices, and expense reports

- Integration with ERP to sync expense data

Pricing:

It has standard all-in-one pricing of $2000/month. But custom pricing quotes are provided for add-ons like more users, more domains, NetSuite integration, on-premise training, implementation services, and on-premise hybrid implementation.

Pros:

- Easy to make amendments, for instance, to invoice amounts, which helps when raising a PO before receiving the invoice

- Responsive support team when handling technical issues

Cons:

- Does not offer corporate cards in UAE

- Only supports procurement based spending

- Poor reporting capabilities—lacks functionality

3. Spendesk

Spendesk combines approvals, corporate cards, expense reimbursements, and invoice management to automate the spend management process. Specifically designed for finance teams, it offers real-time expense tracking and offers custom workflows for complete control. By consolidating all payments, it provides a spend management solution that enhances financial transparency.

Key Features:

- 100% digital expense reports

- OCR technology to capture and extract key details from receipts

- Expense claim history, available anytime, anywhere, for quick and accurate reporting

- A mobile app for quick reimbursement requests by snapping a photo of receipts

- Real-time expense monitoring to spot errors and missing receipts and stay compliant

- Automates categorization of expenses and VAT account

- Detects duplicate invoices and errors to support three-way matching

- Tracks all purchase orders and invoices with the ability to schedule payments

Pricing:

Request the sales team for a custom quote. A free trial is available.

Pros:

- Single purchases are straightforward and simple

- Easy to integrate with an SSO provider, making login easy and secure for users

- Handy drag-and-drop receipt functionality

Cons:

- Virtual cards are glitchy, with merchants rejecting transactions that have already gone through

- Some basic features are not included in the basic option where they should have been (i.e., memorizing accounting patterns for vendors).

- Corporate cards have defects (especially for travel expenses)

4. Airbase

Airbase simplifies expense reporting with AI and ML. It ensures quick, hassle-free, and smart corporate expense management. It is an automation solution for SMBs and large enterprises. It packages various modules such as AP automation and corporate cards to ease the spend management process for accounting teams and employees.

Key Features:

- OCR to populate details, including GL category, date, amount, and purpose

- Ensures compliance by sending reminders and, if needed, locking cards until policies are met

- Reminders to upload receipts, eliminating the need to chase employees for receipts

- Custom approval workflows and budget limits for physical cards

- Real-time alerts for suspicious activity, enabling quick responses to potential fraudulent purchases

- Supports onboarding with a self-service vendor portal and custom questionnaires

- Facilitates payments and approvals, including multi-subsidiary support, international currency, and real-time GL sync

- Real-time audit trail with receipts, notes, and documentation for transparency.

Pricing:

Request the sales team for a custom quote.

Pros:

- Intuitive and easy to use; no training or previous knowledge required

- Seamless approval workflows

Cons:

- Poor reporting capabilities

- The mobile app is slow and takes time to load pages

- SSO-based login sometimes takes a few tries

- Not suitable for complex branch-level approvals and expenses

5. Coupa

Coupa is a cloud-based automation platform to manage business spending, ranging from procurement to expense management. It facilitates supply chain optimization by providing visibility and control. It streamlines expenses, reduces risk, and ensures compliance by automating reporting, simplifying reimbursements, and offering mobile tracking.

Key Features:

- Offers virtual payment cards for pre-approved expenses, speeding up the reconciliation

- OCR technology and integration with accounting software eliminates manual data entry

- Provides expense reports with intelligent algorithms to prevent fraud and ensure compliance

- A centralized view of all expense spending, enabling accurate assessment

- Enables visibility and control over travel expenses before they occur, ensuring budget control

- Simplifies procurement by offering a centralized area for comparing items from various suppliers and managing punchouts and hosted catalogs

- Provides real-time visibility into purchase orders, order lifecycle, and order line availability

- SmarterTrip feature to automate expense tracking based on the user's location, including mileage and receipt capture

Pricing:

Request the sales team for a custom quote.

Pros:

- Several categories and filters in the analytics section to streamline data

- Chat option enables approver and claimant to discuss issues with receipts

- Enables setting up of customized approval chains and including additional new approvers

Cons:

- Lots of unnecessary notifications, making it difficult to select the ones that need action or comment

- Low receipt searchability, making retrieval time-consuming

- Inconsistent syncing of remit-to address from NetSuite

- Complex to implement and not intuitive, forcing admins to spend more time resolving employees' queries

- Slow customer service

- Very expensive

6.BILL

BILL simplifies expense tracking by providing real-time visibility and customization to manage expenses. It is a spend management solution for SMBs to control payables, receivables expenses, and all corporate expenses. It allows businesses to combine a scattered spend management process into a single platform with seamless syncing.

