Contents

7 Ultimate Digital Transformation Tips for CFOs in UAE

Leen Shami

•

•

The finance landscape is undergoing a seismic shift in an era of unstinted technological advancement. Back in 2018, a PWC report found that amongst the top 12 challenges that financial organisations faced, 4 of them were technology-related. It wasn't about deciding whether to implement digital transformation technologies but more about understanding the enterprise value these investments would add.

According to Deloitte, adopting the right digital transformation strategies can increase market value by up to $1.25 trillion across Fortune 500 companies. But how can organisations implement these strategies successfully?

The CFO's Perspective on Digital Transformation

Digital transformation is no longer just a buzzword; it is a mandate for modern businesses, and the CFO plays a central role in this paradigm shift. Gone are the days when the Chief Financial Officer (CFO) position revolved solely around balance sheets, budgeting, and compliance. The modern CFO is now tasked with leading the charge in the digital transformation of the finance department.

With its vision of becoming a global technology and innovation hub in the UAE, the need for digital transformation is even more compelling.

Why is digital transformation so vital for a CFO?

- Real-Time Financial Insights: Real-time access to financial data can be an invaluable asset in combating expense fraud. Digital transformation allows CFOs to detect irregularities promptly, leading to timely intervention and reducing the financial losses associated with fraud.

- Enhanced Reporting: CFOs can generate comprehensive financial reports more quickly and accurately, aiding in transparency and stakeholder communication.

- Cost Reduction: Automating financial processes can lead to cost savings, such as reduced labour and operational costs.

- Strategic Planning: Digital tools help CFOs analyse financial data and create insights to make strategic decisions and adapt to changing market conditions.

- Compliance and Risk Management: Digital solutions assist in maintaining compliance with changing regulations and mitigating financial risks.

What is the best digital transformation tool for you?

As a CFO, your journey towards a comprehensive digital transformation should be guided by specific features that enhance financial efficiency and help combat one of the most prevalent issues—expense fraud. Here's what you should look for in a digital transformation tool to achieve these goals:

1. Full Control Over Budget Allocation and Spend Visibility:

Access to complete control over budget allocation and clear visibility into how those budgets are spent is the foundation of sound financial management. Your chosen digital transformation tool should empower you to allocate resources efficiently and make data-driven decisions.

