Contents

The Role of Accounts Payable Automation in Modern Accounting Practices

Vlad Falin

•

•

From receiving goods to clearing payments, it is not a single-click process. Multiple steps in between make the accounts payable process tedious and time-consuming.

You receive goods, match them with purchase orders and invoices, send the invoices for approval, make the payment, and finally, maintain records for bookkeeping. This process alone takes weeks and creates confusion when multiple stakeholders are involved.

Think about purchases above $50,000. There are multiple approvals, and each purchase triggers a unique workflow. Documents are not consolidated, and no one has a clear idea of the payment status.

Thus, accounts payable become chaotic.

Can You Automate Accounts Payable?

To streamline your accounts payable process, you can use tools to automate it. This will simplify bill payments and give you more visibility and control over money.

While it will take time for stakeholders and employees to embrace automation, you can consolidate your scattered pieces on a centralized platform. If you are looking for suitable AP automation tools for your company, check out our list of the top accounts payable automation software.

This post will delve deeper into how you can automate the accounts payable process and how it will help your business.

{{less-time-managing="/components"}}

What is the Accounts Payable Automation Process?

Accounts payable automation uses tools to automate invoice verification, approval workflow, payment processing, and bookkeeping.

Instead of manually organizing, matching, approving, and clearing invoices, the entire process goes on a digital platform to provide visibility and control at each step. So, earlier, employees would spend hours getting approvals and days clearing payments, but now, an automation tool reduces the invoice processing time.

The platform captures and extracts the invoice from emails via optical character recognition (OCR). The invoice goes to the platform with all the critical information, such as purchase order and simplifies three-way matching. A trigger-based approval workflow notifies the stakeholders to approve invoices. The admin gets complete visibility of each step and clears the payment without going through a variety of software.

How to Automate Accounts Payable

Automating accounts payable is as simple as choosing and integrating the right automation software with your existing accounting and procurement software.

The automation software offers visibility into where the money is going and control over the entire process. You can customize the approval workflows and payment gateways and create an ecosystem that supports your procurement process. You can accommodate manual processes and integrate them with other software without going through a complete flip.

With the right automation software, you bring all the critical stages of accounts payable on a centralized platform. Here are the five key steps you can automate:

1. Invoice Management

Manual: The vendor sends an invoice to a dedicated email or a physical copy via fax or mail. The employee receives it and moves from one stakeholder to another for approval. The process is delayed for days if any manager is unavailable. Once the approval is complete, all the documents go to the accounting team, who clears the payment.

Automated: Depending on how the vendor sends the invoice, the automation platform captures the invoice from email or WhatsApp. If you receive a physical invoice, you can upload the invoice, and the system extracts all the vital information via OCR. There's no need to manually enter details or add a general ledger (GL) and taxation code. The system captures, extracts, and consolidates all the invoices.

2. GRN Matching

Manual: The dedicated team receives goods along with the goods receipt note (GRN) and must match it with the invoice and purchase order. This ensures that the specified goods are received as per the purchase order. Manually, this process is prone to errors, leading to discrepancies. It demands accuracy to ensure you receive the correct items in specified quantities.

Automated: Automated software makes this easy by combining all the relevant documents on a single platform. The dedicated team has the invoice and purchase order side by side, making it easy to compare items, purchase orders, and invoices for three-way matching. As a result, spotting discrepancies becomes more manageable, reducing the chances of errors.

3. Approval Workflow

Manual: Once the invoice is received, the employee gets it approved by dedicated managers. Based on the invoice amount, they need more than a single approval. Manually, this means going from one office to another or delving into long threads of email or Slack conversations. It becomes difficult for accounting teams to track approval and clear payments.

Automated: With automated software, each invoice triggers an approval workflow for relevant stakeholders to approve the payments. The admin can create custom no-code workflows based on different if-then rules. For instance, marketing purchases above $50,000 will have more approvals than expenses of $5,000. Also, all the relevant teams will have visibility into the approval status, making it easier to clear payments on time without confusion.

4. Payment Processing

Manual: Once the invoice is approved, the accounting team determines the details and pays via checks, cards, or other payment methods. It takes a few days before the payment is cleared, and the teams need to sync all the information across the accounting software for reconciliation.

Automated: With automation, accounting teams and employees enjoy more flexibility. For instance, Pluto offers corporate cards, payment gateway integration, and a digitization platform for bookkeeping.

- With corporate cards, you can create custom vendor-specific cards with advanced controls to ensure payments are made only for approved vendors.

- Pluto integrates directly with your payment gateways to facilitate payment within the platform.

- If you make payments via checks or other physical modes, Pluto will act as a digital bookkeeping platform. You can enter the payments made on the centralized platform and ensure that all the information is streamlined.

5. Reconciliation

Manual: Reconciliation is the messiest part of accounts payable. Teams must maintain records, manually enter all the details, and sync them across the accounting platforms and ERPs. It is time-consuming, prone to errors, and tricky in case of purchases where one invoice invites multiple tax and GL codes.

Automated: Automation consolidates all the information on a single platform without manual data entry. It uses OCR to extract all the critical information with a feature to upload the invoices in bulk. Further, you can split the transactions to add multiple tax and GL codes to address the audit season rush.

How Accounts Payable Automation Simplifies the Procurement Process

Accounts payable automation is not just for the procurement or the accounting department. It also makes it easier for stakeholders to approve the payments and employees to get timely resources.

Overall, it assists you in bringing together scattered parts of the procurement process. Here are reasons why you must invest in accounts payable automation:

1. Improve Compliance

You get complete visibility and control over your accounts payable. You can create custom workflows to ensure that any purchase that goes against the company policy is rejected. You can also accommodate intricate hierarchies to suit your organization's needs and get timely approvals.

