Contents

How IT & Procurement Teams Should Evaluate Spend Management Products

Vlad Falin

•

•

In today's fast-paced business world, managing expenses can be a daunting task for IT and procurement teams.

To help you out, we compiled a list of features and functionalities that you should consider when picking your spend management platform.

Spoiler alert, Pluto has them all.

PCI DSS Level 1 Provider

One of the essential features that should be given high importance is the product's PCI DSS Level 1 compliance.

The Payment Card Industry Data Security Standard (PCI DSS) is a set of guidelines and security requirements designed to safeguard payment card data.

The standard was developed by major credit card companies, including Visa, Mastercard, American Express, Discover, and JCB, to ensure that all companies that handle payment card data maintain a secure environment. PCI DSS compliance helps to prevent fraud and data breaches, protecting both the company and its customers.

PCI DSS Level 1 is the highest level of certification a company can achieve for PCI compliance.

It requires companies to undergo a rigorous independent audit to ensure compliance with all 12 of the PCI DSS requirements, including network security, access control, and vulnerability management.

Achieving PCI DSS Level 1 certification demonstrates that a company has a comprehensive and effective security program in place to protect payment card data.

When evaluating corporate spend management products, IT and procurement teams should look for products that have achieved PCI DSS Level 1 compliance to ensure that the product meets the highest security standards.

This will help to ensure that the company's payment card data is adequately protected and that the company is meeting its compliance obligations. By prioritizing PCI DSS Level 1 compliance, IT and procurement teams can help to safeguard their company's reputation and financial well-being.

Being PCI DSS Level 1 compliant is essential for any organization that handles corporate card information, as it provides a high level of security and assurance that the organization is taking all necessary measures to protect its customers’ data.

Pluto Card is proud to be PCI DSS Level 1 compliant. This means that our customers can trust that we have taken all necessary measures to secure their data and protect it from unauthorized access.

We also partner with vendors who are held to the highest security standards, such as PCI or SOC2 compliance.

Passwordless Login

Passwordless login is a secure and convenient way for users to access their accounts without the need for a password. It is an effective way to protect against unwanted access to your account, as passwords can be easily compromised or stolen. By tying your Pluto access with a company email account provided by your organization ensures that when your employees lose access to their company email address they also lose access to Pluto.

At Pluto Card, we understand the importance of passwordless login, and we offer this feature to our customers. With our passwordless login feature, our customers can access their accounts quickly and securely, without the need for a password.

Activity Log And Audit Trails

Activity logs and audit trails are crucial for ensuring strict auditing everywhere. An activity log records all user activity within an application or system, while an audit trail provides a record of all changes made to data within the system.

Pluto Card offers a 7-year audit log, which means that our customers can track critical changes made to their data over a seven-year period.

Data Access

Employees that are using our platform have only as much access as they need, and we have infrastructure redundancy built into Pluto, which means that all compute and data is run in multiple geographies.

Business continuity is paramount at Pluto - to this end, we ensure data redundancy with redundant backups in multiple geographies as well.

In addition, at Pluto, your application data is always encrypted in transit, and at rest.

Continuous Security Scans

Pluto also provides a continuous security scan, which tackles multiple dimensions, including code or dependency vulnerabilities, infrastructure, and public endpoint scans.

Our customers can be assured that we take security very seriously and are always on the lookout for any potential security threats.

In the event of a security incident, we have an immediate incident response plan in place and will notify impacted customers without undue delay of any unauthorized disclosure of customer data.

24x7 Customer Support and Dedicated Account Manager

In addition to these security features, Pluto Card also provides 24x7 customer support.

We understand that our customers need support around the clock, and we are always available to help with any questions or issues that may arise.

Data Infrastructure, Redundancy and E2E Encryption

We also provide infrastructure and data redundancy, which means that our customers’ data is highly available and secure, even in the event of a system failure or outage.

Data is always encrypted in transit, which means that it is always protected during transmission between servers or devices.

Finally, another crucial feature that IT and procurement teams should consider when evaluating corporate spend management products is data residency and retention policies.

Pluto Card offers an audit trail for changes to customer data, so we can track who did what.

Additionally, we have a data residency promise of 7 years, which means that we retain customer data for that period of time.

This can be important for compliance with regulatory requirements, such as tax or financial reporting.

Conclusion

In conclusion, when evaluating corporate spend management products for your enterprise, it’s essential to consider the security features that the product offers.

