Contents

PlutoCard is Now GetPluto: Your Unified Payable Solution

Mohammed Ridwan

•

•

PlutoCard now becomes GetPluto — your new one-stop solution for all payables.

What's New?

After much anticipation and hard work, we're excited to announce the migration from plutocard.io to getpluto.com, a step towards redefining corporate payments.

With getpluto.com, we are extending our vision beyond providing corporate cards.

We understand the challenges that businesses face when handling their finances. It involves more than swiping a card and filing expenses. That's why we've developed a comprehensive suite of products and features to simplify everything from procurement to payables.

So, whether you want to streamline purchase requests, integrate your ERP without impacting costs, or manage reimbursements — getpluto.com has you covered!

Beyond Cards: The All-In-One Platform

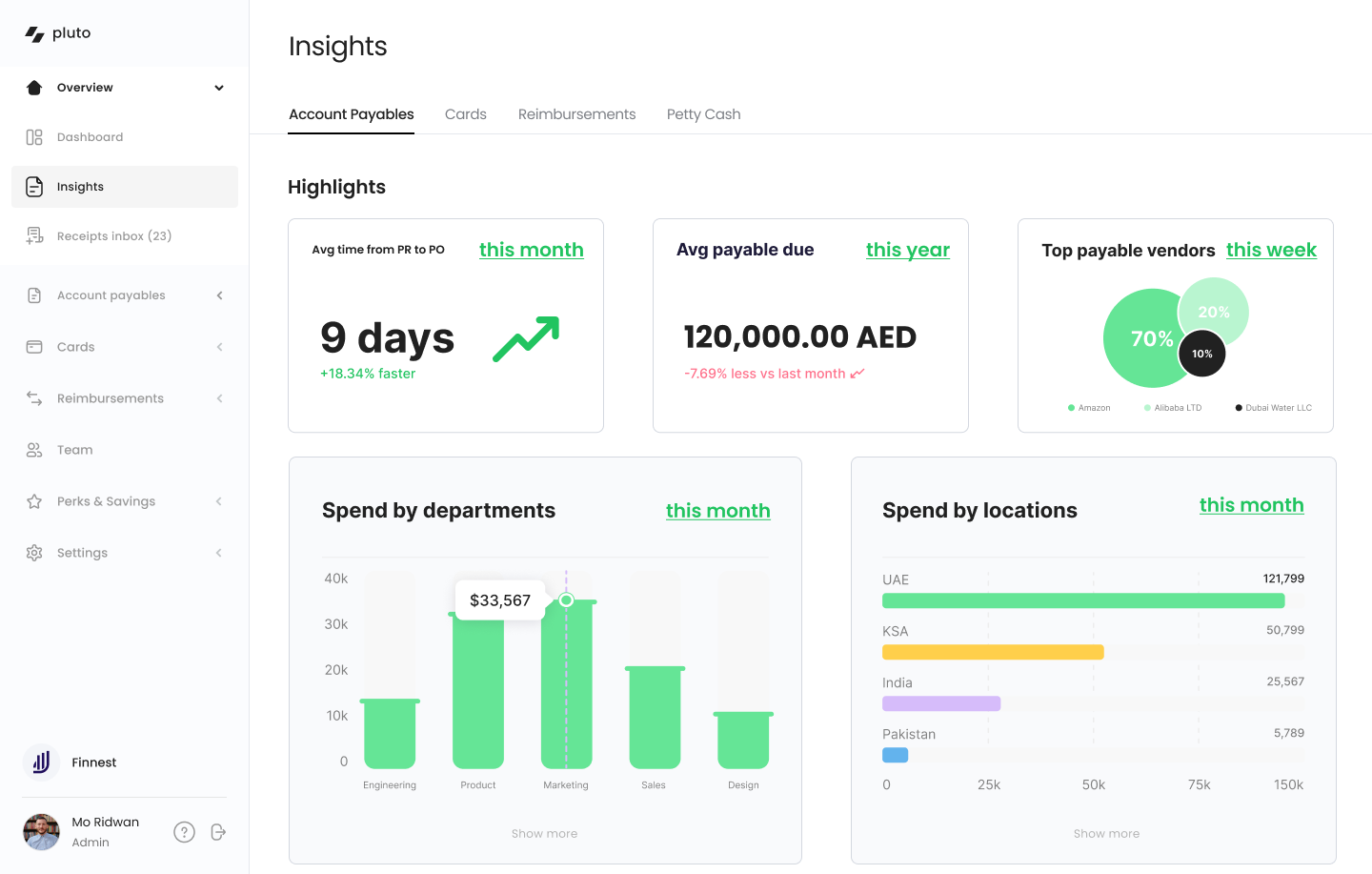

Here's a glimpse of what Pluto has to offer:

- Procure-to-pay: Streamline your procurement process from purchase requests to invoice matching, all in one place.

