The Pluto blog

CFO Cornerstone: Navigating Finance's Complex Landscape

Stay informed with the latest insights on pioneering expense, procurement, and payables practices designed for today's modern finance teams.

See why MENA finance teams love us!

Other useful resources

•

Mohammed Ridwan

PlutoCard is Now GetPluto: Your Unified Payable Solution

PlutoCard now becomes GetPluto — your new one-stop solution for all payables.

What's New?

After much anticipation and hard work, we're excited to announce the migration from plutocard.io to getpluto.com, a step towards redefining corporate payments.

With getpluto.com, we are extending our vision beyond providing corporate cards.

We understand the challenges that businesses face when handling their finances. It involves more than swiping a card and filing expenses. That's why we've developed a comprehensive suite of products and features to simplify everything from procurement to payables.

So, whether you want to streamline purchase requests, integrate your ERP without impacting costs, or manage reimbursements — getpluto.com has you covered!

Beyond Cards: The All-In-One Platform

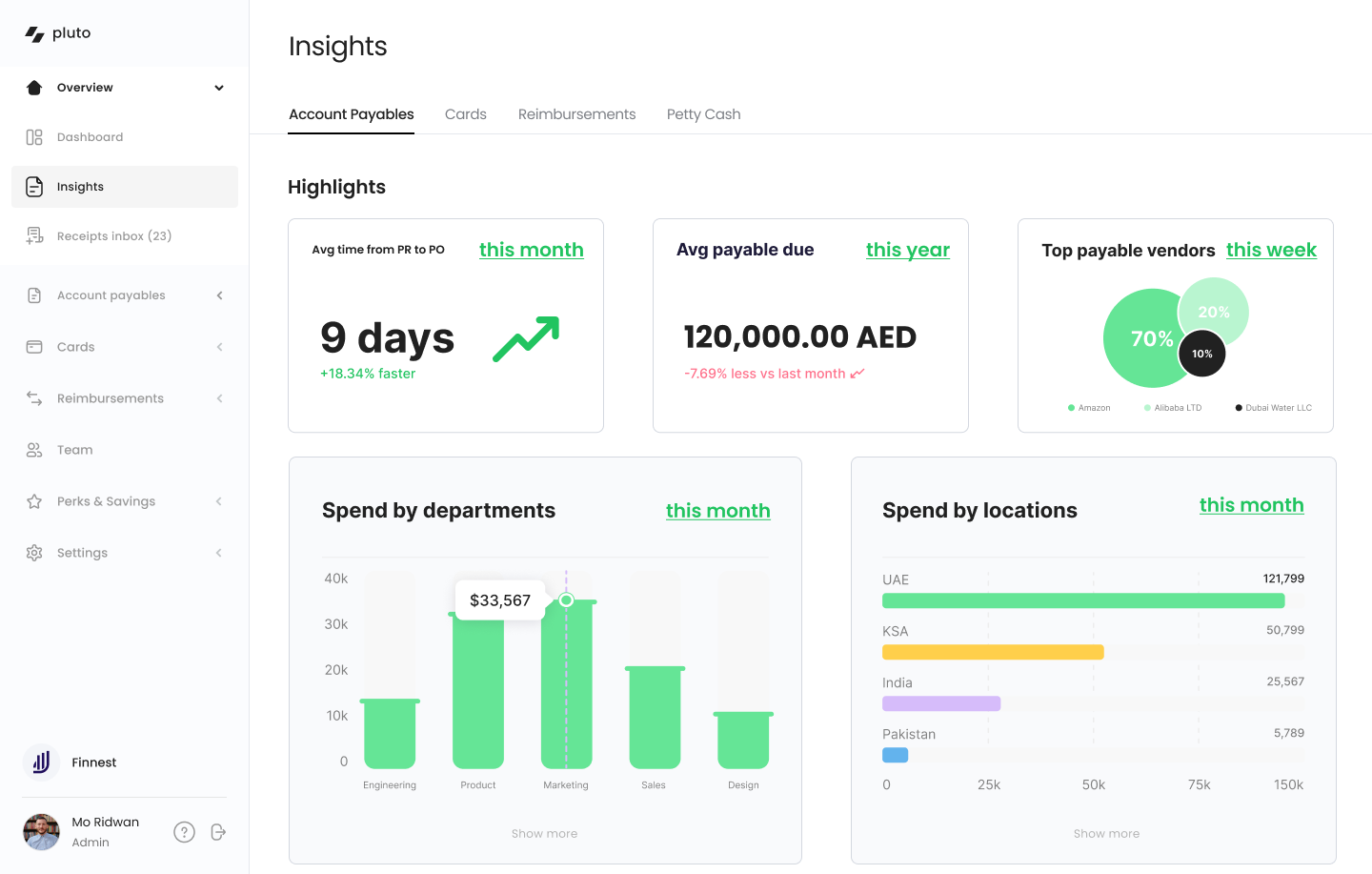

Here's a glimpse of what Pluto has to offer:

- Procure-to-pay: Streamline your procurement process from purchase requests to invoice matching, all in one place.