PCI DSS Level 1 Compliance, passwordless login, activity logs and audit trails, and data residency and retention policies are all critical features that can help ensure the security and integrity of your organization’s financial data.

Pluto Card offers all of these features, along with 24x7 customer support and infrastructure and data redundancy, making it an excellent choice for organizations looking for a secure and reliable corporate spend management solution.

For more information visit Pluto and book a demo.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Vlad Falin, Finance Writer

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Mohammed Ridwan

Purchase Order Automation: Transforming Business Transactions for the Better

The sales team needs a new SaaS product for cold calling, but the approval is due. It has been weeks, and neither the finance nor the legal team has reverted. The sales team keeps following up, and the procurement team is stuck in the loop of approvals, only to spend some more weeks negotiating with the right vendor later.

This is a common scenario in most companies where teams follow a fixed standard operating procedure, and procuring basic items takes months. All this, combined with multiple tools, complicates procurement further. One tool to raise requests, one for approvals, one to manage vendors, and so on.

In this blog post, we will discuss how to automate purchase orders and simplify the procurement process. Instead of relying on hundreds of procurement automation software, we will look at how you can automate with minimal effort.

What is Purchase Order Automation?

Purchase order automation is the process of automating and removing all the manual tasks associated with creating purchase orders.

This is what the traditional procurement process looks like in most companies:

- Employees fill out forms to raise purchase requests, but have a long wait before they receive a response.

- The procurement team struggles to manage hundreds of purchase requests and seek approvals from different departments.

- The finance team is disliked by both employees and the procurement team because they focus on cost-saving and resource optimization.

As a result, there is continuous internal resentment.

Automating parts of this process lifts the weight off of each of them. Instead of relying on forms and different task management tools, you invest in centralized software to manage requests, set approval workflows, and maintain vendor databases.

How to Automate Purchase Orders

Here is a simple four-step method to automate your purchase orders:

1. Find the Right Automation Software

We have explored the top procurement automation software previously, which will help you evaluate the alternatives available. To pick the right one, look for the following features:

- Ease of use- To simplify adoption and reduce training time

- Flexible workflows- To adapt to complex organizational hierarchies

- Integration- To connect and sync with existing accounting systems and ERPs

- Reporting- To support data-driven decision-making and enhanced transparency

- Real-time visibility- To track expenses and identify thefts and fraud

- Scalability- To accommodate increased transactions and users without performance issues

2. Integrate With Your Accounting Software and ERPs

Connect your existing accounting software and ERPs to procurement automation software to sync vendors and transactions across multiple software platforms.

As a result, it becomes easier to maintain vendor databases and reconcile accounts. You can streamline purchase orders and eliminate chances of errors. You get real-time visibility into the status of orders, ensuring that relevant stakeholders are informed at every stage.

3. Set Up Policy and Approval Workflow

Create and enforce guidelines, rules, and approval hierarchies for purchase orders that align with organizational policies. This includes the following steps:

- Outlining the approval workflow to follow the organizational hierarchy

- Setting spending limits to control the amounts allocated in a single purchase order

- Syncing and defining the preferred vendor's list

- Specifying user permissions, access levels, and actions based on roles within the procurement process

- Activating alerts for relevant stakeholders about the status of purchase orders, pending approvals, or other critical updates

This step will enhance security, communication, and transparency throughout the procurement workflow.

4. Implement Automation

Finally, once you complete the setup, you will be able to automate the following parts of purchase orders:

a. Approval Workflows

You can set up trigger-based approval workflows without requiring any technical expertise. From approving purchase requests to clearing payments, you can set up a proper hierarchy with all the required stakeholders.

So whether a purchase demands approval from three managers or three departments, you can accommodate the complexities without any delays.

b. Vendor Database

Instead of importing/exporting or manually maintaining vendor data in your procurement software, you can integrate the software into your existing accounting system and ERPs for a convenient two-way sync.

You can also create a list of items for each vendor, making two-way and three-way matching easier.

c. Receipts

Be it from email or WhatsApp, you no longer need to upload receipts and information in your system manually. The software captures the receipts and other key details via OCR, eliminating redundant record-keeping.

