Contents

Purchase Order Automation: Transforming Business Transactions for the Better

Mohammed Ridwan

•

•

The sales team needs a new SaaS product for cold calling, but the approval is due. It has been weeks, and neither the finance nor the legal team has reverted. The sales team keeps following up, and the procurement team is stuck in the loop of approvals, only to spend some more weeks negotiating with the right vendor later.

This is a common scenario in most companies where teams follow a fixed standard operating procedure, and procuring basic items takes months. All this, combined with multiple tools, complicates procurement further. One tool to raise requests, one for approvals, one to manage vendors, and so on.

In this blog post, we will discuss how to automate purchase orders and simplify the procurement process. Instead of relying on hundreds of procurement automation software, we will look at how you can automate with minimal effort.

What is Purchase Order Automation?

Purchase order automation is the process of automating and removing all the manual tasks associated with creating purchase orders.

This is what the traditional procurement process looks like in most companies:

- Employees fill out forms to raise purchase requests, but have a long wait before they receive a response.

- The procurement team struggles to manage hundreds of purchase requests and seek approvals from different departments.

- The finance team is disliked by both employees and the procurement team because they focus on cost-saving and resource optimization.

As a result, there is continuous internal resentment.

Automating parts of this process lifts the weight off of each of them. Instead of relying on forms and different task management tools, you invest in centralized software to manage requests, set approval workflows, and maintain vendor databases.

How to Automate Purchase Orders

Here is a simple four-step method to automate your purchase orders:

1. Find the Right Automation Software

We have explored the top procurement automation software previously, which will help you evaluate the alternatives available. To pick the right one, look for the following features:

- Ease of use- To simplify adoption and reduce training time

- Flexible workflows- To adapt to complex organizational hierarchies

- Integration- To connect and sync with existing accounting systems and ERPs

- Reporting- To support data-driven decision-making and enhanced transparency

- Real-time visibility- To track expenses and identify thefts and fraud

- Scalability- To accommodate increased transactions and users without performance issues