- Bill management: Centralize bill management and payments for faster approvals, better vendor relationships, and more accurate two/three-way matching.

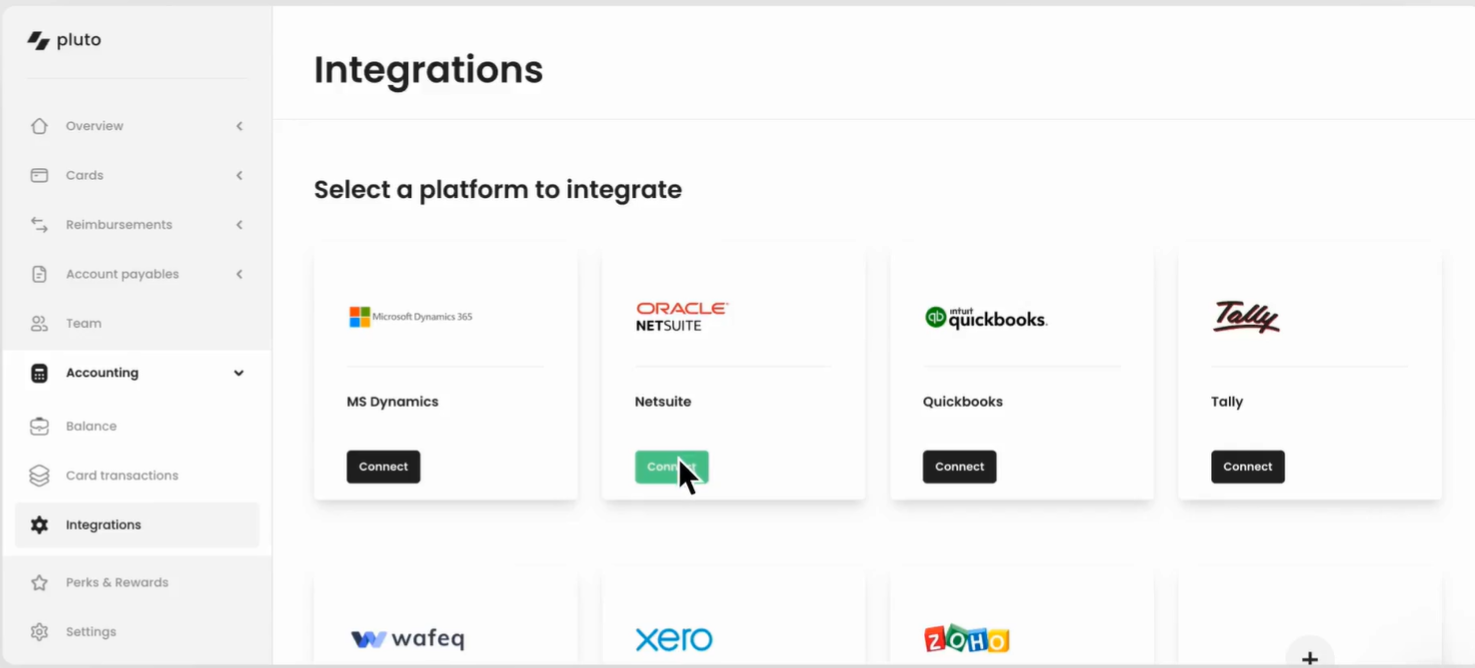

- Accounting ERP integrations: Sync seamlessly with major ERPs like Xero, Zoho, QuickBooks, Dynamics, and Netsuite to close your books 10X faster.

- Petty cash management: Digitize cash-in-hand management to eliminate leaks without losing flexibility or visibility.

- T&E reimbursements: Simplify travel and expense reimbursements with unlimited budget-controlled corporate cards and custom approval workflows.

- Corporate cards: Get budget-controlled corporate cards with built-in compliance management — from receipt capture to policy enforcement.

“We have been using Pluto for a few months now, and we literally have everything in one place.”

~ Lee Kersen Mascarenhas, Head of Operations at BloomingBox

From Our CoFounder — Mo Aziz

Pluto's Corporate Cards have been serving the largest businesses in UAE powered by a platform built for companies of all sizes: from small-scale SMEs to businesses with 1000s of employees.

But company spending does not happen just through Corporate Cards…

At Pluto, we believe CFO & Finance teams need a unified, comprehensive platform that solves all types of corporate spending problems end-to-end.