2. Avoid Double Payments

It is usual for teams to end up paying the same invoice twice as no one has visibility into the payment status. It happens when the same invoice is paid twice by different team members or when vendors send the same invoice twice, and both get paid. You can avoid this as the software detects duplicate invoices and gives visibility into the status of invoices. The main dashboard highlights the pending invoices and the ones awaiting approval. It becomes easy to stay on top of all the invoices and avoid errors.

3. Faster Approvals and Matching

You get a trigger-based no-code approval workflow engine where you can create customized workflows to accommodate intricate hierarchies. The software notifies the stakeholders to review and approve the invoices. Since all the information is available on a single dashboard, two-way or three-way matching is a matter of a few minutes. This accelerates the approval process, and payments are disbursed much faster. It improves the vendor relationship without risking over, under, or delayed payments.

4. Better Reconciliation

You get all the relevant documents consolidated on a single platform with the appropriate purchase. Additionally, the software automates the coding and categorization, simplifying the reconciliation process. In case of discrepancies, spotting errors becomes easy. Moreover, with features like locking the approved payments and restricted access for auditing, you can eliminate the chances of fraud or manipulation.

5. Accuracy

You improve the accuracy of your records and GRN matching with all the information streamlined on a single platform. Moreover, as the software relies on OCR, you eliminate the need for manual data entry, reducing the chances of errors. Also, you can integrate the automation software with your accounting platform and ERPs to sync data and ensure consistency across the platforms.