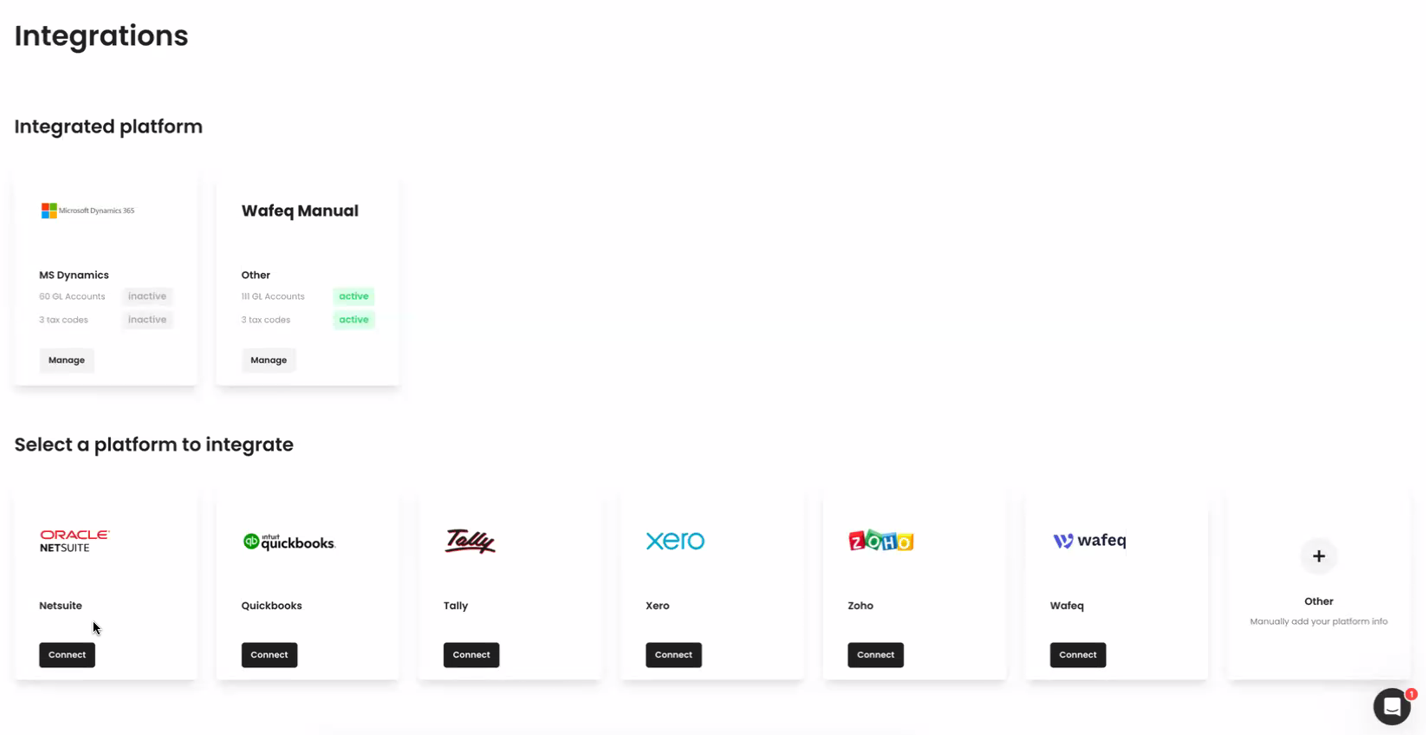

2. Integrate With Your Accounting Software and ERPs

Connect your existing accounting software and ERPs to procurement automation software to sync vendors and transactions across multiple software platforms.

As a result, it becomes easier to maintain vendor databases and reconcile accounts. You can streamline purchase orders and eliminate chances of errors. You get real-time visibility into the status of orders, ensuring that relevant stakeholders are informed at every stage.

3. Set Up Policy and Approval Workflow

Create and enforce guidelines, rules, and approval hierarchies for purchase orders that align with organizational policies. This includes the following steps:

- Outlining the approval workflow to follow the organizational hierarchy

- Setting spending limits to control the amounts allocated in a single purchase order

- Syncing and defining the preferred vendor's list

- Specifying user permissions, access levels, and actions based on roles within the procurement process

- Activating alerts for relevant stakeholders about the status of purchase orders, pending approvals, or other critical updates

This step will enhance security, communication, and transparency throughout the procurement workflow.

4. Implement Automation

Finally, once you complete the setup, you will be able to automate the following parts of purchase orders:

a. Approval Workflows

You can set up trigger-based approval workflows without requiring any technical expertise. From approving purchase requests to clearing payments, you can set up a proper hierarchy with all the required stakeholders.

So whether a purchase demands approval from three managers or three departments, you can accommodate the complexities without any delays.

b. Vendor Database

Instead of importing/exporting or manually maintaining vendor data in your procurement software, you can integrate the software into your existing accounting system and ERPs for a convenient two-way sync.

You can also create a list of items for each vendor, making two-way and three-way matching easier.

c. Receipts

Be it from email or WhatsApp, you no longer need to upload receipts and information in your system manually. The software captures the receipts and other key details via OCR, eliminating redundant record-keeping.

Additionally, you can bulk upload the invoices to add all the information in a centralized platform and sync across accounting systems. This simplifies reconciliation and provides complete visibility into each expense.

d. Expense Categorization

You no longer need to manually add tax and general ledger (GL) codes to any expense. Based on the key information extracted via OCR, the software categorizes the expenses. Plus, this syncs across platforms, accelerating reconciliation.

e. Goods Received Note (GRN) Matching

With OCR and receipt information retrieval, two-way and three-way matching becomes easy. The stakeholders can side-by-side compare the purchase order, invoice, and items listed. This significantly reduces the time spent on GRN matching and consolidates all the information on a unified platform.

f. Audit Trails

You get away with the need to maintain thousands of receipts and documents and get all the key information on a unified platform. From purchase requests to stakeholders involved and order status, you get complete visibility into each order.