The new Pluto is our step towards this future where UAE businesses get a best-in-class platform, helping manage company spending across Cards, Reimbursements, Invoice Management, Procurement & more.

Join Us At getpluto.com

We're excited about the possibilities that getpluto.com brings.

We understand the importance of this change and are here to support you at every step of the way, offering a more comprehensive platform to meet all your financial needs.

Sign up for a demo or create a free account at getpluto.com today and discover how Pluto simplifies payments for—finance teams, procurement teams, and employees.

Thank you for your continued support!

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Vlad Falin

Efficient Receipt Management For UAE Businesses

Collecting, storing, and otherwise managing receipts is essential to a well-oiled expense reporting machine.

Each receipt serves as confirmation of payment processing between yourself and the customer or vendor. You also need expense and sales receipts to file taxes and maintain your peace of mind.

Unfortunately, while saying receipt management is easy, the whole process itself is daunting. Tracking hundreds, thousands, even millions of employee and customer receipts leaves loopholes for fraud and misreporting.

Physical expense receipts are especially susceptible to being lost, damaged, or fading with time.

Fortunately, there’s a better way to do it: digital receipt management with Pluto.

- Automate more of the expense management process

- Reduce the risk of fraud and inaccuracies

- Create more efficient workflows and financial departments

- And overall streamline modern business operations

While you probably can’t eliminate 100% of paper receipts from your workday, you can still improve your process with an increasingly-digital footprint!

What is Receipt Management?

Receipt management is the process of collecting, tracking, and storing business receipts. This task is usually handled by internal finance teams. Their role involves collecting various receipts, tracking costs in accounting software, and storing these receipts for future reference. Additionally, they may need to manually sort each expense, depending on the system in place.

Why Do You Need It?

- A well-run receipt management protocol is crucial for businesses for several reasons:

1. Simplify Employee Reimbursement Programs: It aids in the smooth operation of reimbursement programs for employees.

2. Track and Report Tax Deductions: It's essential for accurately tracking and reporting tax deductions.

3. Provide Proof during Tax Audits: It serves as necessary documentation during tax audits.

4. Streamline Expense Reports and Budgets: Helps in making expense reports and budgeting more efficient.

5. Combat Internal Fraud and Inauthentic Chargebacks: Plays a key role in preventing fraud and false chargebacks within the company.

6. Avoid Repair or Replacement Costs for Items Under Warranty: Keeps track of receipts necessary for warranty claims, saving costs on repairs or replacements.

7. Calculate and Improve Long-Term Profitability: Receipt management is vital in calculating and enhancing the long-term profitability of a business.

Different types of receipt management systems are in use today, including those for printed receipts, e-receipts, and even handwritten receipts. This diversity can be challenging for businesses, as they need to follow multiple procedures to reconcile their books effectively.

Types of receipt management

Today, there are three basic ways to handle receipts directly:

- Manual receipt management involves handling, tracking, and storing paper receipts

- Digitization receipt management scans physical receipts to digitize the tracking process

- Digital-only receipt management is used for online or digitally generated receipts

While many businesses are moving toward digitization and digital-only receipts, some businesses are stuck in the dark ages. (The kind that involves typing physical receipt information into a digital spreadsheet.)

And as we’ll see below, manual entry strategies come with some…problems.

Difficulties of Manual Receipt Management

1. Easily Lost or Damaged Receipts

Perhaps the most obvious problem with physically tracking expense receipts is that there’s so much that can go wrong. Lost, damaged, or faded receipts make the business expense tracking process that much harder.

Even if the employee who spent the money doesn’t drop their receipt, it’s possible for paperwork to get lost on a desk somewhere. And if you need to find a receipt two years later? Better hope it was filed properly and hasn’t faded completely.

2. Consumes Human Resources

Manual receipt management is an extremely hours-intensive process.

Your financial team has to collect invoices, type their data into your accounting software, and double-check their work. Then, they have to reconcile business expenses against company credit card statements and track down potential instances of fraud or misreporting.

Not only does this require a lot of time, but it also impacts employee productivity. Every hour an accountant spends tracking receipts is an hour of productivity lost elsewhere.

3. Leaves Room for Human Error

Aside from the time and human resource cost, manual receipt management presents the potential for human error. And unlike on the product line or in customer service, every reporting mistake risks an unfavorable tax audit.

Even the simplest receipt management and tracking process involves several steps from collection to reconciliation. Every stage is an opportunity for an employee to get distracted, mistype a name or number, or duplicate entries. In bigger cases, they might even duplicate a payment, costing you more money.

And even if you catch the mistakes before they’re submitted, that’s more human hours wasted double-checking and correcting completed work.