- Bill management: Centralize bill management and payments for faster approvals, better vendor relationships, and more accurate two/three-way matching.

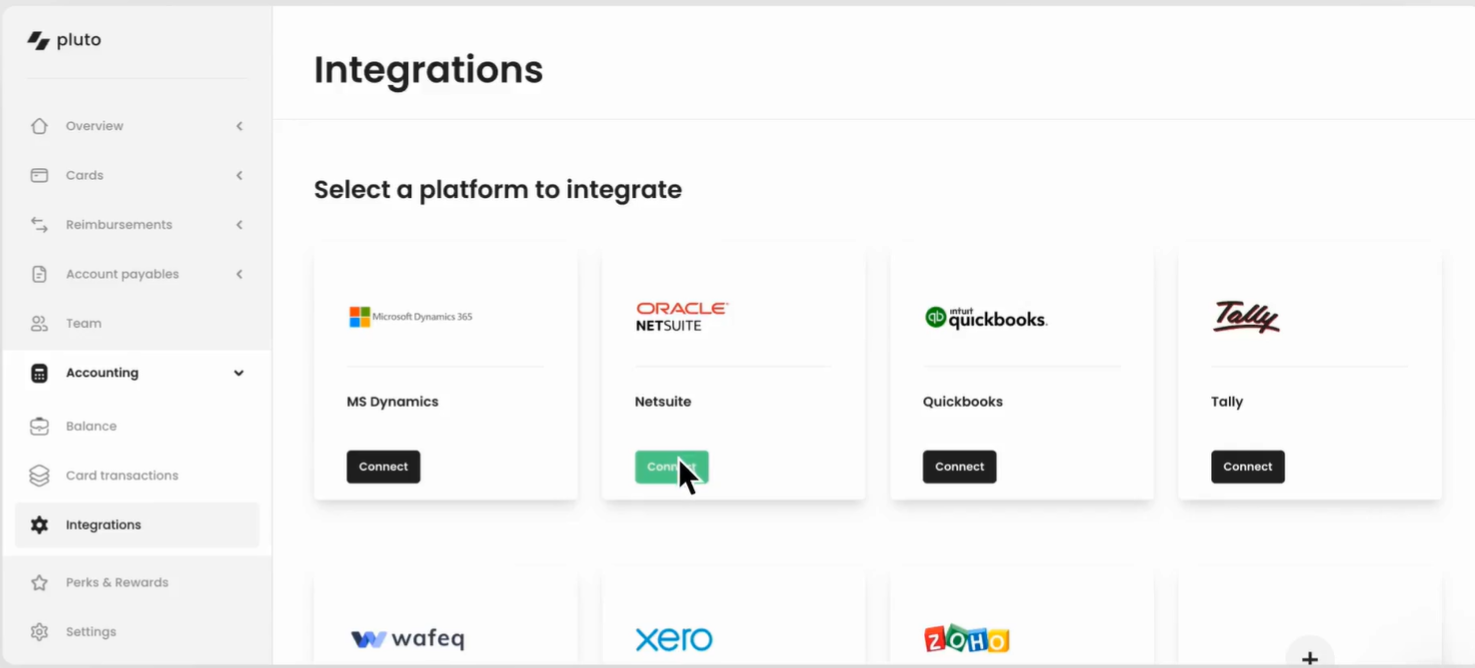

- Accounting ERP integrations: Sync seamlessly with major ERPs like Xero, Zoho, QuickBooks, Dynamics, and Netsuite to close your books 10X faster.

- Petty cash management: Digitize cash-in-hand management to eliminate leaks without losing flexibility or visibility.

- T&E reimbursements: Simplify travel and expense reimbursements with unlimited budget-controlled corporate cards and custom approval workflows.