This audit trail becomes a blessing during the audit season when you only need 30 seconds to retrieve a specific receipt or document.

How Automating Purchase Orders Makes Procurement Easier

While automation comes with multiple benefits, one reason to try it out would be gaining control and visibility.

You go from not knowing what the teams need, where the money is going, which department spends the most, or why these reports don’t make any sense to getting clarity on every aspect of procurement, not just purchase orders.

Here are five more benefits of automating purchase orders:

1. Reduce Error and Manual Tasks

You minimize the risk of human errors that come from manual data entry. For instance, a manual typo in the quantity ordered leads to complications and delays. Similarly, a mistake in categorization can cause legal issues. Automation ensures accuracy by eliminating such human errors.

2. Faster Reconciliation

You get real-time data synced across your accounting systems, easing the reconciliation process. The finance team can quickly match records, such as invoices and receipts, without delays and discrepancies. Further, this eases the process of GRN matching, helping you close books much faster with accuracy.

3. Streamlined Approvals

You accelerate the approval process for purchase orders even with complex hierarchies. Instead of waiting for physical signatures or manual confirmations, you get trigger-based approval workflows. As a result, you can set up a proper notification system to send purchase order requests to designated approvers, speeding up the entire approval chain.

4. Compliance Support

You can enhance compliance with organizational policies and regulatory standards. For instance, the system can flag a purchase order exceeding predefined spending limits, ensuring compliance with budget constraints. This helps prevent unauthorized purchases or deviations from established guidelines.

5. Scalable

You can scale procurement easily to meet the evolving needs of the business. As the organization grows, the automated system handles increased transaction volumes without affecting or increasing the manual effort.

Your Search for a Purchase Order Automation Tool Ends Here

Stop looking for different automation tools for each step in your procurement process. You don’t need an individual solution for purchase requests, purchase orders, and processing payments. You can automate it all on a single platform and ensure accuracy and consistency among your accounting systems.

At Pluto, our main aim is to stop the chaos and make procurement easier for three core stakeholders—spenders (employees), savers (finance teams), and sourcers (procurement teams). We streamline the entire process on a centralized platform and give you more visibility and control at each stage. And whether you want to automate one step or digitize your entire procurement process, Pluto gives you the flexibility to meet your needs.

Refer to our dedicated post on procurement automation to understand how a single procurement platform can sync with your accounting systems and automate the procurement process on a centralized platform.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Mohammed Ridwan

Future of B2B Payments

Introduction

In this blog post, we will dive into a discussion between two individuals about the future of financial services and the opportunities and challenges in the SME (Small and Medium-sized Enterprises) segment. The speakers discuss the impact of technology on businesses, the need for innovation in business payments, and the changing landscape of entrepreneurship. Let's explore the key themes discussed in this conversation.

The Impact of Technology on Businesses

The conversation begins by highlighting the significant focus on consumer-centric technology companies in recent years. Companies like Uber and Instacart have revolutionized the way individuals access services and products. However, the speakers note that there has been a lack of focus on technology solutions for businesses. This is starting to change, with a surge in B2B marketplaces and business planning tools emerging.

The Evolution of the SME Segment

The speakers acknowledge that the SME segment has traditionally been overlooked due to various obstacles and challenges. However, they discuss how the COVID-19 pandemic has accelerated the need for digital transformation in businesses. They mention that 56% of SMEs have pivoted or shifted their business models towards digital channels. This shift has opened up new opportunities for technology companies to cater to the evolving needs of SMEs.

Pain Points in Business Payments

One of the pain points discussed is the inefficiency and frustration associated with business payments. The speakers highlight the challenges faced by businesses when making and receiving payments. They mention the difficulties of distributing petty cash to employees, the reliance on personal cards for business expenses, and the cumbersome process of entering vendor details in banking portals. These challenges result in cash leakages, accounting nightmares, and inefficiencies.

