Contents

A Guide to Improve Internal Control Over Financial Reporting

Mohammed Ridwan

•

•

Internal control over financial reporting (ICFR) refers to the legal obligation of a company to provide accurate financial statements. It requires you to adopt policies and processes that show the true picture of the company's finances. This involves:

- Avoiding errors, fraud, or omissions

- Meeting deadlines

- Reviewing statements regularly.

An example of ICFR is inventory control, which involves maintaining accurate records of the company's goods. This requires adopting practices such as:

- Maintaining documents, such as receipts, shipments, and adjustments

- Segregating duties to different individuals or teams for handling, recording, and verifying inventory

- Matching physical inventory counts with recorded inventory levels

- Valuing inventory in accordance with generally accepted accounting principles (GAAP) principles, such as FIFO, LIFO, or the weighted average method.

These practices minimize the risk of inventory discrepancies and enhance the accuracy of financial statements.

What is the Purpose of ICFR?

ICFR is mandatory as per the Foreign Corrupt Practices Act (FCPA) of 1977 and the Sarbanes-Oxley Act (SOX) of 2002.

FCPA requires public companies to establish and maintain accounting controls. This reasonably ensures that financial statements comply with GAAP.

SOX takes this a step ahead and mandates public companies to assess the effectiveness of ICFR efforts and share the results with the public. Additionally, it demands large companies to get independent auditors for the evaluation.

Why is Internal Control Over Financial Reporting Important?

ICFR’s purpose is not restricted to being a statutory obligation. Here are five reasons why ICFR should be on your priority list:

Accurate Financial Statements

ICFR ensures accurate financial statements that reflect the company's financial position and performance. Such reports enable investors, creditors, and internal management to make informed decisions.

Error Reduction

ICFR emphasizes the use of automation, standardized procedures, and clear documentation. This reduces the risk of errors due to human oversight, saving time and resources.

Preventing Fraud and Misconduct

ICFR employs strategies such as segregation of duties, multiple approvals, and regular audits. This reduces the chances of oversight and ensures employees do not engage in fraudulent activities.

Reliability

Stakeholders (including investors and creditors) rely on financial reports to assess a company's performance. Effective ICFR policies build confidence in the company's financial reports.

Avoiding Costly Errors

ICFR detects errors and discrepancies before they can escalate into expensive matters. This saves significant expenses and protects its long-term viability. For example, identifying accounting errors eliminates the need for financial restatements.

What are the Components of Internal Control Over Financial Reporting?

There are five main components of internal control over financial reporting. These are defined by the Committee on Sponsoring Organizations (COSO) of the Treadway Commission.

These five components are also known as the COSO framework.

Control Environment

The control environment includes the organization's standards, processes, structures, and values. It comprises:

- Ethical values of the organization

- Organizational structure and authority workflow

- Processes to build a competent team

- Focus on performance measurement, incentives and rewards.

These elements create an environment that fosters internal control in the organization.

Risk Assessment

Risk assessment is an agile process for identifying and assessing risks. It involves:

- Identification of potential risks that impact the ICFR efforts. This includes both internal and external risks.

- Evaluation of the potential impact of identified risks. Some risks have a higher likelihood and a greater impact than others.

For instance, an internal risk could be employees intentionally inflating their expense reports to receive higher reimbursements. The potential impact will be financial misstatements if the risk goes undetected.

Control Activities

Control activities refer to the plan of action to address the risks identified during risk assessment. This requires establishing specific policies and procedures, such as:

- Segregation of duties to prevent fraud and collusion

- Controls in information security, application development, and system maintenance

- Implementation of entity-level controls, such as reviewing differences between planned budget and expenditure

- Employing preventive control, such as limited access to IT systems and automated approvals

- Using detective control to identify misstatements via reconciliations and management review controls

One such example would be accounts payable automation to eliminate manual data entry. For instance, an OCR-based automation tool will improve receipt retrieval if there are recurring manual errors.

Information and Communication

Information and communication ensure that key stakeholders know their roles and responsibilities. It involves:

- Defining expectations from each stakeholder in the financial reporting process

- Educating employees on ICFR policies, procedures, and compliance requirements

- Providing channels for reporting concerns and issues related to ICFR.

An example would be communicating reimbursement policies to manage company spending. These rules set clear limits and expectations for employees.

Hence, if the policy says entry-level employees can't claim travel expenses, they should not submit such expenses for reimbursement.

Monitoring Activities

Monitoring activities involve regular review of financial controls and processes to identify and rectify issues. It includes the following steps:

- Review expense reports, receipts, and other data to verify the accuracy.

- Test sample data to ensure that controls are operating as intended.

- Detect unusual patterns or anomalies in the data.

- Verify that employees are following established policies and procedures.

One such example would be reviewing travel expense reports as a part of expense management. It involves verifying receipts and approval compliance. Any detected exceptions trigger investigations and corrective actions.