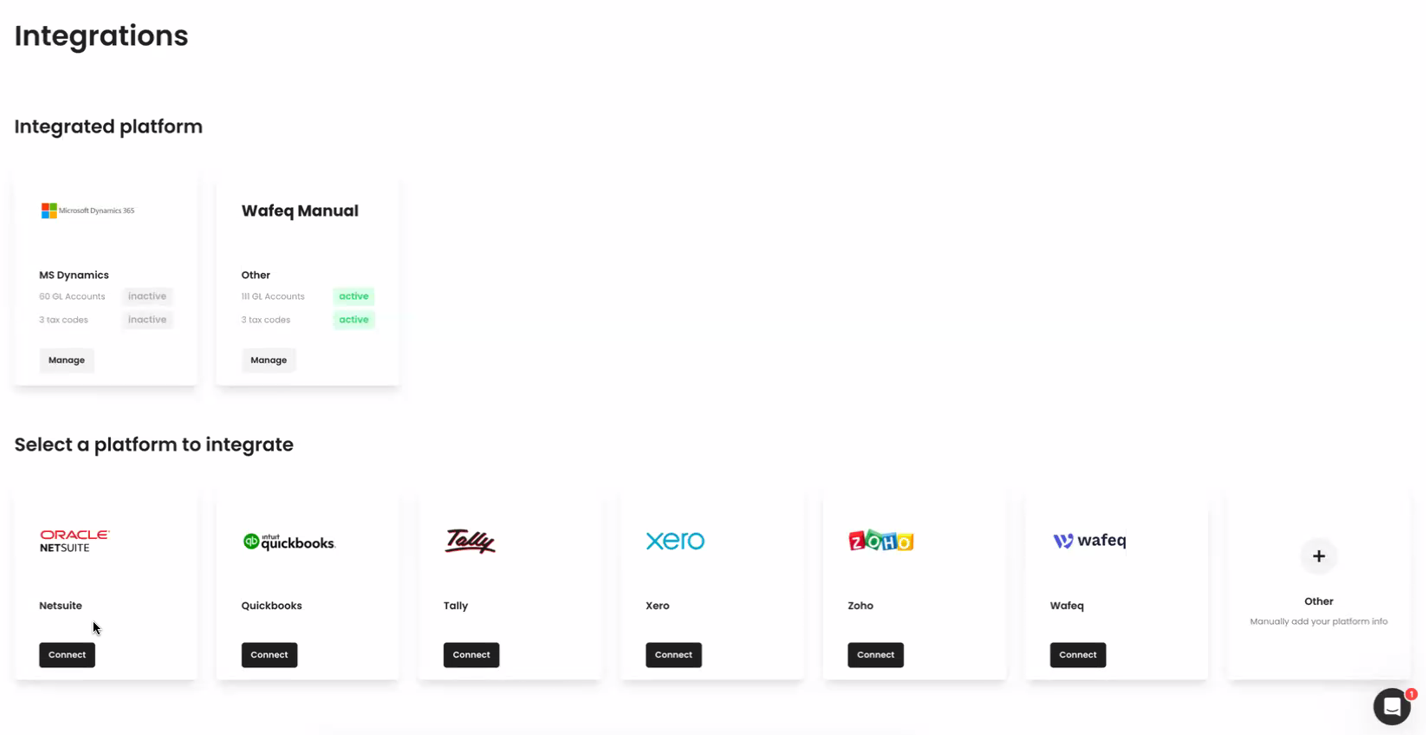

2. Real-Time Closure with ERP Integration:

Moving from traditional month-end closures to real-time closures is a game-changer. This transition ensures you have real-time insights into your company's expenditure, allowing you to address financial challenges swiftly. An essential component of this is seamless integration with your ERP system, which provides instant access to financial data.

3. Elimination of Petty Cash Usage:

Digitization of financial processes is a fundamental aspect of modern financial management. To achieve this, focus on strategies to eliminate petty cash usage as much as possible. Consider solutions that offer alternatives, such as merchant-specific cards, fuel cards, and PRO cards, which reduce inefficiency and enhance security.

4. Advanced Expense Fraud Detection:

Expense fraud is an all-too-common challenge faced by many companies. Leveraging digitization to combat this issue is essential. Look for a solution equipped with world-class Optical Character Recognition (OCR) technology to identify duplicate receipts and suspicious transactions. The goal is to ensure transactions are monitored in real-time and in an automated manner, such that financial compliance is continuously maintained.

5. Improved Audit Process for Accounting Teams:

Ensuring an enhanced audit process is a vital component of your CFO responsibilities. You must seek a digital transformation tool with two critical features for this. First, accounting automation powered by ERP integration streamlines financial processes and reduces the potential for human error. Second, the tool should provide 100% visibility into all receipts across the company, creating a comprehensive audit trail and reducing the likelihood of discrepancies.

6. Insights and Forecasting:

To thrive in a rapidly changing business environment, a CFO must have a finger on the pulse of their company's finances. A 360-degree digital transformation solution offers complete real-time visibility into all company expenditures. This feature allows you to provide timely, data-driven insights and forecasts, enabling proactive decision-making.

7. Multi-Subsidiary Expense Tracking:

In the UAE, as businesses achieve a reasonable size, they often evolve into multi-subsidiary or multi-branch entities. Given this common trajectory, it's imperative that the chosen digital transformation tool supports multi-subsidiary expense tracking. This ensures that financial data from all parts of the organization is aggregated and analyzed effectively. Not only does it provide a holistic view of the company's financial health, but it also enables consistent monitoring and control of expenses across the entire organization.

To illustrate the power of these digital transformation features, let's look at real-life business examples from the UAE:

1. Dubai Blockchain Mandate: Dubai is on a mission to become the world's inaugural blockchain-powered city. The Dubai Blockchain Mandate, led by the Smart Dubai Office, lays out a clear path for integrating blockchain technology across the city. By embracing blockchain technology, Dubai has the potential to realize annual savings of 5.5 billion dirhams in document processing alone, equivalent to the value of one Burj Khalifa every year.

2. Dubai Government Services: The government is committed to digitizing its services, the rate of which in 2023 stands at 99.5%. Currently, 87% of all government service transactions are digital. Furthermore, the government has also developed over 100 smartphone apps with cybersecurity and data law compliance.