The Opportunity for Innovation in Business Payments

The speakers emphasize the need for innovation in business payments. They discuss the potential for technology solutions to address the pain points faced by businesses. By streamlining payment processes, reducing fraud, and improving efficiency, businesses can save time and money. The speakers believe that there is a significant opportunity to disrupt the traditional business payments landscape and provide better solutions for businesses of all sizes.

The Changing Landscape of Entrepreneurship

The conversation concludes with a discussion on the changing landscape of entrepreneurship. The speakers predict that businesses will continue to shrink in size as more functions become automated. However, they also anticipate the emergence of a new breed of entrepreneurs who will serve multiple businesses through their own ventures. This shift towards self-employment and the gig economy is expected to create new opportunities and challenges for both entrepreneurs and businesses.

Conclusion

In conclusion, the discussion highlights the need for technology solutions in the SME segment and the opportunities for innovation in business payments. The speakers emphasize the importance of addressing the pain points faced by businesses and predict a future where entrepreneurship takes on a new form. As the business landscape continues to evolve, it is crucial for businesses and entrepreneurs to adapt and leverage technology to stay competitive. If you're interested in learning more about the future of financial services and how technology can transform your business payments, we invite you to explore the solutions offered by Holly Wally, the world's first wallet-as-a-service platform. Visit Holly Wally's website to find out how they can help you build your mobile wallets, increase revenue, and reduce time to market. Remember, the future is full of opportunities, and embracing innovation is the key to success in the ever-changing business landscape.

•

Mohammed Ridwan

Corporate P-Cards: How to Use Them for Maximum Advantage

P-cards can replace your corporate credit cards.

If you rely on credit cards, you would have 2-3 cards issued to the executives, which are shared with the employees. Though it seems a great method to ensure approval and budget control, it has many loopholes.

The finance teams are running after employees for receipts, employees are waiting on OTPs and approvals, and the CFO is not satisfied with the numbers.

You look for alternatives and land on p-cards.

P-cards (or purchase cards) are corporate cards you issue to your employees for business expenses. Then, be it purchasing a SaaS or making vendor payments, employees use it for all work-related spending.

What are Corporate P cards?

Corporate P cards are company purchase cards that employees can use to make business purchases without going through the traditional purchase request and approval process. Corporate P cards make it easy for companies to manage account payables & automate expense accounting while staying in complete control of their spending.

What Is the Difference Between a Credit Card and a P-Card?

While both cards are used exclusively for business expenses, there are many differences.

Credit cards make expense management difficult, with no visibility into where the money is going. An executive shares a single card with their team, creating a chaotic financial situation.

The card owner struggles to manage a constant stream of payment requests. Employees are left hanging with delayed payments, waiting for approvals. Especially in bigger companies, finance teams struggle with reconciliation and zombie spending (which is when a company continues to pay for something that isn’t used anymore, or when it pays for services that former employees had used).

On the flip side, if you use p-cards, you can issue each employee a separate card for corporate expenses. Each card has a specific budget and restrictions to ensure control and facilitate approval without delays.

For instance, you issue a card with a $500 monthly limit, restricted to office supply vendors like "Office One."

In this way, you manage budget control and approvals without losing visibility or having to micromanage.

How can Businesses use Corporate P Cards for Employee Expenses?

Moving from a credit card to a P-card isn’t complicated. Here is a step-by-step process of how you can provide your employees p cards and start using them:

Step 1: Generate Corporate Cards

The first step is to choose the type of card you want for your employees: physical or virtual. While a virtual card can be set up in under a minute, a physical card takes about 2-3 days to get delivered.

Physical cards work well for those who travel or have on-site jobs, making petty cash management easy. Contrarily, virtual cards support secure online purchases, such as buying SaaS tools or paying for digital advertising campaigns.

Once you decide whom to give a card and what type, set the budget and policies. You can incorporate the following policies to customize the cards:

- Specify the budget and replenishment frequency of the budget on the card- daily, monthly, or yearly.

- Define the purpose of cards by enabling only specific general ledgers (GL), labels, and tax codes.

- Switch on/off the ATM withdrawal option.

- Enable auto-lock for cards in case of receipt policy violation, where if the receipt isn’t attached in 7 days, the card is frozen.

