Contents

Top 6 Procurement Software Solutions for Modern Businesses

Mohammed Ridwan

•

•

The traditional procurement process is time-consuming, prone to errors, complex, and challenging to implement efficiently. From raising a purchase request to making vendor payments, multiple stakeholders are involved. In addition, securing approvals through various channels of an organization leads to chaos. Hence, 77% of companies are shifting to procure-to-pay solutions, also known as procurement software.

What is Procurement Software?

Procurement software are tools that automate the procurement process.

Instead of relying on multiple platforms and different channels to procure goods and services, the process is automated and brought together on a centralized platform.

A powerful procurement solution helps you in:

- streamlining the request and approval process for purchases

- generating, tracking, and managing purchase orders

- creating, negotiating, and tracking supplier contracts

- managing and maintaining supplier relationships

- automating invoice validation, approval, and payment workflows

- integrating with other systems for seamless data flow and coordination.

What Are the Benefits of Procurement Software?

By automating your procurement process with a procurement management software, you can improve it in the following ways:

- Once you enter data, it is auto-populated throughout the procurement cycle. This minimizes the risk of errors due to manual data entry in purchase orders, invoices, and other documents.

- You get real-time visibility into the procurement process. You can also track the status of purchase requests, orders, deliveries, and payments.

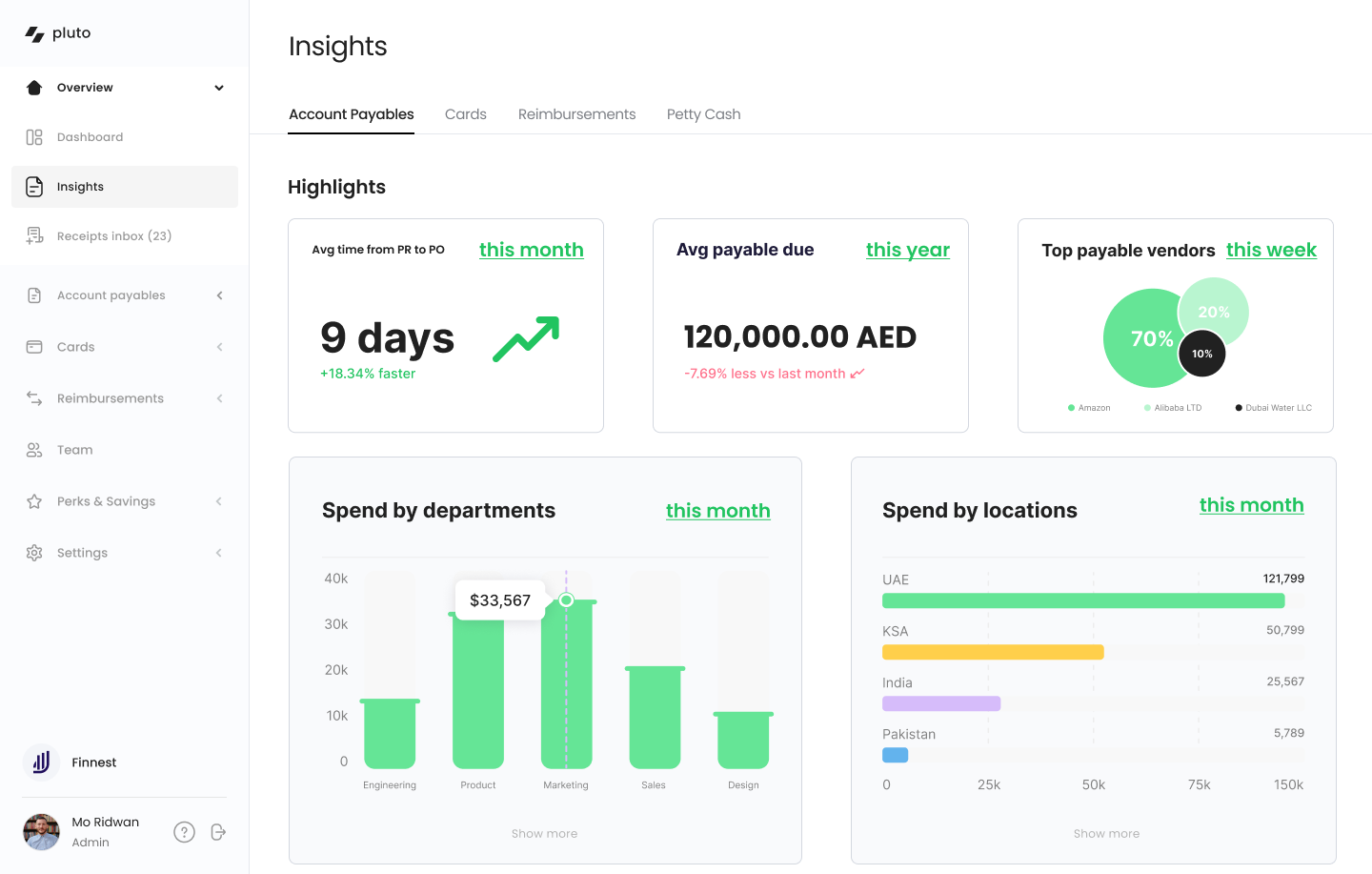

- With built-in reporting and analytics tools, you can generate detailed reports on spending, supplier performance, and other key metrics. This data-driven insight enables better inventory planning and strategic decision-making.

- You can standardize workflows for purchase requisitions and approvals. Route the requests to the appropriate individuals for approval and reduce any delays. Notifications and reminders are automated, ensuring timely responses.

- Invoice processing and payment workflows are automated. This ensures that invoices are paid on time. This helps in taking advantage of early payment discounts and strengthens vendor relationships.

Top 6 Procurement Software

To help you select the procurement management software best suited for the needs of your organization, we have listed the top 6 procurement solutions:

1. Pluto

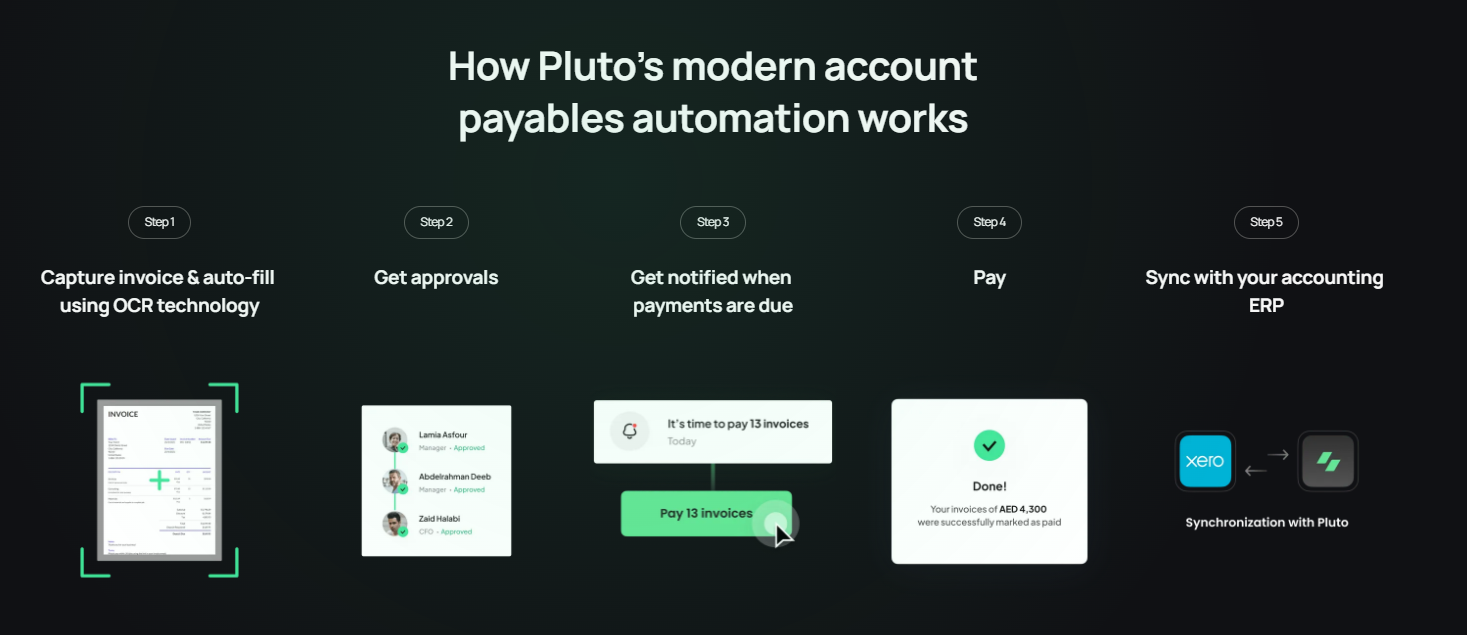

Pluto is an all-in-one procurement software designed to transform your accounts payable (AP) processes. It reduces your finance team's workload and makes procurement easy. From automating purchase requests to setting multi-layer approval workflows and managing vendors, it is the ultimate procurement solution to transform a chaotic procurement process into a faster and more efficient one.

Key Features:

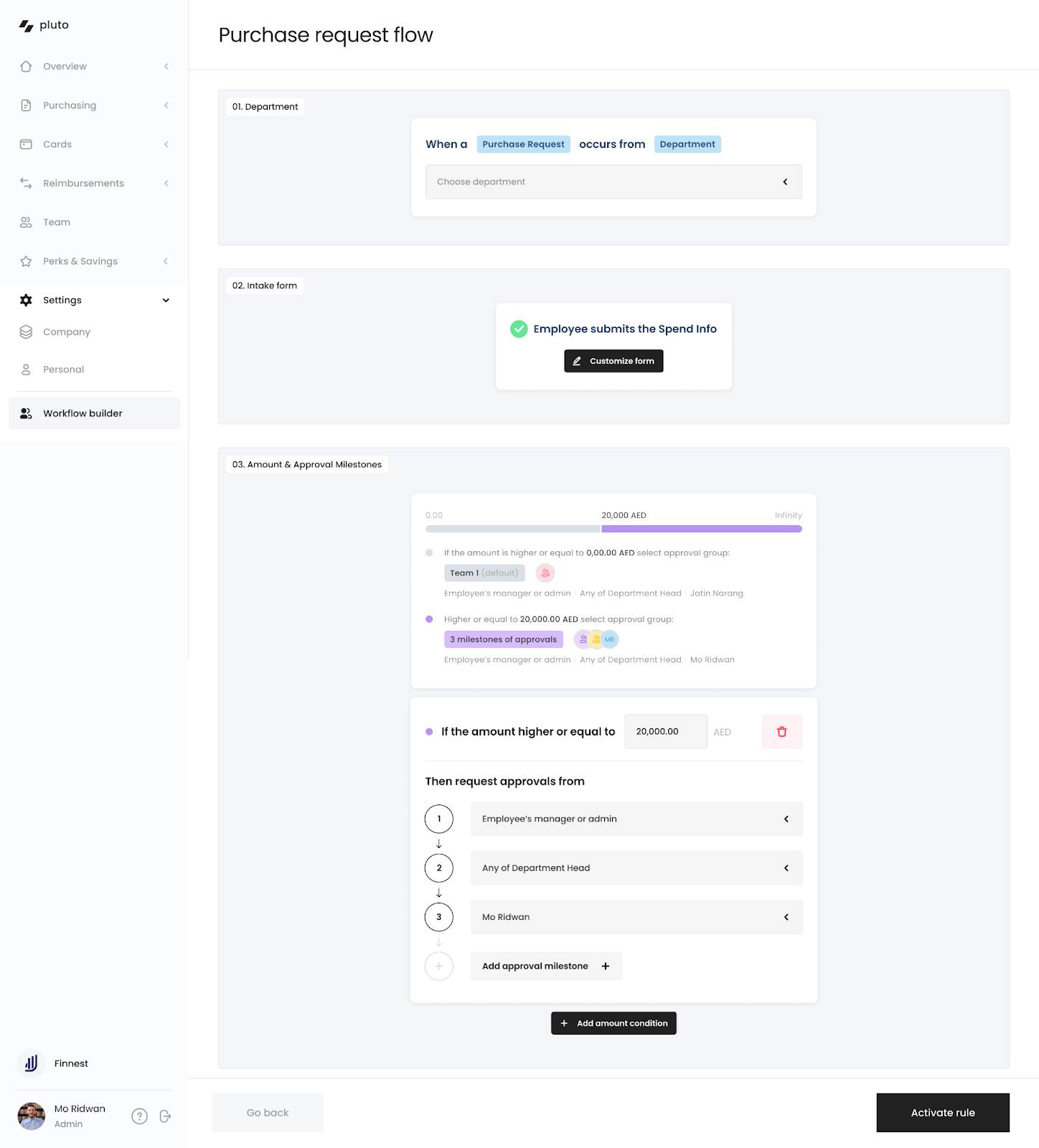

- Features fully customizable and automated workflows for raising purchase requests and purchase orders, requiring no technical expertise

- Offers flexible approval engine capable of managing intricate hierarchies

- Enables multi-layer invoice approvals with policies to align with your company's structure

- Ability to upload invoices easily via WhatsApp images, eliminating the need to search for invoice details. Also, facilitates invoice capture via emails directly to speed up the receipt capture process.

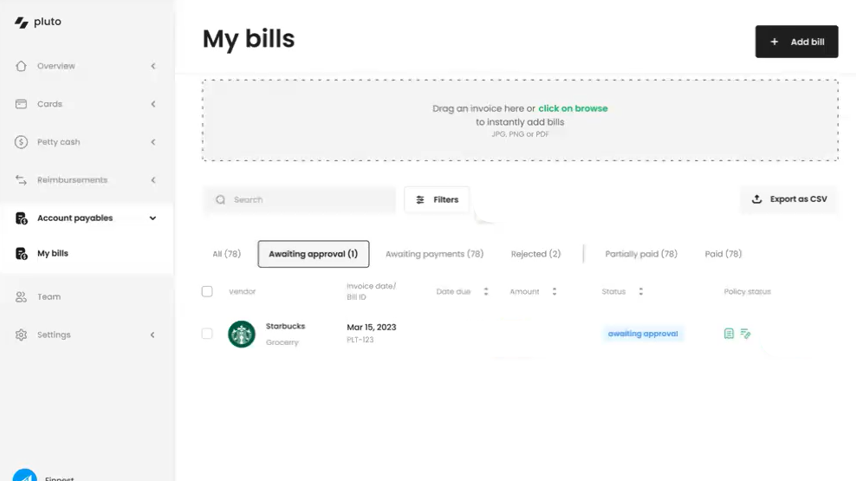

- A centralized dashboard to gather bills in one place and track the status to avoid double payments

- Vendor-specific corporate cards to control budgets and detect irrelevant expenses

- Supports local and international wire transfers to make payments

- OCR technology minimizes manual data entry by creating and populating bills from invoices

