Contents

Corporate P-Cards: How to Use Them for Maximum Advantage

Mohammed Ridwan

•

•

P-cards can replace your corporate credit cards.

If you rely on credit cards, you would have 2-3 cards issued to the executives, which are shared with the employees. Though it seems a great method to ensure approval and budget control, it has many loopholes.

The finance teams are running after employees for receipts, employees are waiting on OTPs and approvals, and the CFO is not satisfied with the numbers.

You look for alternatives and land on p-cards.

P-cards (or purchase cards) are corporate cards you issue to your employees for business expenses. Then, be it purchasing a SaaS or making vendor payments, employees use it for all work-related spending.

What are Corporate P cards?

Corporate P cards are company purchase cards that employees can use to make business purchases without going through the traditional purchase request and approval process. Corporate P cards make it easy for companies to manage account payables & automate expense accounting while staying in complete control of their spending.

What Is the Difference Between a Credit Card and a P-Card?

While both cards are used exclusively for business expenses, there are many differences.

Credit cards make expense management difficult, with no visibility into where the money is going. An executive shares a single card with their team, creating a chaotic financial situation.

The card owner struggles to manage a constant stream of payment requests. Employees are left hanging with delayed payments, waiting for approvals. Especially in bigger companies, finance teams struggle with reconciliation and zombie spending (which is when a company continues to pay for something that isn’t used anymore, or when it pays for services that former employees had used).

On the flip side, if you use p-cards, you can issue each employee a separate card for corporate expenses. Each card has a specific budget and restrictions to ensure control and facilitate approval without delays.

For instance, you issue a card with a $500 monthly limit, restricted to office supply vendors like "Office One."

In this way, you manage budget control and approvals without losing visibility or having to micromanage.

How can Businesses use Corporate P Cards for Employee Expenses?

Moving from a credit card to a P-card isn’t complicated. Here is a step-by-step process of how you can provide your employees p cards and start using them:

Step 1: Generate Corporate Cards

The first step is to choose the type of card you want for your employees: physical or virtual. While a virtual card can be set up in under a minute, a physical card takes about 2-3 days to get delivered.

Physical cards work well for those who travel or have on-site jobs, making petty cash management easy. Contrarily, virtual cards support secure online purchases, such as buying SaaS tools or paying for digital advertising campaigns.

Once you decide whom to give a card and what type, set the budget and policies. You can incorporate the following policies to customize the cards:

- Specify the budget and replenishment frequency of the budget on the card- daily, monthly, or yearly.

- Define the purpose of cards by enabling only specific general ledgers (GL), labels, and tax codes.

- Switch on/off the ATM withdrawal option.

- Enable auto-lock for cards in case of receipt policy violation, where if the receipt isn’t attached in 7 days, the card is frozen.

All these customization options offer you better control without having to chase employees later. Deciding the budget, frequency, and vendors ensures that the card is used rightfully.

For instance, you would switch off ATM withdrawal for virtual cards that are meant for buying SaaS tools. Likewise, you can establish a monthly replenishment schedule to maintain sufficient funds while preventing excess spending.

Apart from this method, your employees can also request to activate the P-cards. They explain the card's purpose, after which the admin can approve/reject the request.

Now that the employees have cards in their hands, let’s see how you can better manage corporate spending with them.

Step 2: Manage Expenses Via Centralized Dashboard

Every expense on the corporate p-card is visible in real time on a centralized transactions dashboard. You get key information such as merchant name, expense category, card information, amount, and approval status.

Along with this dashboard, you get a dedicated tab for each expense where all its information is available.

You can review the key information such as receipt, department, merchant, date/time, expense category, etc. you can also download the receipt, approve/reject the expense, and check the activity log.

The activity log keeps track of all the conversations that have been happening with a particular transaction. Traditionally, companies use email and Slack, which makes communication messy. With this log, they can keep all their conversations and important information in one organized place.

Step 3: Create Approval Workflows

Approval workflows ensure that each expense follows a defined hierarchy for approval by the right stakeholders. You can customize them depending on different amounts, departments, and other factors.

It is a simple no-code system where you create workflows based on if-then rules.

A custom approval workflow ensures timely and effective approval without having to run after dedicated team members. Each of them receives a notification as soon as the expense takes place, and they can approve it easily.

Approvals and employee reimbursement become easy with a frictionless workflow like this.

