Contents

Efficient Receipt Management For UAE Businesses

Vlad Falin

•

•

Collecting, storing, and otherwise managing receipts is essential to a well-oiled expense reporting machine.

Each receipt serves as confirmation of payment processing between yourself and the customer or vendor. You also need expense and sales receipts to file taxes and maintain your peace of mind.

Unfortunately, while saying receipt management is easy, the whole process itself is daunting. Tracking hundreds, thousands, even millions of employee and customer receipts leaves loopholes for fraud and misreporting.

Physical expense receipts are especially susceptible to being lost, damaged, or fading with time.

Fortunately, there’s a better way to do it: digital receipt management with Pluto.

- Automate more of the expense management process

- Reduce the risk of fraud and inaccuracies

- Create more efficient workflows and financial departments

- And overall streamline modern business operations

While you probably can’t eliminate 100% of paper receipts from your workday, you can still improve your process with an increasingly-digital footprint!

What is Receipt Management?

Receipt management is the process of collecting, tracking, and storing business receipts. This task is usually handled by internal finance teams. Their role involves collecting various receipts, tracking costs in accounting software, and storing these receipts for future reference. Additionally, they may need to manually sort each expense, depending on the system in place.

Why Do You Need It?

- A well-run receipt management protocol is crucial for businesses for several reasons:

1. Simplify Employee Reimbursement Programs: It aids in the smooth operation of reimbursement programs for employees.

2. Track and Report Tax Deductions: It's essential for accurately tracking and reporting tax deductions.

3. Provide Proof during Tax Audits: It serves as necessary documentation during tax audits.

4. Streamline Expense Reports and Budgets: Helps in making expense reports and budgeting more efficient.

5. Combat Internal Fraud and Inauthentic Chargebacks: Plays a key role in preventing fraud and false chargebacks within the company.

6. Avoid Repair or Replacement Costs for Items Under Warranty: Keeps track of receipts necessary for warranty claims, saving costs on repairs or replacements.

7. Calculate and Improve Long-Term Profitability: Receipt management is vital in calculating and enhancing the long-term profitability of a business.

Different types of receipt management systems are in use today, including those for printed receipts, e-receipts, and even handwritten receipts. This diversity can be challenging for businesses, as they need to follow multiple procedures to reconcile their books effectively.

Types of receipt management

Today, there are three basic ways to handle receipts directly:

- Manual receipt management involves handling, tracking, and storing paper receipts

- Digitization receipt management scans physical receipts to digitize the tracking process

- Digital-only receipt management is used for online or digitally generated receipts

While many businesses are moving toward digitization and digital-only receipts, some businesses are stuck in the dark ages. (The kind that involves typing physical receipt information into a digital spreadsheet.)

And as we’ll see below, manual entry strategies come with some…problems.

Difficulties of Manual Receipt Management

1. Easily Lost or Damaged Receipts

Perhaps the most obvious problem with physically tracking expense receipts is that there’s so much that can go wrong. Lost, damaged, or faded receipts make the business expense tracking process that much harder.

Even if the employee who spent the money doesn’t drop their receipt, it’s possible for paperwork to get lost on a desk somewhere. And if you need to find a receipt two years later? Better hope it was filed properly and hasn’t faded completely.

2. Consumes Human Resources

Manual receipt management is an extremely hours-intensive process.

Your financial team has to collect invoices, type their data into your accounting software, and double-check their work. Then, they have to reconcile business expenses against company credit card statements and track down potential instances of fraud or misreporting.

Not only does this require a lot of time, but it also impacts employee productivity. Every hour an accountant spends tracking receipts is an hour of productivity lost elsewhere.

3. Leaves Room for Human Error

Aside from the time and human resource cost, manual receipt management presents the potential for human error. And unlike on the product line or in customer service, every reporting mistake risks an unfavorable tax audit.

Even the simplest receipt management and tracking process involves several steps from collection to reconciliation. Every stage is an opportunity for an employee to get distracted, mistype a name or number, or duplicate entries. In bigger cases, they might even duplicate a payment, costing you more money.

And even if you catch the mistakes before they’re submitted, that’s more human hours wasted double-checking and correcting completed work.

4. Increases Fraud and Misreporting Risk

The risk of fraud is higher in manual receipt management programs, and instances of fraud may be harder to detect. Types of fraud that commonly crop up in expense reporting include:

- Inflated claim amounts

- Claiming personal costs on the business’ dime

- Submitting expense reports twice

- Falsifying “proof” to claim for money that wasn’t spent

Unfortunately, manual receipt management makes these kinds of fraud more likely and difficult to catch. For example, if the employee who authenticates receipts is committing or permitting the fraud, it’s harder to detect until after you’ve lost money.

Over time, even small acts of fraud can have massive financial consequences.

5. Contributes to Employee Dissatisfaction

For many companies, employee reimbursement programs contribute both to the need for manual receipt management – and to employee dissatisfaction.

Think about it. In a modern, tech-savvy business world, why should employees have to pay out of pocket, ever?

Virtual cards and online-based businesses have all but eliminated the need for an employee to front your expenses.

But if you’re still stuck doing manual receipt management, chances are, your employees are still submitting reimbursement tickets. (And grumbling about the time it takes to get paid back.)

And that’s not even touching on the frustration, tedium, and headaches manual receipt management programs cause your high-paid finance teams.

6. Jacks Up Business Costs

Together, all these factors paint a picture of increased business costs.

The time and human resource cost to track, reconcile, and store receipts.

The human and financial cost of detecting and counteracting fraud.

Even the maintenance costs for your printer and filing cabinets.

Every dollar spent on manual receipt management is a dollar sucked from office parties, growth, or your bottom line.

Benefits of Digital Receipt Management

It’s easy to see the costs that manual receipt management impose. Fortunately, there’s a simple solution: digital receipt management.

In short, digital receipt management involves using digital copies of receipts in your expense reporting strategy. Digital smart receipts are easy – simply integrate them into your accounting software and let automation take you away.

But even physical sales receipts can be digitized, Pluto allows you to digitize your receipt very simply - through your phone.

Incorporating such technology means that even paper receipts fold neatly into your overarching digital strategy.

And as you’ll see, the process comes with tons of benefits.