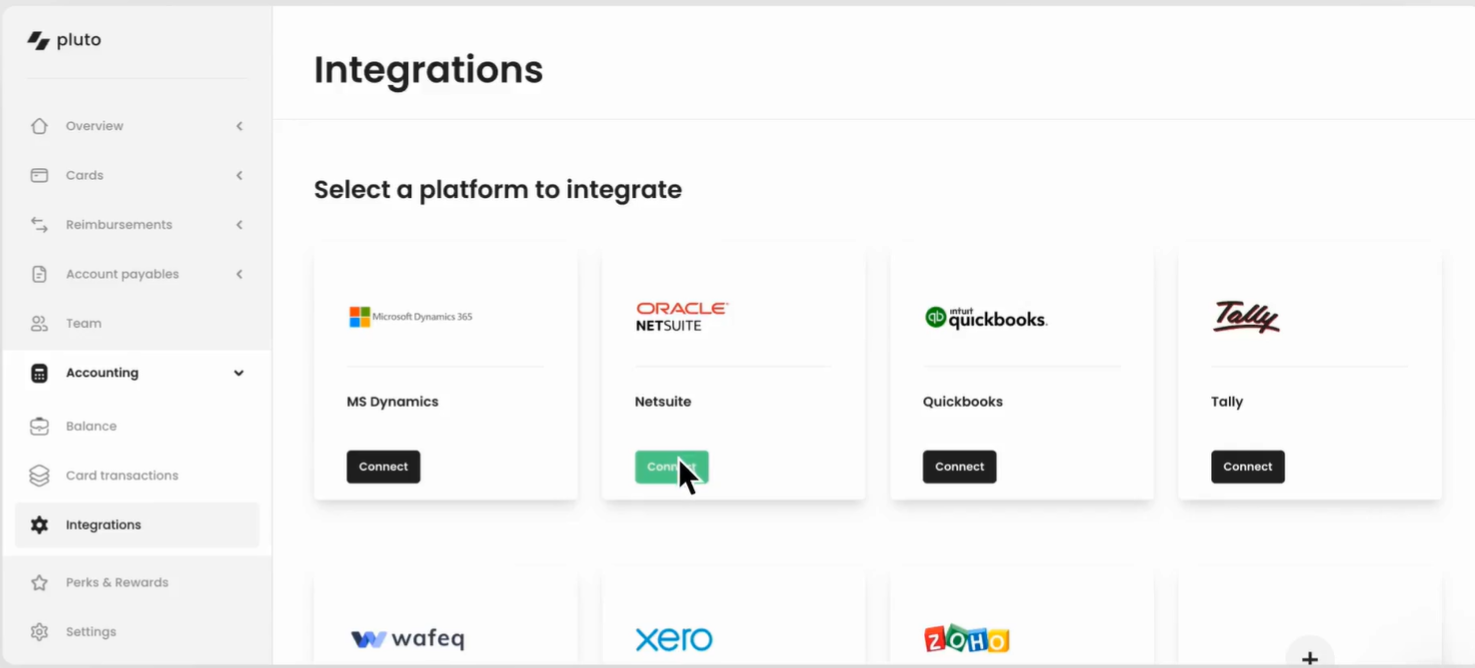

- Supports ERP integration to synchronize your vendors, POs, and bills and integrates with accounting software, such as Oracle, NetSuite, Zoho, Quickbooks, Wafeq, Xero, etc.

- Raises alerts for upcoming payments and enables scheduling payments in advance and automate invoices

- Provides a complete audit trail of the process to ensure visibility at each step

- Shows real-time analytics to facilitate deep insights for supporting budget control

Pricing:

Request the sales team for a custom quote

Pros:

- More financial control with vendor-specific corporate cards

- Better Forex rates than most local banks

- Multiple integration options

Cons:

- Slightly longer on-boarding due to corporate card offering

- Integrates with all other major ERPs except Tally

2. Yooz

Yooz optimizes the AP process, specifically focusing on invoice management. It is a cloud based software that uses artificial intelligence (AI) and machine learning technologies to enhance security and control in AP automation. It is suitable for mid-size companies of all sectors wanting to automate procurement with a cloud-based procurement solution.

Key Features:

- Enables online, real-time management of supplier relationships, improving communication and collaboration

- Provides mobile access for invoice approval and communication

- Maintains regulation-compliant traceability, ensuring adherence to relevant laws and standards

- Automates real-time GL coding and purchase order matching

- Captures all types of documents through various channels, such as email, drag-and-drop, mobile, scan, and sFTP, supporting multiple formats, including PDF, Factur-X, UBL, CII, and EDIFACT

- Integrates with accounting software and and ERPs

- Allows users to approve and pay invoices in batches, offering multiple payment options, such as Virtual Credit Card, ACH, eCheck, and Paper Check

- Offers a range of services, including consulting, configuration, training, and user support

Pricing:

Free trial for up to 15 days followed by a "pay-as-you-use" model.

Pros:

- Integration with Sage Intacct

- Ability to tag people in the comments and email them directly from the invoice

- Numerous criteria available for setting up the approval workflows

Cons:

- Doesn’t offer payment services in UAE, so you need to carry out payments on a different platform

- Doesn't have integrations with major suppliers as a form of punchout

- Time-consuming to download and export files

- Hard for vendors to send the invoices through Yooz

3. Procurify

Procurify speeds up the procurement process, enhances internal communication, and reduces financial risks. It is an easy-to-implement tool that saves time for finance and operations teams. From catalog management to custom user controls, it helps to track the procurement process in real-time.

Key Features:

- Tailors purchase orders to match your internal processes and vendor expectations

- Creates, tracks, and maintains an audit trail of all procurement transactions for transparency and compliance.

- Enhances financial controls by enabling purchase order-based purchasing

- Ensures that requested items are approved against budgets before procurement.

- Sync purchase orders with your accounting system or ERP, whether via API, CSV, flat file, or direct integration

- Integrates with trusted suppliers through PunchOut catalogs to streamline the ordering process.

- Enables blanket purchase orders, which involve making multiple purchases against a single purchase order, even when details of future purchases may be unknown.

- Purchase order workflows to save on shipping costs, unlock vendor discounts, and reduce paperwork

Pricing:

Starts at $2000/month with a custom pricing tier

Pros:

- Easy to make amendments in the original purchase order

- Enables ordering from multiple websites for resources, including Amazon

- Makes it easy to upload documents to support expense and order reports

Cons:

- Doesn’t offer payment services in UAE, so you will need to carry out payments on a different platform

- Isn’t catered to the UAE market, and does not support UAE specific workflows such as VAT management

- Cannot edit orders once they are approved

- Cannot see the order history for a catalog item without running a report

- Physical inventory has to be tracked outside Procurify

4. Precoro

Precoro is a cloud-based solution designed to streamline operations, automate tasks, and centralize purchasing procedures. It enables tracking discounts, monitoring corporate expenses, and enhancing cash flow transparency. It also provides analytics and reports for strategic procurement planning.

Key Features:

- Simplifies the approval by allowing users to approve from any device via email or Slack notifications.

- Supports customizable approval workflows with multi-step and role assignment

- Facilitates creating, approving, and tracking purchase orders and transfer orders from Amazon Business via Punch-in

- Connects with various ERPs and business tools like NetSuite, QuickBooks, and Xero, or its API

- Ensures data security through Single Sign-On (SSO) and 2-factor authentication

- Offers an intuitive interface and guidance from a dedicated customer success manager whenever needed

- Gives a risk-free 14-day free trial with access to all features

Pricing:

Starts at $35 per user per month billed annually for teams with under 20 members and offers custom pricing for enterprises

Pros:

- Provides flexibility for enterprise needs

- Works well for budgeting procurement

- Allows tracking invoices in a centralized environment

Cons:

- Requires training to customize complex workflows

- Invoice processing is slow

- Isn’t suitable for manufacturing industries

- Difficult to collaborate on invoice drafting

5. Kissflow

Kissflow simplifies and enhances procurement processes while ensuring transparency and compliance. It helps to automate the entire process without requiring technical expertise or coding experience. It comes with 50+ ready-to-use applications, enabling unlimited automation applications.