Step 4: Report and Reconcile Expenses

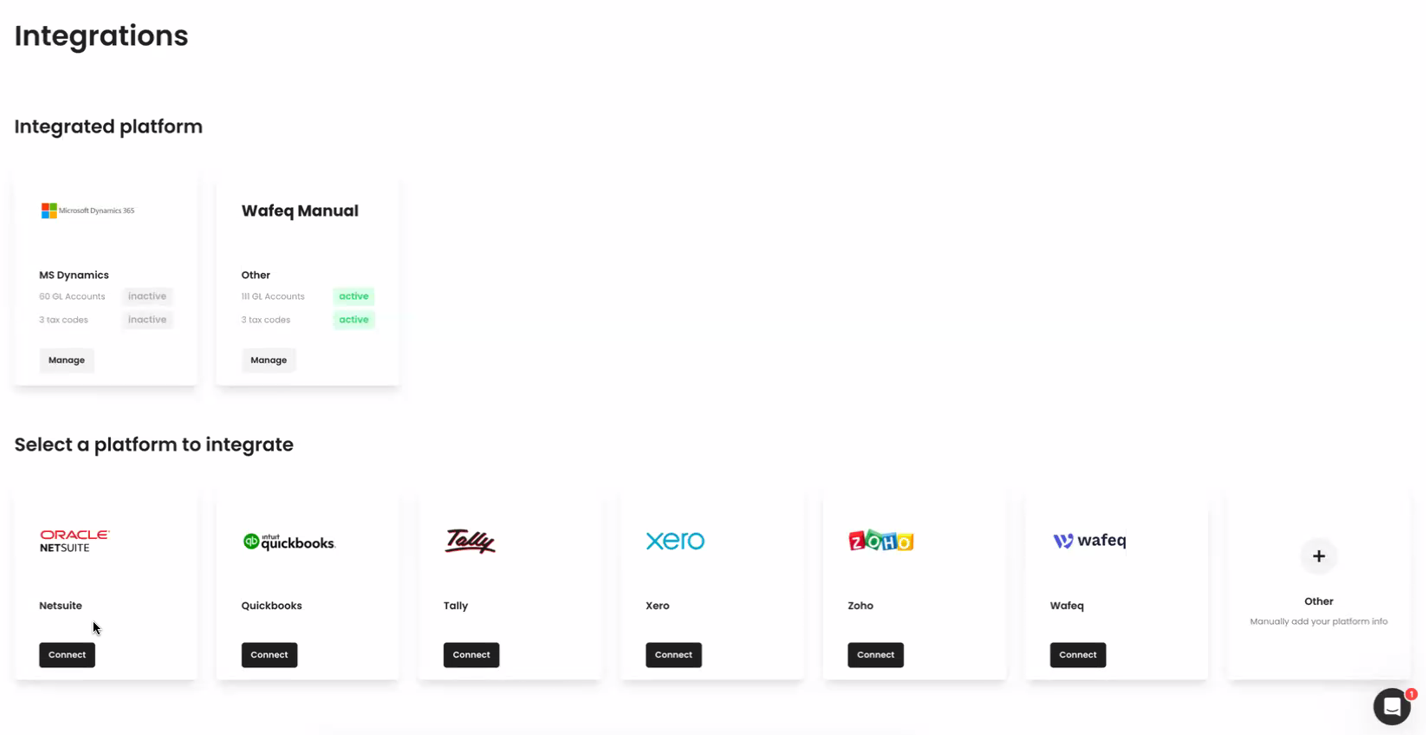

Integrating your cards with your accounting systems becomes the last step to facilitate reporting and reconciliation.

Once you integrate with your accounting software, you can enjoy complete visibility and control over your corporate expenses.

You get a dedicated insights window to track expenses and identify trends. You can add custom filters and export these for further analysis.

To understand the entire process better, book a demo and see how you can benefit from switching to a corporate p card.

Why Shift From Traditional Methods to Corporate P Cards?

Credit cards seem simpler, where a bank gives a few credit cards to share among the teams. But here’s why it doesn’t work:

- It is difficult to track who spends what, how much, and why.

- Employees wait for OTPs and approvals, delaying payments and reimbursements.

- The chances of zombie spending increase because the same card is shared. This also becomes one of the loopholes which leads employees to misuse the cards.

- The admins have to chase employees for receipts during reconciliation.

While these are just a few, relying on credit cards can cause chaos in expense management. Here are some reasons corporate p-cards are a more suitable option today:

No More Shared Cards

You ditch the whole system of sharing credit cards, which is the root cause of limited visibility. With corporate p cards, you can issue any employee a dedicated card for specific expenses.