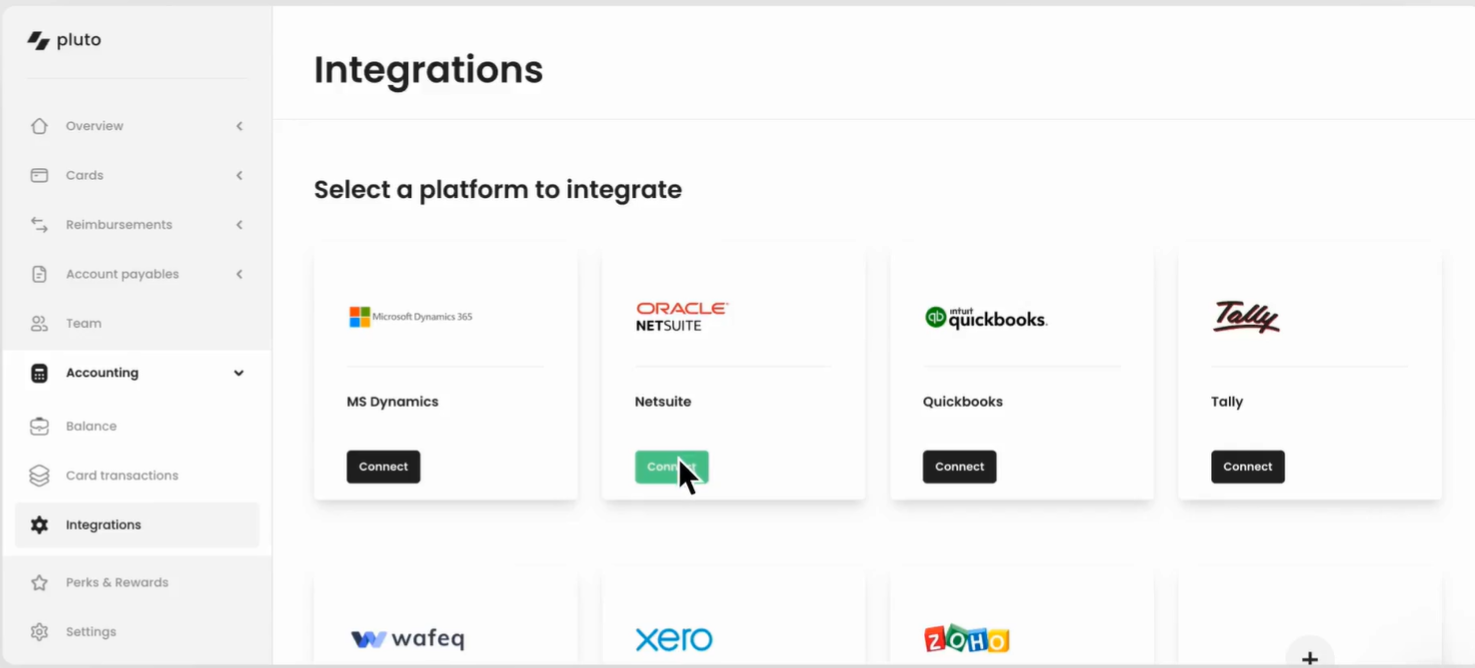

1. Increases Integration Potential

A massive benefit of digital tracking is the sheer integration potential. Most receipt management tools, from receipt scanning devices to receipt tracking software, easily mesh with your existing expense reports system.

From there, you can automate mindless tasks and set up occasional human checks to ensure the system works as intended.

2. Fewer Costly Errors

Another way that a digital receipt management program saves costs is by reducing employee errors. Digital receipts should meld seamlessly into your tracking system – no surprises there.

But even processing physical receipts is cheaper and easier.

With their mobile phones, employees can scan receipts and upload them instantly. From there, Pluto categorizes the information and adds it to the overall report.

While employees may spend a second filling in any blanks, increased automation greatly reduces the risk of input errors.

3. Reduces Risk of Fraud

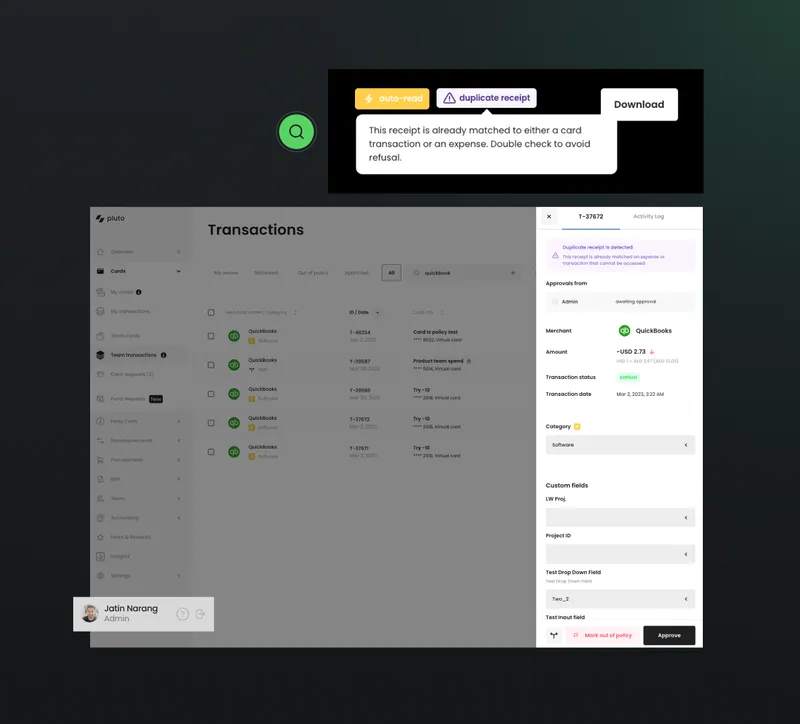

Less human interference means your financial system is more resilient to fraudulent activities. Pluto improves speed and accuracy while digitizing the receipts.

That leaves fewer opportunities for fraudulent claims.

4. Reduces Clutter

Uploading physical receipts means less physical space is needed for storage. That can save you on storage costs and reduce desktop and file cabinet clutter.

And because everything’s digitally maintained, you’ll still meet or exceed your tax authority’s required financial record storage period.