Additionally, you can bulk upload the invoices to add all the information in a centralized platform and sync across accounting systems. This simplifies reconciliation and provides complete visibility into each expense.

d. Expense Categorization

You no longer need to manually add tax and general ledger (GL) codes to any expense. Based on the key information extracted via OCR, the software categorizes the expenses. Plus, this syncs across platforms, accelerating reconciliation.

e. Goods Received Note (GRN) Matching

With OCR and receipt information retrieval, two-way and three-way matching becomes easy. The stakeholders can side-by-side compare the purchase order, invoice, and items listed. This significantly reduces the time spent on GRN matching and consolidates all the information on a unified platform.

f. Audit Trails

You get away with the need to maintain thousands of receipts and documents and get all the key information on a unified platform. From purchase requests to stakeholders involved and order status, you get complete visibility into each order.

This audit trail becomes a blessing during the audit season when you only need 30 seconds to retrieve a specific receipt or document.

How Automating Purchase Orders Makes Procurement Easier

While automation comes with multiple benefits, one reason to try it out would be gaining control and visibility.

You go from not knowing what the teams need, where the money is going, which department spends the most, or why these reports don’t make any sense to getting clarity on every aspect of procurement, not just purchase orders.

Here are five more benefits of automating purchase orders:

1. Reduce Error and Manual Tasks

You minimize the risk of human errors that come from manual data entry. For instance, a manual typo in the quantity ordered leads to complications and delays. Similarly, a mistake in categorization can cause legal issues. Automation ensures accuracy by eliminating such human errors.

2. Faster Reconciliation

You get real-time data synced across your accounting systems, easing the reconciliation process. The finance team can quickly match records, such as invoices and receipts, without delays and discrepancies. Further, this eases the process of GRN matching, helping you close books much faster with accuracy.

3. Streamlined Approvals

You accelerate the approval process for purchase orders even with complex hierarchies. Instead of waiting for physical signatures or manual confirmations, you get trigger-based approval workflows. As a result, you can set up a proper notification system to send purchase order requests to designated approvers, speeding up the entire approval chain.

4. Compliance Support

You can enhance compliance with organizational policies and regulatory standards. For instance, the system can flag a purchase order exceeding predefined spending limits, ensuring compliance with budget constraints. This helps prevent unauthorized purchases or deviations from established guidelines.

5. Scalable

You can scale procurement easily to meet the evolving needs of the business. As the organization grows, the automated system handles increased transaction volumes without affecting or increasing the manual effort.

Your Search for a Purchase Order Automation Tool Ends Here

Stop looking for different automation tools for each step in your procurement process. You don’t need an individual solution for purchase requests, purchase orders, and processing payments. You can automate it all on a single platform and ensure accuracy and consistency among your accounting systems.

At Pluto, our main aim is to stop the chaos and make procurement easier for three core stakeholders—spenders (employees), savers (finance teams), and sourcers (procurement teams). We streamline the entire process on a centralized platform and give you more visibility and control at each stage. And whether you want to automate one step or digitize your entire procurement process, Pluto gives you the flexibility to meet your needs.

Refer to our dedicated post on procurement automation to understand how a single procurement platform can sync with your accounting systems and automate the procurement process on a centralized platform.

•

Mohammed Ridwan

How Corporate Fleet Cards Help Modern Transport & Logistic Businesses

Companies use petty cash for managing driver and transport expenses, including maintenance, repairs, and small purchases, by allocating a small amount of physical cash to drivers. Drivers submit receipts for reconciliation, and they manually track these small transactions.

However, tracking numerous trivial transactions becomes time-consuming, and discrepancies emerge during reconciliation. There's always a risk of misuse or theft, demanding strict security measures. Moreover, negotiating favorable terms with vendors for minor, recurring transactions becomes challenging. They must carefully budget and maintain a sufficient petty cash fund, which strains their overall cash flow.

Overall, the manual process raises efficiency concerns, necessitating a balance between control and practicality in managing day-to-day vehicle-related expenses.

A better alternative to petty cash is a fleet card.

This post will explore corporate fleet cards, their benefits for transport and logistics, and strategies to overcome potential fuel card challenges for improved spend management.

What Is Meant by Fleet Card?

A fleet card, also known as a fuel or gas card, is a specialized payment card used by businesses to cover expenses related to their vehicle fleets. It is issued by fuel companies or financial institutions specifically for fuel purchases, maintenance, and other vehicle-related expenses.

What Can Fleet Cards Be Used For?

The fleet cards are primarily used for fuel purchases, maintenance, and repairs. They facilitate seamless payments for routine servicing, tolls and parking fees, and purchasing vehicle-related products.