So, if you issue Rashid from the marketing department a virtual corporate card for running Ads, he can not use it otherwise. He will be accountable for any unnecessary expenses beyond the specified budget.

This means more visibility and control over corporate expenses.

Easy Receipt Management

Corporate cards make receipt management easier with OCR technology in the following ways:

- Submitting expense reports at the end of the day becomes easier as it auto-populates all the information

- Uploading receipts in bulk upload with OCR handling the rest makes the process faster

- Detecting duplicate receipts becomes simpler as OCR eliminates the risk of manual errors

Apart from OCR, you also get the option to split the transactions to make the accounting process easier. Here, for each transaction, you can split the amount into a separate category, GL account, tax code, etc.

For instance, a $300 expense can be split into $200 for software purchases and the remaining $100 as consulting fees. Each will have a specific category, GL account, and corresponding tax code.

Budget Control

Corporate cards give more visibility and control over finances.

Although both credit cards and p-cards can have specific budgets, p-cards enable you to set specific policies and rules.

For instance, you give an employee a $1,000 monthly budget but restrict them to using the card only for office supplies purchases.

Similarly, you can set a $500 monthly limit for marketing expenses and restrict the card to "Ad Campaigns" and "Promotions," ensuring focused spending.

Another benefit is to assign monthly, yearly, and weekly budgets.

For instance, you can allocate an annual budget of $500,000 for the marketing department but assign a weekly budget of $10,000 for ad campaigns.

This facilitates flexibility for the teams to function better and gives the finance team more control over resource planning and allocation.

WhatsApp Integration

Receipt uploading becomes simpler when all you have to do is click a picture on WhatsApp and hit send.

After each transaction, employees get a notification to upload the receipts via WhatsApp. With this simple integration, receipt capturing becomes simple and fast.

Not only is the receipt captured, but stored under the relevant transaction tab with all its information intact. OCR makes it easier to extract key details and populate expense reports.

Admins can approve these expenses, and reconciliation becomes a breeze.

Eliminate Corporate Card Fraud

P-cards give you more control and security. From setting custom policies to raising alerts in case of duplicate receipts, p-cards ensure that employees don’t misuse the cards.

Additionally, the custom approvals workflows and dedicated activity logs reduce the chances of oversight. This system helps prevent unauthorized spending.

For instance, an employee tries to use the card for a personal expense, like an expensive dinner.

The custom approval setup will alert the admins. The active activity log with documented conversations will further ensure that no personal expense is charged on corporate cards.

Get the Most Out of Your Corporate Cards

Transitioning from credit cards to corporate p cards can be an exciting move. But to make the most of it:

- Set an expense policy outlining the guidelines that will govern the corporate cards. This practice will also become the pillar for a healthier financial environment to support internal control over financial reporting (ICFR) efforts.

- Understand the hierarchies in the company to create approval workflows accordingly. Find a balance between control and micromanagement. Managers should be informed about expenses without being excessively involved in them.

Do this right, and you will have better visibility and control over your finances. The employees will not be left hanging for approvals. The finance team will be at peace, and the CFO will have more faith in the numbers.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Mohammed Ridwan

Pluto Wins Big at the MENA Fintech Awards

The MENA Fintech Awards, a prestigious event within the financial technology industry, recently celebrated the most innovative and impactful solutions in the sector.

We at Pluto are thrilled to announce that our company has been honoured with the 'Best Corporate Solution' award! This recognition is a testament to our team's hard work, dedication, and innovative approach in the fintech space.

Our co-founders, having spent a considerable part of their lives in the UAE. Working within the fintech sector, identified a significant gap in the region's finance sector. They observed that the tools, platforms, and software available to CFOs and finance teams were not only outdated but also overly complex, hindering efficient financial management.

With Pluto, they embarked on a mission to develop a software solution that would change how mid to enterprise level businesses handled their finances.

The MENA Fintech Awards, organised in collaboration with the MENA Fintech Association, are designed to recognize excellence and innovation in financial technology. These awards are a highlight of the Abu Dhabi Finance Week (ADFinanceWeek), an event that fosters innovation and growth in the fintech sector. The 'Best Corporate Solution' category, in which we were victorious, emphasises practical, innovative solutions that address significant corporate financial challenges.

