Contents

How to Improve the Accounts Payable Management Process for Healthy Working Capital

Mohammed Ridwan

•

•

Accounts payable (AP) is the money you owe vendors and creditors, i.e., short-term liabilities. These are the payments for goods and services you received that are yet to be cleared.

Companies struggle to manage accounts payable because the process involves multiple stakeholders, and the workflow isn't clearly laid out. The teams have to handle hundreds of documents, including purchase requests, purchase orders, goods received notes (GRN), invoices, etc. and ensure there isn't any discrepancy with the order received.

So, decentralized approvals and verifications make the process chaotic before the team can clear the final payment. If you find yourself in a similar situation, where accounts payable is hectic, and the working capital is messed up, read this post to discover the top strategies for effective accounts payable management.

{{less-time-managing="/components"}}

What is the Account Payable Process?

The AP process starts upon receiving goods and an accompanying invoice for payment processing. The next step involves verifying the accuracy of the invoice details. This verification process ensures that the goods received match the information provided in the invoice, including quantities, prices, and other relevant terms.

Following the confirmation, the invoice undergoes an approval workflow. It involves obtaining the necessary authorizations from various departments or individuals within the organization and ensuring compliance with internal policies and procedures before proceeding with the payment.

After completing the payment, the accounts payable team records the transaction in the financial system, updating the company's records. This step ensures accurate financial reporting and maintains an up-to-date overview of the company's financial position.

Challenges of the Decentralized Accounts Payable Process

Companies strive to maintain a seamless flow of goods and services while meeting financial responsibilities through timely and accurate AP management. However, relying on a manual process for these tasks introduces these bottlenecks:

- Managing documents manually raises concerns, particularly with paper-based documents that are susceptible to misplacement or damage. It not only hampers day-to-day operational efficiency but also poses a threat to data integrity.

- Similarly, a manual verification process increases susceptibility to mistakes. Achieving precise alignment between received goods and invoice information requires meticulous attention, heightening the possibility of overlooking crucial details such as terms and conditions.

- The manual handling in the approval workflow introduces risks of delays and potential oversights. Obtaining authorizations from different departments becomes time-consuming, and ensuring compliance with internal policies is prone to human errors.

- After completing the payment, the critical step of recording the transaction in the financial system becomes vulnerable to manual data entry errors, impacting the precision of financial reporting and the clarity of the company's financial standing.

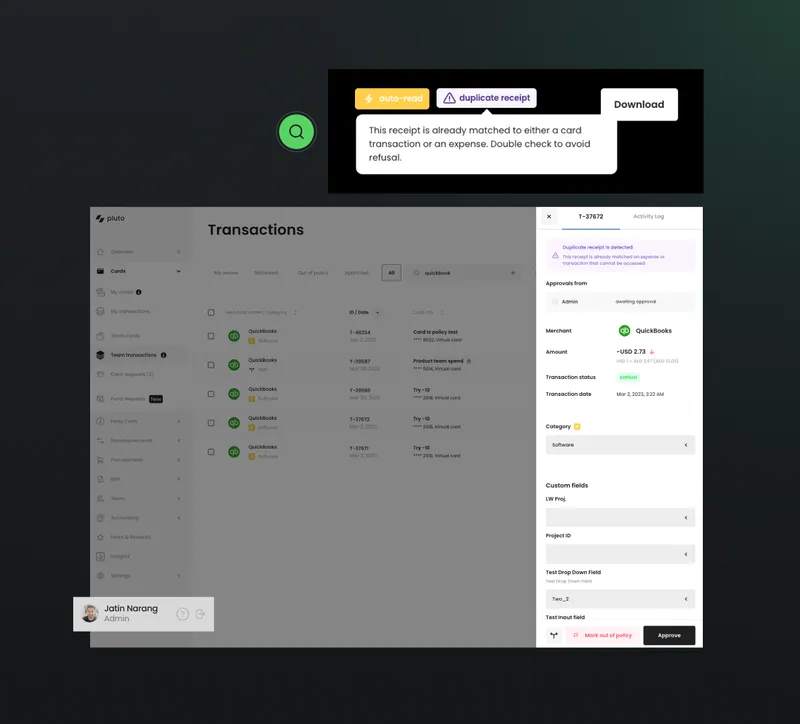

- The manual process increases the likelihood of inadvertently paying the same invoice multiple times. Inaccurate data entry and a lack of robust authentication processes expose the organization to fraud, including the manipulation of invoices.

In summary, the manual accounts payable process detrimentally affects operational efficiency and financial stability. The lack of synchronization across different teams results in communication gaps and discrepancies. Failing to maintain a cohesive and streamlined process leads to errors in financial reporting, impedes effective decision-making, and strains interdepartmental collaboration.

Strategies for Efficient Accounts Payable Management

Effective management of the accounts payable process is possible when you optimize the human and technological aspects of the same.

On the human side, optimizing requires streamlining workflows, enhancing communication, and fostering a collaborative environment. Simultaneously, the technological part involves shifting to an accounts payable automation solution that provides a centralized platform for complete visibility and control.

Here are the strategies for efficient accounts payable management:

Strengthen Internal Control Over Financial Reporting

Internal control over financial reporting (ICFR) ensures the accuracy, reliability, and integrity of financial information within an organization. ICFR helps safeguard financial processes and mitigate risks as the intricate nature of accounts payable necessitates a robust control framework.

Strengthening ICFR for enhancing accounts payable management involves the following elements:

1. Segregation of Duties

With the segregation of duties, you ensure that no single individual controls all the stages of the accounts payable process. You divide the responsibilities among different staff members, which reduces the risk of errors, fraud, and mismanagement.

For instance, by assigning one team member to handle invoice approval and another to process payments, the segregation of duties minimizes the risk of errors or fraudulent activities and promotes accountability.

2. Audit Trail

Establishing a comprehensive audit trail involves recording and documenting every transaction in a chronological sequence of activities. It facilitates transparency and serves as a valuable tool for tracking and investigating discrepancies that arise during the accounts payable process.