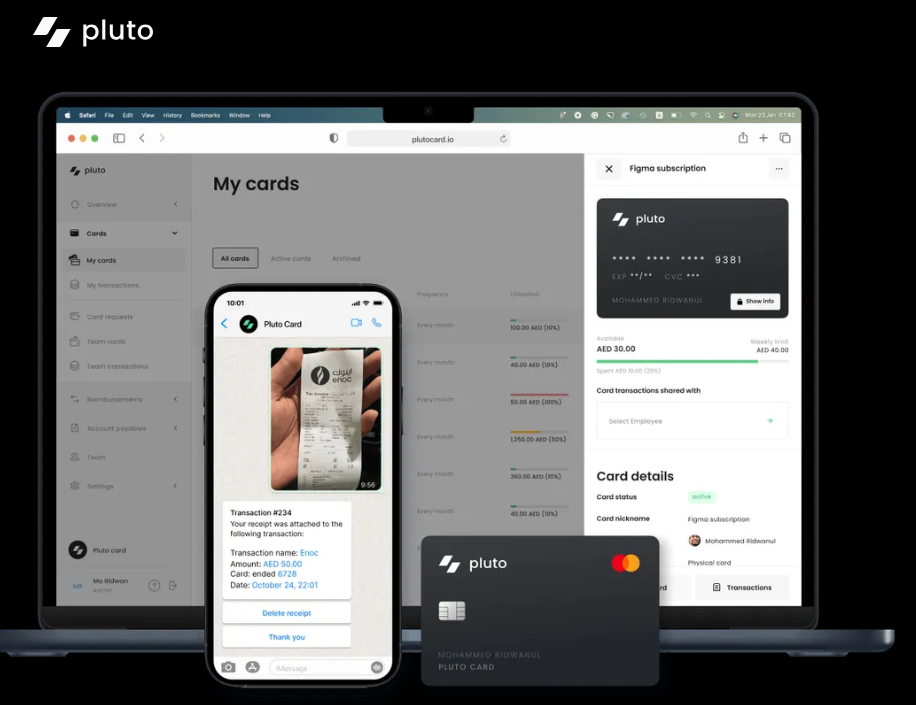

- Corporate cards: Get budget-controlled corporate cards with built-in compliance management — from receipt capture to policy enforcement.

“We have been using Pluto for a few months now, and we literally have everything in one place.”

~ Lee Kersen Mascarenhas, Head of Operations at BloomingBox

From Our CoFounder — Mo Aziz

Pluto's Corporate Cards have been serving the largest businesses in UAE powered by a platform built for companies of all sizes: from small-scale SMEs to businesses with 1000s of employees.

But company spending does not happen just through Corporate Cards…

At Pluto, we believe CFO & Finance teams need a unified, comprehensive platform that solves all types of corporate spending problems end-to-end.

The new Pluto is our step towards this future where UAE businesses get a best-in-class platform, helping manage company spending across Cards, Reimbursements, Invoice Management, Procurement & more.

Join Us At getpluto.com

We're excited about the possibilities that getpluto.com brings.

We understand the importance of this change and are here to support you at every step of the way, offering a more comprehensive platform to meet all your financial needs.

Sign up for a demo or create a free account at getpluto.com today and discover how Pluto simplifies payments for—finance teams, procurement teams, and employees.

Thank you for your continued support!

•

Mohammed Ridwan

How to Improve the Expense Reconciliation Process to Close Books Faster

For every expense, teams maintain extensive documents like purchase orders, goods received notes (GRN), invoices, etc. With each increasing expense, the finance team has to spend more and more time on spend management — maintaining these documents, syncing data across accounting systems, ensuring proper approval, categorizing accurately, etc.

This manual process is time-consuming and prone to errors like missing receipts, employee fraud, unrecorded expenses, data entry typos, etc.

As a result, teams have inconsistent data across company systems and spend more time fixing these issues than focusing on their core activities. So, when finance teams strive to improve budget allocations, streamline expense tracking, and enhance financial reporting, they find themselves dedicating substantial time to addressing discrepancies among different financial databases and systems.

This blog will cover improving the expense reconciliation process and replacing manual and old methods with an improved solution.

What is Expense Reconciliation?

Expense reconciliation is a process that matches the actual expenses with the corresponding book entries. It involves comparing two sets of financial records, such as bank statements, credit card statements, receipts, etc., to identify and rectify discrepancies between them.

So, for every expense, you have an entry at an external source and in the internal systems. You match them together to ensure the accuracy of financial reporting, compliance with accounting standards, and prevention of errors or fraud.