You get cards with custom spending limits and advanced controls, such as real-time transaction monitoring mechanisms, category-specific restrictions, and automated alerts for enhanced security and streamlined expense management.

Drivers purchase fuel, maintenance, and other vehicle-related expenses at authorized locations with the cards, and you enjoy complete visibility on a centralized dashboard for each transaction.

What Are the Benefits of a Corporate Fleet Card?

Switching from manual petty cash management to a fleet card yields the following benefits:

- Simplifies payment processes by reducing the complexity of cash handling

- Improves tracking and monitoring of all vehicle-related expenses

- Minimizes the risk of theft or misuse, providing enhanced security measures

- Automates the expense management and reconciliation process, eliminating manual record-keeping and ensuring accuracy with reduced likelihood of errors

- Promotes compliance by enabling you to set controls and restrictions on card usage according to company policies

- Enhances budgeting by providing detailed reports and insights into the spending patterns for a structured and controlled approach to managing vehicle-related costs

- Streamlines transactions with vendors, offering an efficient payment method for small, frequent transactions

Should I Use a Fuel Card or a Credit Card?

Fuel cards and credit cards share similarities in providing a convenient payment method for expenses. Both can be used at gas stations and offer detailed transaction records for monitoring expenditures. Moreover, both cards come with features such as spending controls, reporting tools, and rewards programs.

However, here are some differences between the two:

- Fuel cards restrict card usage to fuel and maintenance-related purchases, providing greater control and limiting potential misuse.

- Fuel cards come with fuel discounts or rewards programs at specific gas stations, providing potential cost savings that credit cards do not generally offer.

- While credit cards provide transaction records, fuel cards offer more detailed reporting on vehicle-related expenses like fuel consumption, maintenance costs, and odometer tracking.

- Fleet cards partner with fuel providers, service centers, and other vendors, allowing businesses to negotiate favorable terms and discounts for bulk purchases or regular transactions. For instance, a fleet card's partnership with a fuel station yields discounted fuel prices, facilitating substantial cost savings.

So, for transport and logistics businesses, corporate fleet cards offer specialized controls for fuel and maintenance, streamlined reporting, and potential fuel-related discounts.

What Are the Risks of Fuel Cards?

Fuel cards, tailored for fleet management, are designed to address the unique needs of companies in the transport and logistics sector. However, organizations face the following challenges when switching to corporate fleet fuel cards:

1. Gas Station Availability Issues

Fuel cards encounter challenges related to gas station availability that limit refueling options. As a result, drivers can not find suitable gas stations, leading to increased travel time and delays in delivery schedules.

3. Location-Dependent Acceptance

The acceptance of corporate fleet cards varies by location, leading to constraints and inconveniences for companies operating in areas where certain cards are not widely accepted.

Drivers will encounter difficulties during interstate routes if you offer a nationwide delivery service and the fleet card is only accepted at specific gas stations or regions. It complicates expense management and hinders the company's ability to streamline fuel-related transactions.

3. Management Complexity

The specialized design of fuel cards introduces an administrative burden when managed separately. For instance, a company using distinct fuel cards for different vehicles finds consolidating expenses difficult, leading to increased administrative efforts and potential operational inefficiencies.

As a result, administrators have a hard time reconciling statements, accurately tracking expenses, and ensuring compliance. This burden increases processing times and errors in financial reporting.

4. Reward Limitations

While crafted to suit industry needs, fuel cards encounter limitations in cashback offers. Consider a scenario where a company's preferred fuel card provides cashback benefits only at select stations, restricting potential cost savings for the entire fleet.

Why Should You Switch to Pluto Corporate Fleet Cards?

Pluto fleet cards don't restrict the use of cards at their discretion. Instead, they facilitate advanced controls and real-time visibility. From issuing budgeted fuel cards to creating vendor-specific cards, you can set rules that align with your company's needs and policies. Then, with each transaction, you track all fleet expenses from a single dashboard and get real-time data without manual effort.

So, you set cards and add controls, and you are good to go! Drivers can spend them at convenient gas stations while you enjoy complete visibility and control. Each transaction appears on the dashboard and notifies drivers to upload the receipt directly from WhatsApp. Once uploaded, you can approve the expense, and the data syncs with your accounting software to help you close your books ten times faster.

Here are the top six benefits of switching to Pluto corporate fleet cards:

1. Unrestricted Access Anywhere

Unlike traditional restrictions, Pluto corporate fleet cards liberate your drivers. There are no limitations on locations or specific fuel stations. Enjoy the convenience of using cards at the most budget-friendly and strategically located gas stations, repair shops, or truck stops that welcome Mastercard.