For instance, in the case of an invoice mismatch, a comprehensive audit trail makes it easy to trace the exact steps in the transaction history, revealing where the error occurred. It speeds up the resolution process and enhances accuracy in financial reporting by promptly addressing issues.

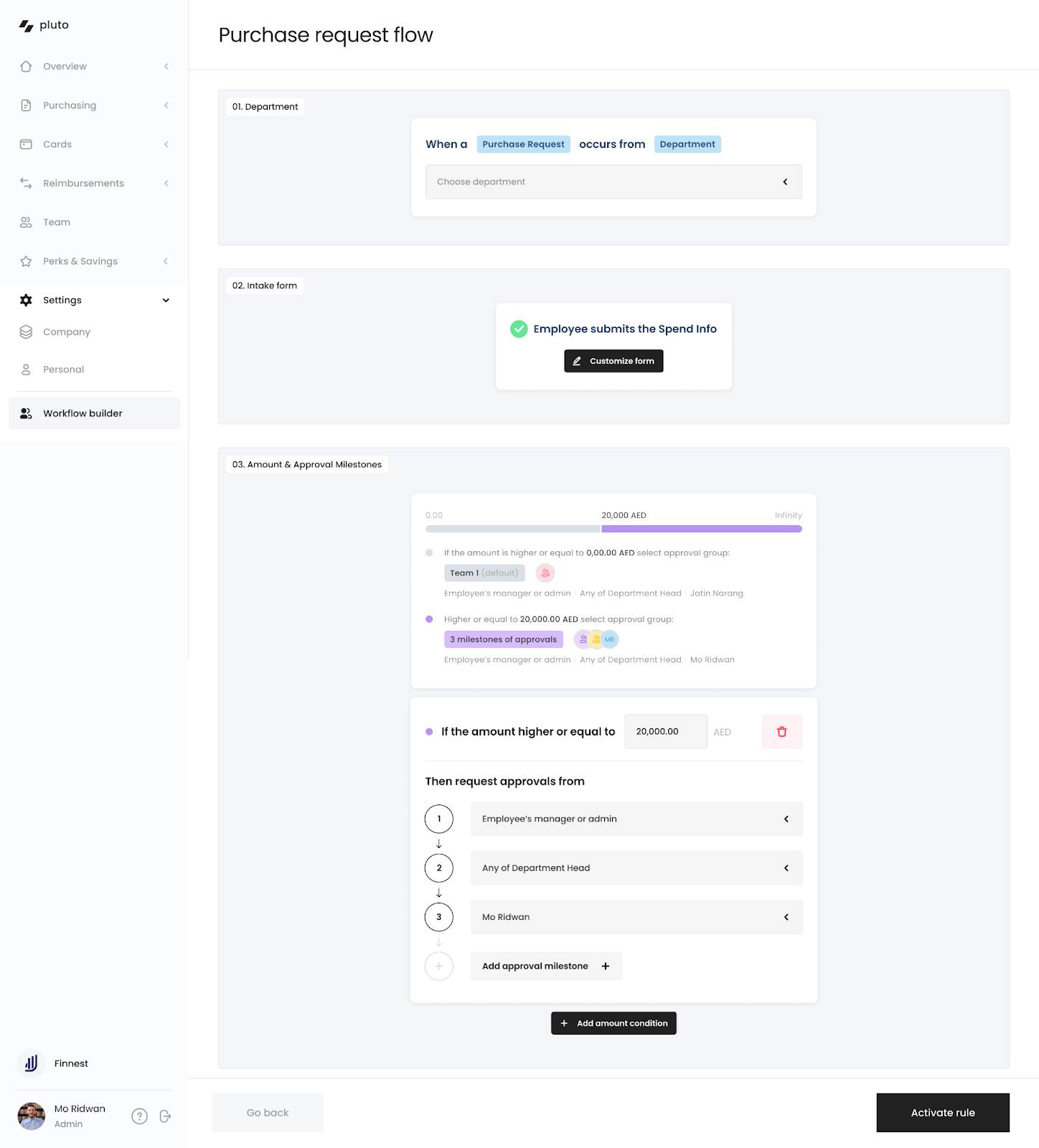

3. Approval Policies

Clearly defined approval policies outline the hierarchy of authorizations required for various transaction amounts, ensuring that financial transactions undergo proper scrutiny before processing.

For instance, a clearly defined approval policy mandates that transactions under $1,000 require approval from a department head, while amounts exceeding $10,000 necessitate approval from top-level management.

4. Document Policies and Procedures

Clear documentation outlines specific steps for the accounts payable process. When a team member adheres to these guidelines, all required approvals are obtained, documentation is consistently retained, and errors are minimized.

In practical terms, this means that during an audit, the organization quickly and accurately traces the entire lifecycle of an invoice, showcasing compliance, reducing audit time, and enhancing financial transparency.

By strengthening ICFR, organizations systematically address challenges such as fraud, errors, and inefficiencies.

Employing Technology

AP automation optimizes the accounts payable management process beyond mere operational enhancements, enabling accuracy, efficiency, and informed decision-making. Automating AP management is a strategic approach with the following key elements:

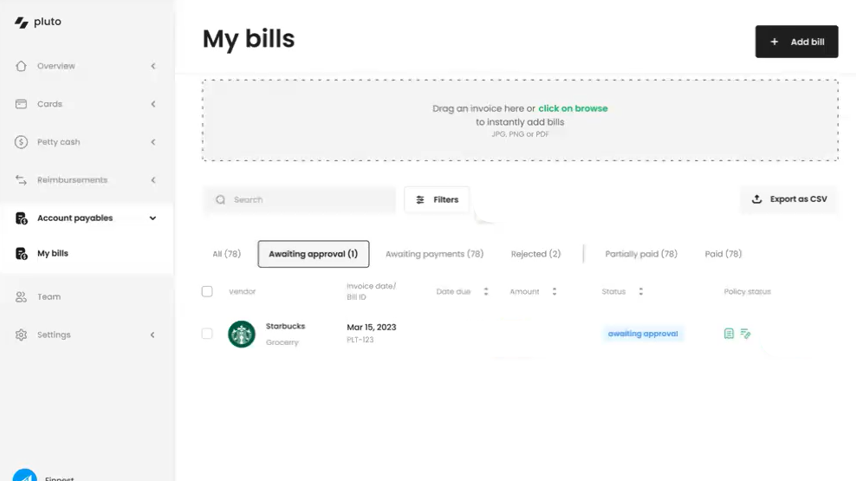

1. Centralized Collaboration

Automation involves centralizing AP management and creating a unified document storage and collaboration platform. Not only does it extract all the critical information, but it also stores them on a centralized dashboard for easy access and processing. This fosters seamless communication among team members, ensuring everyone can access real-time information and collaborate effectively.