Key Features:

- Offers fluid forms to enable easy capturing, approval, and tracking of purchase requests

- Allows to register and maintain vendors effortlessly with access to multilingual catalogs

- Integration with accounting systems, ERP, and finance systems like Quickbooks, SAP, and Microsoft Dynamics

- Accelerates the invoice approval process with timely alerts and automated checks. Connect invoices to contracts, purchase orders, and service entry sheets in a single dashboard

- Customizable reports to visualize data using charts, filters, and heatmaps

- Ability to define and manage budget restrictions with dynamic rules throughout the entire procure-to-pay lifecycle

- Customized approval workflows to ensure transparency with rule-based approval processes

- Smart alerts that provide real-time updates on the status of purchase orders and invoices to keep stakeholders informed

Pricing:

Starts at $2499/month (billed annually). Pricing varies based on transaction volume and number of users.

Pros:

- Intuitive interface with a relatively short learning curve

- Allows automated workflows to be created with limited technical expertise

Cons:

- Not built specifically for procurement teams

- Does not support payment flows in UAE

- Cost of its license is high (particularly for SMBs)

- Can not handle intricate processes that require a high degree of customization or involve multiple conditional branches

- Customization options are limited, including specific integrations, advanced business rules, or more sophisticated automation capabilities

6. Vendr

Vendr is a practical solution for streamlining SaaS procurement. It simplifies the entire process, from intake requests to contract management. It provides essential SaaS insights, negotiates expert advice, and integrates with core business tools for procurement and vendor management.

Key Features:

- Buyer guides to provide negotiation insights and gain the upper hand in software purchases

- Negotiation advisory to provide personalized guidance on negotiating like a pro and enter negotiations with confidence

- Simplified intake forms to ensure company-wide compliance and visibility

- Integration with different accounting and finance tools, such as Oracle, NetSuite, Intuit, Quickbooks.

- Integrates with platforms like Rippling Workday to include correct stakeholders. Additional integration with SSO providers such as onelogin.

- Comprehensive renewal dashboard to receive early alerts and streamline the renewal preparation process to maximize savings.

- Vendr Slack integration for quick answers and timely notifications to collaborate in real time with your team, minimizing approval cycle times

Pricing:

There are 2 packages—the basic one starts at $15,000/year and the pro package starts at $20,000/year.

Pros:

- Offers assisted buying with a team who negotiates on your behalf

- Comprehensive database of vendors in one place

- Helps standardize procurement workflow

- Provides insights about fair market value

Cons:

- Restricted to SaaS procurement only

- Multilingual services are limited

- Navigating multiple workflows is not as fluid as desired

- Doesn't support multiple currencies

Find the Right Procurement Software

When choosing procurement software, focus on user-friendliness, scalability, and integration capabilities. Make sure the software aligns with your specific needs.

Finding the right software for accounts payable automation will be crucial for your business. For instance, if you frequently deal with multiple suppliers and have a complex approval process, ensure the software can accommodate these intricacies. Similarly, if you're in the healthcare industry, look for procurement software that complies with industry regulations like UAE Healthcare Law and the Dubai Health Authority (DHA) regulations. This ensures the privacy and security of patient data and adheres to local data protection standards. Moreover, check if the vendor offers active support and training. In case of a technical issue, having an unresponsive support team can disrupt the process and create bottlenecks.

Don't rush the decision. Thoroughly evaluate multiple options. Investing in an appropriate solution will save you money and headaches in the long run.

Want a tool that is safe, fast, and transforms your chaotic procurement process into an automated solution? Book a demo today and see how Pluto can simplify procurement for your team.

Disclaimer: The comparisons and rankings of procurement software competitors in this article are based primarily on reviews found online. While we strive to provide accurate and up-to-date information, these reviews are subjective and reflect the opinions of the users who posted them. The information presented is intended for general informational purposes and should not be considered as a definitive guide for choosing a software provider. We encourage readers to conduct their own research and consider their specific needs before making a decision.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Vlad Falin

How to Manage Petty Cash Effectively in 2024

Not every expense in the company requires you to issue a check. Payments like petrol, supplies, stamps, etc., are paid via cash. For these business transactions, either the employees take cash in advance or put in a request for reimbursement. This mechanism requires you to set some cash aside and employ a person for receipt management and reporting. The cash is referred to as petty cash.

What Is the Meaning of Petty Cash?

Petty cash refers to a small amount of money that businesses keep readily available for handling minor payments and expenses that are too small to be processed through regular accounting procedures. It is often kept on hand and is reimbursed periodically.

{{take-pain-banner="/components"}}

What are Petty Cash Examples?

Petty cash includes small miscellaneous expenses, such as:

- Office supplies

- Gifts

- Client lunch

- Refreshments

- Postage

- Medicine and first aid

- Minor repairs

- Transportation

What Is the Process of Petty Cash Disbursement?

The first step in petty cash disbursement is to define policies and procedures. This includes specifying:

- The purpose of the fund

- The maximum cash amount

- The types of expenses the fund can cover

- The process for replenishing the fund

The next step is to appoint a petty cash custodian. They are responsible for handling the petty cash fund.

Then, you set up the fund by transferring the initial sum of money into a safe or locker. This amount should be sufficient to cover minor expenses for a defined period.

When employees make small purchases, they request funds from the custodian. After the purchase, they return with a petty cash voucher, receipt, and cash balance.

The custodian reviews the receipts and provides reimbursement. They maintain detailed records of every transaction, including the date, purpose, recipient, amount, and a brief description of the expense. This record-keeping method ensures transparency and accountability.

After that, the custodian reconciles the petty cash fund at regular intervals. They add up the safe's cash balance and the receipts' value. The total should match the original amount in the fund.

{{cs-cta-component}}

What are the Two Types of Petty Cash?

To manage petty cash, the custodian relies on either of the petty cash book systems:

1. Imprest Petty Cash Book

An imprest petty cash system involves maintaining a fixed amount of money in the petty cash fund at all times.

For instance, you set up a fund of $100. When the fund gets down to $20, the custodian requests reimbursement and replenishes the fund to $100.

2. Columnar or Analytical Petty Cash Book

A columnar or analytical petty cash book is a detailed and structured method of recording petty cash transactions. It categorizes expenses into different general ledger codes for better tracking.

For instance, you create separate columns, such as "office supplies," "refreshments," "meals," etc. Whenever a transaction occurs, the custodian records it in the appropriate column and specifies its purpose.

What are the Challenges of Petty Cash?

While the process of petty cash seems linear and simple, it has many intricacies in practice.

Imagine the custodian getting hundreds or thousands of requests and receipts every day. So, maintaining a petty cash system is easier in a smaller business with limited expenses and reporting needs. However, for larger enterprises, relying on manual vouchers and physical safes/lockers causes a lot of chaos.

1. Vulnerability to Theft and Misuse

Unlike an automated system, a manual petty cash system lacks controls and security measures.

For example, if the custodian is not vigilant, employees can use the cash for personal expenses. Similarly, if the custodian gets stuck between multiple requests and receipts, it leads to oversight.

Moreover, the physical nature of cash in a petty cash box makes it an easier target for theft. Since there's no immediate digital record, anybody can steal money, which goes unnoticed for a while. This lack of transparency and a digital audit trail makes it difficult to identify funds misuse.

2. Poor Receipt Management

Receipts are the document of proof for the expense. With the traditional approach, custodians have to chase employees for receipts. This results in incomplete or unaccounted-for submissions.

Moreover, relying on the manual petty cash process makes it harder. The custodians have to manage countless receipts daily, making reconciliation tedious. Hence, you end up with misplaced, duplicate, or even damaged receipts.

A common example of this issue is when a custodian receives multiple receipts and with an analytical petty cash book to maintain. It takes them hours to reconcile, report, and ensure accurate categorization.

The worst is when it's time to report, and locating these receipts takes hours.

3. Chaotic Approval Workflow

In smaller companies, getting approval for expenses is easy. But, in large enterprises, even small expenses can prompt approvals from various departments and stakeholders. This makes the approval workflow complicated and time-consuming. This delays the fund release, disrupting the workflow and reimbursement process.