Key Features:

- Provides credit limits ranging from $500 to $5 million to control spending within constraints

- Makes it easier to monitor spending with real-time visibility into the business finances

- Custom approval workflows to speed up the approval process with minimal friction

- Multiple payment options, including ACH, credit card, check, international wire transfers

- Automates purchase order workflows with the ability to sync and automate two-way matching and three-way matching

- Ability to do quick coding and sync with accounting systems to streamline expense reconciliation

- Enables automated receipt matching, categorization, and expense reporting, reducing administrative workload

- Offers security features, including the ability to freeze and create corporate cards instantly

- Notifies administrators of each employee's transactions, ensuring timely oversight

Pricing:

Bill provides a free trial and essentials pack starting at $45 for six standard user roles. Its team and corporate pack are for $55 and $79, respectively. Enterprises need to request a custom quote.

Pros:

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons:

- Customer support is difficult to initiate, slow, and unresponsive

- Frequent changes in the interface create confusion for users

How to Choose the Right Spend Management Software

To pick the right software, understand your organization's unique needs.

- What are your goals—cutting costs, enhancing compliance, or making expense processing more efficient?

- What issues do you face with expenses now—a time-consuming process, too many errors, or poor vendor relationships?

- How many employees will use the software, and should it be scalable to accommodate future hires?

- Do you have specific industry rules or in-house policies the software must follow?

Consider these eight factors:

Ease of Use

The software should require minimal training or support with a not-too-steep learning curve. Admins shouldn’t have to spend hours training their employees.

Automation

Choose software with features like automated approval workflows, expense categorization, and notifications. This will improve not only visibility but also accuracy and speed. You will have complete control over finances without having to do tedious manual tasks.

Security

Pick software that complies with security and is certified. It should provide data encryption, role-based access control, and regular security updates.

ERP Integration

The software should integrate with existing financial and accounting systems. This provides a unified view of your financial data without any disruptions. You shouldn’t have to sync data from multiple sources, which can add up to the manual tasks.

Document Capture and Retrieval

Pick a software that has simple document capture and retrieval capabilities. Attaching or retrieving receipts, invoices, and other relevant documents should not take more than a minute. OCR-based software that detects the information to auto-populate expense reports is better than that requiring manual entry.

Budget Control

Select software that enables specifying budgets for different projects, departments, or expense categories. It should be able to monitor the set budgets and raise alerts in case of breach. It should also allow you to modify these budgets at your discretion, ensuring funds reach the right place at the right time.

Multiple Payment Options

The software should allow you to configure custom payment options to suit your business needs. This includes credit cards, ACH, or other payment methods.

Scalability and Flexibility

Select software that can accommodate increased usage for growing businesses. It must also be flexible enough to adapt to changing needs, such as new expense categories, compliance requirements, and organizational structures.

The Spend Management Solution for Your Team

Investing in a spend management tool like Pluto is a smart decision that can improve your financial visibility. From set-up to integration and managing intricate workflows, Pluto handles all aspects of spend management.

- It seamlessly integrates with your current processes, ensuring a smooth transition.

- It offers flexibility to handle complex operations, catering to the needs of both small and large teams.

- Its automation capabilities reduce manual tasks and enhance accuracy for better expense management.

Pluto is the only independently audited PCI DSS Level 1 provider in the UAE, ensuring the highest security standards for enterprises.

Pluto offers a spend management tool that adapts to your evolving needs and provides freedom from financial chaos.

If you want to see how Pluto can transform your spend management into a simpler process, book a demo today.

Disclaimer: The comparisons and rankings of spend management software competitors in this article are based primarily on reviews found online. While we strive to provide accurate and up-to-date information, these reviews are subjective and reflect the opinions of the users who posted them. The information presented is intended for general informational purposes and should not be considered as a definitive guide for choosing a software provider. We encourage readers to conduct their own research and consider their specific needs before making a decision.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Leen Shami

What is Pluto Card?

What is Pluto Card?

At Pluto, we believe better expense management should be within everyone's reach. We solve MENA finance teams' pain points by replacing their business credit cards with Pluto corporate cards to help manage their expenses, saving them time and money.

How do we do that?

- {{time-money="/components"}}

Create Unlimited Corporate Cards

When multiple employees have access to one company credit card, it can be difficult for finance teams and business owners to track how much is being spent and where.

The result: everyone texting the CEO or CFO for OTPs during important meetings.

Pluto makes it easy to create and distribute virtual and physical corporate cards to each employee. Not only does this minimize fraud risk, but it also makes expense tracking simpler for finance teams, CFOs, and CEOs.