Our award-winning solution, the Pluto Card, addresses various corporate financial management needs. It offers features like employee reimbursements, petty cash management, and an efficient account payable cycle, along with robust accounting integrations.

Winning the 'Best Corporate Solution' award at the MENA Fintech Awards is not just an honor but also a motivation for our future endeavours. We are excited about our upcoming initiatives, which include further enhancements to the Pluto Card and expanding our market reach to serve more businesses globally.

We extend our deepest gratitude to the organisers of the MENA Fintech Awards and ADFinanceWeek, the judges for recognizing our efforts, and most importantly, our dedicated team and loyal customers. Your support and trust in our solution have been invaluable!

.png)

•

Mohammed Ridwan

Top 6 Procurement Software Solutions for Modern Businesses

The traditional procurement process is time-consuming, prone to errors, complex, and challenging to implement efficiently. From raising a purchase request to making vendor payments, multiple stakeholders are involved. In addition, securing approvals through various channels of an organization leads to chaos. Hence, 77% of companies are shifting to procure-to-pay solutions, also known as procurement software.

What is Procurement Software?

Procurement software are tools that automate the procurement process.

Instead of relying on multiple platforms and different channels to procure goods and services, the process is automated and brought together on a centralized platform.

A powerful procurement solution helps you in:

- streamlining the request and approval process for purchases

- generating, tracking, and managing purchase orders

- creating, negotiating, and tracking supplier contracts

- managing and maintaining supplier relationships

- automating invoice validation, approval, and payment workflows

- integrating with other systems for seamless data flow and coordination.

What Are the Benefits of Procurement Software?

By automating your procurement process with a procurement management software, you can improve it in the following ways:

- Once you enter data, it is auto-populated throughout the procurement cycle. This minimizes the risk of errors due to manual data entry in purchase orders, invoices, and other documents.

- You get real-time visibility into the procurement process. You can also track the status of purchase requests, orders, deliveries, and payments.

- With built-in reporting and analytics tools, you can generate detailed reports on spending, supplier performance, and other key metrics. This data-driven insight enables better inventory planning and strategic decision-making.

- You can standardize workflows for purchase requisitions and approvals. Route the requests to the appropriate individuals for approval and reduce any delays. Notifications and reminders are automated, ensuring timely responses.

- Invoice processing and payment workflows are automated. This ensures that invoices are paid on time. This helps in taking advantage of early payment discounts and strengthens vendor relationships.

Top 6 Procurement Software

To help you select the procurement management software best suited for the needs of your organization, we have listed the top 6 procurement solutions:

1. Pluto

Pluto is an all-in-one procurement software designed to transform your accounts payable (AP) processes. It reduces your finance team's workload and makes procurement easy. From automating purchase requests to setting multi-layer approval workflows and managing vendors, it is the ultimate procurement solution to transform a chaotic procurement process into a faster and more efficient one.

Key Features:

- Features fully customizable and automated workflows for raising purchase requests and purchase orders, requiring no technical expertise

- Offers flexible approval engine capable of managing intricate hierarchies

- Enables multi-layer invoice approvals with policies to align with your company's structure

- Ability to upload invoices easily via WhatsApp images, eliminating the need to search for invoice details. Also, facilitates invoice capture via emails directly to speed up the receipt capture process.

- A centralized dashboard to gather bills in one place and track the status to avoid double payments

- Vendor-specific corporate cards to control budgets and detect irrelevant expenses

- Supports local and international wire transfers to make payments

- OCR technology minimizes manual data entry by creating and populating bills from invoices

- Supports ERP integration to synchronize your vendors, POs, and bills and integrates with accounting software, such as Oracle, NetSuite, Zoho, Quickbooks, Wafeq, Xero, etc.

- Raises alerts for upcoming payments and enables scheduling payments in advance and automate invoices

- Provides a complete audit trail of the process to ensure visibility at each step

- Shows real-time analytics to facilitate deep insights for supporting budget control

Pricing:

Request the sales team for a custom quote

Pros:

- More financial control with vendor-specific corporate cards

- Better Forex rates than most local banks

- Multiple integration options

Cons:

- Slightly longer on-boarding due to corporate card offering

- Integrates with all other major ERPs except Tally

2. Yooz

Yooz optimizes the AP process, specifically focusing on invoice management. It is a cloud based software that uses artificial intelligence (AI) and machine learning technologies to enhance security and control in AP automation. It is suitable for mid-size companies of all sectors wanting to automate procurement with a cloud-based procurement solution.