For example, imagine an employee who wants to buy a subscription for less than $300. In a big company, it will prompt approval from the manager, IT, finance, and legal departments.

All this back-and-forth slows things down a lot.

4. Internal Resentment

In big companies, there's tension between the finance team and other departments. This issue occurs when employees can't access the funds and have to wait for approval. Such a delay disrupts the work or delays the reimbursement.

For instance, an employee needs to buy a subscription for work. But the delay in approval impacted the deadline and client relationship. This creates problems and stress between the finance team and other departments.

5. Branch-Level Petty Cash Management

Large enterprises use separate petty cash systems for departments at the branch level. This means that each department has its own petty cash fund to manage.

Managing small amounts of cash at individual branches is tricky. Employees misuse/steal the money as there's not much oversight. There is no visibility on how money is being spent. Maintaining funds for multiple branches becomes a headache. Also, departments find it challenging to request more funds.

Reconciliation becomes challenging as the finance teams have to chase branches for complete information. This leaves a lot of loopholes for employees and branch custodians to misuse petty cash.

6. Tedious Reconciliation Process

Reconciliation ensures that the petty cash fund's balance matches the sum of all expenses.

Manually, reconciliation in large enterprises takes weeks and is prone to errors. Moreover, when adding up expenses, the process is prone to manual errors, which are hard to identify and correct.

For instance, the custodian overlooks a receipt. This mismatch between the recorded expenses and the actual cash on hand can take him weeks to spot errors.

7. Low Visibility Over Expenses

Traditional petty cash systems lack real-time data. At any given point of time, the custodian is unaware of the fund's current status. This lack of visibility delays financial decision-making. For instance, it can take weeks before the custodian realizes that the petty cash fund is running low. This can lead to temporary cash shortages for essential expenses.

The absence of a clear record makes it slower to notice problems and reconcile the cash. Moreover, transactions and expenses are recorded on paper, which leads to further errors. For example, when an employee uses petty cash to buy office supplies, there will be a delay until the expense is recorded.

Similarly, when many employees spend money simultaneously, tracking them in real-time is tough. This lack of transparency allows employees to misuse petty cash for personal expenses.

How to Manage Petty Cash Effectively With Pluto?

To overcome the challenges described previously, you can not rely on any automation tool. Instead, you need a product that is tailored to your specific needs. While many tools can assist you in digitizing petty cash management, Pluto goes the extra mile.

With Pluto, you no longer need to maintain a physical safe or countless vouchers and receipts. Pluto records every transaction in real time and gives you visibility at each step. From receipt to reimbursement, you manage everything with complete control and clarity.

Unlimited Corporate Cards

Pluto enables you to issue unlimited corporate cards, simplifying petty cash management. It eliminates the need for physical lockers or safes, promoting smoother cash flow. The availability of unlimited cards allows you to replace shared credit cards. This enables the use of cards for even small petty cash expenses.

Finance teams get full control and visibility over each petty cash expense in real time.

Employees can either swipe the cards for a seamless process or withdraw cash from ATMs. Every expense made with the corporate card triggers an approval workflow. It prompts employees to add receipts and managers to approve expenses. They can then add the receipts simply via WhatsApp and get reimbursed without any delays.

With all the data consolidated on a single platform, reconciliation becomes easier. This simplified process eliminates the need for a dedicated custodian to manage petty cash.

Not only do you get more control, but you save money with visibility at each step.

Budget Control

Pluto allows you to specify limits for corporate cards issued. This ensures employees stay within budget.

When the spending exceeds, employees can request more funds. The budget expands on the manager's approval in seconds, allowing for necessary spending.

Administrators can also issue zero balance cards. These cards with zero balances prompt an approval request for each expense. This approach ensures budget control without causing any delays or resentment.

Easy Receipt Management

Pluto simplifies receipt management thanks to its seamless WhatsApp integration.

Your employees can upload receipts via WhatsApp, which are recorded in real-time. The custodians no longer need to run after employees for the receipts.

However, Pluto does more than just store receipts. It extracts vital information through OCR, including vendor names, amounts, and GLs. As a result, your accounting team spends less time on manual tasks like creating logs.

Approval Workflow

Normally, getting approval for expenses can involve a lot of back and forth. But with Pluto, you can set up custom approval processes to make the process smoother.

When an employee uploads receipts, Pluto automatically starts the approval workflow. It notifies the custodian and managers to approve the expense, removing the friction.

The reimbursement process accelerates without any compromise on efficiency.

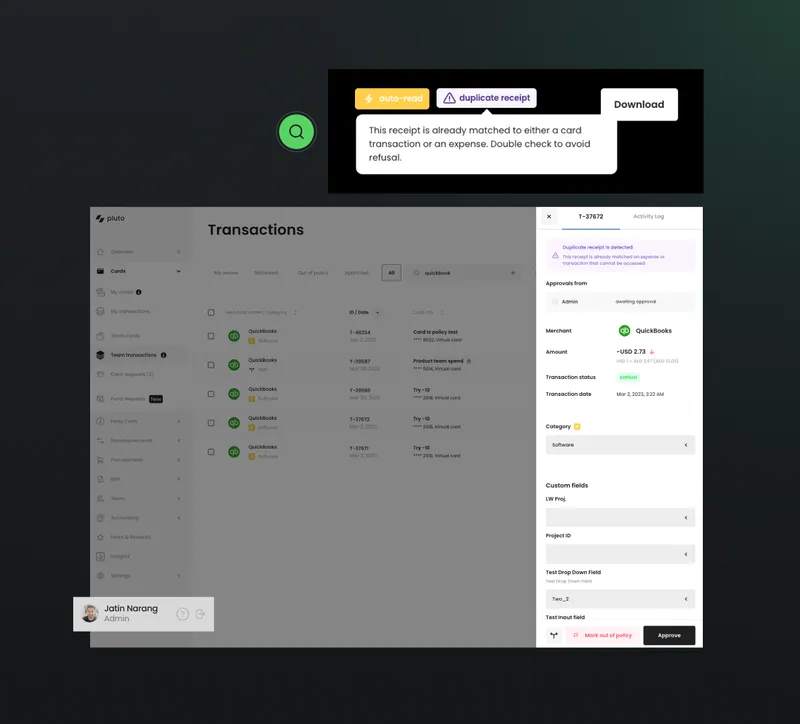

Further, Pluto uses OCR to detect duplicate receipts to avoid dual payments and fraud. This makes it easier to double-check expenses and approve the legitimate ones.

Digital Expense Report

Pluto offers digital expense reports that compile data from all the receipts.

The report simplifies the task for your finance teams to see how each branch/department is spending. It enables them to make adjustments to policies and procedures as needed.

For instance, a company has small office supply purchases spread across various departments. Pluto's real-time visibility and report help to locate these costs. As a result, finance teams can reconsider and promote bulk purchases for cost savings.

With Pluto, the custodian gets complete visibility into the expenses and the available funds at all times.

Close Books 10X Faster

Pluto simplifies the process of closing books.

Since employees can submit receipts directly through WhatsApp, custodians don’t need to chase employees for receipt submissions. This enables you to close the book 10X faster by accelerating the reconciliation process.

Pluto records all transactions in a centralized digital platform. This streamlines audit logs and eliminates the need to maintain physical records.

With its OCR-based receipt retrieval, finding specific receipts and information becomes more effortless. This simplifies the reconciliation process, making the entire book-closing process faster.

Replace Petty Cash With Corporate Cards

Small expenses and cash transactions can not be removed. However, finding an expense management tool can make petty cash management simpler.

Stop relying on manual traditional processes to manage petty cash. Choose Pluto to replace your tedious petty cash books and vouchers with corporate cards.

Sign up today to digitize your petty cash for complete visibility and control.