With Pluto’s unlimited corporate cards, you’ll be able to:

- Create virtual cards in seconds.

- Receive physical cards in 1-2 days.

- Use cards for vendor-specific cases.

- Assign every employee a budgeted corporate card.

Spend Control

Are you running ads at a cost that exceeds your marketing budget? Are you providing new hires with an allowance to cover the costs of their office equipment and software, or do you offer employees additional perks such as a monthly gym stipend?

Pluto gives you the ability to set limits and take control of your company’s business expenses, hassle-free.

With Pluto’s all-in-one expense management platform, you’ll be able to:

- Assign virtual or physical cards with spend limits.

- Allocate a specific budget towards daily, weekly, or monthly expenditures.

- Create a single-use purchase card that automatically deactivates once it is used.

- Control spending for different departments by allotting a budgeted amount to be spent.

Goodbye overspending 👋🏼

Reimburse In Record Time

Reimbursements can be a painful process when the end of the month rolls in. Whether you’re scrambling to find lost receipts, trying to match receipts to their expenses, or organizing them in a document, there’s no easy way.

Drag & drop receipts

Pluto makes it easy for employees to list receipts.

Once a business expense is made by an employee, they’ll be able to drag & drop an image or screenshot of the receipt onto the Pluto dashboard.

Yes, as simple as that.

Easily reconcile receipts

Pluto allows you to seamlessly submit your receipts onto the platform. With Pluto, reconciliation is a breeze.

Once a business expense is made:

- Attach receipts to card transactions with just a few clicks.

- Transactions will automatically be categorized.

Add a memo to every transaction.

Get reimbursed in minutes

Waiting till the end of the month to get reimbursed for out-of-pocket business expenses is no longer necessary!

Pluto gives you the opportunity to get reimbursed in minutes.

Once a reimbursable out-of-pocket expense is made, head to the Pluto dashboard to log the expense and get reimbursed as soon as it is approved.

Get Real-Time Data

Your month-end expense report comes in—and you find that you've spent more money than budgeted. Again.

With Pluto, you can stay on top of your expenses at any given moment.

By getting real-time data, you can view reports of your company’s spending and ensure that your company’s finances are in check.

It's simple, Pluto helps you avoid overspending and keep track of your company's finances in real-time.

So what does this mean for you?

- See transactions happening on your cards in real time.

- Receive notifications about every single card transaction, if needed.

- Collect information on which vendors your company is spending the most money with.

- Identify which employees or departments are spending the most.

- Get an overview of the expenses you have incurred daily or month-to-month.

Pluto allows you to adjust if spending has gone off course—and plop some celebratory balloons if it hasn't 🎊!