2. Easy Cashback

Pluto corporate fleet cards make cashback benefits straightforward. With up to 2% unlimited cashback on over 100+ currency spends, enjoy seamless cost savings without intricate conditions or restrictions.

3. Smart Budgeting

Pluto fleet cards, functioning as debit cards, provide smart budgeting without blocking cash flow. Drivers can request limit increases in seconds, ensuring operational flexibility with swift approvals. This distinctive feature sets Pluto apart, seamlessly blending budget management and uninterrupted cash flow for efficient fleet operations.

4. Driver-Friendly Controls

Provide drivers with budgeted fuel cards and set spending rules. Real-time data and advanced controls give you complete transparency of fleet expenses, enabling strategic decision-making.

5. Grow With Ease

Whether you have hundreds or thousands of drivers, the streamlined process of issuing corporate fleet cards and setting controls remains hassle-free, supporting your scalability with ease.

6. Eliminate Fraud

Lock or freeze cards instantly from the Pluto app, ensuring proactive measures against fraud. Enable company policies to ensure in-policy transactions, eliminating the risk of unauthorized spending.

Enhance End-to-End Spend Management

Pluto eliminates the need for separate investments in corporate fleet cards, offering an all-in-one spend management solution.

Pluto's comprehensive platform facilitates both corporate purchase cards and fleet cards, streamlining your financial operations. Enjoy the same benefits as traditional corporate fleet cards but with enhanced functionality, all within a unified platform. With Pluto, you get unparalleled efficiency in managing corporate expenses, ensuring a seamless and integrated approach to financial control.

Transform your spend management today. Book a demo and discover how Pluto can optimize your financial processes and elevate your business operations.

•

Mohammed Ridwan

Top 6 Expense Management Software for Global Businesses in 2024

You have just received an OTP, and now you are guessing which one of your employees is spending this amount and why. You don’t have time to review it, nor can you delay the payment too much. You neither have control nor visibility. This is the problem of shared corporate cards.

If you want to make it simpler for your employees, invest in expense management software. It is an automation tool to streamline employee-related expenses—reimbursement, petty cash, and corporate cards. In addition, it offers a centralized platform with real-time visibility into how employees spend company money. As a result, the entire cycle of approval and accounting becomes simpler.

In this post, we share the top six expense management software to help you get started.

Top 6 Expense Management Software

Here are six options for expense management software to manage employee-related expenses:

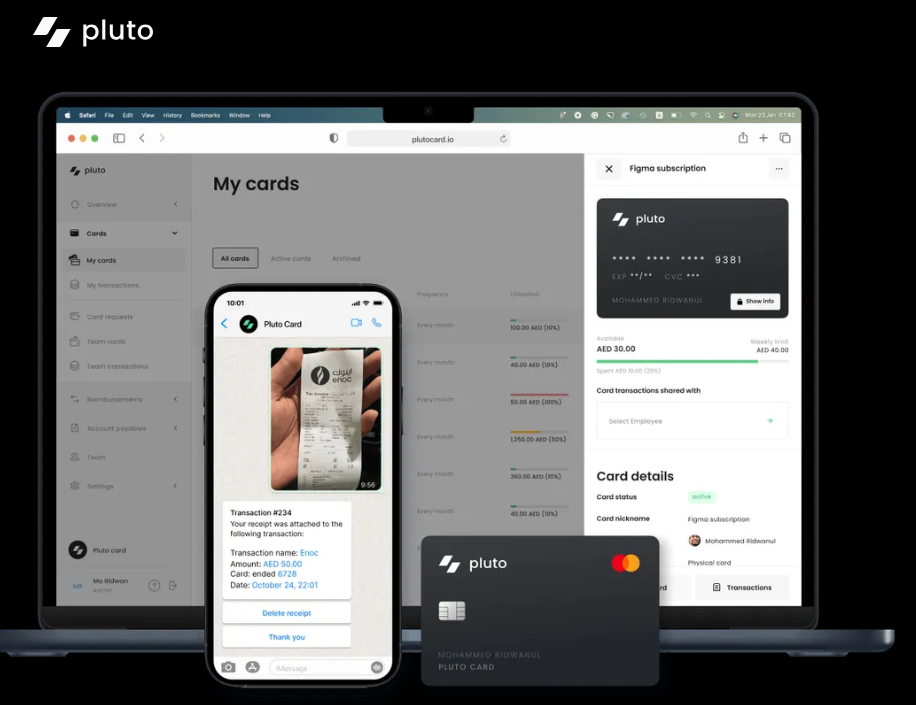

1. Pluto

Pluto is the best platform for managing employee expenses as it streamlines petty cash management, corporate cards, employee reimbursements and account payables. It is trusted by the largest finance and procurement teams in the Middle East, such as Tamara and Petrochem. With Pluto, you can transform reimbursements to get more control and visibility without causing delays or confusion.