A Better Way to Manage Internal Control Over Financial Reporting

Setting effective policies for ICFR requires financial data visibility and proper reconciliation processes. Hence, achieving this demands more than policies and procedures.

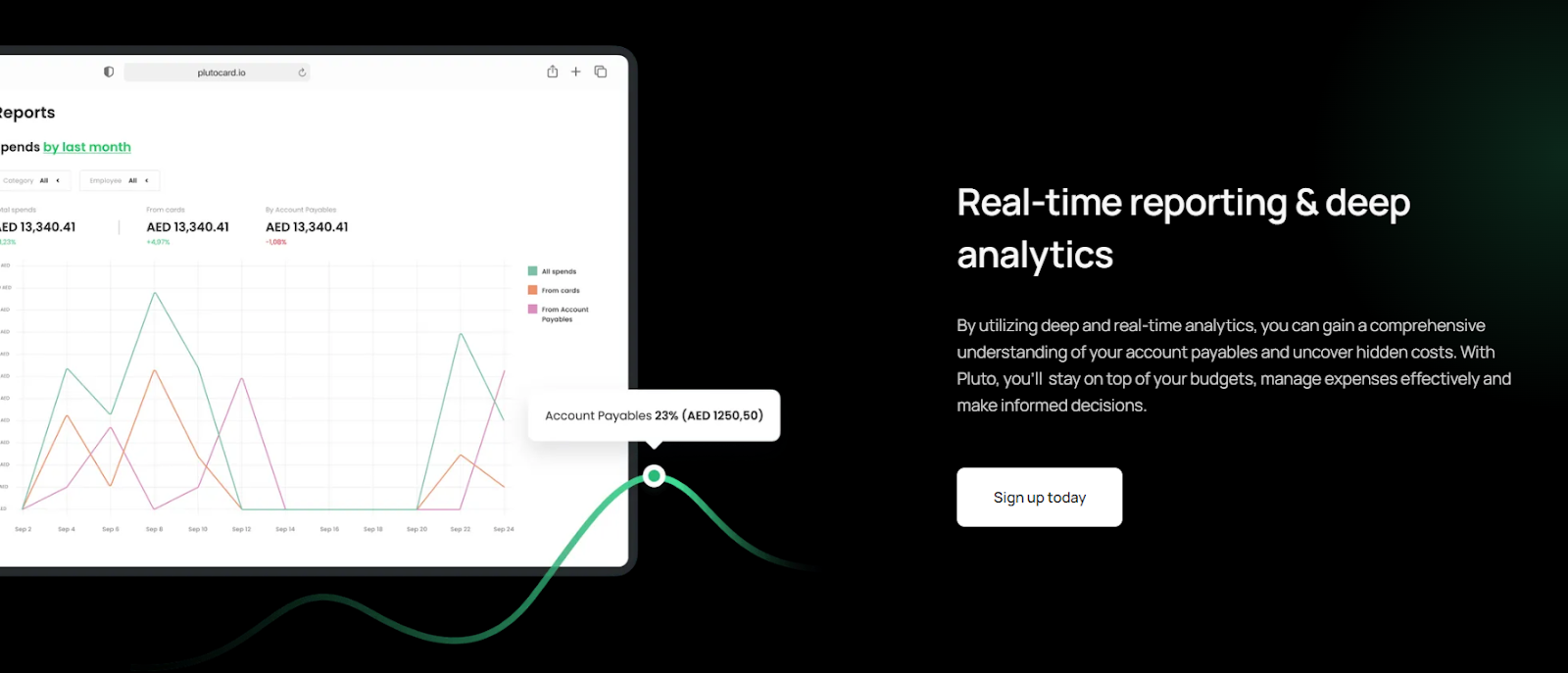

You need software to support operational efficiency transformation. Here is how Pluto offers a helping hand to get better control over your ICFR efforts:

Seamless Financial Reporting

Pluto generates detailed financial reports, providing more accurate and effective financial reporting. You can automate the process of data entry with OCR-based receipt capture. This reduces the manual errors and ensures accuracy.

A multi-layer approval workflow ensures that financial transactions are reviewed and authorized on time. This helps you comply with company policies, enhancing control and accuracy.

The seamless integration with accounting software provides real-time data sync. This keeps the data up-to-date, enabling faster report generation.

Simplify Financial Audit

Pluto centralizes financial data, enhancing auditing capabilities.

Document management becomes simple with the easy uploading and retrieving of financial records. You can bulk download all audit logs and supporting files in a single click. This eliminates the time-consuming task of searching for and gathering individual paperwork.

Pluto's automated systems keep expense records for all financial transactions. As a result, auditors can trace every step of the transaction, ensuring transparency and accuracy.

With end-to-end encryption, Pluto meets bank-grade security standards to safeguard sensitive financial information. This ensures the safety and easy accessibility of financial data.

Accounts Payable Automations

Pluto automates the accounts payable (AP) process to simplify procurement and payments. From purchase request (PR) to goods received notes (GRN) matching, you can streamline the entire AP process.