2. Safeguards for Duplicate Payments

Automation includes built-in safeguards to prevent duplicate payments. Automated systems employ checks and validation processes to flag duplicate receipts and eliminate the risk of paying the same invoice multiple times, reducing the likelihood of financial errors. Moreover, since the centralized platform acts as a single source truth, the possibility of double payments automatically reduces.

3. Streamline Workflow

Automated workflows simplify and streamline the entire AP process. With simple if-then rules, you can create workflows for trigger-based approvals. By eliminating manual intervention at various stages, tasks such as invoice approval, payment processing, and data entry become more efficient, reducing processing times and enhancing overall workflow.

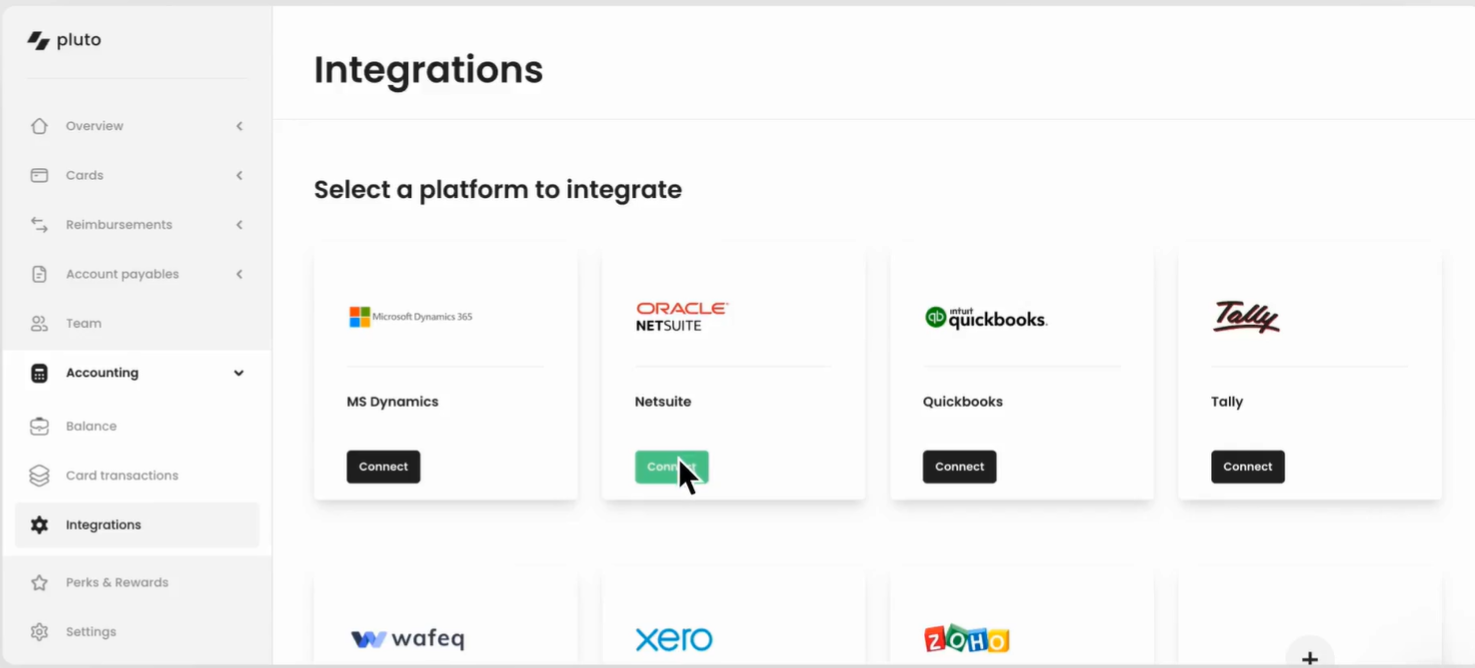

4. Integrate

The accounts payable software integrates with other financial systems. This integration ensures a cohesive flow of information across departments, reducing data silos and enhancing accuracy in financial reporting.