Key Features:

- Enables online, real-time management of supplier relationships, improving communication and collaboration

- Provides mobile access for invoice approval and communication

- Maintains regulation-compliant traceability, ensuring adherence to relevant laws and standards

- Automates real-time GL coding and purchase order matching

- Captures all types of documents through various channels, such as email, drag-and-drop, mobile, scan, and sFTP, supporting multiple formats, including PDF, Factur-X, UBL, CII, and EDIFACT

- Integrates with accounting software and and ERPs

- Allows users to approve and pay invoices in batches, offering multiple payment options, such as Virtual Credit Card, ACH, eCheck, and Paper Check

- Offers a range of services, including consulting, configuration, training, and user support

Pricing:

Free trial for up to 15 days followed by a "pay-as-you-use" model.

Pros:

- Integration with Sage Intacct

- Ability to tag people in the comments and email them directly from the invoice

- Numerous criteria available for setting up the approval workflows

Cons:

- Doesn’t offer payment services in UAE, so you need to carry out payments on a different platform

- Doesn't have integrations with major suppliers as a form of punchout

- Time-consuming to download and export files

- Hard for vendors to send the invoices through Yooz

3. Procurify

Procurify speeds up the procurement process, enhances internal communication, and reduces financial risks. It is an easy-to-implement tool that saves time for finance and operations teams. From catalog management to custom user controls, it helps to track the procurement process in real-time.

Key Features:

- Tailors purchase orders to match your internal processes and vendor expectations

- Creates, tracks, and maintains an audit trail of all procurement transactions for transparency and compliance.

- Enhances financial controls by enabling purchase order-based purchasing

- Ensures that requested items are approved against budgets before procurement.

- Sync purchase orders with your accounting system or ERP, whether via API, CSV, flat file, or direct integration

- Integrates with trusted suppliers through PunchOut catalogs to streamline the ordering process.

- Enables blanket purchase orders, which involve making multiple purchases against a single purchase order, even when details of future purchases may be unknown.

- Purchase order workflows to save on shipping costs, unlock vendor discounts, and reduce paperwork

Pricing:

Starts at $2000/month with a custom pricing tier

Pros:

- Easy to make amendments in the original purchase order

- Enables ordering from multiple websites for resources, including Amazon

- Makes it easy to upload documents to support expense and order reports

Cons:

- Doesn’t offer payment services in UAE, so you will need to carry out payments on a different platform

- Isn’t catered to the UAE market, and does not support UAE specific workflows such as VAT management

- Cannot edit orders once they are approved

- Cannot see the order history for a catalog item without running a report

- Physical inventory has to be tracked outside Procurify

4. Precoro

Precoro is a cloud-based solution designed to streamline operations, automate tasks, and centralize purchasing procedures. It enables tracking discounts, monitoring corporate expenses, and enhancing cash flow transparency. It also provides analytics and reports for strategic procurement planning.

Key Features:

- Simplifies the approval by allowing users to approve from any device via email or Slack notifications.

- Supports customizable approval workflows with multi-step and role assignment

- Facilitates creating, approving, and tracking purchase orders and transfer orders from Amazon Business via Punch-in

- Connects with various ERPs and business tools like NetSuite, QuickBooks, and Xero, or its API

- Ensures data security through Single Sign-On (SSO) and 2-factor authentication

- Offers an intuitive interface and guidance from a dedicated customer success manager whenever needed

- Gives a risk-free 14-day free trial with access to all features

Pricing:

Starts at $35 per user per month billed annually for teams with under 20 members and offers custom pricing for enterprises

Pros:

- Provides flexibility for enterprise needs

- Works well for budgeting procurement

- Allows tracking invoices in a centralized environment

Cons:

- Requires training to customize complex workflows

- Invoice processing is slow

- Isn’t suitable for manufacturing industries

- Difficult to collaborate on invoice drafting

5. Kissflow

Kissflow simplifies and enhances procurement processes while ensuring transparency and compliance. It helps to automate the entire process without requiring technical expertise or coding experience. It comes with 50+ ready-to-use applications, enabling unlimited automation applications.