The digital transformation process is an ongoing journey that entails mobilising the entire workforce and instilling a change-oriented mindset with no pre-defined endpoint that might extend well beyond your current leadership. It serves as the fundamental framework for an organisation's survival in an era marked by disruptions. Achieving success in this context involves formulating a strategy around making purposeful investments in the digital realm. It requires the prudent allocation of resources toward innovative technologies that can drive the organisation's strategic initiatives.

Ultimately, the successful execution of digital transformation mandates the ability to communicate to stakeholders that every digital initiative undertaken is a deliberate move to enhance the organisation's prospects for sustained success.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Leen Shami, Content Marketing Lead

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Mohammed Ridwan

Future of B2B Payments

Introduction

In this blog post, we will dive into a discussion between two individuals about the future of financial services and the opportunities and challenges in the SME (Small and Medium-sized Enterprises) segment. The speakers discuss the impact of technology on businesses, the need for innovation in business payments, and the changing landscape of entrepreneurship. Let's explore the key themes discussed in this conversation.

The Impact of Technology on Businesses

The conversation begins by highlighting the significant focus on consumer-centric technology companies in recent years. Companies like Uber and Instacart have revolutionized the way individuals access services and products. However, the speakers note that there has been a lack of focus on technology solutions for businesses. This is starting to change, with a surge in B2B marketplaces and business planning tools emerging.

The Evolution of the SME Segment

The speakers acknowledge that the SME segment has traditionally been overlooked due to various obstacles and challenges. However, they discuss how the COVID-19 pandemic has accelerated the need for digital transformation in businesses. They mention that 56% of SMEs have pivoted or shifted their business models towards digital channels. This shift has opened up new opportunities for technology companies to cater to the evolving needs of SMEs.

Pain Points in Business Payments

One of the pain points discussed is the inefficiency and frustration associated with business payments. The speakers highlight the challenges faced by businesses when making and receiving payments. They mention the difficulties of distributing petty cash to employees, the reliance on personal cards for business expenses, and the cumbersome process of entering vendor details in banking portals. These challenges result in cash leakages, accounting nightmares, and inefficiencies.

The Opportunity for Innovation in Business Payments

The speakers emphasize the need for innovation in business payments. They discuss the potential for technology solutions to address the pain points faced by businesses. By streamlining payment processes, reducing fraud, and improving efficiency, businesses can save time and money. The speakers believe that there is a significant opportunity to disrupt the traditional business payments landscape and provide better solutions for businesses of all sizes.

The Changing Landscape of Entrepreneurship

The conversation concludes with a discussion on the changing landscape of entrepreneurship. The speakers predict that businesses will continue to shrink in size as more functions become automated. However, they also anticipate the emergence of a new breed of entrepreneurs who will serve multiple businesses through their own ventures. This shift towards self-employment and the gig economy is expected to create new opportunities and challenges for both entrepreneurs and businesses.

Conclusion

In conclusion, the discussion highlights the need for technology solutions in the SME segment and the opportunities for innovation in business payments. The speakers emphasize the importance of addressing the pain points faced by businesses and predict a future where entrepreneurship takes on a new form. As the business landscape continues to evolve, it is crucial for businesses and entrepreneurs to adapt and leverage technology to stay competitive. If you're interested in learning more about the future of financial services and how technology can transform your business payments, we invite you to explore the solutions offered by Holly Wally, the world's first wallet-as-a-service platform. Visit Holly Wally's website to find out how they can help you build your mobile wallets, increase revenue, and reduce time to market. Remember, the future is full of opportunities, and embracing innovation is the key to success in the ever-changing business landscape.

•

Mohammed Ridwan

Corporate P-Cards: How to Use Them for Maximum Advantage

P-cards can replace your corporate credit cards.

If you rely on credit cards, you would have 2-3 cards issued to the executives, which are shared with the employees. Though it seems a great method to ensure approval and budget control, it has many loopholes.

The finance teams are running after employees for receipts, employees are waiting on OTPs and approvals, and the CFO is not satisfied with the numbers.

You look for alternatives and land on p-cards.

P-cards (or purchase cards) are corporate cards you issue to your employees for business expenses. Then, be it purchasing a SaaS or making vendor payments, employees use it for all work-related spending.

What are Corporate P cards?

Corporate P cards are company purchase cards that employees can use to make business purchases without going through the traditional purchase request and approval process. Corporate P cards make it easy for companies to manage account payables & automate expense accounting while staying in complete control of their spending.

What Is the Difference Between a Credit Card and a P-Card?