All these customization options offer you better control without having to chase employees later. Deciding the budget, frequency, and vendors ensures that the card is used rightfully.

For instance, you would switch off ATM withdrawal for virtual cards that are meant for buying SaaS tools. Likewise, you can establish a monthly replenishment schedule to maintain sufficient funds while preventing excess spending.

Apart from this method, your employees can also request to activate the P-cards. They explain the card's purpose, after which the admin can approve/reject the request.

Now that the employees have cards in their hands, let’s see how you can better manage corporate spending with them.

Step 2: Manage Expenses Via Centralized Dashboard

Every expense on the corporate p-card is visible in real time on a centralized transactions dashboard. You get key information such as merchant name, expense category, card information, amount, and approval status.

Along with this dashboard, you get a dedicated tab for each expense where all its information is available.

You can review the key information such as receipt, department, merchant, date/time, expense category, etc. you can also download the receipt, approve/reject the expense, and check the activity log.

The activity log keeps track of all the conversations that have been happening with a particular transaction. Traditionally, companies use email and Slack, which makes communication messy. With this log, they can keep all their conversations and important information in one organized place.

Step 3: Create Approval Workflows

Approval workflows ensure that each expense follows a defined hierarchy for approval by the right stakeholders. You can customize them depending on different amounts, departments, and other factors.

It is a simple no-code system where you create workflows based on if-then rules.

A custom approval workflow ensures timely and effective approval without having to run after dedicated team members. Each of them receives a notification as soon as the expense takes place, and they can approve it easily.

Approvals and employee reimbursement become easy with a frictionless workflow like this.

Step 4: Report and Reconcile Expenses

Integrating your cards with your accounting systems becomes the last step to facilitate reporting and reconciliation.

Once you integrate with your accounting software, you can enjoy complete visibility and control over your corporate expenses.

You get a dedicated insights window to track expenses and identify trends. You can add custom filters and export these for further analysis.

To understand the entire process better, book a demo and see how you can benefit from switching to a corporate p card.

Why Shift From Traditional Methods to Corporate P Cards?

Credit cards seem simpler, where a bank gives a few credit cards to share among the teams. But here’s why it doesn’t work:

- It is difficult to track who spends what, how much, and why.

- Employees wait for OTPs and approvals, delaying payments and reimbursements.

- The chances of zombie spending increase because the same card is shared. This also becomes one of the loopholes which leads employees to misuse the cards.

- The admins have to chase employees for receipts during reconciliation.

While these are just a few, relying on credit cards can cause chaos in expense management. Here are some reasons corporate p-cards are a more suitable option today:

No More Shared Cards

You ditch the whole system of sharing credit cards, which is the root cause of limited visibility. With corporate p cards, you can issue any employee a dedicated card for specific expenses.

So, if you issue Rashid from the marketing department a virtual corporate card for running Ads, he can not use it otherwise. He will be accountable for any unnecessary expenses beyond the specified budget.

This means more visibility and control over corporate expenses.

Easy Receipt Management

Corporate cards make receipt management easier with OCR technology in the following ways:

- Submitting expense reports at the end of the day becomes easier as it auto-populates all the information

- Uploading receipts in bulk upload with OCR handling the rest makes the process faster

- Detecting duplicate receipts becomes simpler as OCR eliminates the risk of manual errors

Apart from OCR, you also get the option to split the transactions to make the accounting process easier. Here, for each transaction, you can split the amount into a separate category, GL account, tax code, etc.

For instance, a $300 expense can be split into $200 for software purchases and the remaining $100 as consulting fees. Each will have a specific category, GL account, and corresponding tax code.

Budget Control

Corporate cards give more visibility and control over finances.

Although both credit cards and p-cards can have specific budgets, p-cards enable you to set specific policies and rules.

For instance, you give an employee a $1,000 monthly budget but restrict them to using the card only for office supplies purchases.

Similarly, you can set a $500 monthly limit for marketing expenses and restrict the card to "Ad Campaigns" and "Promotions," ensuring focused spending.