Key Features:

- Offers fluid forms to enable easy capturing, approval, and tracking of purchase requests

- Allows to register and maintain vendors effortlessly with access to multilingual catalogs

- Integration with accounting systems, ERP, and finance systems like Quickbooks, SAP, and Microsoft Dynamics

- Accelerates the invoice approval process with timely alerts and automated checks. Connect invoices to contracts, purchase orders, and service entry sheets in a single dashboard

- Customizable reports to visualize data using charts, filters, and heatmaps

- Ability to define and manage budget restrictions with dynamic rules throughout the entire procure-to-pay lifecycle

- Customized approval workflows to ensure transparency with rule-based approval processes

- Smart alerts that provide real-time updates on the status of purchase orders and invoices to keep stakeholders informed

Pricing:

Starts at $2499/month (billed annually). Pricing varies based on transaction volume and number of users.

Pros:

- Intuitive interface with a relatively short learning curve

- Allows automated workflows to be created with limited technical expertise

Cons:

- Not built specifically for procurement teams

- Does not support payment flows in UAE

- Cost of its license is high (particularly for SMBs)

- Can not handle intricate processes that require a high degree of customization or involve multiple conditional branches

- Customization options are limited, including specific integrations, advanced business rules, or more sophisticated automation capabilities

6. Vendr

Vendr is a practical solution for streamlining SaaS procurement. It simplifies the entire process, from intake requests to contract management. It provides essential SaaS insights, negotiates expert advice, and integrates with core business tools for procurement and vendor management.

Key Features:

- Buyer guides to provide negotiation insights and gain the upper hand in software purchases

- Negotiation advisory to provide personalized guidance on negotiating like a pro and enter negotiations with confidence

- Simplified intake forms to ensure company-wide compliance and visibility

- Integration with different accounting and finance tools, such as Oracle, NetSuite, Intuit, Quickbooks.

- Integrates with platforms like Rippling Workday to include correct stakeholders. Additional integration with SSO providers such as onelogin.

- Comprehensive renewal dashboard to receive early alerts and streamline the renewal preparation process to maximize savings.

- Vendr Slack integration for quick answers and timely notifications to collaborate in real time with your team, minimizing approval cycle times

Pricing:

There are 2 packages—the basic one starts at $15,000/year and the pro package starts at $20,000/year.

Pros:

- Offers assisted buying with a team who negotiates on your behalf

- Comprehensive database of vendors in one place

- Helps standardize procurement workflow

- Provides insights about fair market value

Cons:

- Restricted to SaaS procurement only

- Multilingual services are limited

- Navigating multiple workflows is not as fluid as desired

- Doesn't support multiple currencies

Find the Right Procurement Software

When choosing procurement software, focus on user-friendliness, scalability, and integration capabilities. Make sure the software aligns with your specific needs.

Finding the right software for accounts payable automation will be crucial for your business. For instance, if you frequently deal with multiple suppliers and have a complex approval process, ensure the software can accommodate these intricacies. Similarly, if you're in the healthcare industry, look for procurement software that complies with industry regulations like UAE Healthcare Law and the Dubai Health Authority (DHA) regulations. This ensures the privacy and security of patient data and adheres to local data protection standards. Moreover, check if the vendor offers active support and training. In case of a technical issue, having an unresponsive support team can disrupt the process and create bottlenecks.

Don't rush the decision. Thoroughly evaluate multiple options. Investing in an appropriate solution will save you money and headaches in the long run.

Want a tool that is safe, fast, and transforms your chaotic procurement process into an automated solution? Book a demo today and see how Pluto can simplify procurement for your team.

Disclaimer: The comparisons and rankings of procurement software competitors in this article are based primarily on reviews found online. While we strive to provide accurate and up-to-date information, these reviews are subjective and reflect the opinions of the users who posted them. The information presented is intended for general informational purposes and should not be considered as a definitive guide for choosing a software provider. We encourage readers to conduct their own research and consider their specific needs before making a decision.

.jpg)

•

Vlad Falin

What is an Expense Report? How to Create One?

One crucial aspect of business finance management is knowing how the money of your organization is being spent. You can’t paint a complete picture of your organization’s financial health without understanding how the money is flowing first. This clarity is precisely what effective expense reports provide. When properly maintained, expense reports give you a clear perspective over your organization's finances.

In this comprehensive guide, we delve into:

- The Definition of Expense Reports: What are they and why are they crucial?

- The Importance of Accurate Expense Reporting: How does it affect your organization's financial health?

- Creating Effective Expense Reports: We'll explore two practical methods to craft accurate and insightful expense reports, empowering you to make informed financial decisions.

What is an expense report?

An expense report is a crucial tool in business finance management. It is a categorized and itemized list of expenses made on behalf of the organization. These reports assist employers or finance teams in determining what money was spent, what was purchased, and how much of the expenditure is eligible for reimbursement.