5. Insights

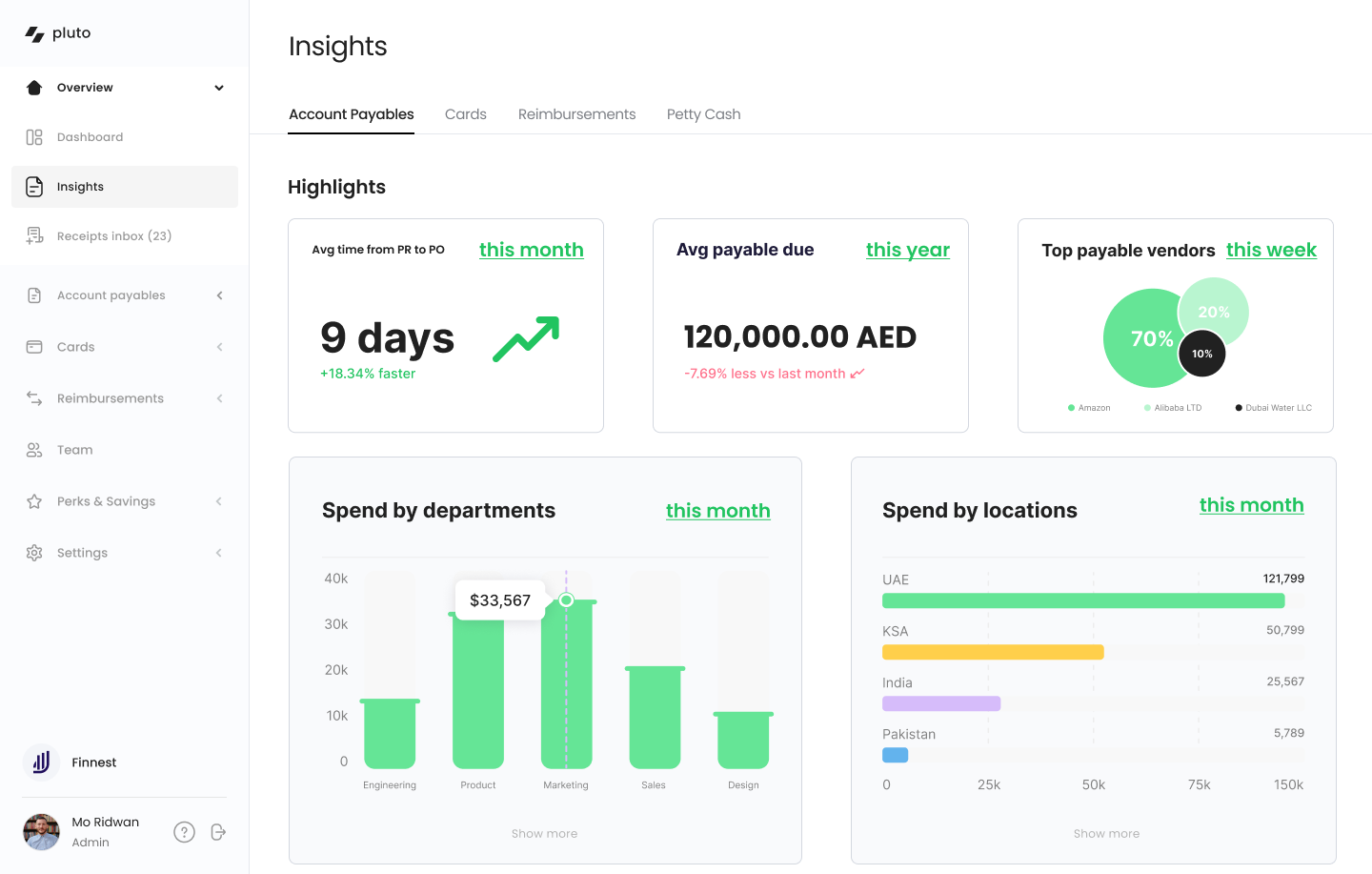

Automated AP systems provide valuable insights through analytics and reporting tools. These insights enable businesses to track key performance indicators, identify trends, and make data-driven decisions. This analytical capability contributes to strategic financial management and planning.

Improve Vendor Relationships

Vendor relationships are not just about successful transactions. Healthy partnerships bring many benefits, such as streamlined processes, minimized disruptions, and a collaborative atmosphere that enhances the overall effectiveness of the accounts payable function within the organization.

Improving accounts payable management involves the following components:

1. Negotiate With Vendors

Initiating negotiations with vendors involves engaging in open discussions about terms, pricing, and contractual agreements till both parties arrive at mutually beneficial arrangements. Compelling negotiation ensures favorable terms for the company and establishes a foundation of trust and collaboration.

For instance, when negotiating with a key supplier for raw materials, the company secures favorable terms such as bulk purchase discounts and extended payment periods. This not only reduces costs but also builds a positive, long-term relationship.

2. Timely Payments

Adhering to agreed-upon payment schedules fosters goodwill and reliability, positioning the company as a trusted and preferred partner. Timely payments strengthen vendor relationships and contribute to smoother transactions and potential benefits such as early payment discounts.

3. Transparent Communication

Keeping vendors informed about payment timelines, potential delays, or any changes in the process contributes to a positive working dynamic. Open lines of communication facilitate problem-solving, creating an environment where both parties feel comfortable addressing concerns and finding resolutions.

4. Streamline Onboarding Process

Simplifying the onboarding procedure by providing clear guidelines, efficient documentation processes, and transparent communication ensures that vendors can seamlessly integrate into the accounts payable system. It saves time and lays the groundwork for a cooperative and efficient long-term partnership.

By implementing these strategies, businesses cultivate vendor relationships that go beyond transactional interactions, fostering a collaborative environment.