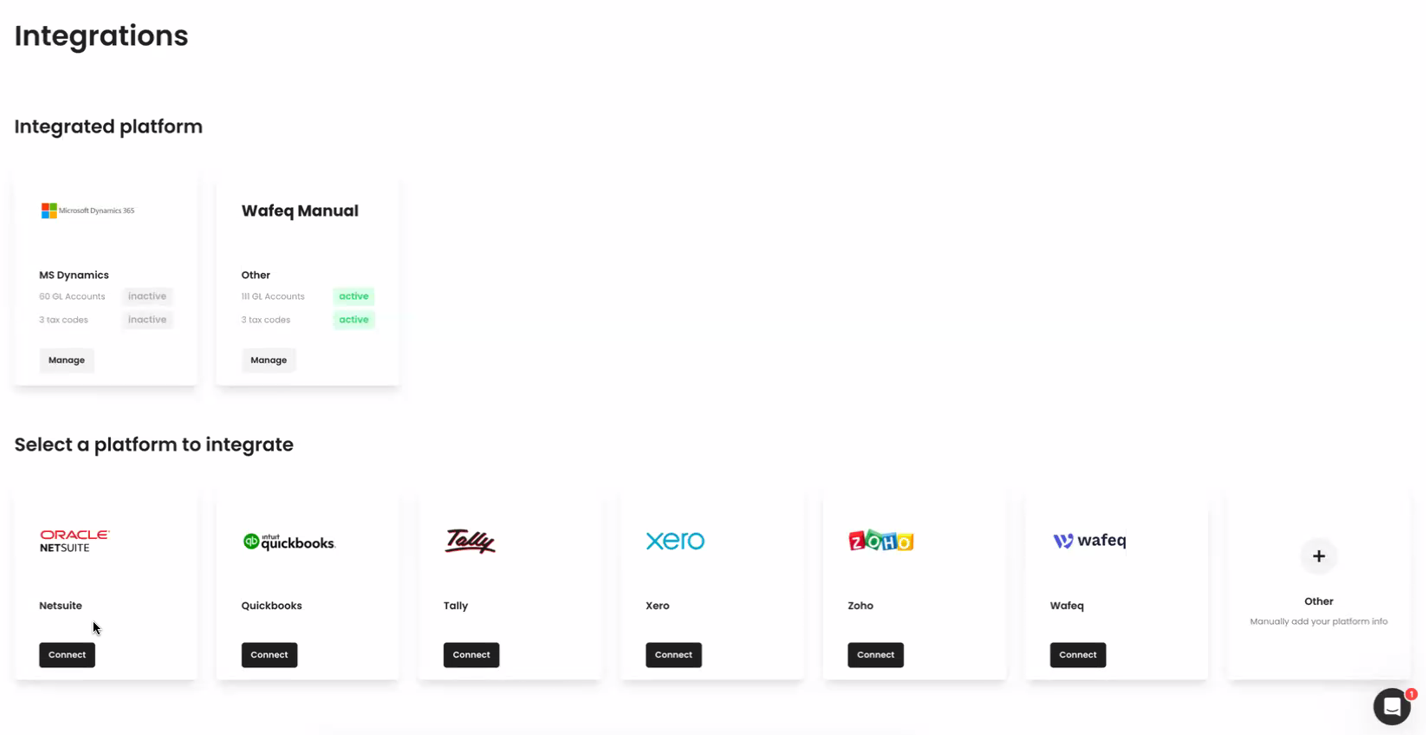

Integrate With Other Platforms

Every business has multiple platforms, and we know how important it is for them to talk to each other. Pluto's integrations make it easy to get started and ensure you have all the data you need in one place.

Accounting Integration

Pluto syncs your company's transactional data to the most popular accounting platforms through direct integrations so you can automate your accounting and close books faster.

No more end-of-month mayhem! 😅

Mobile Wallet Integration

With Pluto, you can add your virtual or physical cards to your digital wallet to make transactions seamless and easy.

We support Google Pay, Android Pay, and Samsung Pay.

What Else Does Pluto Offer?

Pluto gives you the opportunity to scale your business, without having to worry about the smaller details.

No FX Fees

Pluto doesn't charge you any foreign transaction fees for using your Pluto corporate card outside of the UAE.

If your business is expanding rapidly and your team is traveling more frequently, you won't have to worry about those pesky charges eating into your profits.

Or if your company needs to pay for subscriptions, contractors, or freelancers in a different country, you can do so without racking up a bill in FX fees.

Remote teams, frequent flyers, or big spenders, we've got you covered!

Accepted Worldwide

Whether your team is distributed, travels a lot, or makes international payments, Pluto’s corporate cards are accepted worldwide.

Advanced Security & Privacy

Pluto is PCI DSS Compliant. We take the safety of your information very seriously; all your data is stored and processed following the highest data protection standards in the industry.

Get Started in Minutes

Pluto's sign-up process takes minutes, not hours. By adopting a KYB and KYC process that can be done within a few clicks, you’ll be making transactions in no time.

- Simple application process.

- No credit history is required.

- Fast approvals.

- Instant card access once approved.

Let us take the hassle out of managing your expenses. Start Using Pluto Today - For Free.

•

Vlad Falin

Efficient Receipt Management For UAE Businesses

Collecting, storing, and otherwise managing receipts is essential to a well-oiled expense reporting machine.

Each receipt serves as confirmation of payment processing between yourself and the customer or vendor. You also need expense and sales receipts to file taxes and maintain your peace of mind.

Unfortunately, while saying receipt management is easy, the whole process itself is daunting. Tracking hundreds, thousands, even millions of employee and customer receipts leaves loopholes for fraud and misreporting.

Physical expense receipts are especially susceptible to being lost, damaged, or fading with time.

Fortunately, there’s a better way to do it: digital receipt management with Pluto.

- Automate more of the expense management process

- Reduce the risk of fraud and inaccuracies

- Create more efficient workflows and financial departments

- And overall streamline modern business operations

While you probably can’t eliminate 100% of paper receipts from your workday, you can still improve your process with an increasingly-digital footprint!

What is Receipt Management?

Receipt management is the process of collecting, tracking, and storing business receipts. This task is usually handled by internal finance teams. Their role involves collecting various receipts, tracking costs in accounting software, and storing these receipts for future reference. Additionally, they may need to manually sort each expense, depending on the system in place.

Why Do You Need It?

- A well-run receipt management protocol is crucial for businesses for several reasons:

1. Simplify Employee Reimbursement Programs: It aids in the smooth operation of reimbursement programs for employees.

2. Track and Report Tax Deductions: It's essential for accurately tracking and reporting tax deductions.

3. Provide Proof during Tax Audits: It serves as necessary documentation during tax audits.

4. Streamline Expense Reports and Budgets: Helps in making expense reports and budgeting more efficient.

5. Combat Internal Fraud and Inauthentic Chargebacks: Plays a key role in preventing fraud and false chargebacks within the company.