Not to mention, just finding your records will be easier than ever!

5. Easier Audits

No person or business enjoys tax season. But digital management makes the process at least a little easier.

Because all of your information is stored online, it’s easier to access and export receipts as needed.

When tax time or the dreaded audit comes around, your data will be well-organized and easily accessible.

6. More Efficient Expense Reporting

Traditional receipt management is a costly, time-intensive, error-prone manual process that used to be necessary. With modern tools, businesses can streamline the entire financial structure of their organization.

No more lost receipts or worrying about fraud.

Less time spent inputting and double-checking data, and more time helping your business grow.

All these positive benefits will improve efficiency – and even bring smiles to your accountants’ faces.

7. Faster Reimbursements

Like using a virtual corporate card, digital receipt management speeds up the reimbursement process.

Since everything is tracked and verified electronically, it’s easy to set up an automatic or streamlined reimbursement protocol.

8. Putting Your Eco-Friendly Foot Forward

Lastly, any step your business can take toward going paperless is good news for the environment.

Cutting down fewer trees and reducing printer ink usage are laudable goals that can decrease your environmental footprint.

Not only will you enjoy cost savings, but you’ll feel better about doing business in an increasingly eco-conscious world.

8 Tips for Efficient Receipt Management

Digitizing your receipt management strategy is just the first step toward expense report success. To ensure you’re operating at maximum efficiency, consider the following tips.

1. Use Pluto App

The first step is to get Pluto and start managing your spending digitally.

While you’re moving toward digital efficiency, your vendors aren’t required to follow. Keeping the proper tech on hand ensures you can digitize any paper receipts that come your way.

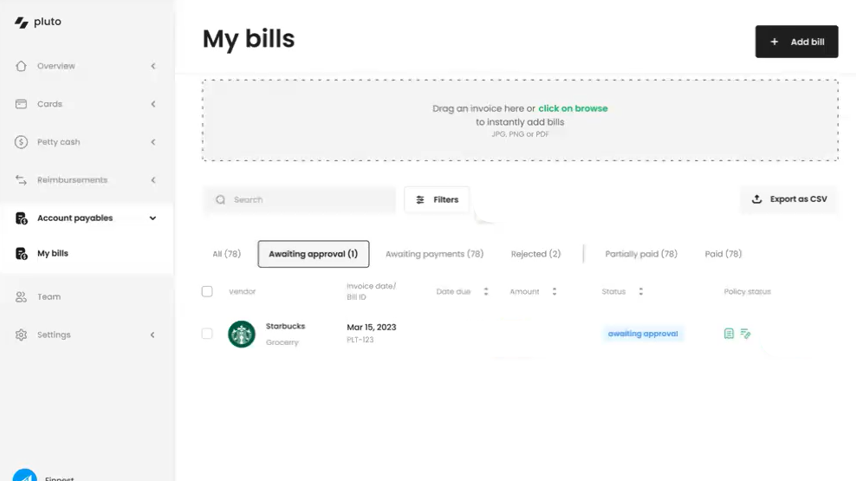

Pluto allows you to take a picture of the receipt, upload it to your expense and just like that the reconciliation process is done!

2. Save Your Receipts

While you can set up secure digital folders to store all your digital originals and copies - Pluto does that for you!

Just take a picture of the receipt, upload it to the app and that is it.

3. Ensure High-Quality Digital Format Uploads

There’s no point in uploading and saving documents if you can’t read them.

Before tossing your physical copies, make sure you can clearly read the essential information on each receipt. (Such as the company name, date, purchased item(s), and amount.)

4. Categorize Submitted Expenses

Take some time to categorize your expenses (most businesses do this in chronological order). Pluto helps you with that, but just make sure to check the right category so the reporting stays in top notch condition.

5. Set Up a Simple Expense Report Strategy

Expense reporting is the backbone of any business’ financials. For prompt, complete reporting and tracking, ensure that you design a straightforward strategy.

Same-day submissions, fewer Excel sheets, and faster reimbursement protocols will improve efficiency and attitudes. Better yet, invest in a quality expense and receipt management software.

Or even better - start with Pluto, we have a free package. It will allow you to completely digitize and control your spending, while keeping your reporting in the best possible shape.

6. Establish Accountability

A top-notch expense reporting strategy only works if people use it.

To ensure your protocols are followed, emphasize and encourage accountability. Keep all managers and supervisors up-to-date with company spending and card policies and remind them to disseminate that information appropriately. Follow up with employee expenditures as needed.

7. Run Regular Internal Audits

Regular expense report audits help businesses track receipts fraud, clear up discrepancies, and streamline inefficiencies.

Take time each month or quarter to check for fictitious or overblown expenses or troubles with your expense reporting strategy.

Pluto allows you to run real-time reports at any given moment for any period of time.

8. Switch to Virtual Corporate Cards

Virtual corporate cards make managing receipt tracking even easier. Not only can you digitize the entire process end-to-end, but corporate p cards give you greater control over your expenditures and tracking.

Sure, you can’t prevent vendors from handing you physical receipts. But you can greatly minimize instances of employees walking in with a big stack of thermal paper to scan in.

Pluto offers unlimited virtual cards which will book all your expenses right into the dashboard!

Key Takeaways

- Proper receipt management is key to running a financially successful business.

- While manual receipt management reconciles physical copies, it’s increasingly unnecessary in an increasingly digital world.

- Digital receipt management simplifies the collection, reconciliation, and storage process.

- Digital tracking also reduces fraud potential, time and financial waste, and increases employee satisfaction.

- Digitizing your expense reports pairs nicely with digitizing your own payments with virtual corporate cards.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Vlad Falin, Finance Writer

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Vlad Falin

Employee Expense Reimbursement Management: Types & Policies

Business expense reimbursement is one area of spend management that business owners do not always give its due. And yet, nearly every organization will have to reimburse employees for their expenses at some point.

Part of the problem is that these expenses can vary significantly, from buying office supplies to traveling or even medical costs. If your business deals with many types of expense reimbursements, you might wonder what you need to cover and how you should handle it.

If you’ve had trouble working out your organization's different business expense reimbursements, or you want to learn more about repayments, you’ve come to the right place.

Today, we’ll take a look at the different types of business expense reimbursements and even share some tips to help you streamline your expense reimbursement process.