However, companies rely on outdated systems — entry-level accounting tools, spreadsheet-based solutions, or legacy ERPs, which cannot handle end-to-end reconciliation processes. These compel finance teams to spend valuable time on manual tasks like data entry and receipt management, hindering reconciliation efficiency and increasing the risk of errors in financial data.

Hence, submitting and tracking expenses becomes cumbersome for employees, while finance teams face manual verification and reconciliation challenges. Managers struggle with delayed approvals, and the overall process becomes susceptible to errors, affecting accuracy and compliance.

How to Reconcile Expenses Faster

Invest in spend management software to reconcile expenses faster. With spend management software, you can track and monitor each transaction on a centralized platform in real time.

The automated process makes reconciliation simpler and faster by providing a single source of information and enabling advanced controls. You can create customizable approval workflows and specify spending rules to suit complex hierarchies and ensure compliance with company policies.

Especially with Pluto, each expense triggers the approval workflow and notifies employees to upload the receipt through WhatsApp. The accounting system integration syncs data across the financial systems to provide a consistent and accurate database.

Here is how switching to Pluto helps you reconcile efficiently and close your books of accounts ten times faster:

1. Easy to Identify Discrepancies

In a traditional manual reconciliation process, identifying discrepancies involves sifting through piles of paperwork or navigating complex spreadsheets.

With Pluto's automated system, this cumbersome task is simplified. The platform's alert system actively flags potential issues, promptly notifying users of duplicate receipts. It not only streamlines the identification of irregularities but also introduces a proactive layer of fraud prevention.

You can visualize and interact with discrepancies directly on the centralized platform, turning what used to be a tedious task into a more intuitive and efficient process.

2. Speed and Accuracy

Automation, real-time tracking, receipt capture (via optical character recognition (OCR)), approval workflows, and robust controls accelerate reconciliation cycles on Pluto.

You need not spend a minute on a manual redundant task. The platform captures and extracts invoices from emails and WhatsApp on a centralized platform. The trigger-based workflows ensure prompt approvals without any friction. Matching documents for three-way and four-way matching simplifies with all the documents on a single tool.

Therefore, the inherent accuracy of financial data, coupled with efficient discrepancy identification, ensures speed and reliability in the reconciliation process.

3. Real-Time Tracking and Visibility

Unlike conventional tracking methods, Pluto offers real-time insights through its centralized dashboard. This furnishes internal teams with immediate visibility into transactions, guaranteeing proactive adherence to company policies.

The agility provided by real-time tracking enables timely data-driven decision-making based on the latest and most accurate data.

4. Better Data Sync for a True Picture

Manual data entry is prone to errors and delays, leading to discrepancies in financial records. Pluto's seamless integration with major accounting systems like Xero, Zoho, QuickBooks, Netsuite, and Dynamics ensures that the financial data is up-to-date and aligns with the organization's accounting records. This synchronization eliminates the need for manual adjustments and corrections, providing a true and accurate picture of the organization's financial status.

5. Enhanced Controls Over Processes

Building intricate approval workflows is simplified with Pluto. You can set up approval processes using simple if-then rules without the need for complex coding. Devise custom workflows that align perfectly with your company policies, creating a seamless and controlled process.

6. Traceable Audit Trail

Pluto maintains a traceable audit trail of all financial transactions and activities. It provides a comprehensive record of changes made to financial data. From the initiation of a transaction to any subsequent modifications, the traceable audit trail ensures transparency and accountability. This trail helps you avoid fraud and trackback discrepancies without friction.

Also, you can lock transactions post-approval, which adds an additional layer of security and integrity, facilitating smoother audits.

7. Save Time and Money

Automating financial processes, including procurement, expenses, and payables, significantly reduces manual steps in reconciliation.

Pluto's ability to capture general ledger and tax codes from expenses automates data entry. It reduces the time spent on routine reconciliation tasks. This efficiency allows finance teams to allocate resources more strategically, focusing on higher-value initiatives rather than repetitive manual tasks.

Timely financial insights help finance teams support decision-making processes with precision and confidence, fostering a data-driven financial ecosystem.

Internal Controls Strengthen Expense Reconciliation

Expense reconciliation burdens finance teams with time-consuming manual efforts and the constant threat of challenges like duplicate receipts and policy violations. These complexities lead to prolonged reconciliation cycles, hindering financial efficiency.

However, the actual progress happens when you strengthen internal control over financial reporting (ICFR), which is the anchor for successful automation in finance.