End Result: Optimized Accounts Payable Management Process

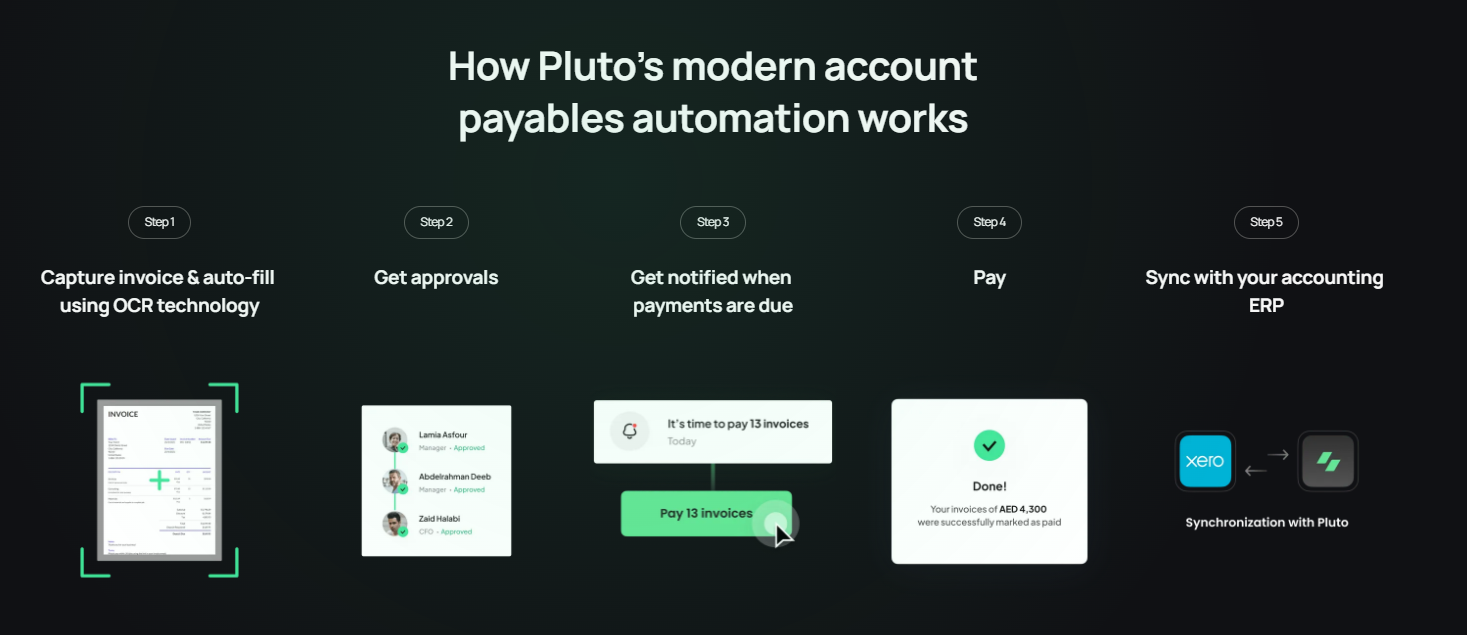

For storing and retrieving documents, you get optical character recognition (OCR) technology that extracts invoice information accurately. All the information goes on a centralized digital platform, reducing the chance of misplacement and improving accessibility.

For verification, you get all the necessary information on a unified dashboard. This centralized database enables accurate cross-referencing of received goods with invoice details, minimizing errors and making the process more efficient.

You get a no-code trigger-based approval workflow builder for approvals, where you can create workflows with simple if-then rules. These preset rules and automated notifications make authorization seamless across departments, reducing delays, ensuring policy compliance, and lowering the risk of human errors.

For recording transactions, you get integration facilities, where your accounts payable software syncs data across your accounting systems for consistent records, minimizes errors, ensures precise financial reporting, and offers a real-time, accurate view of the company's finances.

Next Steps for Efficient Accounts Payable Management

After establishing transparent processes and policies and adopting the right automation tools, plan an AP audit.

An AP audit involves reviewing and assessing the existing procedures to pinpoint areas that can be improved. By doing so, you identify inefficiencies or bottlenecks in the accounts payable management system. It provides insights into how well the established processes align with the intended goals and whether adjustments are needed.

This proactive approach helps enhance the overall efficiency and effectiveness of accounts payable management, ensuring that the system operates smoothly and aligns with the company's objectives.

Read more about AP audits in our post to understand how they help and how you can prepare for them in advance.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Vlad Falin

How IT & Procurement Teams Should Evaluate Spend Management Products

In today's fast-paced business world, managing expenses can be a daunting task for IT and procurement teams.

To help you out, we compiled a list of features and functionalities that you should consider when picking your spend management platform.

Spoiler alert, Pluto has them all.

PCI DSS Level 1 Provider

One of the essential features that should be given high importance is the product's PCI DSS Level 1 compliance.

The Payment Card Industry Data Security Standard (PCI DSS) is a set of guidelines and security requirements designed to safeguard payment card data.

The standard was developed by major credit card companies, including Visa, Mastercard, American Express, Discover, and JCB, to ensure that all companies that handle payment card data maintain a secure environment. PCI DSS compliance helps to prevent fraud and data breaches, protecting both the company and its customers.

PCI DSS Level 1 is the highest level of certification a company can achieve for PCI compliance.

It requires companies to undergo a rigorous independent audit to ensure compliance with all 12 of the PCI DSS requirements, including network security, access control, and vulnerability management.

Achieving PCI DSS Level 1 certification demonstrates that a company has a comprehensive and effective security program in place to protect payment card data.

When evaluating corporate spend management products, IT and procurement teams should look for products that have achieved PCI DSS Level 1 compliance to ensure that the product meets the highest security standards.

This will help to ensure that the company's payment card data is adequately protected and that the company is meeting its compliance obligations. By prioritizing PCI DSS Level 1 compliance, IT and procurement teams can help to safeguard their company's reputation and financial well-being.

Being PCI DSS Level 1 compliant is essential for any organization that handles corporate card information, as it provides a high level of security and assurance that the organization is taking all necessary measures to protect its customers’ data.

Pluto Card is proud to be PCI DSS Level 1 compliant. This means that our customers can trust that we have taken all necessary measures to secure their data and protect it from unauthorized access.

We also partner with vendors who are held to the highest security standards, such as PCI or SOC2 compliance.

Passwordless Login

Passwordless login is a secure and convenient way for users to access their accounts without the need for a password. It is an effective way to protect against unwanted access to your account, as passwords can be easily compromised or stolen. By tying your Pluto access with a company email account provided by your organization ensures that when your employees lose access to their company email address they also lose access to Pluto.

At Pluto Card, we understand the importance of passwordless login, and we offer this feature to our customers. With our passwordless login feature, our customers can access their accounts quickly and securely, without the need for a password.

Activity Log And Audit Trails

Activity logs and audit trails are crucial for ensuring strict auditing everywhere. An activity log records all user activity within an application or system, while an audit trail provides a record of all changes made to data within the system.

Pluto Card offers a 7-year audit log, which means that our customers can track critical changes made to their data over a seven-year period.

Data Access

Employees that are using our platform have only as much access as they need, and we have infrastructure redundancy built into Pluto, which means that all compute and data is run in multiple geographies.

Business continuity is paramount at Pluto - to this end, we ensure data redundancy with redundant backups in multiple geographies as well.

In addition, at Pluto, your application data is always encrypted in transit, and at rest.