The purpose of an expense report is to track the expenditures of a business and expense forms should include all purchases necessary to operate a business, such as food, gas, or parking.

It is most commonly used by employees when requesting reimbursement for expenditures.

When expenditure amounts exceed a certain threshold, receipts are usually attached to the form.

Employees are paid the requested amounts after the employer examines their submissions for accuracy and validity.

In this case, the employer will be able to recognize accounting profit and taxable profit based on the reimbursements.

Business expense reports are usually generated on a monthly, quarterly, or annual basis to track business spending:

- It is important for a company to maintain monthly and quarterly expense reports to track all of its purchases during that period. The reports are used to determine whether spending within the organization's budget is within its limits and to identify areas for cost reductions.

- Yearly expense reports are in turn used for tax purposes. A company's tax returns are prepared using its annual expense reports.

It is also possible to use expense reports to detail expenditures made against an initial employee advance.

Employers still record employee expenses as business expenses, but they do not reimburse employees; instead, they deduct the expenditures from employee advances.

Why use an expense report?

Expense reports are essential for small businesses, enabling a clear tracking of business expenses often paid out-of-pocket by employees. These reports detail all reimbursable expenses and require attaching receipts for accurate verification. Once reviewed for accuracy, employees are reimbursed accordingly. Additionally, small business owners and accountants use these reports to analyze total expenses over specific periods, employing accounting tools to assess whether costs align with budget expectations

The following are some benefits of generating a expense report:

1. Facilitates efficient expense tracking and cost control

Analyzing expense report data is the ideal starting point for cost control. This allows you to track your firm's spending over time by giving you a clearer picture of what your money is being spent on.

Additionally, you can analyze how much your employees are spending on different expense categories, determine which categories are driving up costs, and implement strategies to reduce or eliminate them. In addition to identifying loopholes in expense policies, these reports can help you decide which vendors to prioritize and which ones to let go by identifying loopholes in expense policies.

Tracking expenses over time allows you to identify whether a particular expense category (such as transportation or hotels) is increasing costs excessively. As a result, you can strategize on how to reduce or eliminate these costs.

2. Helps with budgeting

A business's budget is essential to its smooth operation. A detailed and accurate expense report can help your organization develop a strong and informed financial plan. As a result, various departments and projects can be allocated more appropriate budgets. You can maintain your business's financial security long-term by consistently tracking expenses in order to ensure that different departments and projects adhere to their budgets.

3. Makes for accurate reimbursements

In the event that an employee paid for business expenses out of pocket, they would expect a fair and accurate reimbursement.

Also, you want to make sure that the request is fair so that you don't pay more than you are owed.

It allows organizations to determine if a claim is legitimate faster by providing employees with a standardized process to learn what can and cannot be expensed.

In addition to providing solid evidence of when, where, and how expenses were incurred, itemized expense reports with receipts do the same for proving compliance with your organization's expense policy.

4. Simplifies tax deductions

Tax deductions are available for many business expenses incurred by employees at work. In order to claim expenses as deductions, you must properly record them and provide proof that they were actually incurred.

Business owners sometimes use their bank account or corporate card statements to keep track of their deductible expenses. It's important to keep in mind that these statements may not include all expenses.

In contrast, expense reports simplify the process of keeping track and deducting deductible expenses during tax season. The finance team simply needs to add up all the expenses that can be deducted and enter them into the appropriate tax forms.

{{cs-cta-component}}

What should be in the expense report?

By creating an expense report, you (or your accountant) can easily add up all expenses so that they can be entered into your tax return.

Some crucial elements to include in an expense report include:

- The name, department, designation, and contact information of the employee who submitted the report.

- The date and amount of each expense (corresponding to the date and amount on the receipt)

- What type of expense is being incurred (meals, mileage, internet, etc.)?

- Vendor or merchant who sold the item

- If applicable, the client or project for which it was purchased

- From your accounting chart, determine the account where the expense should be charged

- A description of each expense in more detail

- Expense subtotals and total costs, including taxes, for each type of expense

- (If applicable) a deduction for prior advances made to the employee

How to create expense reports

Companies most often generate and track expense reports using spreadsheets, templates, or expense reporting software.

You can generate expense reports in two different ways: manually through templates, or through Pluto.