{{reimburse-employees="/components"}}

What is expense reimbursement?

A business expense reimbursement is simply the act of paying back an employee for expenses incurred while performing a job for your organization.

Technically, almost any type of expense can qualify as a business expense for the purpose of reimbursement, depending on the reimbursement policies of the business. But to give you a clearer idea, here are some common examples of reimbursable expenses:

- Business travel costs

- Meals and entertainment

- Employee education or training

- Medical expenses

- Gas expenses for a company-issued or private vehicle

- Business supplies or tools

- And other miscellaneous business-related expenses

You could handle these expense reimbursements individually, meaning you review each expense separately, or you could create a policy for employee expense reimbursement.

{{effortlessly-manage-banner="/components"}}

Do I Need to Have an Expense Reimbursement Policy?

You are not required to have an expense reimbursement policy, and in some cases, reimbursing expenses is not even mandatory to begin with. Though that largely depends on the legal framework of your country.

However, since it is customary in the UAE and the MENA region to reimburse employees for expenses, then it would be wise to create guidelines and policies to help you organize and streamline that process.

Creating a policy for reimbursements helps set the right expectations for employees about what qualifies for repayment and enables you to streamline your expense reimbursement process.

With an expense reimbursement policy, your employees will know precisely what they can be reimbursed for, how to request said reimbursement, and how long it would take to receive the funds.

Whether you have a business reimbursement policy or not, you need to have a clear picture of which expenses your employees might incur for your business and how you would go about reimbursing them.

- Is the expense tax deductible?

- Is this a common type of business expense in your industry?

- Do you have a policy in place for this expense?

- Are there any types of emergency purchases that an employee might need to make?

Types of expense reimbursements

Traveling and accommodation

One of the most common types of reimbursement requests is for travel expenses. Gas has been a particular pain point for many businesses in the MENA region due to the rising costs of fuel. Other examples of travel expenses include moving to and from an airport or travel terminal, travel tickets, public and private transportation expenses, car rentals, and lodging.

Office supplies and communication

If your organization relies heavily on digital work, you might need to reimburse your employees for supplies like laptops, tablets, software purchases or subscriptions, training materials, and more.

Also, if your team needs to move around frequently and you need to maintain communication at all times, reimbursing them for their cell phone plans might be necessary. In particular, this applies to teams in sales, marketing, and business development.

Food and entertainment

Business trips typically cover employee meals as reimbursable expenses. As long as the expenses are incurred in the interest of the business, they’re reimbursable.

Other expenses

Medical expenses, such as health insurance, insurance premiums, and tuition, are another form of employee expense that is often reimbursed by companies. If your business deals with these types of expenses, make sure you have a clear policy for handling them.

8 tips to simplify your expense reimbursements

1. Learn what you need to reimburse

Although the legalities of employee reimbursements vary from country to country, it’s traditionally customary for employers to reimburse their employees for expenses incurred on behalf of the company.

It is important to note, however, that your employees cannot claim reimbursements for every purchase made, only those that are specifically tied to your business in some form.

While the specific type of expenses you have to reimburse will vary from industry to industry, you should have a general idea of what costs an employee might have to cover out of pocket in the process of working for you.

- Do they need to travel around in their own vehicle?

- Do you need them to be communicated at all times?

- What kind of equipment do they require?

- Are there any health risks associated with their job?

These types of questions can help you figure out which expenses you will have to deal with. Clear guidelines about what is and isn’t reimbursable will help reduce instances of fraudulent reimbursement requests.

2. Use a spend management platform

With the right expense management software, you would be able to automate and optimize end-to-end workflows throughout your process.

For instance, with a spend management platform like Pluto, employees can use a mobile app to record expenses as they incur them.

In this way, your employees no longer have to save receipts or wait before entering their expenses. Plus, Pluto can automatically assign reports to the right reviewer, making the review and approval process more efficient.

Not only that, but Pluto can also tag the receipt so the categorization of the expense is much easier and reporting is real-time.

In addition to providing digital copies of relevant documents, Pluto can notify your finance team of approvals and deadlines.

3. Spend management platforms enhance collaboration

Pluto’s expense management solutions come with an employee portal so that your finance team can collaborate seamlessly with your employees.

This allows you to save time when you need to discuss any irregularities with their expense reports. Additionally, your employees can use Pluto to check the status of their reimbursement requests.

The finance team can also use Pluto to manage costs more efficiently due to its analytical capabilities, real-time reporting and instantaneous spend limit settings.

4. Create a Thorough Expense Reimbursement Policy

When creating your reimbursement policy, you’ll want to make sure that it covers as many angles as possible.

One way to do so is to invite stakeholders from multiple different departments, such as HR, finance, legal, and procurement, to a brainstorming session, as their knowledge will make it easier to draft the policy.

5. Crafting your reimbursement policy

It’s also critical to consider the following when drafting your expense reimbursement policy:

- The specific type of expenses that can be reimbursed

- The process your employees need to follow to submit their expenses, including any proof and supporting documentation

- Whether any allowances will be given for expenses, and how to manage any excess

- The specific time an employee has to submit their expense report

- How the approval process will be handled

- When and how your employees are reimbursed

6. Promote the adoption of the policy

One way to help employees adopt the policy more quickly is by making it readily available to them. The policy should be emailed to your employees or posted on your internal networks.

Employees should be informed when they will receive their payment from the company. You should set up a transparent and clear process to communicate what can be expected in terms of expense reimbursement.

7. Be extra clear about deadlines and payments.

Be sure to let them know how they will receive the payment, such as via direct deposit or check, as well as how they will receive recorded confirmation of the payment made (such as a statement on their paycheque). You can complete this step easily with the help of an online payroll solution.

It is important to keep things running smoothly when it comes to paying employees. By processing reimbursements timely and reliably, you can easily prevent frustration caused by late payments.

Having your employees pay out of their own pockets and not receiving payment back sooner rather than later can cause unnecessary ill feelings toward your company. When you handle reimbursements well, it reflects back on you as a respectable and considerate employer who cares about employees.

8. Make sure your employees follow the deadlines you set

You need to provide employees with deadlines for submitting expense reports, such as one week before their next pay date, so they can be reimbursed and get approval for their claims.