While both cards are used exclusively for business expenses, there are many differences.

Credit cards make expense management difficult, with no visibility into where the money is going. An executive shares a single card with their team, creating a chaotic financial situation.

The card owner struggles to manage a constant stream of payment requests. Employees are left hanging with delayed payments, waiting for approvals. Especially in bigger companies, finance teams struggle with reconciliation and zombie spending (which is when a company continues to pay for something that isn’t used anymore, or when it pays for services that former employees had used).

On the flip side, if you use p-cards, you can issue each employee a separate card for corporate expenses. Each card has a specific budget and restrictions to ensure control and facilitate approval without delays.

For instance, you issue a card with a $500 monthly limit, restricted to office supply vendors like "Office One."

In this way, you manage budget control and approvals without losing visibility or having to micromanage.

How can Businesses use Corporate P Cards for Employee Expenses?

Moving from a credit card to a P-card isn’t complicated. Here is a step-by-step process of how you can provide your employees p cards and start using them:

Step 1: Generate Corporate Cards

The first step is to choose the type of card you want for your employees: physical or virtual. While a virtual card can be set up in under a minute, a physical card takes about 2-3 days to get delivered.

Physical cards work well for those who travel or have on-site jobs, making petty cash management easy. Contrarily, virtual cards support secure online purchases, such as buying SaaS tools or paying for digital advertising campaigns.

Once you decide whom to give a card and what type, set the budget and policies. You can incorporate the following policies to customize the cards:

- Specify the budget and replenishment frequency of the budget on the card- daily, monthly, or yearly.

- Define the purpose of cards by enabling only specific general ledgers (GL), labels, and tax codes.

- Switch on/off the ATM withdrawal option.

- Enable auto-lock for cards in case of receipt policy violation, where if the receipt isn’t attached in 7 days, the card is frozen.

All these customization options offer you better control without having to chase employees later. Deciding the budget, frequency, and vendors ensures that the card is used rightfully.

For instance, you would switch off ATM withdrawal for virtual cards that are meant for buying SaaS tools. Likewise, you can establish a monthly replenishment schedule to maintain sufficient funds while preventing excess spending.

Apart from this method, your employees can also request to activate the P-cards. They explain the card's purpose, after which the admin can approve/reject the request.

Now that the employees have cards in their hands, let’s see how you can better manage corporate spending with them.

Step 2: Manage Expenses Via Centralized Dashboard

Every expense on the corporate p-card is visible in real time on a centralized transactions dashboard. You get key information such as merchant name, expense category, card information, amount, and approval status.

Along with this dashboard, you get a dedicated tab for each expense where all its information is available.

You can review the key information such as receipt, department, merchant, date/time, expense category, etc. you can also download the receipt, approve/reject the expense, and check the activity log.

The activity log keeps track of all the conversations that have been happening with a particular transaction. Traditionally, companies use email and Slack, which makes communication messy. With this log, they can keep all their conversations and important information in one organized place.

Step 3: Create Approval Workflows

Approval workflows ensure that each expense follows a defined hierarchy for approval by the right stakeholders. You can customize them depending on different amounts, departments, and other factors.

It is a simple no-code system where you create workflows based on if-then rules.

A custom approval workflow ensures timely and effective approval without having to run after dedicated team members. Each of them receives a notification as soon as the expense takes place, and they can approve it easily.

Approvals and employee reimbursement become easy with a frictionless workflow like this.

Step 4: Report and Reconcile Expenses

Integrating your cards with your accounting systems becomes the last step to facilitate reporting and reconciliation.

Once you integrate with your accounting software, you can enjoy complete visibility and control over your corporate expenses.

You get a dedicated insights window to track expenses and identify trends. You can add custom filters and export these for further analysis.

To understand the entire process better, book a demo and see how you can benefit from switching to a corporate p card.

Why Shift From Traditional Methods to Corporate P Cards?

Credit cards seem simpler, where a bank gives a few credit cards to share among the teams. But here’s why it doesn’t work:

- It is difficult to track who spends what, how much, and why.

- Employees wait for OTPs and approvals, delaying payments and reimbursements.

- The chances of zombie spending increase because the same card is shared. This also becomes one of the loopholes which leads employees to misuse the cards.

- The admins have to chase employees for receipts during reconciliation.