4. Increases Fraud and Misreporting Risk

The risk of fraud is higher in manual receipt management programs, and instances of fraud may be harder to detect. Types of fraud that commonly crop up in expense reporting include:

- Inflated claim amounts

- Claiming personal costs on the business’ dime

- Submitting expense reports twice

- Falsifying “proof” to claim for money that wasn’t spent

Unfortunately, manual receipt management makes these kinds of fraud more likely and difficult to catch. For example, if the employee who authenticates receipts is committing or permitting the fraud, it’s harder to detect until after you’ve lost money.

Over time, even small acts of fraud can have massive financial consequences.

5. Contributes to Employee Dissatisfaction

For many companies, employee reimbursement programs contribute both to the need for manual receipt management – and to employee dissatisfaction.

Think about it. In a modern, tech-savvy business world, why should employees have to pay out of pocket, ever?

Virtual cards and online-based businesses have all but eliminated the need for an employee to front your expenses.

But if you’re still stuck doing manual receipt management, chances are, your employees are still submitting reimbursement tickets. (And grumbling about the time it takes to get paid back.)

And that’s not even touching on the frustration, tedium, and headaches manual receipt management programs cause your high-paid finance teams.

6. Jacks Up Business Costs

Together, all these factors paint a picture of increased business costs.

The time and human resource cost to track, reconcile, and store receipts.

The human and financial cost of detecting and counteracting fraud.

Even the maintenance costs for your printer and filing cabinets.

Every dollar spent on manual receipt management is a dollar sucked from office parties, growth, or your bottom line.

Benefits of Digital Receipt Management

It’s easy to see the costs that manual receipt management impose. Fortunately, there’s a simple solution: digital receipt management.

In short, digital receipt management involves using digital copies of receipts in your expense reporting strategy. Digital smart receipts are easy – simply integrate them into your accounting software and let automation take you away.

But even physical sales receipts can be digitized, Pluto allows you to digitize your receipt very simply - through your phone.

Incorporating such technology means that even paper receipts fold neatly into your overarching digital strategy.

And as you’ll see, the process comes with tons of benefits.

1. Increases Integration Potential

A massive benefit of digital tracking is the sheer integration potential. Most receipt management tools, from receipt scanning devices to receipt tracking software, easily mesh with your existing expense reports system.

From there, you can automate mindless tasks and set up occasional human checks to ensure the system works as intended.

2. Fewer Costly Errors

Another way that a digital receipt management program saves costs is by reducing employee errors. Digital receipts should meld seamlessly into your tracking system – no surprises there.

But even processing physical receipts is cheaper and easier.

With their mobile phones, employees can scan receipts and upload them instantly. From there, Pluto categorizes the information and adds it to the overall report.

While employees may spend a second filling in any blanks, increased automation greatly reduces the risk of input errors.

3. Reduces Risk of Fraud

Less human interference means your financial system is more resilient to fraudulent activities. Pluto improves speed and accuracy while digitizing the receipts.

That leaves fewer opportunities for fraudulent claims.

4. Reduces Clutter

Uploading physical receipts means less physical space is needed for storage. That can save you on storage costs and reduce desktop and file cabinet clutter.

And because everything’s digitally maintained, you’ll still meet or exceed your tax authority’s required financial record storage period.

Not to mention, just finding your records will be easier than ever!

5. Easier Audits

No person or business enjoys tax season. But digital management makes the process at least a little easier.

Because all of your information is stored online, it’s easier to access and export receipts as needed.

When tax time or the dreaded audit comes around, your data will be well-organized and easily accessible.

6. More Efficient Expense Reporting

Traditional receipt management is a costly, time-intensive, error-prone manual process that used to be necessary. With modern tools, businesses can streamline the entire financial structure of their organization.

No more lost receipts or worrying about fraud.

Less time spent inputting and double-checking data, and more time helping your business grow.

All these positive benefits will improve efficiency – and even bring smiles to your accountants’ faces.

7. Faster Reimbursements

Like using a virtual corporate card, digital receipt management speeds up the reimbursement process.

Since everything is tracked and verified electronically, it’s easy to set up an automatic or streamlined reimbursement protocol.

8. Putting Your Eco-Friendly Foot Forward

Lastly, any step your business can take toward going paperless is good news for the environment.

Cutting down fewer trees and reducing printer ink usage are laudable goals that can decrease your environmental footprint.

Not only will you enjoy cost savings, but you’ll feel better about doing business in an increasingly eco-conscious world.

8 Tips for Efficient Receipt Management

Digitizing your receipt management strategy is just the first step toward expense report success. To ensure you’re operating at maximum efficiency, consider the following tips.