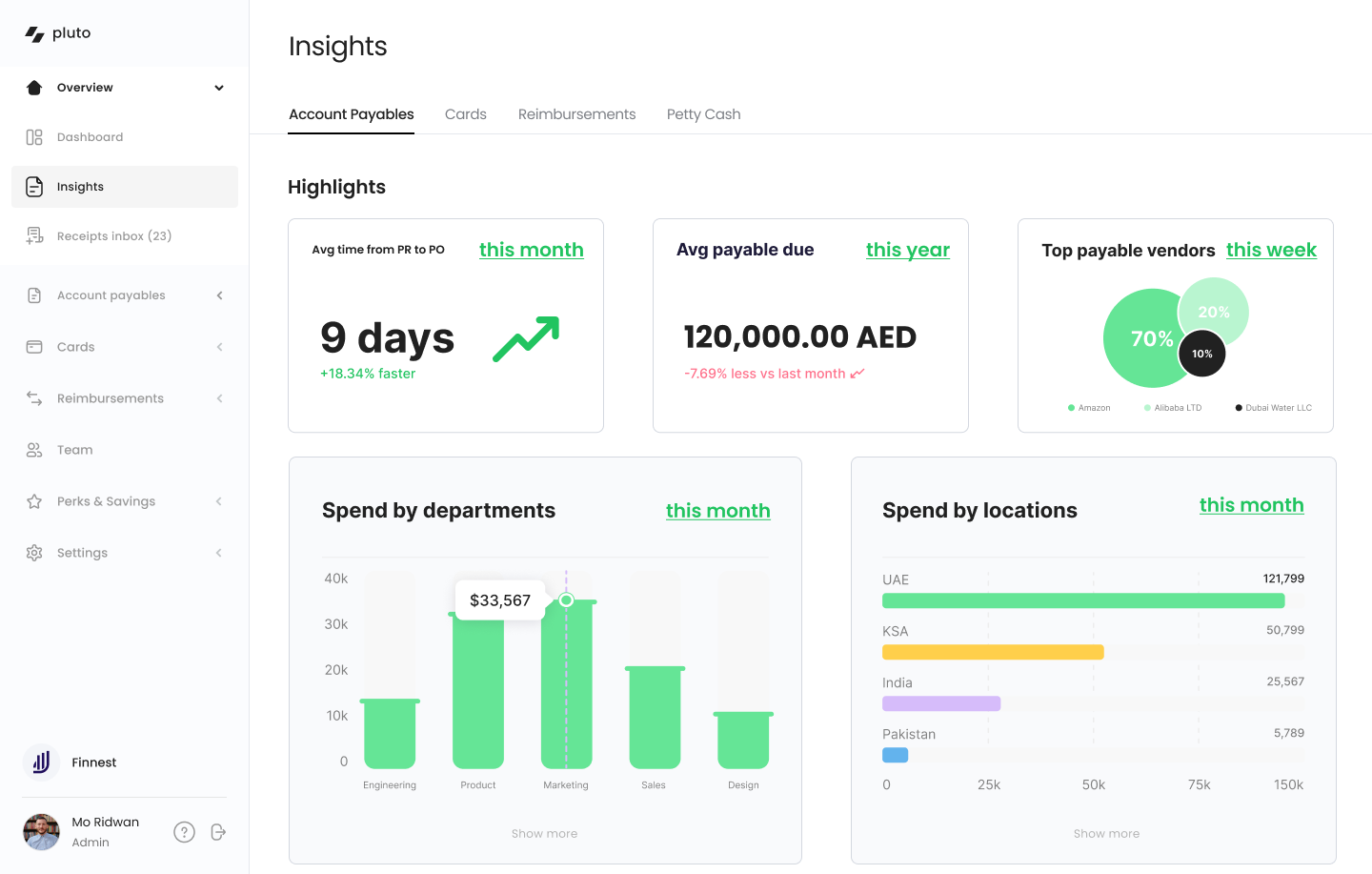

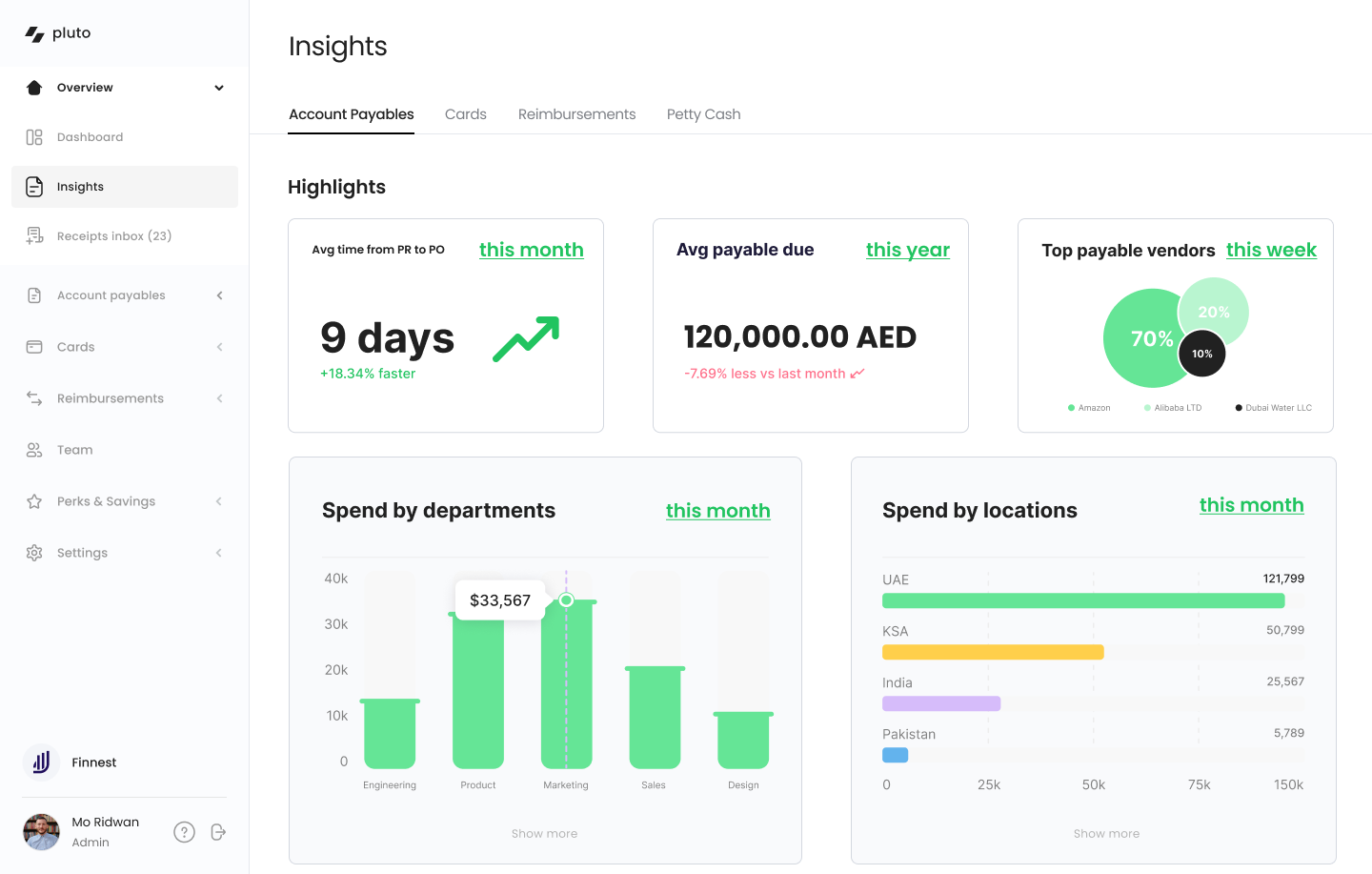

6. Centralized Dashboard

You get a centralized dashboard with all the key information available in a unified place, acting as a single source of truth. Additionally, you get insights that can help in data-driven decision-making to facilitate procurement cost savings. Further, you can view all the awaiting payments and approvals on a dedicated dashboard. You no longer need to run from one platform to another for information as the software integrates with your accounting system.

7. Accessibility

The unavailability of a single person can create bottlenecks in the approval process and block the supply chain. With all the information streamlined on a single platform, each stakeholder can access relevant data for decision-making. So, whether the CEO is traveling or the CFO is not at the office, they can access the details from any corner of the world and avoid disruption in the supply chain.

8. Visibility

You get visibility for each step, each document, and each purchase. You can bring the entire procurement automation on a single platform and track the status in real time. Whether an employee raises a request, gets an invoice, or needs to clear payment, you will stay on top of the information without creating any delays or friction.

Automation is Easy With the Right Software

Adopting automation software isn’t easy, especially for critical processes like accounts payable, which also involve external stakeholders. The top three factors to look for in appropriate software are flexibility, visibility, and integration.

Choose one that integrates with your existing processes and systems and is flexible enough to accommodate complex hierarchies. Instead of focusing solely on the accounting or procurement team, it should cater to all the key stakeholders and make automation easier to adopt.

At Pluto, we aim to bring a balance among the spenders (employees), the savers (finance teams), and the sourcers (procurement teams). Each stakeholder gets visibility, and decision-makers get flexibility. Pluto integrates with your current system and enables you to automate accounts payable without affecting the supply chain.

You can also automate your entire procurement process with Pluto and improve your bottom line. Read more in our procurement automation post.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Vlad Falin, Finance Writer

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Mohammed Ridwan

How to Improve the Expense Reconciliation Process to Close Books Faster

For every expense, teams maintain extensive documents like purchase orders, goods received notes (GRN), invoices, etc. With each increasing expense, the finance team has to spend more and more time on spend management — maintaining these documents, syncing data across accounting systems, ensuring proper approval, categorizing accurately, etc.

This manual process is time-consuming and prone to errors like missing receipts, employee fraud, unrecorded expenses, data entry typos, etc.

As a result, teams have inconsistent data across company systems and spend more time fixing these issues than focusing on their core activities. So, when finance teams strive to improve budget allocations, streamline expense tracking, and enhance financial reporting, they find themselves dedicating substantial time to addressing discrepancies among different financial databases and systems.

This blog will cover improving the expense reconciliation process and replacing manual and old methods with an improved solution.

What is Expense Reconciliation?

Expense reconciliation is a process that matches the actual expenses with the corresponding book entries. It involves comparing two sets of financial records, such as bank statements, credit card statements, receipts, etc., to identify and rectify discrepancies between them.