6. Avoid Repair or Replacement Costs for Items Under Warranty: Keeps track of receipts necessary for warranty claims, saving costs on repairs or replacements.

7. Calculate and Improve Long-Term Profitability: Receipt management is vital in calculating and enhancing the long-term profitability of a business.

Different types of receipt management systems are in use today, including those for printed receipts, e-receipts, and even handwritten receipts. This diversity can be challenging for businesses, as they need to follow multiple procedures to reconcile their books effectively.

Types of receipt management

Today, there are three basic ways to handle receipts directly:

- Manual receipt management involves handling, tracking, and storing paper receipts

- Digitization receipt management scans physical receipts to digitize the tracking process

- Digital-only receipt management is used for online or digitally generated receipts

While many businesses are moving toward digitization and digital-only receipts, some businesses are stuck in the dark ages. (The kind that involves typing physical receipt information into a digital spreadsheet.)

And as we’ll see below, manual entry strategies come with some…problems.

Difficulties of Manual Receipt Management

1. Easily Lost or Damaged Receipts

Perhaps the most obvious problem with physically tracking expense receipts is that there’s so much that can go wrong. Lost, damaged, or faded receipts make the business expense tracking process that much harder.

Even if the employee who spent the money doesn’t drop their receipt, it’s possible for paperwork to get lost on a desk somewhere. And if you need to find a receipt two years later? Better hope it was filed properly and hasn’t faded completely.

2. Consumes Human Resources

Manual receipt management is an extremely hours-intensive process.

Your financial team has to collect invoices, type their data into your accounting software, and double-check their work. Then, they have to reconcile business expenses against company credit card statements and track down potential instances of fraud or misreporting.

Not only does this require a lot of time, but it also impacts employee productivity. Every hour an accountant spends tracking receipts is an hour of productivity lost elsewhere.

3. Leaves Room for Human Error

Aside from the time and human resource cost, manual receipt management presents the potential for human error. And unlike on the product line or in customer service, every reporting mistake risks an unfavorable tax audit.

Even the simplest receipt management and tracking process involves several steps from collection to reconciliation. Every stage is an opportunity for an employee to get distracted, mistype a name or number, or duplicate entries. In bigger cases, they might even duplicate a payment, costing you more money.

And even if you catch the mistakes before they’re submitted, that’s more human hours wasted double-checking and correcting completed work.

4. Increases Fraud and Misreporting Risk

The risk of fraud is higher in manual receipt management programs, and instances of fraud may be harder to detect. Types of fraud that commonly crop up in expense reporting include:

- Inflated claim amounts

- Claiming personal costs on the business’ dime

- Submitting expense reports twice

- Falsifying “proof” to claim for money that wasn’t spent

Unfortunately, manual receipt management makes these kinds of fraud more likely and difficult to catch. For example, if the employee who authenticates receipts is committing or permitting the fraud, it’s harder to detect until after you’ve lost money.

Over time, even small acts of fraud can have massive financial consequences.

5. Contributes to Employee Dissatisfaction

For many companies, employee reimbursement programs contribute both to the need for manual receipt management – and to employee dissatisfaction.

Think about it. In a modern, tech-savvy business world, why should employees have to pay out of pocket, ever?

Virtual cards and online-based businesses have all but eliminated the need for an employee to front your expenses.

But if you’re still stuck doing manual receipt management, chances are, your employees are still submitting reimbursement tickets. (And grumbling about the time it takes to get paid back.)

And that’s not even touching on the frustration, tedium, and headaches manual receipt management programs cause your high-paid finance teams.

6. Jacks Up Business Costs

Together, all these factors paint a picture of increased business costs.

The time and human resource cost to track, reconcile, and store receipts.

The human and financial cost of detecting and counteracting fraud.

Even the maintenance costs for your printer and filing cabinets.

Every dollar spent on manual receipt management is a dollar sucked from office parties, growth, or your bottom line.

Benefits of Digital Receipt Management

It’s easy to see the costs that manual receipt management impose. Fortunately, there’s a simple solution: digital receipt management.

In short, digital receipt management involves using digital copies of receipts in your expense reporting strategy. Digital smart receipts are easy – simply integrate them into your accounting software and let automation take you away.

But even physical sales receipts can be digitized, Pluto allows you to digitize your receipt very simply - through your phone.

Incorporating such technology means that even paper receipts fold neatly into your overarching digital strategy.