Make sure the expense reports comply with the policy guidelines by giving yourself enough time to review them. By doing so, you can consult with the employee if there are any discrepancies, missing or incomplete documentation, or expenses that do not fall within the policy.

It’s important to submit expense reports on time since certain business expenses are tax deductible.

Optimize your expense reimbursement management process

It’s not enough to know what your expenses are and to create a policy for their reimbursement.

You also need to make sure that your reimbursement process is organized and efficient.

Otherwise, you run the risk of creating bottlenecks if you get slammed by more requests than you can handle. You can avoid this by optimizing the process used to submit reports and their attachments, ensuring all reports are reviewed in a timely manner and processing reimbursements as quickly as possible.

Having put all of this in place, it’s now time for the audit. The importance of audits is particularly important for enterprises and mid-size firms where employees incur large expenses. Auditing your expense reports also helps you identify loopholes in your policy and reduce instances of fraudulent claims.

You can also use audits to analyze your business expenses and identify areas for reduction.

Ensure there is an organized system for expense reimbursement requests

You should ensure that the system your employees need to use to submit their expense reports is easy to use and understand.

Pluto allows the employee to submit all necessary supporting documentation, such as their receipt, the total amount of the purchase, a description of the goods or services purchased, and the date of the transaction.

Use a corporate card or direct deposits to remove the need for reimbursements

A corporate p card is a great way to prevent employees from paying out-of-pocket for business expenses.

You can track your expenses more efficiently and effectively with corporate cards, which provide spending limits that prevent employees from abusing their privileges.

Consider issuing corporate cards only to your regular travelers, or try direct deposits if you’re concerned about the cost.

Alternatively, you can also use direct deposits of reimbursement funds to eliminate the reimbursement process.

Two benefits result from this: One great perk of following either process is that your finance teams will have better visibility into the reimbursement process, making auditing employee expenses easier.

Key Takeaways

- The best way to deal with business expense reimbursements is to have a rock-solid reimbursement policy in place. This way, you can reimburse employees for their costs on your terms.

- Another great way to manage your expenses is to make use of a corporate card to eliminate the reimbursement process altogether, though this might not be feasible for all cases.

- As in many situations, your best option will most likely come in the form of digitization. Using a spend management platform like Pluto, will not only give you much better visibility over your employee spending but also streamline the reimbursement process for you.

•

Mohammed Ridwan

How to Improve the Accounts Payable Management Process for Healthy Working Capital

Accounts payable (AP) is the money you owe vendors and creditors, i.e., short-term liabilities. These are the payments for goods and services you received that are yet to be cleared.

Companies struggle to manage accounts payable because the process involves multiple stakeholders, and the workflow isn't clearly laid out. The teams have to handle hundreds of documents, including purchase requests, purchase orders, goods received notes (GRN), invoices, etc. and ensure there isn't any discrepancy with the order received.

So, decentralized approvals and verifications make the process chaotic before the team can clear the final payment. If you find yourself in a similar situation, where accounts payable is hectic, and the working capital is messed up, read this post to discover the top strategies for effective accounts payable management.

{{less-time-managing="/components"}}

What is the Account Payable Process?

The AP process starts upon receiving goods and an accompanying invoice for payment processing. The next step involves verifying the accuracy of the invoice details. This verification process ensures that the goods received match the information provided in the invoice, including quantities, prices, and other relevant terms.

Following the confirmation, the invoice undergoes an approval workflow. It involves obtaining the necessary authorizations from various departments or individuals within the organization and ensuring compliance with internal policies and procedures before proceeding with the payment.

After completing the payment, the accounts payable team records the transaction in the financial system, updating the company's records. This step ensures accurate financial reporting and maintains an up-to-date overview of the company's financial position.

Challenges of the Decentralized Accounts Payable Process

Companies strive to maintain a seamless flow of goods and services while meeting financial responsibilities through timely and accurate AP management. However, relying on a manual process for these tasks introduces these bottlenecks:

- Managing documents manually raises concerns, particularly with paper-based documents that are susceptible to misplacement or damage. It not only hampers day-to-day operational efficiency but also poses a threat to data integrity.

- Similarly, a manual verification process increases susceptibility to mistakes. Achieving precise alignment between received goods and invoice information requires meticulous attention, heightening the possibility of overlooking crucial details such as terms and conditions.

- The manual handling in the approval workflow introduces risks of delays and potential oversights. Obtaining authorizations from different departments becomes time-consuming, and ensuring compliance with internal policies is prone to human errors.

- After completing the payment, the critical step of recording the transaction in the financial system becomes vulnerable to manual data entry errors, impacting the precision of financial reporting and the clarity of the company's financial standing.

- The manual process increases the likelihood of inadvertently paying the same invoice multiple times. Inaccurate data entry and a lack of robust authentication processes expose the organization to fraud, including the manipulation of invoices.

In summary, the manual accounts payable process detrimentally affects operational efficiency and financial stability. The lack of synchronization across different teams results in communication gaps and discrepancies. Failing to maintain a cohesive and streamlined process leads to errors in financial reporting, impedes effective decision-making, and strains interdepartmental collaboration.

Strategies for Efficient Accounts Payable Management

Effective management of the accounts payable process is possible when you optimize the human and technological aspects of the same.

On the human side, optimizing requires streamlining workflows, enhancing communication, and fostering a collaborative environment. Simultaneously, the technological part involves shifting to an accounts payable automation solution that provides a centralized platform for complete visibility and control.

Here are the strategies for efficient accounts payable management:

Strengthen Internal Control Over Financial Reporting

Internal control over financial reporting (ICFR) ensures the accuracy, reliability, and integrity of financial information within an organization. ICFR helps safeguard financial processes and mitigate risks as the intricate nature of accounts payable necessitates a robust control framework.

Strengthening ICFR for enhancing accounts payable management involves the following elements:

1. Segregation of Duties

With the segregation of duties, you ensure that no single individual controls all the stages of the accounts payable process. You divide the responsibilities among different staff members, which reduces the risk of errors, fraud, and mismanagement.

For instance, by assigning one team member to handle invoice approval and another to process payments, the segregation of duties minimizes the risk of errors or fraudulent activities and promotes accountability.