So, for every expense, you have an entry at an external source and in the internal systems. You match them together to ensure the accuracy of financial reporting, compliance with accounting standards, and prevention of errors or fraud.

However, companies rely on outdated systems — entry-level accounting tools, spreadsheet-based solutions, or legacy ERPs, which cannot handle end-to-end reconciliation processes. These compel finance teams to spend valuable time on manual tasks like data entry and receipt management, hindering reconciliation efficiency and increasing the risk of errors in financial data.

Hence, submitting and tracking expenses becomes cumbersome for employees, while finance teams face manual verification and reconciliation challenges. Managers struggle with delayed approvals, and the overall process becomes susceptible to errors, affecting accuracy and compliance.

How to Reconcile Expenses Faster

Invest in spend management software to reconcile expenses faster. With spend management software, you can track and monitor each transaction on a centralized platform in real time.

The automated process makes reconciliation simpler and faster by providing a single source of information and enabling advanced controls. You can create customizable approval workflows and specify spending rules to suit complex hierarchies and ensure compliance with company policies.

Especially with Pluto, each expense triggers the approval workflow and notifies employees to upload the receipt through WhatsApp. The accounting system integration syncs data across the financial systems to provide a consistent and accurate database.

Here is how switching to Pluto helps you reconcile efficiently and close your books of accounts ten times faster:

1. Easy to Identify Discrepancies

In a traditional manual reconciliation process, identifying discrepancies involves sifting through piles of paperwork or navigating complex spreadsheets.

With Pluto's automated system, this cumbersome task is simplified. The platform's alert system actively flags potential issues, promptly notifying users of duplicate receipts. It not only streamlines the identification of irregularities but also introduces a proactive layer of fraud prevention.

You can visualize and interact with discrepancies directly on the centralized platform, turning what used to be a tedious task into a more intuitive and efficient process.

2. Speed and Accuracy

Automation, real-time tracking, receipt capture (via optical character recognition (OCR)), approval workflows, and robust controls accelerate reconciliation cycles on Pluto.

You need not spend a minute on a manual redundant task. The platform captures and extracts invoices from emails and WhatsApp on a centralized platform. The trigger-based workflows ensure prompt approvals without any friction. Matching documents for three-way and four-way matching simplifies with all the documents on a single tool.

Therefore, the inherent accuracy of financial data, coupled with efficient discrepancy identification, ensures speed and reliability in the reconciliation process.

3. Real-Time Tracking and Visibility

Unlike conventional tracking methods, Pluto offers real-time insights through its centralized dashboard. This furnishes internal teams with immediate visibility into transactions, guaranteeing proactive adherence to company policies.

The agility provided by real-time tracking enables timely data-driven decision-making based on the latest and most accurate data.

4. Better Data Sync for a True Picture

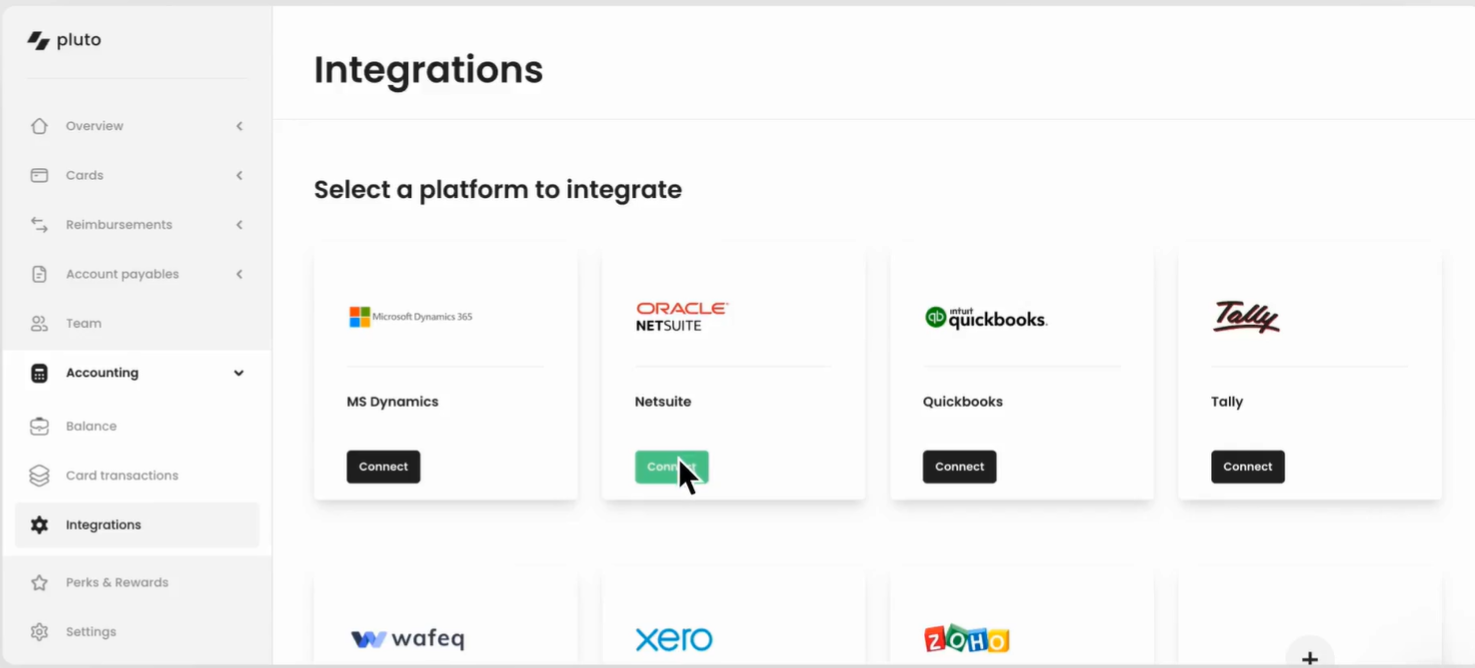

Manual data entry is prone to errors and delays, leading to discrepancies in financial records. Pluto's seamless integration with major accounting systems like Xero, Zoho, QuickBooks, Netsuite, and Dynamics ensures that the financial data is up-to-date and aligns with the organization's accounting records. This synchronization eliminates the need for manual adjustments and corrections, providing a true and accurate picture of the organization's financial status.