1. Use Pluto App

The first step is to get Pluto and start managing your spending digitally.

While you’re moving toward digital efficiency, your vendors aren’t required to follow. Keeping the proper tech on hand ensures you can digitize any paper receipts that come your way.

Pluto allows you to take a picture of the receipt, upload it to your expense and just like that the reconciliation process is done!

2. Save Your Receipts

While you can set up secure digital folders to store all your digital originals and copies - Pluto does that for you!

Just take a picture of the receipt, upload it to the app and that is it.

3. Ensure High-Quality Digital Format Uploads

There’s no point in uploading and saving documents if you can’t read them.

Before tossing your physical copies, make sure you can clearly read the essential information on each receipt. (Such as the company name, date, purchased item(s), and amount.)

4. Categorize Submitted Expenses

Take some time to categorize your expenses (most businesses do this in chronological order). Pluto helps you with that, but just make sure to check the right category so the reporting stays in top notch condition.

5. Set Up a Simple Expense Report Strategy

Expense reporting is the backbone of any business’ financials. For prompt, complete reporting and tracking, ensure that you design a straightforward strategy.

Same-day submissions, fewer Excel sheets, and faster reimbursement protocols will improve efficiency and attitudes. Better yet, invest in a quality expense and receipt management software.

Or even better - start with Pluto, we have a free package. It will allow you to completely digitize and control your spending, while keeping your reporting in the best possible shape.

6. Establish Accountability

A top-notch expense reporting strategy only works if people use it.

To ensure your protocols are followed, emphasize and encourage accountability. Keep all managers and supervisors up-to-date with company spending and card policies and remind them to disseminate that information appropriately. Follow up with employee expenditures as needed.

7. Run Regular Internal Audits

Regular expense report audits help businesses track receipts fraud, clear up discrepancies, and streamline inefficiencies.

Take time each month or quarter to check for fictitious or overblown expenses or troubles with your expense reporting strategy.

Pluto allows you to run real-time reports at any given moment for any period of time.

8. Switch to Virtual Corporate Cards

Virtual corporate cards make managing receipt tracking even easier. Not only can you digitize the entire process end-to-end, but corporate p cards give you greater control over your expenditures and tracking.

Sure, you can’t prevent vendors from handing you physical receipts. But you can greatly minimize instances of employees walking in with a big stack of thermal paper to scan in.

Pluto offers unlimited virtual cards which will book all your expenses right into the dashboard!

Key Takeaways

- Proper receipt management is key to running a financially successful business.

- While manual receipt management reconciles physical copies, it’s increasingly unnecessary in an increasingly digital world.

- Digital receipt management simplifies the collection, reconciliation, and storage process.

- Digital tracking also reduces fraud potential, time and financial waste, and increases employee satisfaction.

- Digitizing your expense reports pairs nicely with digitizing your own payments with virtual corporate cards.

.jpg)

•

Vlad Falin

What is an Expense Report? How to Create One?

One crucial aspect of business finance management is knowing how the money of your organization is being spent. You can’t paint a complete picture of your organization’s financial health without understanding how the money is flowing first. This clarity is precisely what effective expense reports provide. When properly maintained, expense reports give you a clear perspective over your organization's finances.

In this comprehensive guide, we delve into:

- The Definition of Expense Reports: What are they and why are they crucial?

- The Importance of Accurate Expense Reporting: How does it affect your organization's financial health?

- Creating Effective Expense Reports: We'll explore two practical methods to craft accurate and insightful expense reports, empowering you to make informed financial decisions.

What is an expense report?

An expense report is a crucial tool in business finance management. It is a categorized and itemized list of expenses made on behalf of the organization. These reports assist employers or finance teams in determining what money was spent, what was purchased, and how much of the expenditure is eligible for reimbursement.

The purpose of an expense report is to track the expenditures of a business and expense forms should include all purchases necessary to operate a business, such as food, gas, or parking.

It is most commonly used by employees when requesting reimbursement for expenditures.

When expenditure amounts exceed a certain threshold, receipts are usually attached to the form.

Employees are paid the requested amounts after the employer examines their submissions for accuracy and validity.

In this case, the employer will be able to recognize accounting profit and taxable profit based on the reimbursements.

Business expense reports are usually generated on a monthly, quarterly, or annual basis to track business spending:

- It is important for a company to maintain monthly and quarterly expense reports to track all of its purchases during that period. The reports are used to determine whether spending within the organization's budget is within its limits and to identify areas for cost reductions.

- Yearly expense reports are in turn used for tax purposes. A company's tax returns are prepared using its annual expense reports.

It is also possible to use expense reports to detail expenditures made against an initial employee advance.