2. Audit Trail

Establishing a comprehensive audit trail involves recording and documenting every transaction in a chronological sequence of activities. It facilitates transparency and serves as a valuable tool for tracking and investigating discrepancies that arise during the accounts payable process.

For instance, in the case of an invoice mismatch, a comprehensive audit trail makes it easy to trace the exact steps in the transaction history, revealing where the error occurred. It speeds up the resolution process and enhances accuracy in financial reporting by promptly addressing issues.

3. Approval Policies

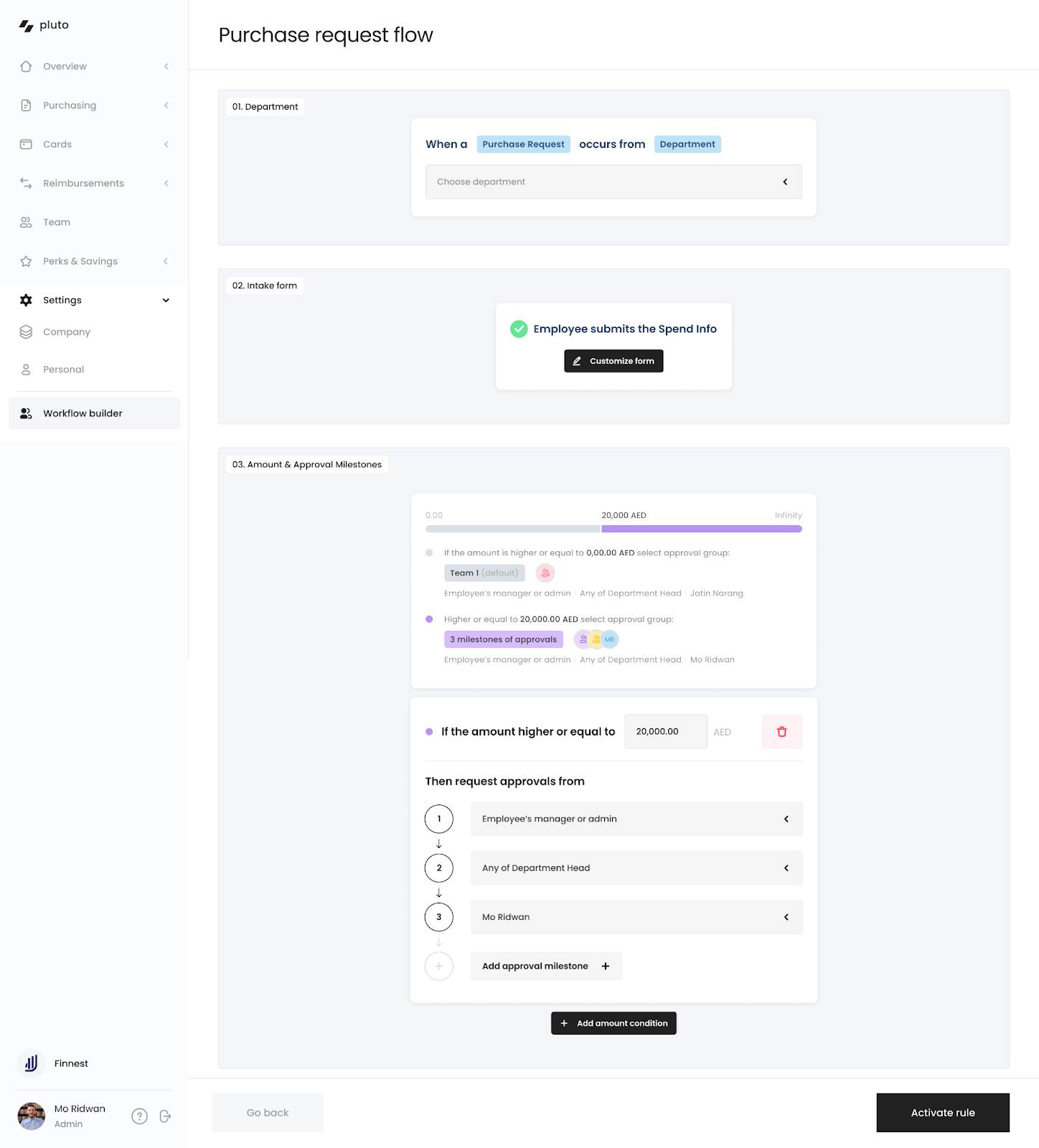

Clearly defined approval policies outline the hierarchy of authorizations required for various transaction amounts, ensuring that financial transactions undergo proper scrutiny before processing.

For instance, a clearly defined approval policy mandates that transactions under $1,000 require approval from a department head, while amounts exceeding $10,000 necessitate approval from top-level management.

4. Document Policies and Procedures

Clear documentation outlines specific steps for the accounts payable process. When a team member adheres to these guidelines, all required approvals are obtained, documentation is consistently retained, and errors are minimized.

In practical terms, this means that during an audit, the organization quickly and accurately traces the entire lifecycle of an invoice, showcasing compliance, reducing audit time, and enhancing financial transparency.

By strengthening ICFR, organizations systematically address challenges such as fraud, errors, and inefficiencies.

Employing Technology

AP automation optimizes the accounts payable management process beyond mere operational enhancements, enabling accuracy, efficiency, and informed decision-making. Automating AP management is a strategic approach with the following key elements:

1. Centralized Collaboration

Automation involves centralizing AP management and creating a unified document storage and collaboration platform. Not only does it extract all the critical information, but it also stores them on a centralized dashboard for easy access and processing. This fosters seamless communication among team members, ensuring everyone can access real-time information and collaborate effectively.

2. Safeguards for Duplicate Payments

Automation includes built-in safeguards to prevent duplicate payments. Automated systems employ checks and validation processes to flag duplicate receipts and eliminate the risk of paying the same invoice multiple times, reducing the likelihood of financial errors. Moreover, since the centralized platform acts as a single source truth, the possibility of double payments automatically reduces.

3. Streamline Workflow

Automated workflows simplify and streamline the entire AP process. With simple if-then rules, you can create workflows for trigger-based approvals. By eliminating manual intervention at various stages, tasks such as invoice approval, payment processing, and data entry become more efficient, reducing processing times and enhancing overall workflow.