5. Enhanced Controls Over Processes

Building intricate approval workflows is simplified with Pluto. You can set up approval processes using simple if-then rules without the need for complex coding. Devise custom workflows that align perfectly with your company policies, creating a seamless and controlled process.

6. Traceable Audit Trail

Pluto maintains a traceable audit trail of all financial transactions and activities. It provides a comprehensive record of changes made to financial data. From the initiation of a transaction to any subsequent modifications, the traceable audit trail ensures transparency and accountability. This trail helps you avoid fraud and trackback discrepancies without friction.

Also, you can lock transactions post-approval, which adds an additional layer of security and integrity, facilitating smoother audits.

7. Save Time and Money

Automating financial processes, including procurement, expenses, and payables, significantly reduces manual steps in reconciliation.

Pluto's ability to capture general ledger and tax codes from expenses automates data entry. It reduces the time spent on routine reconciliation tasks. This efficiency allows finance teams to allocate resources more strategically, focusing on higher-value initiatives rather than repetitive manual tasks.

Timely financial insights help finance teams support decision-making processes with precision and confidence, fostering a data-driven financial ecosystem.

Internal Controls Strengthen Expense Reconciliation

Expense reconciliation burdens finance teams with time-consuming manual efforts and the constant threat of challenges like duplicate receipts and policy violations. These complexities lead to prolonged reconciliation cycles, hindering financial efficiency.

However, the actual progress happens when you strengthen internal control over financial reporting (ICFR), which is the anchor for successful automation in finance.

When you embrace ICFR strategically, it bolsters internal controls, protects against risks and fraud, and sets the stage for smooth automation. The impact goes beyond just easing manual work; it promotes precision, reliability, and transparency in financial workflows.

In simple terms, ICFR mitigates risks tied to financial inaccuracies. Read how to improve your ICFR framework for enhanced reconciliation processes.

•

Leen Shami

Understanding Business Expenses

All companies and businesses will incur business expenses, but how can you know what exactly is considered business expenses? And how will the introduction of UAE corporate taxes affect business expenses and income reports?

What are business expenses?

Business expenses are costs a business incurs to run the business properly. In simpler terms, they're expenses made by the business for the business.

With the UAE introducing corporate tax laws in 2023, it's crucial for businesses to be able to track and categorize their business expenses, as some of them may be tax deductible.

While the IRS may divide business expenses into ordinary and necessary business expenses, the UAE takes a different approach.

Ordinary business expenses are anything that is "common and accepted" to a business, whereas necessary expenses are anything that is "helpful and appropriate" to a business but not essential.

The federal tax authority in the UAE does not take a similar approach and only considers business expenses as tax deductible or not. We will discuss this in a later section.

- {{time-money="/components"}}

Examples of business expenses

Business expenses include a wide range of expenses, from insurance to office space, to online subscriptions, such as Zoom, Figma, or Adobe.

Let's break it down; if a design agency bills a client AED 120K per year, that doesn't mean they made a profit of 120K. When a business brings in revenue, it must account for the business expenses made to provide its clients with its services. These services include digital software subscriptions, office rent, employee wage, and/or wifi fees.

Here are some examples of the most common business expenses:

- Advertising and marketing

- Business travel (fuel, airfare, taxis, etc.)

- Employee costs (payroll, salaries, insurance, perks, etc.)

- Employee equipment (such as laptops, monitors, phones, etc.)

- Legal fees

- Office space rent & utilities

- Software subscriptions

While many more expenses are considered business expenses, these are the ones most businesses will incur.

Types of business expenses

When setting up a budgeting plan, business expenses play a vital role in keeping the businesses' financials in check. When preparing a budgeting plan, finance teams typically begin by looking at the three types of business expenses incurred.

These business expenses include:

1. Fixed expenses

Fixed costs are costs that do not change; they happen at known intervals, such as month to month.

With predictable costs, budgeting is more straightforward, as these costs are always expected and never come as a surprise.

Examples of fixed expenses include:

- Rent

- Employee payroll/salaries

- Utility bills

- Insurance

2. Variable expenses

Variable expenses are business expenses that change from month to month. These costs vary depending on a company's production or sales volume; if production or sales increase, variable expenses increase, and if production or sales decrease, variable expenses decrease as well.

Variable expenses are typically a business's largest expense, as some may be unexpected or unaccounted for.

To calculate the variable cost, multiply the quantity of the output by the variable cost per unit of output.

Total variable cost = Total quantity of output X Variable cost per unit of output

Examples of variable expenses include:

- Shipping expenses

- Sales commissions

- Raw materials (used in production)

3. Periodic expenses

Periodic expenses are business expenses that happen infrequently or, sometimes, semi-regularly.

Typically, periodic expenses happen on a quarterly or yearly basis, such as annual car insurance, but can also come as a surprise, such as a company car repair.

Budgeting can be tricky with periodic expenses, especially when expenses are infrequent.

Examples of periodic expenses include:

- Maintenance & repairs

- Merger and acquisitions costs

- Major equipment purchases

Profit and loss statement report

A profit and loss (P&L) statement, also known as an income statement, is commonly used when businesses record business expenses. Through the P&L, businesses can determine their taxable income. This is especially important for UAE businesses with an annual net income above AED 375,000.

The 3 categories of an income statement include the following:

1. Costs of goods sold (COGS)

Costs of goods sold are the costs associated with the production of goods sold by a company. This typically includes direct costs only, such as materials used and labor costs to create the goods sold. Indirect expenses are not calculated regarding COGS; these include sales and marketing.