Employers still record employee expenses as business expenses, but they do not reimburse employees; instead, they deduct the expenditures from employee advances.

Why use an expense report?

Expense reports are essential for small businesses, enabling a clear tracking of business expenses often paid out-of-pocket by employees. These reports detail all reimbursable expenses and require attaching receipts for accurate verification. Once reviewed for accuracy, employees are reimbursed accordingly. Additionally, small business owners and accountants use these reports to analyze total expenses over specific periods, employing accounting tools to assess whether costs align with budget expectations

The following are some benefits of generating a expense report:

1. Facilitates efficient expense tracking and cost control

Analyzing expense report data is the ideal starting point for cost control. This allows you to track your firm's spending over time by giving you a clearer picture of what your money is being spent on.

Additionally, you can analyze how much your employees are spending on different expense categories, determine which categories are driving up costs, and implement strategies to reduce or eliminate them. In addition to identifying loopholes in expense policies, these reports can help you decide which vendors to prioritize and which ones to let go by identifying loopholes in expense policies.

Tracking expenses over time allows you to identify whether a particular expense category (such as transportation or hotels) is increasing costs excessively. As a result, you can strategize on how to reduce or eliminate these costs.

2. Helps with budgeting

A business's budget is essential to its smooth operation. A detailed and accurate expense report can help your organization develop a strong and informed financial plan. As a result, various departments and projects can be allocated more appropriate budgets. You can maintain your business's financial security long-term by consistently tracking expenses in order to ensure that different departments and projects adhere to their budgets.

3. Makes for accurate reimbursements

In the event that an employee paid for business expenses out of pocket, they would expect a fair and accurate reimbursement.

Also, you want to make sure that the request is fair so that you don't pay more than you are owed.

It allows organizations to determine if a claim is legitimate faster by providing employees with a standardized process to learn what can and cannot be expensed.

In addition to providing solid evidence of when, where, and how expenses were incurred, itemized expense reports with receipts do the same for proving compliance with your organization's expense policy.

4. Simplifies tax deductions

Tax deductions are available for many business expenses incurred by employees at work. In order to claim expenses as deductions, you must properly record them and provide proof that they were actually incurred.

Business owners sometimes use their bank account or corporate card statements to keep track of their deductible expenses. It's important to keep in mind that these statements may not include all expenses.

In contrast, expense reports simplify the process of keeping track and deducting deductible expenses during tax season. The finance team simply needs to add up all the expenses that can be deducted and enter them into the appropriate tax forms.

{{cs-cta-component}}

What should be in the expense report?

By creating an expense report, you (or your accountant) can easily add up all expenses so that they can be entered into your tax return.

Some crucial elements to include in an expense report include:

- The name, department, designation, and contact information of the employee who submitted the report.

- The date and amount of each expense (corresponding to the date and amount on the receipt)

- What type of expense is being incurred (meals, mileage, internet, etc.)?

- Vendor or merchant who sold the item

- If applicable, the client or project for which it was purchased

- From your accounting chart, determine the account where the expense should be charged

- A description of each expense in more detail

- Expense subtotals and total costs, including taxes, for each type of expense

- (If applicable) a deduction for prior advances made to the employee

How to create expense reports

Companies most often generate and track expense reports using spreadsheets, templates, or expense reporting software.

You can generate expense reports in two different ways: manually through templates, or through Pluto.

Manual expense reporting with custom templates

To make the task of preparing expense reports easier for employees, some organizations provide customizable, ready-made templates to download and use. To report expenses in this way, follow these steps:

- The employee outlines their name, contact information, designation, the dates covered, and the purpose of the report in the appropriate fields.

- Following that, they determine how many rows and columns the expense report should contain. For example, some firms have mandatory columns and categories that correspond to the expense categories and columns in tax returns.

- In the report, expenses should be listed chronologically with brief descriptions, with the most recent expense appearing at the end.

- In order to calculate the grand total, the employee must first calculate the subtotals for each expense category followed by the total for all expenses. Subtotals assist the finance department in analyzing expenses.

- Finally, all expenses mentioned above must be accompanied by receipts. The receipts can either be scanned or photocopied depending on whether the report is being submitted digitally.

- Reports are submitted to the line manager or department manager for validation and fraud detection.

- As soon as they approve the report, it is forwarded to the finance department for reimbursement.

Automated expense reporting

The use of expense report templates is a quick way to keep track of expenses for small businesses.

The problem arises when your business grows, at which point the process of filling out a report, even if using a template, can become a time-consuming task.

When multiple departments process several expense reports a day, it is important to switch to an automated expense reporting solution like Pluto, so that these reports can be tracked and managed more efficiently.