When you embrace ICFR strategically, it bolsters internal controls, protects against risks and fraud, and sets the stage for smooth automation. The impact goes beyond just easing manual work; it promotes precision, reliability, and transparency in financial workflows.

In simple terms, ICFR mitigates risks tied to financial inaccuracies. Read how to improve your ICFR framework for enhanced reconciliation processes.

•

Mohammed Ridwan

How Corporate Fleet Cards Help Modern Transport & Logistic Businesses

Companies use petty cash for managing driver and transport expenses, including maintenance, repairs, and small purchases, by allocating a small amount of physical cash to drivers. Drivers submit receipts for reconciliation, and they manually track these small transactions.

However, tracking numerous trivial transactions becomes time-consuming, and discrepancies emerge during reconciliation. There's always a risk of misuse or theft, demanding strict security measures. Moreover, negotiating favorable terms with vendors for minor, recurring transactions becomes challenging. They must carefully budget and maintain a sufficient petty cash fund, which strains their overall cash flow.

Overall, the manual process raises efficiency concerns, necessitating a balance between control and practicality in managing day-to-day vehicle-related expenses.

A better alternative to petty cash is a fleet card.

This post will explore corporate fleet cards, their benefits for transport and logistics, and strategies to overcome potential fuel card challenges for improved spend management.

What Is Meant by Fleet Card?

A fleet card, also known as a fuel or gas card, is a specialized payment card used by businesses to cover expenses related to their vehicle fleets. It is issued by fuel companies or financial institutions specifically for fuel purchases, maintenance, and other vehicle-related expenses.

What Can Fleet Cards Be Used For?

The fleet cards are primarily used for fuel purchases, maintenance, and repairs. They facilitate seamless payments for routine servicing, tolls and parking fees, and purchasing vehicle-related products.

You get cards with custom spending limits and advanced controls, such as real-time transaction monitoring mechanisms, category-specific restrictions, and automated alerts for enhanced security and streamlined expense management.

Drivers purchase fuel, maintenance, and other vehicle-related expenses at authorized locations with the cards, and you enjoy complete visibility on a centralized dashboard for each transaction.

What Are the Benefits of a Corporate Fleet Card?

Switching from manual petty cash management to a fleet card yields the following benefits:

- Simplifies payment processes by reducing the complexity of cash handling

- Improves tracking and monitoring of all vehicle-related expenses

- Minimizes the risk of theft or misuse, providing enhanced security measures

- Automates the expense management and reconciliation process, eliminating manual record-keeping and ensuring accuracy with reduced likelihood of errors

- Promotes compliance by enabling you to set controls and restrictions on card usage according to company policies

- Enhances budgeting by providing detailed reports and insights into the spending patterns for a structured and controlled approach to managing vehicle-related costs

- Streamlines transactions with vendors, offering an efficient payment method for small, frequent transactions

Should I Use a Fuel Card or a Credit Card?

Fuel cards and credit cards share similarities in providing a convenient payment method for expenses. Both can be used at gas stations and offer detailed transaction records for monitoring expenditures. Moreover, both cards come with features such as spending controls, reporting tools, and rewards programs.

However, here are some differences between the two:

- Fuel cards restrict card usage to fuel and maintenance-related purchases, providing greater control and limiting potential misuse.

- Fuel cards come with fuel discounts or rewards programs at specific gas stations, providing potential cost savings that credit cards do not generally offer.

- While credit cards provide transaction records, fuel cards offer more detailed reporting on vehicle-related expenses like fuel consumption, maintenance costs, and odometer tracking.

- Fleet cards partner with fuel providers, service centers, and other vendors, allowing businesses to negotiate favorable terms and discounts for bulk purchases or regular transactions. For instance, a fleet card's partnership with a fuel station yields discounted fuel prices, facilitating substantial cost savings.

So, for transport and logistics businesses, corporate fleet cards offer specialized controls for fuel and maintenance, streamlined reporting, and potential fuel-related discounts.

What Are the Risks of Fuel Cards?