For a business to determine gross profit, the costs of goods sold must be deducted from its revenue. They also affect how much profit a company makes on its products.

2. Operating costs

For a business to run, operating costs are unavoidable.

Generally speaking, operating costs relate to a business's daily maintenance and administration. These include costs such as COGS, payroll, rent, and overhead costs. However, non-operating costs, such as interest and investments, are excluded from an income statement.

An income statement reflects operating income after operating costs are deducted from revenue.

3. Depreciation

When accounting for depreciation, there are two types to look at:

a. Depreciation expense

A depreciation expense is a loss in value of fixed assets that companies record through depreciation. During the period you use an asset, its value decreases, and the price you originally paid for it is allocated over time.

An example would be a physical asset that loses value over time, such as a car or vehicle.

b. Accumulated depreciation

Accumulated depreciation refers to the accumulated depreciation charge a specific asset has taken as it wears down or becomes obsolete. Accumulated depreciation is shown on the balance sheet, unlike depreciation expenses reported on the income statement.

Personal and business expenses

Knowing the difference between personal and business expenses incurred is vital, especially with the UAE corporate tax law coming up. Business expenses can be used to lower a business's taxable income; however, personal expenses incurred are not considered deductible expenses.

So, what's the difference between personal and business expenses?

Personal expenses

Personal expenses are purchases made for personal reasons and cannot be used as deductible expenses.

If you make a purchase for the business but add in an item for personal use, it is crucial to have two transactions to avoid mishaps coming your way. Having two receipts will help you record and store the receipt so the business expenses can be used as deductible expenses.

Business expenses

If you're making purchases that benefit the business, such as driving more revenue, they can be considered business expenses. When making business expenses, it's essential to keep a record of the purchase by storing the receipts. By doing so, you can use these business expenses to lower your tax liability by deducting the amount from your income.

Tax deductible expenses

We've reviewed personal expenses, the 3 types of business expenses, and what goes into P&L statements. But which of these are considered tax-deductible expenses? In a nutshell, all the above, other than personal expenses. Let's delve deeper into tax-deductible expenses.

Tax deductible expenses are business expenses that help businesses generate revenue. These expenses are deducted from the company's income before applying any taxes.

Examples of tax-deductible expenses:

- Administration fees

- Advertising and marketing

- Bank charges

- Insurance

- Legal fees

- Maintenance and repair

- Office expenses

- Office rent

- Payroll/salaries

- Supplies

- Travel and transportation

- Utilities

Non-deductible tax expenses

Non-deductible tax expenses cannot be deducted from a company's income.

In the UAE, there are 3 main categories for non-deductible tax expenses:

1. Related party payments from the mainland to a Free Zone Person

The related party payments made to a Free Zone Person that is taxed at 0% on receipt of the income will not be deductible for CT purposes. However, if the payment is attributed to a mainland branch of the Free Zone Person, the related party can claim a deduction.

2. Entertainment expenses

Because these types of expenses often also have a non-business or personal element, businesses can deduct up to 50% of the expense incurred to entertain customers, shareholders, suppliers, and other business partners.

3. Other expenses

No deduction will be allowed for certain specific other expenses, such as

- Administrative penalties

- Recoverable VAT

- Donations paid to an organization that is not an approved charity or public benefit organization.

How to keep track of business expenses

To maintain your business, it's important to track your business expenses. There are several ways to track business expenses; however, you will need to establish a system to account for costs and accurately manage your business.

Here are 6 steps to keep track of your business expenses:

1. Open a business bank account

A business bank account should be completely separate from your personal checking account and must only be used for business expenses/purposes. This will help you manage your business expenses easily and give you eligibility for business credit cards or, even better, Pluto corporate cards.

2. Select an accounting system

If you haven't chosen an accounting system yet, choosing one that's appropriate for your business is vital. Some businesses opt for spreadsheet software, such as Microsoft Excel; however, to simplify the accounting process, we recommend going for accounting software that will automate the process for you.

3. Choose cash or accrual accounting

Choosing cash or accrual accounting typically depends on the size of your business.

Small businesses can use cash accounting and record transactions when they happen, as volumes are small.

For bigger businesses, accrual accounting is essential, as they have high volumes of transactions. With accrual accounting, only the product sold is recorded, rather than payment received for the product. Similarly, an expense is recorded when a bill is received rather than when an invoice is paid.

4. Store receipts

Storing receipts is essential, as they are proof of business expenses made. You can store receipts by scanning them, taking photos, and keeping digital copies.

5. Regularly manage and record expenses

It's important to track spending and categorize them accordingly. Examine every transaction to compare these business expenses to your revenue.

6. Consider subscribing to an expense software

For some businesses, it is worth looking into expense management software to automate the process of tracking, managing, and recording expenses.

Tracking business expenses with Pluto

If you choose to go for an expense management software, it will help you automate the tracking, managing, and recording of expenses. But Pluto's expense management software offers more than just tracking, managing, and recording your business expenses.

Pluto will keep detailed records of all your expenses, reduce your taxable income, and help you if you are audited or need to reconcile accounts.

With Pluto, you'll be able to do the following:

Store receipts

- Upload your receipt through Whatsapp or the Pluto app as soon as a business expense is made

- Store all digital receipts on Pluto's software

Record business expenses

- All transactions are recorded on the software automatically when using Pluto corporate cards

- Petty cash is automated, meaning expenses are recorded on the spot

- If an expense is made using an employee's personal card, the expense is recorded automatically as soon as they file for a reimbursement

Track business expenses

- All business expenses made by employees can be tracked through Pluto's dashboard

- Daily, weekly, or monthly expense reports are available in real-time

Accounting integrations

- Pluto integrates with all major accounting platforms

Auto-categorization

- All expenses recorded are auto-categorized through Pluto's AI technology

- Pluto categories are synced to your GL codes

Create tax codes

- Create and activate tax codes that sync with your accounting platform to mark expenses as tax deductible or not

Business expense FAQs

More often than not, business expenses have many different rules. Here are the commonly asked questions about business expenses:

How do I categorize expenses?