4. Integrate

The accounts payable software integrates with other financial systems. This integration ensures a cohesive flow of information across departments, reducing data silos and enhancing accuracy in financial reporting.

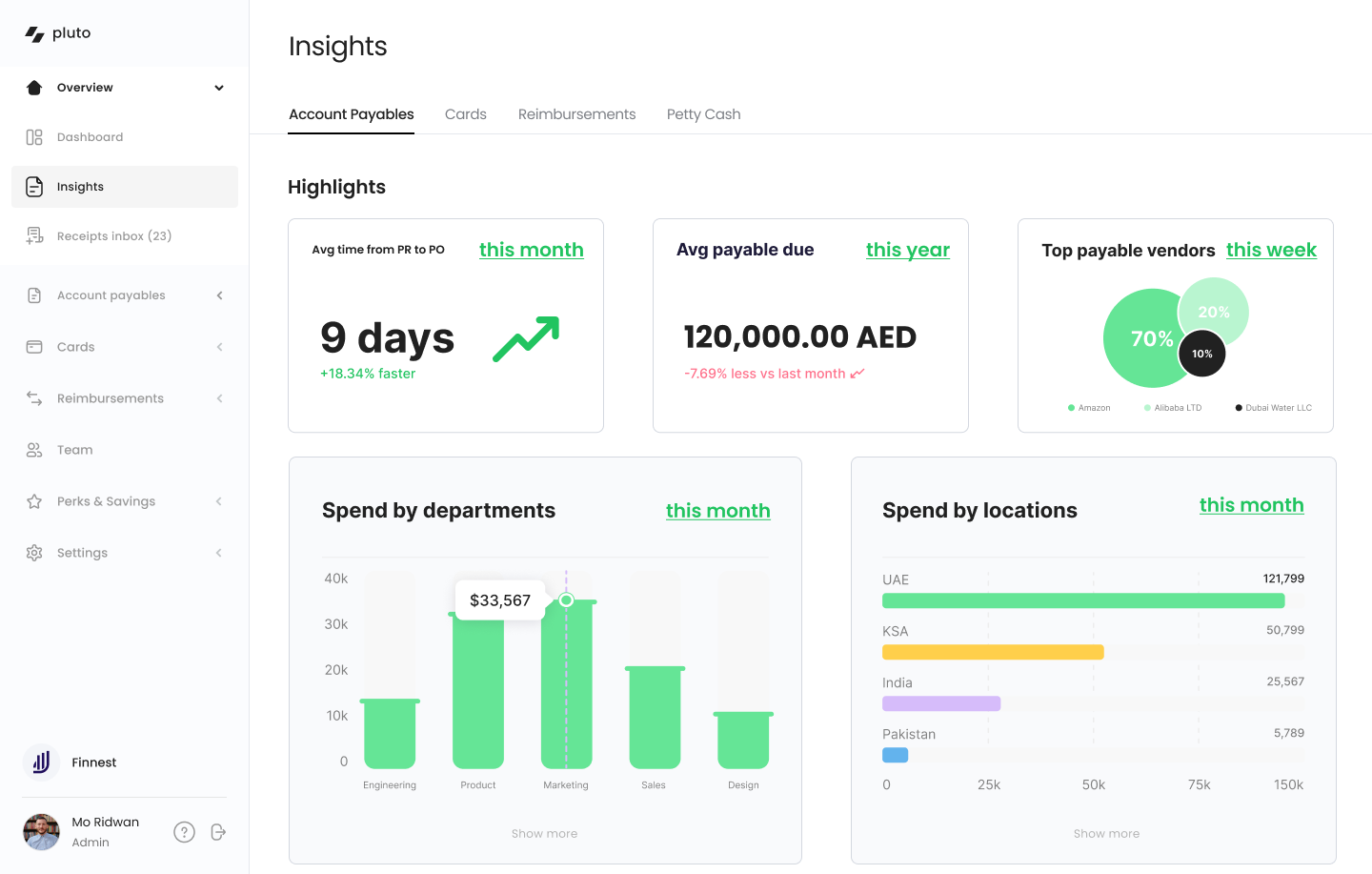

5. Insights

Automated AP systems provide valuable insights through analytics and reporting tools. These insights enable businesses to track key performance indicators, identify trends, and make data-driven decisions. This analytical capability contributes to strategic financial management and planning.

Improve Vendor Relationships

Vendor relationships are not just about successful transactions. Healthy partnerships bring many benefits, such as streamlined processes, minimized disruptions, and a collaborative atmosphere that enhances the overall effectiveness of the accounts payable function within the organization.

Improving accounts payable management involves the following components:

1. Negotiate With Vendors

Initiating negotiations with vendors involves engaging in open discussions about terms, pricing, and contractual agreements till both parties arrive at mutually beneficial arrangements. Compelling negotiation ensures favorable terms for the company and establishes a foundation of trust and collaboration.

For instance, when negotiating with a key supplier for raw materials, the company secures favorable terms such as bulk purchase discounts and extended payment periods. This not only reduces costs but also builds a positive, long-term relationship.

2. Timely Payments

Adhering to agreed-upon payment schedules fosters goodwill and reliability, positioning the company as a trusted and preferred partner. Timely payments strengthen vendor relationships and contribute to smoother transactions and potential benefits such as early payment discounts.

3. Transparent Communication

Keeping vendors informed about payment timelines, potential delays, or any changes in the process contributes to a positive working dynamic. Open lines of communication facilitate problem-solving, creating an environment where both parties feel comfortable addressing concerns and finding resolutions.

4. Streamline Onboarding Process

Simplifying the onboarding procedure by providing clear guidelines, efficient documentation processes, and transparent communication ensures that vendors can seamlessly integrate into the accounts payable system. It saves time and lays the groundwork for a cooperative and efficient long-term partnership.

By implementing these strategies, businesses cultivate vendor relationships that go beyond transactional interactions, fostering a collaborative environment.