- Pluto enables employees to create expense reports on the fly. Their receipts need to be captured digitally or filled out in the mandatory fields within the application.

- By grouping all the expense claims together, a report can be created and submitted effortlessly.

- Pluto also provides virtual and physical cards, so the expense data are booked straight into the platform for later use.

- Line managers and department managers review reports to identify policy violations, fraud, duplicate expenses, or warnings about them.

How to simplify the expense reporting process

While expense reports are important when it comes to gaining an overall view of the way money is moving, creating them can be a hassle when your organization incurs too many expenses to keep track of manually.

However, there are a few ways that you can simplify your expense reporting. These include:

Switching to expense reporting software

The first step in expense management is to file expense reports. You must also maintain policy compliance, reimburse expenses on time, and conduct successful expense audits to stay on top of your business expenses.

This is where Pluto can help. By providing multiple ways to record expenses on the go, we eliminate the need for manual data entry and paperwork. You can benefit from an expense management solution by:

- Generating and submitting reports automatically;

- The ability to support multiple expense policies and spend limits;

- Eliminates policy violations and fraudulent expenditures

- Analytical reports and intuitive dashboards increase spend visibility

With all of these features, you can save time and money while keeping your employees productive.

Make expenses easy to report and track

Provide your employees with Pluto real-time reporting system where they can track expenses, submit receipts, and report business expenses.

Business expense reports can be updated in real-time using online or smartphone apps, and receipt images can be added for total transparency, if you use digital technology.

Time-stamping and expense classification make it easy to catch fraud, which is beneficial to both you and your employees.

Embrace mobile devices

By scanning receipts and automatically extracting and reporting the key data, Pluto saves your employees' time and improves their expense reporting accuracy.

It makes perfect sense for you to use an app that allows your employees to track expenses easily from their phones since most (if not all) of your employees spend a lot of time on their smartphones.

Set up a routine audit

Ensure that you also incorporate a routine audit process into your business expense report policies. Your expense report should be audited quarterly, biannually, or annually, depending on the number of expenditures your employees incur.

You can catch fraud cases through audits, but you can also understand where the biggest expenditures are and reduce them.

Routine audits can also help you improve management and tracking of your business expenses by letting you know how to refine your reporting process.

Automated expense reporting with Pluto

Pluto allows you to issue virtual cards and physical cards and that immediately solves two things:

- No need for petty cash or out of pocket expenses;

- Real-time reporting of all the incurred expenses;

The spend management system allows you to issues cards for a particular employee, vendor, or even expense type.

It also allows you to set the limits on the go, and see all the expenses in the real-time report. All that, while your employees can easily categorize the expenses and upload the physical receipts just by taking a photo on their mobile device.

Reporting expenses manually is very time consuming, but having them all digitally stored and automatically reported solves the problem.

Key takeaways

Expense reports are a crucial aspect of the financial bookkeeping of any business organization. Not only are they important for knowing how much money is being spent by the company, whether as a whole or for a specific project, but also for the purpose of reimbursing employees for business-related expenses.

Plus, they also help you with budgeting, tax reporting, and cost control measures.

You can easily create an expense report using a premade or personalized template, but you’ll have a much easier time in the long run if you start using Pluto.

•

Mohammed Ridwan

How to Improve the Expense Reconciliation Process to Close Books Faster

For every expense, teams maintain extensive documents like purchase orders, goods received notes (GRN), invoices, etc. With each increasing expense, the finance team has to spend more and more time on spend management — maintaining these documents, syncing data across accounting systems, ensuring proper approval, categorizing accurately, etc.

This manual process is time-consuming and prone to errors like missing receipts, employee fraud, unrecorded expenses, data entry typos, etc.

As a result, teams have inconsistent data across company systems and spend more time fixing these issues than focusing on their core activities. So, when finance teams strive to improve budget allocations, streamline expense tracking, and enhance financial reporting, they find themselves dedicating substantial time to addressing discrepancies among different financial databases and systems.

This blog will cover improving the expense reconciliation process and replacing manual and old methods with an improved solution.

What is Expense Reconciliation?

Expense reconciliation is a process that matches the actual expenses with the corresponding book entries. It involves comparing two sets of financial records, such as bank statements, credit card statements, receipts, etc., to identify and rectify discrepancies between them.

So, for every expense, you have an entry at an external source and in the internal systems. You match them together to ensure the accuracy of financial reporting, compliance with accounting standards, and prevention of errors or fraud.

However, companies rely on outdated systems — entry-level accounting tools, spreadsheet-based solutions, or legacy ERPs, which cannot handle end-to-end reconciliation processes. These compel finance teams to spend valuable time on manual tasks like data entry and receipt management, hindering reconciliation efficiency and increasing the risk of errors in financial data.