Key Features:

- Provides custom no-code approval workflows that adapt to the company's hierarchy for timely and accurate approvals

- Automates receipt capture through optical character recognition (OCR), with the ability to support bulk upload via WhatsApp

- Supports unlimited corporate cards—virtual and physical, with budget controls to maintain expenses within corporate policies

- Offers zero-balance cards, which get funded once the expense is approved

- Ability to add comments and other transaction details to maintain a comprehensive audit log. View-only access is available for external accountants to review financial data without making changes

- Facilitates card-specific policies to make branch and subsidiary-level reimbursements easy

- Gives the option to make mass payments to reimburse employees

- Offers custom expense reports to overview business expenses and spending trends

- Alerts in case of duplicate receipt uploads to avoid fraud and compliance issues

- Integrates with accounting platforms like Netsuite for advanced general ledger (GL) coding and tax tracking

- Provides secure document storage with a five-year audit log and bank-grade encryption

Pricing:

Pros:

- Enables branch and subsidiary-level spend tracking (not offered by other platforms)

- WhatsApp integration to make receipt upload easy

- Offers up to 2% cashback on all non-AED transactions

- Independent PCI DSS Level 1 Certification

Cons:

- Slightly longer onboarding due to a corporate card offering

- Integrates with all other major ERPS except Tally

2. Airbase

Airbase simplifies expense reporting with AI and ML and ensures quick, hassle-free, and smart corporate expense management. It is an automation solution for small to midsize businesses (SMBs) and large enterprises with 100-5,000 employees.

Key Features:

- Offers OCR to populate details, including GL category, date, amount, and purpose

- Ensures compliance by sending reminders and, if needed, locking cards until policies are met

- Facilitates reminders to upload receipts, eliminating the need to chase employees for receipts

- Offers a designated email address to send receipts of virtual card transactions

- Allows custom approval workflows and budget limits for physical cards

- Provides alerts for suspicious activity, enabling quick responses to potential fraudulent purchases

- Enables real-time audit trail with receipts, notes, and documentation for transparency

- Automates expense reimbursements to employees' bank accounts once the expenses are approved

Pricing:

Request the sales team for a custom quote

Pros:

- Flexible to accommodate varying team sizes and user base

- Intuitive and easy to use; no training or previous knowledge required

Cons:

- Slow mobile app; takes time to load pages

- Glitchy SSO-based login

- Not suitable for complex branch-level approvals and expenses

3. Ramp

Ramp is an integrated solution that streamlines expense management with corporate cards, automated expense tracking, and real-time reporting to help teams track expenses. It is a suitable solution for businesses of all sizes.

Key Features:

- Provides corporate cards with the ability to add spending policies to prevent unauthorized or non-compliant expenses

- Facilitates customizable workflows for expense approval

- Enables employees to submit expenses on the go through SMS, mobile app, and integrations with platforms like Gmail and Lyft

- Automates the capture and matching of receipts for every transaction, ensuring accurate expense tracking

- Flags non-compliant expenses, including weekend spend, excessive tipping, and alcohol purchases, reducing the need for manual review

- Provides instant access to real-time spending data, allowing businesses to make timely adjustments before exceeding budgets

- Identifies cost savings opportunities, such as duplicate subscriptions and unused solutions

Pricing:

Offers three pricing packages—free or basic features, $15 per user per month for Ramp Plus, and custom quote for enterprises with features like enterprise ERP integration, custom implementation, and local card issuance.

Pros:

- Unlimited 1.5% cash back on credit card purchases made using their VISA branded cards

Cons:

- Only available to businesses registered in the US

- Doesn’t have a mobile app for Android phones

4. Bill.com

Bill.com simplifies employee expense tracking by providing real-time visibility and customization. It is an expense management solution for SMBs to control all corporate expenses. It streamlines a scattered expense management process with seamless syncing.