While these are just a few, relying on credit cards can cause chaos in expense management. Here are some reasons corporate p-cards are a more suitable option today:

No More Shared Cards

You ditch the whole system of sharing credit cards, which is the root cause of limited visibility. With corporate p cards, you can issue any employee a dedicated card for specific expenses.

So, if you issue Rashid from the marketing department a virtual corporate card for running Ads, he can not use it otherwise. He will be accountable for any unnecessary expenses beyond the specified budget.

This means more visibility and control over corporate expenses.

Easy Receipt Management

Corporate cards make receipt management easier with OCR technology in the following ways:

- Submitting expense reports at the end of the day becomes easier as it auto-populates all the information

- Uploading receipts in bulk upload with OCR handling the rest makes the process faster

- Detecting duplicate receipts becomes simpler as OCR eliminates the risk of manual errors

Apart from OCR, you also get the option to split the transactions to make the accounting process easier. Here, for each transaction, you can split the amount into a separate category, GL account, tax code, etc.

For instance, a $300 expense can be split into $200 for software purchases and the remaining $100 as consulting fees. Each will have a specific category, GL account, and corresponding tax code.

Budget Control

Corporate cards give more visibility and control over finances.

Although both credit cards and p-cards can have specific budgets, p-cards enable you to set specific policies and rules.

For instance, you give an employee a $1,000 monthly budget but restrict them to using the card only for office supplies purchases.

Similarly, you can set a $500 monthly limit for marketing expenses and restrict the card to "Ad Campaigns" and "Promotions," ensuring focused spending.

Another benefit is to assign monthly, yearly, and weekly budgets.

For instance, you can allocate an annual budget of $500,000 for the marketing department but assign a weekly budget of $10,000 for ad campaigns.

This facilitates flexibility for the teams to function better and gives the finance team more control over resource planning and allocation.

WhatsApp Integration

Receipt uploading becomes simpler when all you have to do is click a picture on WhatsApp and hit send.

After each transaction, employees get a notification to upload the receipts via WhatsApp. With this simple integration, receipt capturing becomes simple and fast.

Not only is the receipt captured, but stored under the relevant transaction tab with all its information intact. OCR makes it easier to extract key details and populate expense reports.

Admins can approve these expenses, and reconciliation becomes a breeze.

Eliminate Corporate Card Fraud

P-cards give you more control and security. From setting custom policies to raising alerts in case of duplicate receipts, p-cards ensure that employees don’t misuse the cards.

Additionally, the custom approvals workflows and dedicated activity logs reduce the chances of oversight. This system helps prevent unauthorized spending.

For instance, an employee tries to use the card for a personal expense, like an expensive dinner.

The custom approval setup will alert the admins. The active activity log with documented conversations will further ensure that no personal expense is charged on corporate cards.

Get the Most Out of Your Corporate Cards

Transitioning from credit cards to corporate p cards can be an exciting move. But to make the most of it:

- Set an expense policy outlining the guidelines that will govern the corporate cards. This practice will also become the pillar for a healthier financial environment to support internal control over financial reporting (ICFR) efforts.

- Understand the hierarchies in the company to create approval workflows accordingly. Find a balance between control and micromanagement. Managers should be informed about expenses without being excessively involved in them.

Do this right, and you will have better visibility and control over your finances. The employees will not be left hanging for approvals. The finance team will be at peace, and the CFO will have more faith in the numbers.

.jpg)

•

Mohammed Ridwan

Why A Legacy ERP Is Not Enough For Modern Procurement Teams

In today's fast-paced business environment, most organisations rely on Enterprise Resource Planning (ERP) systems as foundational tools to manage and integrate various business processes. ERPs traditionally offer a broad spectrum of functionalities, assisting in handling essential operations such as procurement, data management, accounting, and supply chain management.

ERP systems provide a comprehensive suite of software functionalities to enhance and optimise various aspects of business operations. Over time, these systems have evolved, shifting from on-premises solutions to cloud-based platforms. However, organisations still face challenges when implementing ERP solutions across their enterprise.

One significant aspect often overlooked in ERP systems is their limitation regarding financial operations & intelligence. ERP solutions primarily focus on improving business processes and management but do not directly handle monetary transactions or provide financial products. This necessitates the integration of external financial institutions and banks with ERP systems.

Moreover, traditional ERP systems struggle to keep pace with the dynamic demands of modern procurement, particularly in the ever-evolving supply chain environment. Today, ERP systems need to be more proactive, incorporating features like real-time analytics and flexible processes to meet the ever-shifting requirements of procurement. Adapting to these changes is essential for businesses aiming to enhance their procurement efficiency and agility.