Most accounting software already has business categories incorporated in the software, so you can use them and amend them as needed.

Pluto's expense management software allows integrations with significant accounting platforms and automatically syncs to your GL codes and chart of accounts.

Do fuel costs count as business expenses?

If the fuel cost was made for business purposes, such as travel for a client meeting, then yes, it is counted as a business expense and can be considered tax deductible.

However, driving to and from work is rarely considered a business expense.

Can business expenses be carried forward?

The UAE corporate tax law details report still hasn't come out yet. We will update this question once the Federal Tax Authority shares more details in the UAE.

Is personal expenses tax deductible?

No. Personal expenses are not tax deductible.

Is my rent deductible if I am self-employed and my home is my office?

In some cases, yes, it is possible if you are self-employed, but only a certain percentage of your rent will be considered a business expense, for example, 25% of your rent.

•

Mohammed Ridwan

Top 7 Accounts Payable Automation Software

An invoice has landed in your inbox. As soon as it arrived, a team member cleared the payment. Later, when another team member came across it, they made the payment again. This is a common scenario of duplicate payments that results in cash leakage. Invoices are not consolidated. There is no proper approval workflow, and stakeholders lack visibility.

Overall, managing accounts payable (AP) becomes a nightmare.

An automation tool solves these bottlenecks and provides a centralized platform for invoice management and accounts payable. An accounts payable automation software automates invoice capture and retrieval to consolidate all the information on a unified platform. You get real-time visibility and control over your payables.

As a result, you establish better vendor relationships and supply chain management without impacting cash flows.

This post will cover 7 AP automation software to help you choose the right automation partner.

{{less-time-managing="/components"}}

Top 7 accounts payable automation software

Here are the top 7 AP automation software. You can pick one of these to automate your accounts payable based on your company size and needs.

1. Pluto

Pluto is an accounts payable software that transforms your AP processes by simplifying bill processing. From enabling GRN matching to setting fully customizable multi-layer approval workflows, it is the best AP automation software to manage your vendor payments.

Key Features:

- Facilitates three-way GRN matching with purchase orders and item-based matching

- Offers a flexible approval engine capable of managing intricate hierarchies without requiring technical expertise

- Enables multi-layer invoice approvals with policies to align with your company's structure

- Ability to upload invoices easily via WhatsApp images and emails to speed up the receipt capture process

- Facilitates optical character recognition (OCR) technology to retrieve invoice information, including tax and general ledger (GL) codes

- Offers a centralized dashboard to gather bills in one place and track the status to avoid double payments

- Consolidates approved invoices in a single window to highlight pending bills and avoid delays

- Raises alerts for upcoming payments, enables scheduling payments in advance and automates invoices

- Allows you to seamlessly carry out bulk local and international wire transfers for easy payment clearing through their treasury partners.

- Enables you to split payments for different tax and GL codes, departments, etc.

- Provides vendor-specific corporate cards to control budgets and detect irrelevant expenses

- Supports ERP integration to synchronize your vendors, purchase orders, and bills

- Integrates with accounting software such as Oracle, NetSuite, Zoho, Quickbooks, Wafeq, Xero, etc.

- Provides a complete audit trail of the process to ensure visibility at each step

- Shows real-time analytics to facilitate deep insights for supporting budget control

Pricing:

Pros:

- Free to get started!

- Enables branch and subsidiary-level spend tracking (not offered by other platforms)

- Offers up to 2% cashback on all non-AED transactions

- Independent PCI DSS Level 1 certification for advanced security

- SSO/SAML Capabilities for Enterprises

- Better Forex rates than most local banks

Cons:

- Integrates with all other major ERPs except Tally

- Slightly longer on-boarding due to corporate card offering

{{less-time-managing="/components"}}

2. Tipalti

Tipalti is an automation tool that supports end-to-end AP processes. It streamlines accounts payables and facilitates global payments in local currencies for various recipients, from suppliers to freelancers. The cloud-based platform helps finance teams manage payments without losing visibility and control.

Key Features:

- Supports supplier onboarding and vetting to ensure supplier reliability and trustworthiness

- Integrates with ERP and accounting systems to help with reconciliation reporting

- Uses OCR to scan, capture, match, and process invoice data to reduce manual errors

- Provides built-in approval workflows and payment scheduling

- Offers invoice processing, including two-way and three-way purchase order matching and approval to avoid overpayments

- Assists AP processes for subsidiaries and entities

Pricing:

Starts at $129 per month per user for the platform fee and charges for additional features separately

Pros:

- Can manage supplier bank account details in a secure environment

Cons:

- Cannot use it for prepayment invoices on inventory purchases with the ERP system

- High foreign currency exchange fees

- Tax forms can be difficult to fill out and very difficult if you do not speak English

3. Airbase

Airbase manages global AP processes. It focuses on ensuring compliance and syncing with your accounting tool to streamline payment. It is an automation solution for small to midsize businesses (SMBs) and large enterprises with 100-5,000 employees.

Key Features:

- Offers OCR to populate details, including GL category, date, amount, and purpose

- Supports onboarding with a self-service vendor portal and custom questionnaires

- Has a centralized dashboard with all key information about the invoice to avoid friction

- Accepts invoices from email or vendor portal across all subsidiaries

- Offers automated approval workflows based on multiple parameters, such as vendor, amount, GL category, etc.

- Enables three-way invoice matching to ensure compliance and reduce wasted spend

- Real-time audit trail with receipts, notes, and documentation for transparency

Pricing:

Request a custom quote

Pros:

- Intuitive and easy to use; no training or previous knowledge required

Cons:

- The mobile app is slow and takes time to load pages

- SSO-based login is not smooth

- Not suitable for complex branch-level approvals and expenses

4. Ramp

Ramp is an accounts payable solution for managing payments and business expenses. It automates bill entries, approvals, and payments while offering complete visibility and control. By tracking each AP step from data recording to approvals, it simplifies payment processing and takes the burden off teams.