•

Leen Shami

Understanding Business Expenses

All companies and businesses will incur business expenses, but how can you know what exactly is considered business expenses? And how will the introduction of UAE corporate taxes affect business expenses and income reports?

What are business expenses?

Business expenses are costs a business incurs to run the business properly. In simpler terms, they're expenses made by the business for the business.

With the UAE introducing corporate tax laws in 2023, it's crucial for businesses to be able to track and categorize their business expenses, as some of them may be tax deductible.

While the IRS may divide business expenses into ordinary and necessary business expenses, the UAE takes a different approach.

Ordinary business expenses are anything that is "common and accepted" to a business, whereas necessary expenses are anything that is "helpful and appropriate" to a business but not essential.

The federal tax authority in the UAE does not take a similar approach and only considers business expenses as tax deductible or not. We will discuss this in a later section.

- {{time-money="/components"}}

Examples of business expenses

Business expenses include a wide range of expenses, from insurance to office space, to online subscriptions, such as Zoom, Figma, or Adobe.

Let's break it down; if a design agency bills a client AED 120K per year, that doesn't mean they made a profit of 120K. When a business brings in revenue, it must account for the business expenses made to provide its clients with its services. These services include digital software subscriptions, office rent, employee wage, and/or wifi fees.

Here are some examples of the most common business expenses:

- Advertising and marketing

- Business travel (fuel, airfare, taxis, etc.)

- Employee costs (payroll, salaries, insurance, perks, etc.)

- Employee equipment (such as laptops, monitors, phones, etc.)

- Legal fees

- Office space rent & utilities

- Software subscriptions

While many more expenses are considered business expenses, these are the ones most businesses will incur.

Types of business expenses

When setting up a budgeting plan, business expenses play a vital role in keeping the businesses' financials in check. When preparing a budgeting plan, finance teams typically begin by looking at the three types of business expenses incurred.

These business expenses include:

1. Fixed expenses

Fixed costs are costs that do not change; they happen at known intervals, such as month to month.

With predictable costs, budgeting is more straightforward, as these costs are always expected and never come as a surprise.

Examples of fixed expenses include:

- Rent

- Employee payroll/salaries

- Utility bills

- Insurance

2. Variable expenses

Variable expenses are business expenses that change from month to month. These costs vary depending on a company's production or sales volume; if production or sales increase, variable expenses increase, and if production or sales decrease, variable expenses decrease as well.

Variable expenses are typically a business's largest expense, as some may be unexpected or unaccounted for.

To calculate the variable cost, multiply the quantity of the output by the variable cost per unit of output.

Total variable cost = Total quantity of output X Variable cost per unit of output

Examples of variable expenses include:

- Shipping expenses

- Sales commissions

- Raw materials (used in production)

3. Periodic expenses

Periodic expenses are business expenses that happen infrequently or, sometimes, semi-regularly.

Typically, periodic expenses happen on a quarterly or yearly basis, such as annual car insurance, but can also come as a surprise, such as a company car repair.

Budgeting can be tricky with periodic expenses, especially when expenses are infrequent.

Examples of periodic expenses include:

- Maintenance & repairs

- Merger and acquisitions costs

- Major equipment purchases

Profit and loss statement report

A profit and loss (P&L) statement, also known as an income statement, is commonly used when businesses record business expenses. Through the P&L, businesses can determine their taxable income. This is especially important for UAE businesses with an annual net income above AED 375,000.

The 3 categories of an income statement include the following:

1. Costs of goods sold (COGS)

Costs of goods sold are the costs associated with the production of goods sold by a company. This typically includes direct costs only, such as materials used and labor costs to create the goods sold. Indirect expenses are not calculated regarding COGS; these include sales and marketing.

For a business to determine gross profit, the costs of goods sold must be deducted from its revenue. They also affect how much profit a company makes on its products.

2. Operating costs

For a business to run, operating costs are unavoidable.

Generally speaking, operating costs relate to a business's daily maintenance and administration. These include costs such as COGS, payroll, rent, and overhead costs. However, non-operating costs, such as interest and investments, are excluded from an income statement.

An income statement reflects operating income after operating costs are deducted from revenue.

3. Depreciation

When accounting for depreciation, there are two types to look at:

a. Depreciation expense

A depreciation expense is a loss in value of fixed assets that companies record through depreciation. During the period you use an asset, its value decreases, and the price you originally paid for it is allocated over time.

An example would be a physical asset that loses value over time, such as a car or vehicle.

b. Accumulated depreciation

Accumulated depreciation refers to the accumulated depreciation charge a specific asset has taken as it wears down or becomes obsolete. Accumulated depreciation is shown on the balance sheet, unlike depreciation expenses reported on the income statement.

Personal and business expenses

Knowing the difference between personal and business expenses incurred is vital, especially with the UAE corporate tax law coming up. Business expenses can be used to lower a business's taxable income; however, personal expenses incurred are not considered deductible expenses.

So, what's the difference between personal and business expenses?

Personal expenses

Personal expenses are purchases made for personal reasons and cannot be used as deductible expenses.

If you make a purchase for the business but add in an item for personal use, it is crucial to have two transactions to avoid mishaps coming your way. Having two receipts will help you record and store the receipt so the business expenses can be used as deductible expenses.

Business expenses

If you're making purchases that benefit the business, such as driving more revenue, they can be considered business expenses. When making business expenses, it's essential to keep a record of the purchase by storing the receipts. By doing so, you can use these business expenses to lower your tax liability by deducting the amount from your income.

Tax deductible expenses

We've reviewed personal expenses, the 3 types of business expenses, and what goes into P&L statements. But which of these are considered tax-deductible expenses? In a nutshell, all the above, other than personal expenses. Let's delve deeper into tax-deductible expenses.

Tax deductible expenses are business expenses that help businesses generate revenue. These expenses are deducted from the company's income before applying any taxes.

Examples of tax-deductible expenses:

- Administration fees

- Advertising and marketing

- Bank charges

- Insurance

- Legal fees

- Maintenance and repair

- Office expenses

- Office rent

- Payroll/salaries

- Supplies

- Travel and transportation

- Utilities

Non-deductible tax expenses

Non-deductible tax expenses cannot be deducted from a company's income.

In the UAE, there are 3 main categories for non-deductible tax expenses:

1. Related party payments from the mainland to a Free Zone Person

The related party payments made to a Free Zone Person that is taxed at 0% on receipt of the income will not be deductible for CT purposes. However, if the payment is attributed to a mainland branch of the Free Zone Person, the related party can claim a deduction.

2. Entertainment expenses

Because these types of expenses often also have a non-business or personal element, businesses can deduct up to 50% of the expense incurred to entertain customers, shareholders, suppliers, and other business partners.

3. Other expenses

No deduction will be allowed for certain specific other expenses, such as

- Administrative penalties

- Recoverable VAT

- Donations paid to an organization that is not an approved charity or public benefit organization.

How to keep track of business expenses

To maintain your business, it's important to track your business expenses. There are several ways to track business expenses; however, you will need to establish a system to account for costs and accurately manage your business.

Here are 6 steps to keep track of your business expenses:

1. Open a business bank account

A business bank account should be completely separate from your personal checking account and must only be used for business expenses/purposes. This will help you manage your business expenses easily and give you eligibility for business credit cards or, even better, Pluto corporate cards.

2. Select an accounting system

If you haven't chosen an accounting system yet, choosing one that's appropriate for your business is vital. Some businesses opt for spreadsheet software, such as Microsoft Excel; however, to simplify the accounting process, we recommend going for accounting software that will automate the process for you.

3. Choose cash or accrual accounting

Choosing cash or accrual accounting typically depends on the size of your business.

Small businesses can use cash accounting and record transactions when they happen, as volumes are small.

For bigger businesses, accrual accounting is essential, as they have high volumes of transactions. With accrual accounting, only the product sold is recorded, rather than payment received for the product. Similarly, an expense is recorded when a bill is received rather than when an invoice is paid.