Manual expense reporting with custom templates

To make the task of preparing expense reports easier for employees, some organizations provide customizable, ready-made templates to download and use. To report expenses in this way, follow these steps:

- The employee outlines their name, contact information, designation, the dates covered, and the purpose of the report in the appropriate fields.

- Following that, they determine how many rows and columns the expense report should contain. For example, some firms have mandatory columns and categories that correspond to the expense categories and columns in tax returns.

- In the report, expenses should be listed chronologically with brief descriptions, with the most recent expense appearing at the end.

- In order to calculate the grand total, the employee must first calculate the subtotals for each expense category followed by the total for all expenses. Subtotals assist the finance department in analyzing expenses.

- Finally, all expenses mentioned above must be accompanied by receipts. The receipts can either be scanned or photocopied depending on whether the report is being submitted digitally.

- Reports are submitted to the line manager or department manager for validation and fraud detection.

- As soon as they approve the report, it is forwarded to the finance department for reimbursement.

Automated expense reporting

The use of expense report templates is a quick way to keep track of expenses for small businesses.

The problem arises when your business grows, at which point the process of filling out a report, even if using a template, can become a time-consuming task.

When multiple departments process several expense reports a day, it is important to switch to an automated expense reporting solution like Pluto, so that these reports can be tracked and managed more efficiently.

- Pluto enables employees to create expense reports on the fly. Their receipts need to be captured digitally or filled out in the mandatory fields within the application.

- By grouping all the expense claims together, a report can be created and submitted effortlessly.

- Pluto also provides virtual and physical cards, so the expense data are booked straight into the platform for later use.

- Line managers and department managers review reports to identify policy violations, fraud, duplicate expenses, or warnings about them.

How to simplify the expense reporting process

While expense reports are important when it comes to gaining an overall view of the way money is moving, creating them can be a hassle when your organization incurs too many expenses to keep track of manually.

However, there are a few ways that you can simplify your expense reporting. These include:

Switching to expense reporting software

The first step in expense management is to file expense reports. You must also maintain policy compliance, reimburse expenses on time, and conduct successful expense audits to stay on top of your business expenses.

This is where Pluto can help. By providing multiple ways to record expenses on the go, we eliminate the need for manual data entry and paperwork. You can benefit from an expense management solution by:

- Generating and submitting reports automatically;

- The ability to support multiple expense policies and spend limits;

- Eliminates policy violations and fraudulent expenditures

- Analytical reports and intuitive dashboards increase spend visibility

With all of these features, you can save time and money while keeping your employees productive.

Make expenses easy to report and track

Provide your employees with Pluto real-time reporting system where they can track expenses, submit receipts, and report business expenses.

Business expense reports can be updated in real-time using online or smartphone apps, and receipt images can be added for total transparency, if you use digital technology.

Time-stamping and expense classification make it easy to catch fraud, which is beneficial to both you and your employees.

Embrace mobile devices

By scanning receipts and automatically extracting and reporting the key data, Pluto saves your employees' time and improves their expense reporting accuracy.

It makes perfect sense for you to use an app that allows your employees to track expenses easily from their phones since most (if not all) of your employees spend a lot of time on their smartphones.

Set up a routine audit

Ensure that you also incorporate a routine audit process into your business expense report policies. Your expense report should be audited quarterly, biannually, or annually, depending on the number of expenditures your employees incur.

You can catch fraud cases through audits, but you can also understand where the biggest expenditures are and reduce them.

Routine audits can also help you improve management and tracking of your business expenses by letting you know how to refine your reporting process.

Automated expense reporting with Pluto

Pluto allows you to issue virtual cards and physical cards and that immediately solves two things:

- No need for petty cash or out of pocket expenses;

- Real-time reporting of all the incurred expenses;

The spend management system allows you to issues cards for a particular employee, vendor, or even expense type.

It also allows you to set the limits on the go, and see all the expenses in the real-time report. All that, while your employees can easily categorize the expenses and upload the physical receipts just by taking a photo on their mobile device.

Reporting expenses manually is very time consuming, but having them all digitally stored and automatically reported solves the problem.

Key takeaways

Expense reports are a crucial aspect of the financial bookkeeping of any business organization. Not only are they important for knowing how much money is being spent by the company, whether as a whole or for a specific project, but also for the purpose of reimbursing employees for business-related expenses.

Plus, they also help you with budgeting, tax reporting, and cost control measures.

You can easily create an expense report using a premade or personalized template, but you’ll have a much easier time in the long run if you start using Pluto.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use