And as you’ll see, the process comes with tons of benefits.

1. Increases Integration Potential

A massive benefit of digital tracking is the sheer integration potential. Most receipt management tools, from receipt scanning devices to receipt tracking software, easily mesh with your existing expense reports system.

From there, you can automate mindless tasks and set up occasional human checks to ensure the system works as intended.

2. Fewer Costly Errors

Another way that a digital receipt management program saves costs is by reducing employee errors. Digital receipts should meld seamlessly into your tracking system – no surprises there.

But even processing physical receipts is cheaper and easier.

With their mobile phones, employees can scan receipts and upload them instantly. From there, Pluto categorizes the information and adds it to the overall report.

While employees may spend a second filling in any blanks, increased automation greatly reduces the risk of input errors.

3. Reduces Risk of Fraud

Less human interference means your financial system is more resilient to fraudulent activities. Pluto improves speed and accuracy while digitizing the receipts.

That leaves fewer opportunities for fraudulent claims.

4. Reduces Clutter

Uploading physical receipts means less physical space is needed for storage. That can save you on storage costs and reduce desktop and file cabinet clutter.

And because everything’s digitally maintained, you’ll still meet or exceed your tax authority’s required financial record storage period.

Not to mention, just finding your records will be easier than ever!

5. Easier Audits

No person or business enjoys tax season. But digital management makes the process at least a little easier.

Because all of your information is stored online, it’s easier to access and export receipts as needed.

When tax time or the dreaded audit comes around, your data will be well-organized and easily accessible.

6. More Efficient Expense Reporting

Traditional receipt management is a costly, time-intensive, error-prone manual process that used to be necessary. With modern tools, businesses can streamline the entire financial structure of their organization.

No more lost receipts or worrying about fraud.

Less time spent inputting and double-checking data, and more time helping your business grow.

All these positive benefits will improve efficiency – and even bring smiles to your accountants’ faces.

7. Faster Reimbursements

Like using a virtual corporate card, digital receipt management speeds up the reimbursement process.

Since everything is tracked and verified electronically, it’s easy to set up an automatic or streamlined reimbursement protocol.

8. Putting Your Eco-Friendly Foot Forward

Lastly, any step your business can take toward going paperless is good news for the environment.

Cutting down fewer trees and reducing printer ink usage are laudable goals that can decrease your environmental footprint.

Not only will you enjoy cost savings, but you’ll feel better about doing business in an increasingly eco-conscious world.

8 Tips for Efficient Receipt Management

Digitizing your receipt management strategy is just the first step toward expense report success. To ensure you’re operating at maximum efficiency, consider the following tips.

1. Use Pluto App

The first step is to get Pluto and start managing your spending digitally.

While you’re moving toward digital efficiency, your vendors aren’t required to follow. Keeping the proper tech on hand ensures you can digitize any paper receipts that come your way.

Pluto allows you to take a picture of the receipt, upload it to your expense and just like that the reconciliation process is done!

2. Save Your Receipts

While you can set up secure digital folders to store all your digital originals and copies - Pluto does that for you!

Just take a picture of the receipt, upload it to the app and that is it.

3. Ensure High-Quality Digital Format Uploads

There’s no point in uploading and saving documents if you can’t read them.

Before tossing your physical copies, make sure you can clearly read the essential information on each receipt. (Such as the company name, date, purchased item(s), and amount.)

4. Categorize Submitted Expenses

Take some time to categorize your expenses (most businesses do this in chronological order). Pluto helps you with that, but just make sure to check the right category so the reporting stays in top notch condition.

5. Set Up a Simple Expense Report Strategy

Expense reporting is the backbone of any business’ financials. For prompt, complete reporting and tracking, ensure that you design a straightforward strategy.

Same-day submissions, fewer Excel sheets, and faster reimbursement protocols will improve efficiency and attitudes. Better yet, invest in a quality expense and receipt management software.

Or even better - start with Pluto, we have a free package. It will allow you to completely digitize and control your spending, while keeping your reporting in the best possible shape.

6. Establish Accountability

A top-notch expense reporting strategy only works if people use it.

To ensure your protocols are followed, emphasize and encourage accountability. Keep all managers and supervisors up-to-date with company spending and card policies and remind them to disseminate that information appropriately. Follow up with employee expenditures as needed.

7. Run Regular Internal Audits

Regular expense report audits help businesses track receipts fraud, clear up discrepancies, and streamline inefficiencies.

Take time each month or quarter to check for fictitious or overblown expenses or troubles with your expense reporting strategy.

Pluto allows you to run real-time reports at any given moment for any period of time.

8. Switch to Virtual Corporate Cards

Virtual corporate cards make managing receipt tracking even easier. Not only can you digitize the entire process end-to-end, but corporate p cards give you greater control over your expenditures and tracking.