Continuous Security Scans

Pluto also provides a continuous security scan, which tackles multiple dimensions, including code or dependency vulnerabilities, infrastructure, and public endpoint scans.

Our customers can be assured that we take security very seriously and are always on the lookout for any potential security threats.

In the event of a security incident, we have an immediate incident response plan in place and will notify impacted customers without undue delay of any unauthorized disclosure of customer data.

24x7 Customer Support and Dedicated Account Manager

In addition to these security features, Pluto Card also provides 24x7 customer support.

We understand that our customers need support around the clock, and we are always available to help with any questions or issues that may arise.

Data Infrastructure, Redundancy and E2E Encryption

We also provide infrastructure and data redundancy, which means that our customers’ data is highly available and secure, even in the event of a system failure or outage.

Data is always encrypted in transit, which means that it is always protected during transmission between servers or devices.

Finally, another crucial feature that IT and procurement teams should consider when evaluating corporate spend management products is data residency and retention policies.

Pluto Card offers an audit trail for changes to customer data, so we can track who did what.

Additionally, we have a data residency promise of 7 years, which means that we retain customer data for that period of time.

This can be important for compliance with regulatory requirements, such as tax or financial reporting.

Conclusion

In conclusion, when evaluating corporate spend management products for your enterprise, it’s essential to consider the security features that the product offers.

PCI DSS Level 1 Compliance, passwordless login, activity logs and audit trails, and data residency and retention policies are all critical features that can help ensure the security and integrity of your organization’s financial data.

Pluto Card offers all of these features, along with 24x7 customer support and infrastructure and data redundancy, making it an excellent choice for organizations looking for a secure and reliable corporate spend management solution.

For more information visit Pluto and book a demo.

•

Vlad Falin

Procurement Management: A Guide to the Basics of the Procurement Cycle

Picture handling hundreds of weekly purchase requests from different departments, each demanding new vendor searches. When you finally make purchases after going through the cycle of approvals and negotiations, you end up facing goods and invoice discrepancies.

That’s a chaotic situation you certainly want to avoid.

While procurement may seem like a simple purchase on paper, the process requires planning and structure for larger organizations.

One way to avoid this chaos is through procurement management, which helps businesses streamline the acquisition and record-keeping process. This reduces overhead costs and helps you remain profitable.

In this post, we will explore what is procurement management, outline the steps involved, and give tips to optimize your procurement cycle for an effective procurement management system.

What is Procurement Management?

Procurement management refers to the strategic acquisition of goods and services to meet the needs of an organization. It covers the entire goods procurement process from raising purchase requests to settling payments with vendors. This involves the procurement team’s planning, sourcing, negotiating, validating, and clearing payments to ensure a proper supply chain.

Steps Involved in the Procurement Management System

A standard procurement management process is intricate and involves several stakeholders. Here are the key steps:

- Needs Assessment: Identify internal requirements through meticulous forecasting.

- Vendor Selection and Database Establishment: Thoroughly vet vendors, creating a robust database for strategic partnerships.

- Negotiation of Terms: Engage in negotiations on pricing and delivery schedules to optimize resource utilization.

- Purchase Order Generation: Transform approved purchase requests into precise orders to minimize potential errors.

- Goods Receipt and Matching: Validate received goods against purchase orders (GRN matching) to ensure order accuracy and quality control.

- Invoice Approval and Payment Processing: Ensure accuracy before approving invoices and proceeding with payments.

- Record Maintenance for Auditing: Systematically document all transactions for transparent auditing, ensuring compliance and accountability.

Although the process looks simple, it has several loopholes. There are numerous steps involved, and the entire process becomes tricky to execute. These steps are scattered across multiple platforms, complicating reconciliation during the audit season.

Furthermore, it requires approvals at certain stages, making it unfavorable for larger teams with complex hierarchies.

How to Optimize the Procurement Management System

You can overcome these challenges by automating your systems.

Automation makes this lengthy and complex process a simple and efficient procurement cycle. The employees get a dedicated platform to raise requests. Furthermore, stakeholders can efficiently review and approve requests with automated notifications.

Automation also simplifies GRN matching through the data stored in the software. Accounting and payment integrations help clear approved invoices within seconds.

Throughout this process, you gain real-time visibility and control over expenses. Moreover, having all your information on a unified platform simplifies reconciliation and ensures a proper audit trail.

Here are five ways automating the procurement process helps your business:

1. Internal Control Over Financial Reporting (ICFR)

Automation ensures compliance with ICFR standards and upholds quality controls throughout the procurement process. It does this by using trigger-based approval workflows that follow predefined financial controls. It implements validation checks to ensure that procurement transactions meet quality control standards. This makes two-way and three-way matching seamless.

By deploying a single software solution, you detect and prevent potential errors or discrepancies in financial reporting.

2. Documentation

Automation brings together purchase requests, purchase orders, receipts, and all the relevant conversations on a unified platform. This makes storing and retrieving information easier, especially during the audit season. Also, optical character recognition (OCR) technology simplifies extracting key information, eliminating the need for manual data entry.

As a result, you improve document accuracy and prevent errors such as late or incorrect returns due to missing receipts, invoices, payables, and supporting documentation.

3. Integration

Automation software integrates with your accounting software, payment gateways, and ERPs bringing together the scattered pieces of procurement.

It allows you to request, manage, match goods receipts, and pay vendors from a single place. The best part is that your data remains consistent across all your software making the lives of financial controllers easier.

4. Measure

Automation offers you real-time visibility through a custom dashboard. It gives you a holistic view of the procure-to-pay process with a centralized data repository.

This makes it easier to extract insights and optimize the process to improve margins, such as average payables due, top vendors, department-wise expenses, etc.

5. Standardize Workflows

Automation helps you create standardized workflows to ensure consistency and efficiency. As a result, each stakeholder gets notified to complete their part. So, be it approving expenses or GRN matching, these set workflows eliminate the need to chase employees averting potential delays.

Challenges of Automating the Procurement Cycle

While automation does offer several benefits, choosing the right tool is crucial. One wrong decision and you might end up in one of the following situations:

- You invest in a basic software that lacks functionality and doesn’t solve your procurement issues.