ERP Systems vs Procurement Solutions: How Are They Different?

ERP systems were initially designed to automate business processes and offer insights for internal controls, while procurement solutions comprehensively manage the ecosystem.

A P2P or a procurement solution is primarily built to meet an organisation's procurement and supply chain needs, an arena always problematic for traditional ERP.

Innovative organisations are now adopting leaner and cheaper solutions for their procurement processes. These tools can deftly handle specialised tasks and yield instant results.

Limitations of ERP

Factors like market volatility, evolving work dynamics, and shifting supply chains have made it challenging for businesses to integrate their procurement processes into their current ERP systems. Hence, it is vital to use specialised solutions to cater to dynamic business processes.

But before exploring the benefits of specialised solutions, let us consider the limitations of ERP:

Long Implementation Duration that Impedes ROI

Customising legacy ERP to meet procurement or supply needs is a hassle. It contributes to a longer implementation duration lasting several months. Customisation projects are resource-intensive. That makes a fast ROI virtually impossible to achieve.

Moreover, businesses must hire ERP consultants or trained partners for the implementation. The success rate and the implementation duration heavily depend on the expertise of such third parties.

With many companies already strung tight regarding capital, implementing legacy ERP to function as procurement systems may prove counterproductive.

Expensive Implementation and Maintenance

Legacy ERP licenses come at a high price. Depending on your software, ERP implementation costs can range from $150,000 to $750,000.

Moreover, procurement processes almost always require extra modules that can further increase costs. It also includes the additional burden of maintenance costs and training employees to use the software.

Failures To Meet Business Goals

The success rate of ERP implementation is dwindling. Recent studies from Gartner indicate that the failure rates of ERP implementations can exceed 75%. McKinsey, a reputed global consultancy, supports this claim as it quantifies the failure rate of all digital transformations to be higher than 70%.

One famous example is Hershey's ERP implementation failure in 1996 as they set out to replace their legacy IT systems with an integrated ERP environment. They chose SAP's R/3 ERP software, and an implementation time of 48 months was recommended, which was later cut down to 30 months. The result - a $10 million investment leading to a loss of $150 million in revenue, a 19% reduction in share price, and a 12% loss in international market share.

With such massive costs and periods involved in achieving numbers from legacy ERP solutions, using specialized procurement systems can make achieving business objectives far easier.

Lack of analytics and insights

ERP systems often fail to deliver the necessary analytics and data for effective operations. Managing vast volumes of data within these systems can be daunting. Challenges include ensuring data quality, the lack of real-time insights, limited data analysis capabilities, and integration issues with other software applications.

Poor User Experience

Many ERP systems require makeshift solutions to modify their functionality according to user demands, leading to frustration with end-users.

Legacy ERP systems are notoriously complex, making them challenging for end-users. Frequently, users must navigate between multiple interfaces, hindering productivity and adoption.

Furthermore, the lack of mobile apps and scattered functionalities exacerbate the issue—problems that a dedicated procurement solution can readily address.

Complex User Interfaces

ERP systems offer enterprise-grade capabilities, yet their inherent complexity and poor user experience pose significant challenges. Users often struggle with confusion, as traditional ERPs are overly intricate. The need for add-ons further exacerbates the complexity, as these additions must seamlessly integrate with the existing ERP system. This constant juggling of different user interfaces not only hampers productivity but also hinders widespread adoption.

Compromised Collaboration

One of the most disappointing aspects of legacy ERP systems is the lack of in-built communication channels. ERP systems struggle with establishing themselves as a medium of dialogue between internal business users and external suppliers, as they are not accessible from outside the business network. It tangles communication channels through unnecessary phone calls and scattered information exchange lines.

They are also severely limited in their capacity to maintain supplier pipelines, requiring most data to be entered and managed through several spreadsheets.

Urgent reports, design changes, and other important information cannot be communicated promptly, which may lead to losses. It leads to unnecessary time consumption and inaccuracies.

Solving ERP Issues with Dedicated Procurement Solutions

Addressing the limitations of ERP systems, organisations are increasingly turning to dedicated procurement solutions to streamline their purchasing processes and enhance efficiency. These specialised solutions offer advanced analytics, real-time insights, and improved data quality, making it easier for businesses to manage their procurement operations effectively.