4. Store receipts

Storing receipts is essential, as they are proof of business expenses made. You can store receipts by scanning them, taking photos, and keeping digital copies.

5. Regularly manage and record expenses

It's important to track spending and categorize them accordingly. Examine every transaction to compare these business expenses to your revenue.

6. Consider subscribing to an expense software

For some businesses, it is worth looking into expense management software to automate the process of tracking, managing, and recording expenses.

Tracking business expenses with Pluto

If you choose to go for an expense management software, it will help you automate the tracking, managing, and recording of expenses. But Pluto's expense management software offers more than just tracking, managing, and recording your business expenses.

Pluto will keep detailed records of all your expenses, reduce your taxable income, and help you if you are audited or need to reconcile accounts.

With Pluto, you'll be able to do the following:

Store receipts

- Upload your receipt through Whatsapp or the Pluto app as soon as a business expense is made

- Store all digital receipts on Pluto's software

Record business expenses

- All transactions are recorded on the software automatically when using Pluto corporate cards

- Petty cash is automated, meaning expenses are recorded on the spot

- If an expense is made using an employee's personal card, the expense is recorded automatically as soon as they file for a reimbursement

Track business expenses

- All business expenses made by employees can be tracked through Pluto's dashboard

- Daily, weekly, or monthly expense reports are available in real-time

Accounting integrations

- Pluto integrates with all major accounting platforms

Auto-categorization

- All expenses recorded are auto-categorized through Pluto's AI technology

- Pluto categories are synced to your GL codes

Create tax codes

- Create and activate tax codes that sync with your accounting platform to mark expenses as tax deductible or not

Business expense FAQs

More often than not, business expenses have many different rules. Here are the commonly asked questions about business expenses:

How do I categorize expenses?

Most accounting software already has business categories incorporated in the software, so you can use them and amend them as needed.

Pluto's expense management software allows integrations with significant accounting platforms and automatically syncs to your GL codes and chart of accounts.

Do fuel costs count as business expenses?

If the fuel cost was made for business purposes, such as travel for a client meeting, then yes, it is counted as a business expense and can be considered tax deductible.

However, driving to and from work is rarely considered a business expense.

Can business expenses be carried forward?

The UAE corporate tax law details report still hasn't come out yet. We will update this question once the Federal Tax Authority shares more details in the UAE.

Is personal expenses tax deductible?

No. Personal expenses are not tax deductible.

Is my rent deductible if I am self-employed and my home is my office?

In some cases, yes, it is possible if you are self-employed, but only a certain percentage of your rent will be considered a business expense, for example, 25% of your rent.

•

Mohammed Ridwan

How to Improve the Accounts Payable Management Process for Healthy Working Capital

Accounts payable (AP) is the money you owe vendors and creditors, i.e., short-term liabilities. These are the payments for goods and services you received that are yet to be cleared.

Companies struggle to manage accounts payable because the process involves multiple stakeholders, and the workflow isn't clearly laid out. The teams have to handle hundreds of documents, including purchase requests, purchase orders, goods received notes (GRN), invoices, etc. and ensure there isn't any discrepancy with the order received.

So, decentralized approvals and verifications make the process chaotic before the team can clear the final payment. If you find yourself in a similar situation, where accounts payable is hectic, and the working capital is messed up, read this post to discover the top strategies for effective accounts payable management.

{{less-time-managing="/components"}}

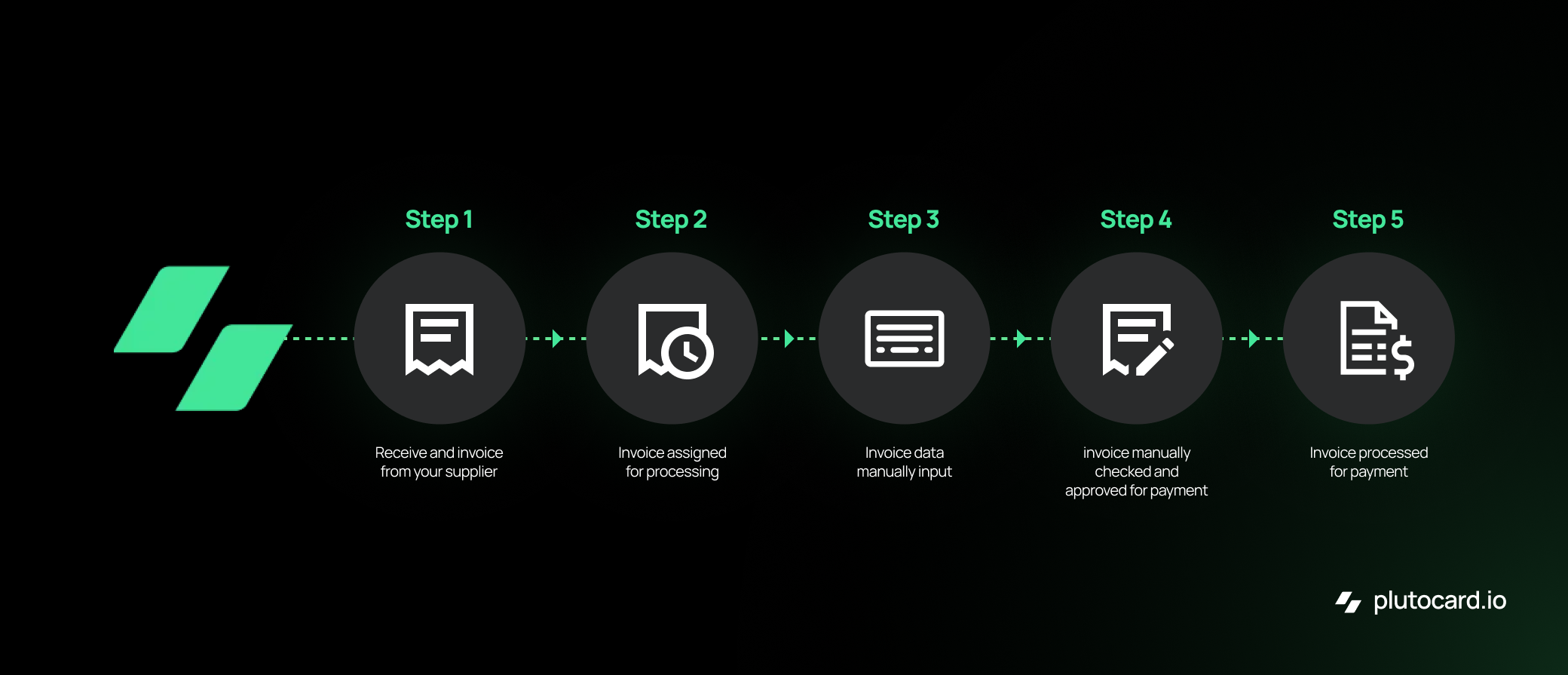

What is the Account Payable Process?

The AP process starts upon receiving goods and an accompanying invoice for payment processing. The next step involves verifying the accuracy of the invoice details. This verification process ensures that the goods received match the information provided in the invoice, including quantities, prices, and other relevant terms.

Following the confirmation, the invoice undergoes an approval workflow. It involves obtaining the necessary authorizations from various departments or individuals within the organization and ensuring compliance with internal policies and procedures before proceeding with the payment.

After completing the payment, the accounts payable team records the transaction in the financial system, updating the company's records. This step ensures accurate financial reporting and maintains an up-to-date overview of the company's financial position.

Challenges of the Decentralized Accounts Payable Process

Companies strive to maintain a seamless flow of goods and services while meeting financial responsibilities through timely and accurate AP management. However, relying on a manual process for these tasks introduces these bottlenecks:

- Managing documents manually raises concerns, particularly with paper-based documents that are susceptible to misplacement or damage. It not only hampers day-to-day operational efficiency but also poses a threat to data integrity.