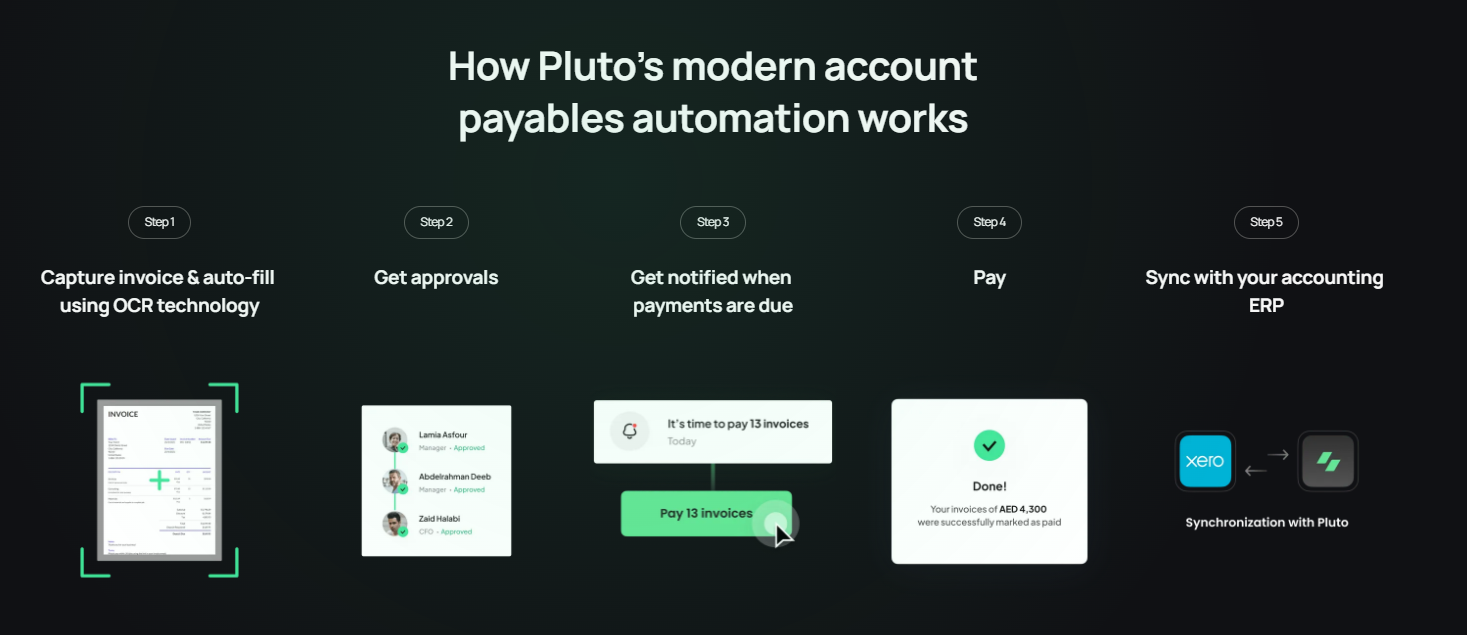

End Result: Optimized Accounts Payable Management Process

For storing and retrieving documents, you get optical character recognition (OCR) technology that extracts invoice information accurately. All the information goes on a centralized digital platform, reducing the chance of misplacement and improving accessibility.

For verification, you get all the necessary information on a unified dashboard. This centralized database enables accurate cross-referencing of received goods with invoice details, minimizing errors and making the process more efficient.

You get a no-code trigger-based approval workflow builder for approvals, where you can create workflows with simple if-then rules. These preset rules and automated notifications make authorization seamless across departments, reducing delays, ensuring policy compliance, and lowering the risk of human errors.

For recording transactions, you get integration facilities, where your accounts payable software syncs data across your accounting systems for consistent records, minimizes errors, ensures precise financial reporting, and offers a real-time, accurate view of the company's finances.

Next Steps for Efficient Accounts Payable Management

After establishing transparent processes and policies and adopting the right automation tools, plan an AP audit.

An AP audit involves reviewing and assessing the existing procedures to pinpoint areas that can be improved. By doing so, you identify inefficiencies or bottlenecks in the accounts payable management system. It provides insights into how well the established processes align with the intended goals and whether adjustments are needed.

This proactive approach helps enhance the overall efficiency and effectiveness of accounts payable management, ensuring that the system operates smoothly and aligns with the company's objectives.

Read more about AP audits in our post to understand how they help and how you can prepare for them in advance.

•

Leen Shami

We got funded!

We're thrilled to announce that Pluto closed US$6M in Seed funding in February, led by Global Founders Capital.

With GFC being the lead investors, we've had participation from several of the world's leading investment firms and entrepreneurs. Soma Capital, Graph Ventures, Adapt Ventures, Ramp, Thejo Kote (Founder of Airbase), Shaan Puri, and William Hockey (Co-founder of Plaid) were some of the few who participated.

With our Seed round, we aim to get closer to achieving our mission; to streamline company expenses for MENA businesses.

The problem

Company spending in the MENA region is problematic, time-consuming, and frustrating. Managing company spending in MENA today is difficult, time-consuming, and frustrating, as today, companies only get a single debit or credit card.

OTPs

Today, employees all share one company credit card, which usually leads to an OTP being sent to the CFO, financial leader, or founder of the company. Most bank OTPs last from 2 to 10 minutes before they’re expired. So, if an employee doesn’t get the OTP in time, they won’t be able to complete the transaction.

Overspending

When a company credit card is issued, you cannot control spending. This means there is no way to set limits on the card to avoid being overcharged by recurring subscriptions or employees going over budget.

No visibility

You cannot get real-time visibility or instant reports on business expenses with company credit cards. This makes making informed decisions about allocating resources in real-time more challenging.

Petty cash

Banks have no ideal solution for petty cash management. Companies typically maintain a cash vault at their offices, distribute loose cash to employees, and spend countless hours collecting and matching invoices.

The solution

Introducing Pluto Card: a corporate card & spend management platform that allows MENA companies to simplify and control their business expenses.

With Pluto's software, managers can issue their employees virtual cards with spend and control limits, cards that get canceled after a one-time purchase, and cards with a recurring daily, weekly, or monthly budget.

Employees can request expenses from their managers and submit reimbursement requests by dragging and dropping receipts onto the software. This happens in real-time, where managers can view employee requests as they happen, see what is being spent and where, and gain insight into instantaneous expense reports, helping them make informed decisions.

Pretty straightforward.

Want to see Pluto in action? Sign up and get a private demo here.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use