Another benefit is to assign monthly, yearly, and weekly budgets.

For instance, you can allocate an annual budget of $500,000 for the marketing department but assign a weekly budget of $10,000 for ad campaigns.

This facilitates flexibility for the teams to function better and gives the finance team more control over resource planning and allocation.

WhatsApp Integration

Receipt uploading becomes simpler when all you have to do is click a picture on WhatsApp and hit send.

After each transaction, employees get a notification to upload the receipts via WhatsApp. With this simple integration, receipt capturing becomes simple and fast.

Not only is the receipt captured, but stored under the relevant transaction tab with all its information intact. OCR makes it easier to extract key details and populate expense reports.

Admins can approve these expenses, and reconciliation becomes a breeze.

Eliminate Corporate Card Fraud

P-cards give you more control and security. From setting custom policies to raising alerts in case of duplicate receipts, p-cards ensure that employees don’t misuse the cards.

Additionally, the custom approvals workflows and dedicated activity logs reduce the chances of oversight. This system helps prevent unauthorized spending.

For instance, an employee tries to use the card for a personal expense, like an expensive dinner.

The custom approval setup will alert the admins. The active activity log with documented conversations will further ensure that no personal expense is charged on corporate cards.

Get the Most Out of Your Corporate Cards

Transitioning from credit cards to corporate p cards can be an exciting move. But to make the most of it:

- Set an expense policy outlining the guidelines that will govern the corporate cards. This practice will also become the pillar for a healthier financial environment to support internal control over financial reporting (ICFR) efforts.

- Understand the hierarchies in the company to create approval workflows accordingly. Find a balance between control and micromanagement. Managers should be informed about expenses without being excessively involved in them.

Do this right, and you will have better visibility and control over your finances. The employees will not be left hanging for approvals. The finance team will be at peace, and the CFO will have more faith in the numbers.

•

Vlad Falin

How to Manage Petty Cash Effectively in 2024

Not every expense in the company requires you to issue a check. Payments like petrol, supplies, stamps, etc., are paid via cash. For these business transactions, either the employees take cash in advance or put in a request for reimbursement. This mechanism requires you to set some cash aside and employ a person for receipt management and reporting. The cash is referred to as petty cash.

What Is the Meaning of Petty Cash?

Petty cash refers to a small amount of money that businesses keep readily available for handling minor payments and expenses that are too small to be processed through regular accounting procedures. It is often kept on hand and is reimbursed periodically.

{{take-pain-banner="/components"}}

What are Petty Cash Examples?

Petty cash includes small miscellaneous expenses, such as:

- Office supplies

- Gifts

- Client lunch

- Refreshments

- Postage

- Medicine and first aid

- Minor repairs

- Transportation

What Is the Process of Petty Cash Disbursement?

The first step in petty cash disbursement is to define policies and procedures. This includes specifying:

- The purpose of the fund

- The maximum cash amount

- The types of expenses the fund can cover

- The process for replenishing the fund

The next step is to appoint a petty cash custodian. They are responsible for handling the petty cash fund.

Then, you set up the fund by transferring the initial sum of money into a safe or locker. This amount should be sufficient to cover minor expenses for a defined period.

When employees make small purchases, they request funds from the custodian. After the purchase, they return with a petty cash voucher, receipt, and cash balance.

The custodian reviews the receipts and provides reimbursement. They maintain detailed records of every transaction, including the date, purpose, recipient, amount, and a brief description of the expense. This record-keeping method ensures transparency and accountability.

After that, the custodian reconciles the petty cash fund at regular intervals. They add up the safe's cash balance and the receipts' value. The total should match the original amount in the fund.

{{cs-cta-component}}

What are the Two Types of Petty Cash?

To manage petty cash, the custodian relies on either of the petty cash book systems:

1. Imprest Petty Cash Book

An imprest petty cash system involves maintaining a fixed amount of money in the petty cash fund at all times.

For instance, you set up a fund of $100. When the fund gets down to $20, the custodian requests reimbursement and replenishes the fund to $100.