Sure, you can’t prevent vendors from handing you physical receipts. But you can greatly minimize instances of employees walking in with a big stack of thermal paper to scan in.

Pluto offers unlimited virtual cards which will book all your expenses right into the dashboard!

Key Takeaways

- Proper receipt management is key to running a financially successful business.

- While manual receipt management reconciles physical copies, it’s increasingly unnecessary in an increasingly digital world.

- Digital receipt management simplifies the collection, reconciliation, and storage process.

- Digital tracking also reduces fraud potential, time and financial waste, and increases employee satisfaction.

- Digitizing your expense reports pairs nicely with digitizing your own payments with virtual corporate cards.

•

Mohammed Ridwan

Corporate P-Cards: How to Use Them for Maximum Advantage

P-cards can replace your corporate credit cards.

If you rely on credit cards, you would have 2-3 cards issued to the executives, which are shared with the employees. Though it seems a great method to ensure approval and budget control, it has many loopholes.

The finance teams are running after employees for receipts, employees are waiting on OTPs and approvals, and the CFO is not satisfied with the numbers.

You look for alternatives and land on p-cards.

P-cards (or purchase cards) are corporate cards you issue to your employees for business expenses. Then, be it purchasing a SaaS or making vendor payments, employees use it for all work-related spending.

What are Corporate P cards?

Corporate P cards are company purchase cards that employees can use to make business purchases without going through the traditional purchase request and approval process. Corporate P cards make it easy for companies to manage account payables & automate expense accounting while staying in complete control of their spending.

What Is the Difference Between a Credit Card and a P-Card?

While both cards are used exclusively for business expenses, there are many differences.

Credit cards make expense management difficult, with no visibility into where the money is going. An executive shares a single card with their team, creating a chaotic financial situation.

The card owner struggles to manage a constant stream of payment requests. Employees are left hanging with delayed payments, waiting for approvals. Especially in bigger companies, finance teams struggle with reconciliation and zombie spending (which is when a company continues to pay for something that isn’t used anymore, or when it pays for services that former employees had used).

On the flip side, if you use p-cards, you can issue each employee a separate card for corporate expenses. Each card has a specific budget and restrictions to ensure control and facilitate approval without delays.

For instance, you issue a card with a $500 monthly limit, restricted to office supply vendors like "Office One."

In this way, you manage budget control and approvals without losing visibility or having to micromanage.

How can Businesses use Corporate P Cards for Employee Expenses?

Moving from a credit card to a P-card isn’t complicated. Here is a step-by-step process of how you can provide your employees p cards and start using them:

Step 1: Generate Corporate Cards

The first step is to choose the type of card you want for your employees: physical or virtual. While a virtual card can be set up in under a minute, a physical card takes about 2-3 days to get delivered.

Physical cards work well for those who travel or have on-site jobs, making petty cash management easy. Contrarily, virtual cards support secure online purchases, such as buying SaaS tools or paying for digital advertising campaigns.

Once you decide whom to give a card and what type, set the budget and policies. You can incorporate the following policies to customize the cards:

- Specify the budget and replenishment frequency of the budget on the card- daily, monthly, or yearly.

- Define the purpose of cards by enabling only specific general ledgers (GL), labels, and tax codes.

- Switch on/off the ATM withdrawal option.

- Enable auto-lock for cards in case of receipt policy violation, where if the receipt isn’t attached in 7 days, the card is frozen.

All these customization options offer you better control without having to chase employees later. Deciding the budget, frequency, and vendors ensures that the card is used rightfully.

For instance, you would switch off ATM withdrawal for virtual cards that are meant for buying SaaS tools. Likewise, you can establish a monthly replenishment schedule to maintain sufficient funds while preventing excess spending.

Apart from this method, your employees can also request to activate the P-cards. They explain the card's purpose, after which the admin can approve/reject the request.

Now that the employees have cards in their hands, let’s see how you can better manage corporate spending with them.

Step 2: Manage Expenses Via Centralized Dashboard

Every expense on the corporate p-card is visible in real time on a centralized transactions dashboard. You get key information such as merchant name, expense category, card information, amount, and approval status.

Along with this dashboard, you get a dedicated tab for each expense where all its information is available.

You can review the key information such as receipt, department, merchant, date/time, expense category, etc. you can also download the receipt, approve/reject the expense, and check the activity log.

The activity log keeps track of all the conversations that have been happening with a particular transaction. Traditionally, companies use email and Slack, which makes communication messy. With this log, they can keep all their conversations and important information in one organized place.