Key Features:

- Uses artificial intelligence (AI) to extract key details from invoices to offer accuracy and eliminate data-entry errors

- Identifies duplicate invoices and helps with two-way matching to purchase orders

- Offers custom approval workflows to minimize errors and ensure timely payments

- Provides a unified dashboard with visibility into the status of invoices

- Consolidates multiple payment options, such as check, card, same-day ACH, or international wire

- Integrates with accounting solutions, such as QuickBooks, Xero, Oracle NetSuite, Sage, etc. for auto-sync bill pay transactions

- Supports international payment processing in multiple currencies

- Tracks vendor data and transactions for easy reporting and data-driven decisions

Pricing:

Three pricing packages—free or basic features, $15 per user per month for Ramp Plus, and custom quote for enterprises with features like enterprise ERP integration, custom implementation, and local card issuance

Pros:

- Works with multiple subsidiaries

- Offers cash back on credit card purchases made using VISA cards

Cons:

- Can’t unmatch an incorrectly matched invoice (invoice to credit card)

- Approval routing can only be set on the vendor level, not the department level

- Limitations in syncing repayments

5. Bill

Bill is an accounts payable solution for SMBs to control payables, receivables, expenses, and all corporate expenses. It allows businesses to streamline scattered AP processes into a single platform and gain more control over their finances.

Key Features:

- Enables custom approval workflows for minimal hassle

- Automates purchase order workflows with the option for automated two-way and three-way matching

- Automates receipt matching, categorization, and expense reporting, decreasing administrative tasks

- Syncs with all major accounting systems like QuickBooks, Sage, Intacct, and NetSuite

- OCR auto-populates invoices for data entry

- Provides bulk payments of approved invoices with payment choices, such as ACH, credit cards, checks, and international wire transfers

- Offers audit trail of any changes or actions related to the invoice on a single page

Pricing:

Provides a free trial and essentials pack starting at $45 for six standard user roles. Its team and corporate pack are for $55 and $79, respectively. Enterprises need to request a custom quote.

Pros:

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons:

- Customer support is difficult to initiate, slow, and unresponsive

- Frequent changes in the interface create confusion for users

6. Procurify

Procurify streamlines AP reconciliation, offering a straightforward solution for financial operations. From catalog management to custom user controls, it helps to track the procurement process in real time. Its no-code configuration allows for a prompt deployment in under six weeks, making it a suitable choice for mid-market to enterprise organizations.

Key Features:

- Creates, tracks, and maintains an audit trail of all procurement transactions for transparency and compliance

- Ensures that requested items are approved against budgets before procurement

- Integrates with trusted vendors through punchout catalogs to streamline the ordering process

- Syncs bills and completes bill payments directly with platforms like QuickBooks Online, NetSuite, and other major accounting systems

- Supports OCR technology to extract data from invoices

Pricing:

Starts at $2000/month with a custom pricing tier

Pros:

- Ability to upload different invoices in the same PO and group invoices

Cons:

- Doesn’t offer payment services, so you need to carry out payments on a different platform

- Physical inventory has to be tracked outside Procurify

7. ZipHq

Ziphq is an end-to-end procure to pay software designed to streamline the entire procurement process, from purchase order to payment. It caters to businesses of all sizes — startups, mid-size companies, and enterprises with no-code configuration and deployment in under six weeks.

Key Features:

- Offers vendor cards to automate recurring and one-time payments

- Centralizes purchasing workflows, providing real-time visibility into the AP process

- Facilitates automatic purchase order matching, ensuring invoice accuracy and timely payments

- Provides automated, no-code workflows, referencing all stakeholders in the approval chain

- Allows employees to comment on invoices and tag stakeholders, ensuring everyone has the context and visibility needed

- Automates renewal planning with workflows initiated well ahead of deadlines, enabling stakeholders to make informed decisions

- Supports vendor payments in 140+ countries and 40+ currencies

- Integrates with ERP, ensuring quick and easy reconciliation, even for complex, multi-subsidiary operations

Pricing:

Pros:

- Provides various customization options to configure internal processes

Cons:

- Localized to the USA market

- Takes over five days to settle vendor payments

- Can’t bulk upload documents

How to choose the right accounts payable automation software?

User-friendliness

Select software that is adaptable and user-friendly, with intuitive trigger-based workflows and a clean interface, ensuring ease of use without excessive reliance on support for basic tasks.

Versatile payment capabilities

Choose a solution that supports a broad spectrum of payment methods, including the ability to issue vendor-specific cards for secure and speedy payments, a feature not commonly found in many platforms.

Accurate Invoice Processing

Opt for software with OCR technology to enhance invoice processing speed and accuracy, capable of handling invoices from various sources and integrating them into a centralized database for reduced manual entry.

Efficient Approval Workflows

The software should include a straightforward, no-code workflow builder that can handle complex hierarchies, essential for large organizations with intricate approval processes.

Seamless System Integration

Ensure the software integrates well with existing accounting systems to automate data entry and maintain synchronized records, which is crucial for effective financial management.

Advanced Reporting Features

Reporting functionality that offers insights into spending patterns and department-specific expenditures is vital. The software should provide a robust reporting dashboard with options for deeper analytics.

Choosing the right accounts payable automation software

Implementing accounts payable software will support your procurement process only when you carefully pick an option that provides flexibility, visibility, and security without losing on functionality.

Imagine software that makes it easy to clear payments but doesn’t settle payments for days on the vendor’s end. Contrarily, consider an option your legal or IT team is skeptical of implementing.

That is why, at Pluto, we focus on simplifying processes and cutting all the chaos without risking security, flexibility, or functionality. We simplify accounts payable by syncing with your payment gateways for faster payments at better forex rates than banks. You get a PCI DSS Level 1 certified solution that provides you with bank-grade security.

So, book a demo and learn more about how you can optimize your entire procurement process.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use