2. Columnar or Analytical Petty Cash Book

A columnar or analytical petty cash book is a detailed and structured method of recording petty cash transactions. It categorizes expenses into different general ledger codes for better tracking.

For instance, you create separate columns, such as "office supplies," "refreshments," "meals," etc. Whenever a transaction occurs, the custodian records it in the appropriate column and specifies its purpose.

What are the Challenges of Petty Cash?

While the process of petty cash seems linear and simple, it has many intricacies in practice.

Imagine the custodian getting hundreds or thousands of requests and receipts every day. So, maintaining a petty cash system is easier in a smaller business with limited expenses and reporting needs. However, for larger enterprises, relying on manual vouchers and physical safes/lockers causes a lot of chaos.

1. Vulnerability to Theft and Misuse

Unlike an automated system, a manual petty cash system lacks controls and security measures.

For example, if the custodian is not vigilant, employees can use the cash for personal expenses. Similarly, if the custodian gets stuck between multiple requests and receipts, it leads to oversight.

Moreover, the physical nature of cash in a petty cash box makes it an easier target for theft. Since there's no immediate digital record, anybody can steal money, which goes unnoticed for a while. This lack of transparency and a digital audit trail makes it difficult to identify funds misuse.

2. Poor Receipt Management

Receipts are the document of proof for the expense. With the traditional approach, custodians have to chase employees for receipts. This results in incomplete or unaccounted-for submissions.

Moreover, relying on the manual petty cash process makes it harder. The custodians have to manage countless receipts daily, making reconciliation tedious. Hence, you end up with misplaced, duplicate, or even damaged receipts.

A common example of this issue is when a custodian receives multiple receipts and with an analytical petty cash book to maintain. It takes them hours to reconcile, report, and ensure accurate categorization.

The worst is when it's time to report, and locating these receipts takes hours.

3. Chaotic Approval Workflow

In smaller companies, getting approval for expenses is easy. But, in large enterprises, even small expenses can prompt approvals from various departments and stakeholders. This makes the approval workflow complicated and time-consuming. This delays the fund release, disrupting the workflow and reimbursement process.

For example, imagine an employee who wants to buy a subscription for less than $300. In a big company, it will prompt approval from the manager, IT, finance, and legal departments.

All this back-and-forth slows things down a lot.

4. Internal Resentment

In big companies, there's tension between the finance team and other departments. This issue occurs when employees can't access the funds and have to wait for approval. Such a delay disrupts the work or delays the reimbursement.

For instance, an employee needs to buy a subscription for work. But the delay in approval impacted the deadline and client relationship. This creates problems and stress between the finance team and other departments.

5. Branch-Level Petty Cash Management

Large enterprises use separate petty cash systems for departments at the branch level. This means that each department has its own petty cash fund to manage.

Managing small amounts of cash at individual branches is tricky. Employees misuse/steal the money as there's not much oversight. There is no visibility on how money is being spent. Maintaining funds for multiple branches becomes a headache. Also, departments find it challenging to request more funds.

Reconciliation becomes challenging as the finance teams have to chase branches for complete information. This leaves a lot of loopholes for employees and branch custodians to misuse petty cash.

6. Tedious Reconciliation Process

Reconciliation ensures that the petty cash fund's balance matches the sum of all expenses.

Manually, reconciliation in large enterprises takes weeks and is prone to errors. Moreover, when adding up expenses, the process is prone to manual errors, which are hard to identify and correct.

For instance, the custodian overlooks a receipt. This mismatch between the recorded expenses and the actual cash on hand can take him weeks to spot errors.

7. Low Visibility Over Expenses

Traditional petty cash systems lack real-time data. At any given point of time, the custodian is unaware of the fund's current status. This lack of visibility delays financial decision-making. For instance, it can take weeks before the custodian realizes that the petty cash fund is running low. This can lead to temporary cash shortages for essential expenses.

The absence of a clear record makes it slower to notice problems and reconcile the cash. Moreover, transactions and expenses are recorded on paper, which leads to further errors. For example, when an employee uses petty cash to buy office supplies, there will be a delay until the expense is recorded.