- Similarly, a manual verification process increases susceptibility to mistakes. Achieving precise alignment between received goods and invoice information requires meticulous attention, heightening the possibility of overlooking crucial details such as terms and conditions.

- The manual handling in the approval workflow introduces risks of delays and potential oversights. Obtaining authorizations from different departments becomes time-consuming, and ensuring compliance with internal policies is prone to human errors.

- After completing the payment, the critical step of recording the transaction in the financial system becomes vulnerable to manual data entry errors, impacting the precision of financial reporting and the clarity of the company's financial standing.

- The manual process increases the likelihood of inadvertently paying the same invoice multiple times. Inaccurate data entry and a lack of robust authentication processes expose the organization to fraud, including the manipulation of invoices.

In summary, the manual accounts payable process detrimentally affects operational efficiency and financial stability. The lack of synchronization across different teams results in communication gaps and discrepancies. Failing to maintain a cohesive and streamlined process leads to errors in financial reporting, impedes effective decision-making, and strains interdepartmental collaboration.

Strategies for Efficient Accounts Payable Management

Effective management of the accounts payable process is possible when you optimize the human and technological aspects of the same.

On the human side, optimizing requires streamlining workflows, enhancing communication, and fostering a collaborative environment. Simultaneously, the technological part involves shifting to an accounts payable automation solution that provides a centralized platform for complete visibility and control.

Here are the strategies for efficient accounts payable management:

Strengthen Internal Control Over Financial Reporting

Internal control over financial reporting (ICFR) ensures the accuracy, reliability, and integrity of financial information within an organization. ICFR helps safeguard financial processes and mitigate risks as the intricate nature of accounts payable necessitates a robust control framework.

Strengthening ICFR for enhancing accounts payable management involves the following elements:

1. Segregation of Duties

With the segregation of duties, you ensure that no single individual controls all the stages of the accounts payable process. You divide the responsibilities among different staff members, which reduces the risk of errors, fraud, and mismanagement.

For instance, by assigning one team member to handle invoice approval and another to process payments, the segregation of duties minimizes the risk of errors or fraudulent activities and promotes accountability.

2. Audit Trail

Establishing a comprehensive audit trail involves recording and documenting every transaction in a chronological sequence of activities. It facilitates transparency and serves as a valuable tool for tracking and investigating discrepancies that arise during the accounts payable process.

For instance, in the case of an invoice mismatch, a comprehensive audit trail makes it easy to trace the exact steps in the transaction history, revealing where the error occurred. It speeds up the resolution process and enhances accuracy in financial reporting by promptly addressing issues.

3. Approval Policies

Clearly defined approval policies outline the hierarchy of authorizations required for various transaction amounts, ensuring that financial transactions undergo proper scrutiny before processing.

For instance, a clearly defined approval policy mandates that transactions under $1,000 require approval from a department head, while amounts exceeding $10,000 necessitate approval from top-level management.

4. Document Policies and Procedures

Clear documentation outlines specific steps for the accounts payable process. When a team member adheres to these guidelines, all required approvals are obtained, documentation is consistently retained, and errors are minimized.

In practical terms, this means that during an audit, the organization quickly and accurately traces the entire lifecycle of an invoice, showcasing compliance, reducing audit time, and enhancing financial transparency.

By strengthening ICFR, organizations systematically address challenges such as fraud, errors, and inefficiencies.

Employing Technology

AP automation optimizes the accounts payable management process beyond mere operational enhancements, enabling accuracy, efficiency, and informed decision-making. Automating AP management is a strategic approach with the following key elements:

1. Centralized Collaboration

Automation involves centralizing AP management and creating a unified document storage and collaboration platform. Not only does it extract all the critical information, but it also stores them on a centralized dashboard for easy access and processing. This fosters seamless communication among team members, ensuring everyone can access real-time information and collaborate effectively.

2. Safeguards for Duplicate Payments

Automation includes built-in safeguards to prevent duplicate payments. Automated systems employ checks and validation processes to flag duplicate receipts and eliminate the risk of paying the same invoice multiple times, reducing the likelihood of financial errors. Moreover, since the centralized platform acts as a single source truth, the possibility of double payments automatically reduces.

3. Streamline Workflow

Automated workflows simplify and streamline the entire AP process. With simple if-then rules, you can create workflows for trigger-based approvals. By eliminating manual intervention at various stages, tasks such as invoice approval, payment processing, and data entry become more efficient, reducing processing times and enhancing overall workflow.

4. Integrate

The accounts payable software integrates with other financial systems. This integration ensures a cohesive flow of information across departments, reducing data silos and enhancing accuracy in financial reporting.

5. Insights

Automated AP systems provide valuable insights through analytics and reporting tools. These insights enable businesses to track key performance indicators, identify trends, and make data-driven decisions. This analytical capability contributes to strategic financial management and planning.

Improve Vendor Relationships

Vendor relationships are not just about successful transactions. Healthy partnerships bring many benefits, such as streamlined processes, minimized disruptions, and a collaborative atmosphere that enhances the overall effectiveness of the accounts payable function within the organization.

Improving accounts payable management involves the following components:

1. Negotiate With Vendors

Initiating negotiations with vendors involves engaging in open discussions about terms, pricing, and contractual agreements till both parties arrive at mutually beneficial arrangements. Compelling negotiation ensures favorable terms for the company and establishes a foundation of trust and collaboration.

For instance, when negotiating with a key supplier for raw materials, the company secures favorable terms such as bulk purchase discounts and extended payment periods. This not only reduces costs but also builds a positive, long-term relationship.

2. Timely Payments

Adhering to agreed-upon payment schedules fosters goodwill and reliability, positioning the company as a trusted and preferred partner. Timely payments strengthen vendor relationships and contribute to smoother transactions and potential benefits such as early payment discounts.

3. Transparent Communication

Keeping vendors informed about payment timelines, potential delays, or any changes in the process contributes to a positive working dynamic. Open lines of communication facilitate problem-solving, creating an environment where both parties feel comfortable addressing concerns and finding resolutions.

4. Streamline Onboarding Process

Simplifying the onboarding procedure by providing clear guidelines, efficient documentation processes, and transparent communication ensures that vendors can seamlessly integrate into the accounts payable system. It saves time and lays the groundwork for a cooperative and efficient long-term partnership.

By implementing these strategies, businesses cultivate vendor relationships that go beyond transactional interactions, fostering a collaborative environment.

End Result: Optimized Accounts Payable Management Process

For storing and retrieving documents, you get optical character recognition (OCR) technology that extracts invoice information accurately. All the information goes on a centralized digital platform, reducing the chance of misplacement and improving accessibility.

For verification, you get all the necessary information on a unified dashboard. This centralized database enables accurate cross-referencing of received goods with invoice details, minimizing errors and making the process more efficient.

You get a no-code trigger-based approval workflow builder for approvals, where you can create workflows with simple if-then rules. These preset rules and automated notifications make authorization seamless across departments, reducing delays, ensuring policy compliance, and lowering the risk of human errors.

For recording transactions, you get integration facilities, where your accounts payable software syncs data across your accounting systems for consistent records, minimizes errors, ensures precise financial reporting, and offers a real-time, accurate view of the company's finances.

Next Steps for Efficient Accounts Payable Management

After establishing transparent processes and policies and adopting the right automation tools, plan an AP audit.

An AP audit involves reviewing and assessing the existing procedures to pinpoint areas that can be improved. By doing so, you identify inefficiencies or bottlenecks in the accounts payable management system. It provides insights into how well the established processes align with the intended goals and whether adjustments are needed.

This proactive approach helps enhance the overall efficiency and effectiveness of accounts payable management, ensuring that the system operates smoothly and aligns with the company's objectives.

Read more about AP audits in our post to understand how they help and how you can prepare for them in advance.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use

.png)