- You choose a complex product that is difficult to understand and operate.

- You get a tool that doesn’t integrate with your existing accounting and payment software, increasing the manual task of syncing data across these systems.

- You get multiple products for different steps that lack integration, hindering efficient and streamlined procurement management.

Automation becomes a nightmare with the wrong software. All these scenarios lead to resource wastage. Moreover, weeks and months spent on implementation disrupt the supply chain.

What a Good Automation Procurement Management System Looks Like

Here’s how a comprehensive automation platform makes your procurement process easy, functional, flexible, and scalable.

1. Standardize Process

You have a centralized platform to consolidate the scattered procurement process. Whether purchase requests, approval workflows, or recurring SaaS payments, it allows you to automate as many procurement elements as you want.

It lets you digitize the entire process without compromising your current workflows. This boosts transparency and provides better control over your expenses.

2. Streamline Approvals

You get a no-code trigger-based approval workflow engine that helps you set exact approval hierarchies to get approvals without disruptions.

For example, you can add if-then rules and set a precise and intricate workflow. Thus, when an employee raises a purchase request, instead of chasing stakeholders, this system notifies them to review and approve the requests.

Additionally, all queries or clarifications unfold within the procurement software, ensuring comprehensive documentation and visibility. This eliminates maverick spending and fosters an accountable procurement process.

3. Vendor Management

You can sync all your vendors to your accounting software and ERPs. This creates vendor consistency across platforms, accelerating the purchase order creation. You also get the ability to add the list of items and simplify the purchase order and GRN matching process.

4. Receipt Management

You get a dedicated dashboard to manage all your receipts. The software captures invoices from emails and WhatsApp and uses OCR technology to extract key information. This streamlines GRN matching as all vendor, purchase order, and invoice details are in one place.

Pluto's procure-to-pay module is an excellent example of this centralization. It accelerates reconciliation with GL codes and tax codes, enhancing finance teams' visibility and control over purchase order spending.

5. Centralize Documentation

You have a unified information source as the software integrates with your accounting and payment software and your ERP. Hence, it becomes easy to store and maintain data while maintaining consistency across.

For instance, Pluto offers you a wide range of integrations, such as NetSuite, Xero, QuickBooks, Zoho, etc., so that you focus on procuring goods and get complete documentation with accuracy.

6. Detailed Reports

You get comprehensive reports, making it easier to extract insights and make data-driven decisions. Also, as all the information is stored within the software, there are no gaps or loss of context. You get an accurate picture of your procurement process. This allows for strategic planning and forecasting.

For instance, with Pluto, you get insights, such as average time for approvals, average payables due, top vendors, department-wise spending, location-wise spending, etc.

7. Audit Trails

Since there’s a unified platform to maintain thousands of receipts, you get complete visibility into each order from purchase requests to stakeholders involved and order status. This audit trail becomes a blessing during the audit season when you need less than 30 seconds to retrieve a specific receipt or document.

There’s More to Procurement Management than Automation

Procurement management is not just about automation. While it does enhance the three core components of procurement—people, process, and paperwork, procurement management requires more than the adoption of software.

Pluto aims not just to automate your processes but also to support your existing workflows. Then, be it purchase requests, accounts payable, or accounting, it strives to improve your processes by removing all the bottlenecks that cause chaos.

Know more about how we can help your business. Book a demo and we’ll see you across to maximize the efficiency of your procurement process.

•

Mohammed Ridwan

What is Account Reconciliation? Basics for UAE-Based Companies

Last day of the fiscal year, and you are closing the books. One of the employees writes a check for 50000 AED to a vendor. The internal records show a payment of 50000 AED, but your balance will not match your bank statement due to the time difference in check clearing.

Account reconciliation addresses these differences and mismatches of records. It helps you identify any gaps in your accounting statement to make adjustments and ensure accuracy.

In this post, we will discuss account reconciliation and how you can ensure compliance with proper reporting.

What is Account Reconciliation?

Account reconciliation involves comparing your internal financial statements to external and third-party sources, such as bank statements, to ensure the accuracy of financial records.

The frequency of account reconciliation will depend upon your company's internal policies and industry practices. Generally, companies conduct account reconciliations every month or quarter.

You can also automate this process and reconcile accounts in real time. The software integrates with your accounting systems and ERPs and facilitates record-keeping. Employees directly upload receipts on the software, and all the transactions are visible on a centralized platform for real-time tracking. Then, the tool automatically categorizes the expenses into different general ledger (GL) accounts and tax codes, making reconciliation simple.

Why Invest in Account Reconciliation?

Account reconciliation is a standard accounting process. While it seems reasonable to continue using traditional manual systems for record-keeping and reconciling, having a unified accounting platform enables you to close books 10X faster.

Imagine a single tool to manage reimbursement, petty cash, corporate cards, and end-to-end procurement. You eliminate the chances of errors and fraud with more visibility over your money. As a result, you get accurate financial statements, creating a transparent environment for stakeholders.

How is Account Reconciliation Done?

Account reconciliation involves comparing GL account balances to supporting external sources and records. Here is a complete breakdown of the process:

1. Identify Accounts for Reconciliation

Identify the accounts that need reconciliation. This depends on the nature of the business, industry regulations, and the company's internal processes. Common accounts include:

- Bank accounts

- Accounts payables and receivables

- VAT

- Inventory

- Intercompany transactions

- Revenue

- Expenses

2. Gather Relevant Documents

Collect supporting documents for the identified accounts, such as bank statements, invoices, receipts, and other relevant financial records.

3. Verify Opening Balances

Compare the opening balances in the company's records with the corresponding balances in external statements or supporting documentation. This ensures that the starting point for reconciliation is accurate.

4. Adjust Differences

Identify discrepancies and make adjustments as needed. Based on the types of accounts chosen, you are likely to have the following discrepancies:

- Bank: Outstanding checks, deposits in transit, or bank fees

- Accounts payable and receivable: For accounts payable, mismatch between the company's records and vendor invoices. On the accounts receivable side, payments not being accurately reflected in the company's records.