Similarly, when many employees spend money simultaneously, tracking them in real-time is tough. This lack of transparency allows employees to misuse petty cash for personal expenses.

How to Manage Petty Cash Effectively With Pluto?

To overcome the challenges described previously, you can not rely on any automation tool. Instead, you need a product that is tailored to your specific needs. While many tools can assist you in digitizing petty cash management, Pluto goes the extra mile.

With Pluto, you no longer need to maintain a physical safe or countless vouchers and receipts. Pluto records every transaction in real time and gives you visibility at each step. From receipt to reimbursement, you manage everything with complete control and clarity.

Unlimited Corporate Cards

Pluto enables you to issue unlimited corporate cards, simplifying petty cash management. It eliminates the need for physical lockers or safes, promoting smoother cash flow. The availability of unlimited cards allows you to replace shared credit cards. This enables the use of cards for even small petty cash expenses.

Finance teams get full control and visibility over each petty cash expense in real time.

Employees can either swipe the cards for a seamless process or withdraw cash from ATMs. Every expense made with the corporate card triggers an approval workflow. It prompts employees to add receipts and managers to approve expenses. They can then add the receipts simply via WhatsApp and get reimbursed without any delays.

With all the data consolidated on a single platform, reconciliation becomes easier. This simplified process eliminates the need for a dedicated custodian to manage petty cash.

Not only do you get more control, but you save money with visibility at each step.

Budget Control

Pluto allows you to specify limits for corporate cards issued. This ensures employees stay within budget.

When the spending exceeds, employees can request more funds. The budget expands on the manager's approval in seconds, allowing for necessary spending.

Administrators can also issue zero balance cards. These cards with zero balances prompt an approval request for each expense. This approach ensures budget control without causing any delays or resentment.

Easy Receipt Management

Pluto simplifies receipt management thanks to its seamless WhatsApp integration.

Your employees can upload receipts via WhatsApp, which are recorded in real-time. The custodians no longer need to run after employees for the receipts.

However, Pluto does more than just store receipts. It extracts vital information through OCR, including vendor names, amounts, and GLs. As a result, your accounting team spends less time on manual tasks like creating logs.

Approval Workflow

Normally, getting approval for expenses can involve a lot of back and forth. But with Pluto, you can set up custom approval processes to make the process smoother.

When an employee uploads receipts, Pluto automatically starts the approval workflow. It notifies the custodian and managers to approve the expense, removing the friction.

The reimbursement process accelerates without any compromise on efficiency.

Further, Pluto uses OCR to detect duplicate receipts to avoid dual payments and fraud. This makes it easier to double-check expenses and approve the legitimate ones.

Digital Expense Report

Pluto offers digital expense reports that compile data from all the receipts.

The report simplifies the task for your finance teams to see how each branch/department is spending. It enables them to make adjustments to policies and procedures as needed.

For instance, a company has small office supply purchases spread across various departments. Pluto's real-time visibility and report help to locate these costs. As a result, finance teams can reconsider and promote bulk purchases for cost savings.

With Pluto, the custodian gets complete visibility into the expenses and the available funds at all times.

Close Books 10X Faster

Pluto simplifies the process of closing books.

Since employees can submit receipts directly through WhatsApp, custodians don’t need to chase employees for receipt submissions. This enables you to close the book 10X faster by accelerating the reconciliation process.

Pluto records all transactions in a centralized digital platform. This streamlines audit logs and eliminates the need to maintain physical records.

With its OCR-based receipt retrieval, finding specific receipts and information becomes more effortless. This simplifies the reconciliation process, making the entire book-closing process faster.

Replace Petty Cash With Corporate Cards

Small expenses and cash transactions can not be removed. However, finding an expense management tool can make petty cash management simpler.

Stop relying on manual traditional processes to manage petty cash. Choose Pluto to replace your tedious petty cash books and vouchers with corporate cards.

Sign up today to digitize your petty cash for complete visibility and control.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use