Step 3: Create Approval Workflows

Approval workflows ensure that each expense follows a defined hierarchy for approval by the right stakeholders. You can customize them depending on different amounts, departments, and other factors.

It is a simple no-code system where you create workflows based on if-then rules.

A custom approval workflow ensures timely and effective approval without having to run after dedicated team members. Each of them receives a notification as soon as the expense takes place, and they can approve it easily.

Approvals and employee reimbursement become easy with a frictionless workflow like this.

Step 4: Report and Reconcile Expenses

Integrating your cards with your accounting systems becomes the last step to facilitate reporting and reconciliation.

Once you integrate with your accounting software, you can enjoy complete visibility and control over your corporate expenses.

You get a dedicated insights window to track expenses and identify trends. You can add custom filters and export these for further analysis.

To understand the entire process better, book a demo and see how you can benefit from switching to a corporate p card.

Why Shift From Traditional Methods to Corporate P Cards?

Credit cards seem simpler, where a bank gives a few credit cards to share among the teams. But here’s why it doesn’t work:

- It is difficult to track who spends what, how much, and why.

- Employees wait for OTPs and approvals, delaying payments and reimbursements.

- The chances of zombie spending increase because the same card is shared. This also becomes one of the loopholes which leads employees to misuse the cards.

- The admins have to chase employees for receipts during reconciliation.

While these are just a few, relying on credit cards can cause chaos in expense management. Here are some reasons corporate p-cards are a more suitable option today:

No More Shared Cards

You ditch the whole system of sharing credit cards, which is the root cause of limited visibility. With corporate p cards, you can issue any employee a dedicated card for specific expenses.

So, if you issue Rashid from the marketing department a virtual corporate card for running Ads, he can not use it otherwise. He will be accountable for any unnecessary expenses beyond the specified budget.

This means more visibility and control over corporate expenses.

Easy Receipt Management

Corporate cards make receipt management easier with OCR technology in the following ways:

- Submitting expense reports at the end of the day becomes easier as it auto-populates all the information

- Uploading receipts in bulk upload with OCR handling the rest makes the process faster

- Detecting duplicate receipts becomes simpler as OCR eliminates the risk of manual errors

Apart from OCR, you also get the option to split the transactions to make the accounting process easier. Here, for each transaction, you can split the amount into a separate category, GL account, tax code, etc.

For instance, a $300 expense can be split into $200 for software purchases and the remaining $100 as consulting fees. Each will have a specific category, GL account, and corresponding tax code.

Budget Control

Corporate cards give more visibility and control over finances.

Although both credit cards and p-cards can have specific budgets, p-cards enable you to set specific policies and rules.

For instance, you give an employee a $1,000 monthly budget but restrict them to using the card only for office supplies purchases.

Similarly, you can set a $500 monthly limit for marketing expenses and restrict the card to "Ad Campaigns" and "Promotions," ensuring focused spending.

Another benefit is to assign monthly, yearly, and weekly budgets.

For instance, you can allocate an annual budget of $500,000 for the marketing department but assign a weekly budget of $10,000 for ad campaigns.

This facilitates flexibility for the teams to function better and gives the finance team more control over resource planning and allocation.

WhatsApp Integration

Receipt uploading becomes simpler when all you have to do is click a picture on WhatsApp and hit send.

After each transaction, employees get a notification to upload the receipts via WhatsApp. With this simple integration, receipt capturing becomes simple and fast.

Not only is the receipt captured, but stored under the relevant transaction tab with all its information intact. OCR makes it easier to extract key details and populate expense reports.

Admins can approve these expenses, and reconciliation becomes a breeze.

Eliminate Corporate Card Fraud

P-cards give you more control and security. From setting custom policies to raising alerts in case of duplicate receipts, p-cards ensure that employees don’t misuse the cards.

Additionally, the custom approvals workflows and dedicated activity logs reduce the chances of oversight. This system helps prevent unauthorized spending.

For instance, an employee tries to use the card for a personal expense, like an expensive dinner.

The custom approval setup will alert the admins. The active activity log with documented conversations will further ensure that no personal expense is charged on corporate cards.

Get the Most Out of Your Corporate Cards

Transitioning from credit cards to corporate p cards can be an exciting move. But to make the most of it:

- Set an expense policy outlining the guidelines that will govern the corporate cards. This practice will also become the pillar for a healthier financial environment to support internal control over financial reporting (ICFR) efforts.

- Understand the hierarchies in the company to create approval workflows accordingly. Find a balance between control and micromanagement. Managers should be informed about expenses without being excessively involved in them.

Do this right, and you will have better visibility and control over your finances. The employees will not be left hanging for approvals. The finance team will be at peace, and the CFO will have more faith in the numbers.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use