By integrating dedicated procurement solutions with their ERP systems, organisations can bridge the gap between data management challenges and their need for comprehensive procurement intelligence, ultimately driving better decision-making and cost savings.

Addresses Overspending Issues

Integrating P2P software with ERP can prevent overspending in procurement. By harnessing ERP with eProcurement solutions, you can efficiently assess expenses across purchasing categories.

It allows you to manage budgets and increase savings. Moreover, integrating procurement solutions with ERP simplifies procurement management by automating approval processes.

Boosts Vendor Collaboration

Vendor collaboration is one of the most essential aspects of procurement. Keeping them informed of the relevant business operations helps avoid miscommunication.

By integrating procurement solutions with ERP systems, buyers and suppliers can access real-time data, empowering them to make informed decisions. This integration brings advantages such as:

- Enhanced collaboration: Seamless collaboration between buyers and sellers, achieved through transparent access to purchase orders, invoices, and receipts.

- Supplier empowerment: Suppliers are empowered with real-time insights into payment statuses via a supplier portal, which enables sound financial planning.

- Stronger buyer-supplier relationship: Heightened transparency nurtures and strengthens the critical relationships between buyers and suppliers, a fundamental cornerstone for any successful business.

- Improves Scalability and Flexibility

As businesses expand, stakeholders must seek platforms that can swiftly adapt to increased operational demands and changes in the operational cycle.

Procurement software provides essential features like mobile and remote access that most businesses require to scale operations. It also allows businesses to create highly specialised and efficient platforms, saving money, time, and human resources.

Helps Eradicate Duplication Issues

Procurement solutions can help connect all departments to ensure office supply orders are placed through a centralised system. They help share real-time data across tech, IT, finance and accounting, HR, sales, and marketing teams. It helps prevent duplicate purchases by coordinating buying across departments. Improved coordination also allows teams to maximise discounts and negotiation opportunities while saving time, money, and effort.

Reduces Procurement Errors Through Automation

Specialised software can help organisations optimise deals, accelerate processes, and reduce errors through automation. It helps allocate repetitive and simple tasks to the system rather than to users.

For example, businesses can automate their supply ordering with this technology. Automation helps set limits to ensure timely orders, prevent shortages, and follow any restrictions they have in place.

Handles Compliance and Risk Management Issues

Managing procurement-related risks and complying with regulations can be pretty challenging. An ERP-procurement integration empowers the software to handle compliance matters and mitigate risks during procurement processes, even involving multi-currency transactions.

Supplier Performance Management

Managing supplier performance during the procurement process can be quite challenging without the right tools at your disposal. However, by integrating procurement software with an ERP system, you can simplify collecting and analysing data related to supplier performance.

This valuable information encompasses delivery times, product quality, and responsiveness, enabling you to decide whether to maintain or end supplier relationships.

Inventory Management

Inadequate inventory management can result in too much or too little stock. These outcomes affect working capital and operational efficiency. One practical approach to tackle this problem is integrating procurement solutions with ERP systems. Such integration offers benefits like:

- Real-time visibility into inventory levels, allowing for monitoring.

- Automated reordering process, reducing the burden on manual efforts.

For example, a supermarket chain can leverage sales data to automate the reordering of items, minimising waste and ensuring the availability of products.

Provides Analytics for Better Insights

By integrating procurement solutions with ERP, businesses gain a flexible data model capable of handling big data. It manages the data and offers valuable insights to enhance information generation, storage, and decision-making. Procurement software encompasses advanced spend analytics, supplier benchmarks, and comprehensive performance management.

Drastically Improves End-User Experience

Procurement solutions are built from the ground up, keeping procurement operations as the top priority. It helps avoid a cluttered, mismanaged UI that comes with legacy ERPs, enabling users to be more productive.

End-users can adapt to changes in the software much quicker, increasing efficiency.

Conclusion

Procurement and sourcing processes require a dedicated platform in 2023. Unlike legacy ERP, such dedicated solutions can handle complex sourcing and procurement operations. They ensure a streamlined and seamless flow of relevant information between internal business organisations and external suppliers, allowing all stakeholders to have complete project visibility.

The outcome of implementing a smaller yet far more efficient tool will facilitate faster time to market, subsequently letting you achieve your ROI at an expedited rate.

While customising an ERP may sound enticing, opting for an eProcurement solution is smarter.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use

.jpg)