Key Features:

- Extends credit limits ranging from $500 to $5 million to control spending within constraints

- Provides custom approval workflows to speed up the approval process with minimal friction

- Offers multiple payment options, including ACH, credit card, check, international wire transfers

- Automates purchase order workflows with the ability to sync and automate two-way matching and three-way matching

- Enables quick coding and sync with accounting systems to streamline expense reconciliation

- Enables automated receipt matching, categorization, and expense reporting, reducing administrative workload

- Offers security features, including the ability to freeze and create corporate cards instantly

- Notifies administrators of each employee's transactions, ensuring timely oversight

Pricing:

Offers a free trial and essentials pack starting at $45 for six standard user roles. Its team and corporate pack are for $55 and $79, respectively. Enterprises need to request a custom quote.

Pros:

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons:

- Customer support is difficult to initiate, slow, and unresponsive

- Glitches in the reimbursement process lead to pending approvals

5. Rydoo

Rydoo is a cloud-based expense management tool that streamlines reimbursement cycles, automates expense flows, and enhances team productivity. It combines the capabilities of an expense tracker and a travel service, enabling you to book flights and hotels. It is suitable for medium-sized businesses that are building international relationships with overseas offices as it supports multiple languages and currencies.

Key Features:

- Supports OCR scanning feature for receipt management

- Automates approval flows for expenses based on company policies

- Assures global compliance by setting up rules, mileage rates, per diems, and tax rates for specific countries and regions. Also provides an advanced rule engine for tailored policies in the admin panel.

- Reimburses employees in their local currency, supporting diverse international operations

- Integrates with popular third-party apps like Dropbox, Slack, Uber, Lyft, and SAP

- Supports accounting software widely used in the European Union, such as Exact Online and E-conomic

- Offers full audit trails for maintaining company policies, IRS compliance, and resource conservation with a 10-year data storage period

Pricing:

Offers a team plan at €8 per user per month with OCR scanning and integrations, growth plan at €10 per user per month adding controls and SAP/Oracle integrations, and enterprise plan with API support and custom pricing for ERP and HR

Pros:

- Makes it easier to add expenses in different currencies and get paid in local currency with multi-currency support

Cons:

- Increases in prices over time leading to significant cost jumps over the years (Source)

- OCR doesn’t work efficiently and requires manual entry

6. Zoho Expenses

Zoho Expense is a travel and expense management solution designed to cater to the needs of growing businesses. Trusted by thousands of businesses across 150+ countries, it is a customizable expense-tracking tool offering a mobile-first approach, automation, and integration capabilities. Its integration with the Zoho suite makes it suitable for SMBs seeking efficient travel and expense management.

Key Features:

- Provides complete control over all stages of employees' business trips—pre-travel approvals, bookings, and post-travel management with a powerful self-booking tool for efficient business travel

- Offers customization and multi-level pre-travel approval flows along with automated visa requests, documentation, and forms

- Supports expense reporting by auto-scanning receipts for automatic expense creation

- Enables simplified approval processes and timely reimbursements

- Integrates with company cards to offer direct card feed retrieval and automated reconciliation

- Facilitates budget creation and comparison with actual spending with customizable rules to restrict overspending

- Provides AI-driven fraud detection for expense audits with country-specific editions for local compliance and mileage rates

- Supports real-time communication with employees through chat, comments, and notifications

- Integrates with leading travel, HRMS, accounting, ERP, and collaboration solutions

Pricing:

Offers flexible pricing plans, starting with a free option and scaling up to $3 per active member per month, $5 per active member per month, and custom enterprise pricing

Pros:

- Adaptable to global taxation regulations

- Easy to set up and deploy, very affordable for SMEs

Cons:

- Limited payment gateway integration options

- Can be a little confusing to learn especially when transitioning from app to desktop

Finding the Right Expense Management Solution

Consider these three factors while choosing the right expense management software — ease of use, security, and flexibility. Choosing the right expense management software can help you start your journey towards a healthy financial ecosystem.

In the end, what matters are your internal policies and controls that govern the expenses. Because no matter what platform you choose, if there are gaps in your internal control systems, the software will not be able to do the heavy lifting.

If you want more clarity on how you can stop the chaos in your company and manage expenses better, read our detailed post on internal control over financial reporting (ICFR). You can also book a call, and our team will help you better understand the bottlenecks and how you can streamline your expense management.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use