Fuel cards, tailored for fleet management, are designed to address the unique needs of companies in the transport and logistics sector. However, organizations face the following challenges when switching to corporate fleet fuel cards:

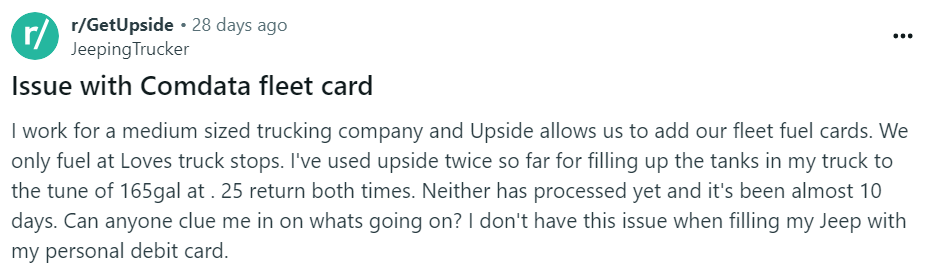

1. Gas Station Availability Issues

Fuel cards encounter challenges related to gas station availability that limit refueling options. As a result, drivers can not find suitable gas stations, leading to increased travel time and delays in delivery schedules.

3. Location-Dependent Acceptance

The acceptance of corporate fleet cards varies by location, leading to constraints and inconveniences for companies operating in areas where certain cards are not widely accepted.

Drivers will encounter difficulties during interstate routes if you offer a nationwide delivery service and the fleet card is only accepted at specific gas stations or regions. It complicates expense management and hinders the company's ability to streamline fuel-related transactions.

3. Management Complexity

The specialized design of fuel cards introduces an administrative burden when managed separately. For instance, a company using distinct fuel cards for different vehicles finds consolidating expenses difficult, leading to increased administrative efforts and potential operational inefficiencies.

As a result, administrators have a hard time reconciling statements, accurately tracking expenses, and ensuring compliance. This burden increases processing times and errors in financial reporting.

4. Reward Limitations

While crafted to suit industry needs, fuel cards encounter limitations in cashback offers. Consider a scenario where a company's preferred fuel card provides cashback benefits only at select stations, restricting potential cost savings for the entire fleet.

Why Should You Switch to Pluto Corporate Fleet Cards?

Pluto fleet cards don't restrict the use of cards at their discretion. Instead, they facilitate advanced controls and real-time visibility. From issuing budgeted fuel cards to creating vendor-specific cards, you can set rules that align with your company's needs and policies. Then, with each transaction, you track all fleet expenses from a single dashboard and get real-time data without manual effort.

So, you set cards and add controls, and you are good to go! Drivers can spend them at convenient gas stations while you enjoy complete visibility and control. Each transaction appears on the dashboard and notifies drivers to upload the receipt directly from WhatsApp. Once uploaded, you can approve the expense, and the data syncs with your accounting software to help you close your books ten times faster.

Here are the top six benefits of switching to Pluto corporate fleet cards:

1. Unrestricted Access Anywhere

Unlike traditional restrictions, Pluto corporate fleet cards liberate your drivers. There are no limitations on locations or specific fuel stations. Enjoy the convenience of using cards at the most budget-friendly and strategically located gas stations, repair shops, or truck stops that welcome Mastercard.

2. Easy Cashback

Pluto corporate fleet cards make cashback benefits straightforward. With up to 2% unlimited cashback on over 100+ currency spends, enjoy seamless cost savings without intricate conditions or restrictions.

3. Smart Budgeting

Pluto fleet cards, functioning as debit cards, provide smart budgeting without blocking cash flow. Drivers can request limit increases in seconds, ensuring operational flexibility with swift approvals. This distinctive feature sets Pluto apart, seamlessly blending budget management and uninterrupted cash flow for efficient fleet operations.

4. Driver-Friendly Controls

Provide drivers with budgeted fuel cards and set spending rules. Real-time data and advanced controls give you complete transparency of fleet expenses, enabling strategic decision-making.

5. Grow With Ease

Whether you have hundreds or thousands of drivers, the streamlined process of issuing corporate fleet cards and setting controls remains hassle-free, supporting your scalability with ease.

6. Eliminate Fraud

Lock or freeze cards instantly from the Pluto app, ensuring proactive measures against fraud. Enable company policies to ensure in-policy transactions, eliminating the risk of unauthorized spending.

Enhance End-to-End Spend Management

Pluto eliminates the need for separate investments in corporate fleet cards, offering an all-in-one spend management solution.

Pluto's comprehensive platform facilitates both corporate purchase cards and fleet cards, streamlining your financial operations. Enjoy the same benefits as traditional corporate fleet cards but with enhanced functionality, all within a unified platform. With Pluto, you get unparalleled efficiency in managing corporate expenses, ensuring a seamless and integrated approach to financial control.

Transform your spend management today. Book a demo and discover how Pluto can optimize your financial processes and elevate your business operations.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use