- Value Added Tax (VAT): Errors in calculating input and output VAT, misclassification of transactions, or discrepancies between recorded and actual tax amounts

- Inventory: Errors in recording stock levels, theft, obsolescence, or misclassification of inventory items

- Intercompany: Errors in eliminating intercompany transactions, misallocating expenses, or differences in intercompany balances

- Revenue: Unrecorded sales, errors in invoicing, or misapplication of revenue recognition principles

- Expenses: Unrecorded expenses, duplicate payments, or errors in expense categorization

5. Review and Finalize

Review the reconciled accounts for accuracy and completeness. Obtain necessary approvals from management or relevant stakeholders before making adjustments and finalizing financial decisions.

Finalize the reconciliation process and document the adjustments made. Retain all relevant records for auditing purposes and future reference.

Top 5 Account Reconciliation Errors

Here are the top 5 most common errors that lead to discrepancies in account reconciliation:

1. Omission

Omission includes missing certain transactions from the accounting records due to oversight. For instance, forgetting to record a payment received results in understating cash and accounts receivable.

Solution: Review transaction documentation, bank statements, and other supporting records to identify and record any omitted transactions.

2. Duplication

Duplication involves recording the same transaction more than once, leading to an overstatement of figures. For instance, recording a sales invoice twice causes excessive revenue figures.

Solution: Review transactions and eliminate any duplicate entries.

3. Timing Difference

Timing differences refer to situations where a transaction is recorded in the books at a different time than when it clears the bank or is recognized for accounting purposes. For instance, writing a check at the end of the month that doesn't clear the bank until the beginning of the following month.

Solution: Regularly compare bank statements with the company's records, adjusting for timing differences.

4. Fraud

Fraudulent activities involve intentionally manipulating financial records to deceive stakeholders and make personal gains. For instance, employees falsify expense receipts to inflate reimbursement claims.

Solution: Implement strong internal controls, conduct regular audits, and promote a culture of ethical behavior.

5. Misclassification

Misclassification occurs when transactions are recorded in the wrong accounts. For instance, adding a purchase of office supplies to the wrong expense account or labeling an incorrect GL code.

Solution: Review transactions to ensure proper coding and provide training to prevent misclassification errors.

Risk of Overlooking Account Reconciliation

While account reconciliation seems a redundant task of matching accounts’ balances, small defaults can lead to operational, financial, and legal challenges.

You can face hefty fines or penalties imposed by regulatory authorities. You may also encounter disruptions due to legal investigations, audits, or even suspension of business activities. Moreover, failure to adhere to regulations can harm a company's reputation.

In some cases, it leads to the revocation of licenses or permits, jeopardizing the company's ability to operate within the UAE.

Here are some challenges you face when you do not pay due attention to account reconciliation:

1. Manual Errors

The chances of errors are high if you rely on manual processes for account reconciliation. It can distort financial records, impacting decision-making and financial analysis.

Example: An employee records a sales transaction twice, leading to an inaccurate representation of the company's revenue.

2. Fraud

Detecting fraud becomes difficult when you lack real-time visibility or the accounts are not being cross-verified. As a result, fraudulent activities go undetected, causing financial losses and damaging trust.

Example: An employee manipulates expense reports to divert company funds for personal use.

3. Overdrafts

You lose sight of the funds available, leading to bounced checks or potential bank charges. This harms the company's financial stability and relationships with vendors.

Example: The employee wrote a check with insufficient funds, resulting in a bounced check and delayed vendor payment.

4. Inaccurate Reporting

You increase the chances of discrepancies in financial reports, providing stakeholders with misleading information. This undermines the confidence in the company's financial health and performance.

Example: An employee overlooking the balance between revenue and expenses leads to inaccurate profitability figures in financial statements.

5. Tax Issues

You can encounter inaccurate tax calculations or omissions, leading to tax filing errors. This leads to penalties, fines, and increased scrutiny from tax authorities.

Example: An employee's oversight of business expenses, like travel and meals, results in underreported deductions, leading to tax filing inaccuracies.

6. Affect Credit Score

You increase the chances of missed payments or errors that negatively impact the company's credit score. This further affects the ability to secure loans or favorable credit terms.

Example: An employee's oversight in paying a critical supplier invoice on time leads to late fees, strains supplier relations, and affects the company's credit score.

7. Audit Challenges

With incomplete or inaccurate reconciliations, you risk challenges during audits, demanding additional time and resources. This results in increased audit costs and potential legal implications.

Example: An employee fails to reconcile monthly bank statements, leading to missing documentation. The subsequent need for extensive audit adjustments increases audit costs and poses legal risks.

Automate For Ease

Managing 1000s of expenses and individually categorizing and coding them is a big headache for finance teams. Leaving this to your accounting software will further require oversight during audit season, adding to the workload. Moreover, these software don’t help with record-keeping or real-time visibility, causing you to spend more on account reconciliation.

Pluto makes this easier by bringing it all to a centralized platform. By shifting to the Pluto ecosystem, you close books 10x faster and simplify spend management. It is as simple as integrating your accounting software and ERPs and getting visibility over your money from Day one.

Streamline your financial management with our all-in-one platform, integrating accounts payable software for comprehensive control. Manage categorization, reimbursements, corporate cards, and all aspects of accounts payable seamlessly from a unified dashboard.

The best part is that you can bulk export and import logs and even lock the transactions to avoid changes once approved. Further, with view-only access to external bookkeepers, you ensure transparency and security with no chaos during audit season.

Reconciliation in Accounting Made Simple

Meeting compliance standards should not be an afterthought during the audit season.

You must adopt the right processes, standards, and tools to get complete control over your accounts. This will ensure accurate records and build trust amongst stakeholders. Moreover, the teams will have a proper systems to reconcile without rushing at the end time.

With automation, you make the process easier and more efficient. Pluto assists you with a centralized platform to automate your accounts payables and simplify account reconciliation without having to juggle multiple accounting software

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use