Hence, submitting and tracking expenses becomes cumbersome for employees, while finance teams face manual verification and reconciliation challenges. Managers struggle with delayed approvals, and the overall process becomes susceptible to errors, affecting accuracy and compliance.

How to Reconcile Expenses Faster

Invest in spend management software to reconcile expenses faster. With spend management software, you can track and monitor each transaction on a centralized platform in real time.

The automated process makes reconciliation simpler and faster by providing a single source of information and enabling advanced controls. You can create customizable approval workflows and specify spending rules to suit complex hierarchies and ensure compliance with company policies.

Especially with Pluto, each expense triggers the approval workflow and notifies employees to upload the receipt through WhatsApp. The accounting system integration syncs data across the financial systems to provide a consistent and accurate database.

Here is how switching to Pluto helps you reconcile efficiently and close your books of accounts ten times faster:

1. Easy to Identify Discrepancies

In a traditional manual reconciliation process, identifying discrepancies involves sifting through piles of paperwork or navigating complex spreadsheets.

With Pluto's automated system, this cumbersome task is simplified. The platform's alert system actively flags potential issues, promptly notifying users of duplicate receipts. It not only streamlines the identification of irregularities but also introduces a proactive layer of fraud prevention.

You can visualize and interact with discrepancies directly on the centralized platform, turning what used to be a tedious task into a more intuitive and efficient process.

2. Speed and Accuracy

Automation, real-time tracking, receipt capture (via optical character recognition (OCR)), approval workflows, and robust controls accelerate reconciliation cycles on Pluto.

You need not spend a minute on a manual redundant task. The platform captures and extracts invoices from emails and WhatsApp on a centralized platform. The trigger-based workflows ensure prompt approvals without any friction. Matching documents for three-way and four-way matching simplifies with all the documents on a single tool.

Therefore, the inherent accuracy of financial data, coupled with efficient discrepancy identification, ensures speed and reliability in the reconciliation process.

3. Real-Time Tracking and Visibility

Unlike conventional tracking methods, Pluto offers real-time insights through its centralized dashboard. This furnishes internal teams with immediate visibility into transactions, guaranteeing proactive adherence to company policies.

The agility provided by real-time tracking enables timely data-driven decision-making based on the latest and most accurate data.

4. Better Data Sync for a True Picture

Manual data entry is prone to errors and delays, leading to discrepancies in financial records. Pluto's seamless integration with major accounting systems like Xero, Zoho, QuickBooks, Netsuite, and Dynamics ensures that the financial data is up-to-date and aligns with the organization's accounting records. This synchronization eliminates the need for manual adjustments and corrections, providing a true and accurate picture of the organization's financial status.

5. Enhanced Controls Over Processes

Building intricate approval workflows is simplified with Pluto. You can set up approval processes using simple if-then rules without the need for complex coding. Devise custom workflows that align perfectly with your company policies, creating a seamless and controlled process.

6. Traceable Audit Trail

Pluto maintains a traceable audit trail of all financial transactions and activities. It provides a comprehensive record of changes made to financial data. From the initiation of a transaction to any subsequent modifications, the traceable audit trail ensures transparency and accountability. This trail helps you avoid fraud and trackback discrepancies without friction.

Also, you can lock transactions post-approval, which adds an additional layer of security and integrity, facilitating smoother audits.

7. Save Time and Money

Automating financial processes, including procurement, expenses, and payables, significantly reduces manual steps in reconciliation.

Pluto's ability to capture general ledger and tax codes from expenses automates data entry. It reduces the time spent on routine reconciliation tasks. This efficiency allows finance teams to allocate resources more strategically, focusing on higher-value initiatives rather than repetitive manual tasks.

Timely financial insights help finance teams support decision-making processes with precision and confidence, fostering a data-driven financial ecosystem.

Internal Controls Strengthen Expense Reconciliation

Expense reconciliation burdens finance teams with time-consuming manual efforts and the constant threat of challenges like duplicate receipts and policy violations. These complexities lead to prolonged reconciliation cycles, hindering financial efficiency.

However, the actual progress happens when you strengthen internal control over financial reporting (ICFR), which is the anchor for successful automation in finance.

When you embrace ICFR strategically, it bolsters internal controls, protects against risks and fraud, and sets the stage for smooth automation. The impact goes beyond just easing manual work; it promotes precision, reliability, and transparency in financial workflows.

In simple terms, ICFR mitigates risks tied to financial inaccuracies. Read how to improve your ICFR framework for enhanced reconciliation processes.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use