Multi-layer approval workflows accelerate purchase requests and approvals. The purchase order (PO) process becomes faster with custom workflows and ERP integration.

Pluto automates the entire invoice management process. OCR technology makes it easy to capture and auto-fill invoice details, ensuring accuracy and speed.

Pluto's cash flow management features provide alerts for upcoming payments. This enables you to schedule payments and avoid penalties.

Budget Control

Pluto enables budget control by facilitating spending limits and approval workflows.

Not only can you decide the limit for corporate cards, but also reject an expense if it goes against company policies. In contrast, you can also approve the spending limit for legitimate expenses.

This ensures that employees adhere to predefined budgets. Moreover, this gives your finance teams immediate visibility into spending against budgeted amounts.

ERP Integration

Pluto's ERP integration streamlines vendor management and fosters an efficient control environment.

It imports vendor lists from your ERP and exports them back. This reduces data discrepancies and duplicates, leading to data consistency.

Pluto's dashboard further makes tracking invoices and payments straightforward. This simplifies the payment and reconciliation process, preventing any errors.

Expense Management

Pluto automates and simplifies expense management processes.

Each expense prompts a WhatsApp notification for employees to upload receipts. Administrators and managers also receive notifications to approve expenses. Approved expenses get reimbursed immediately to employees' bank accounts.

This seamless approval workflow ensures proper control and accurate financial reporting.

Go Beyond Statutory Obligations

ICFR is not just a legal compliance. It is a practice to ensure financial visibility and control. While implementing policies and procedures is the main focus, finding the right tools to support your journey will make the process easier.

Pluto automates your financial processes to reduce manual errors and accelerate reconciliation. You close books 10X faster with more confidence.

Book a demo today, and see how Pluto gives you better control and visibility from day one!

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Leen Shami

Corporate Credit Card Policy: What is it & How to Create One

Corporate cards are a great way to manage your spending, control expenses, eliminate petty cash, and, most importantly - give your employees the freedom to focus on their work without any blockages.

But for everything to work smoothly and for everyone to know how to use your corporate cards, you must establish some ground rules.

What is a Corporate Credit Card Policy?

A corporate credit card policy entails the protocols and terms and conditions of use associated with a company credit card issued in an employee's name. A company credit card policy protects businesses and companies from unauthorized payments and inappropriate use by outlining the repercussions and consequences of such actions.

Why Do You Need a Corporate Credit Card Policy?

In the same way, companies have a travel and expense policy; they have a corporate card policy. A company credit card policy is set in place to ensure all company cards are used for authorized and permitted business purchases.

In a corporate credit card policy, the guidelines, responsibilities of the cardholder, dos and don'ts, and repercussions of misuse are outlined. This ensures that all business finances are regulated.

While it is important to have a corporate credit card policy, Pluto takes the extra step to ensure all transactions and purchases are pre-approved, regulated, and permitted by:

- Creating Pluto cards that can only be used with specific vendors

- Setting daily, weekly, or monthly limits on cards

- Having an approval workflow to make sure the necessary departments are approving all transactions

Which Employees are Eligible for a Corporate Credit Card?

It is essential to note which job roles are eligible for a company credit card to protect your business against accusations of favoritism or discrimination.

A company can decide whether all employees, c-suites, or department heads are eligible for corporate credit cards.

Typically, companies only give executives, VP levels, C-suite, and salespeople access to company credit cards. However, there are situations where employees who are not eligible for a company credit card may have to pay for business-related expenses, such as plane tickets. In this case, the employee would ask their manager to pay for such an expense with the corporate credit card, or they will have to pay using their personal credit card or cash and file a reimbursement, which will be reimbursed with the next paycheck.

With Pluto's expense management platform, a company does not have to worry about corporate credit card eligibility or the hassle of employees filing reimbursements.

Using Pluto's platform, the business will have access to unlimited corporate cards, meaning any employee can be issued corporate cards with spend limits, approval workflows, and category-specific purchases. This results in no overspending and knowing all transactions are pre-approved and authorized due to the card only being accepted at allocated vendors.

Suppose an expense is made using cash or a personal credit card. In that case, the employee can snap a picture of their receipt and have it approved on the spot with Pluto's Whatsapp reimbursement feature, making it easier for finance teams and employees to sort through reimbursement receipts!

Components of a Corporate Credit Card Policy

When creating a corporate credit card policy, the credit cards intended to be used, the credit card provider's requirements, and the company's needs should be known.

In most cases, corporate credit card policies include the following points as part of their corporate credit card policy:

1. Employee Credit Card Agreement

When issuing a corporate credit card to employees, an employee credit card agreement must be signed to ensure that employees understand the card belongs to the company, regardless of the employee's name on the card.

The agreement will also state that the company credit cards can only be used for business-related expenses, where the company can investigate charges, if necessary.

2. Permitted Types of Expenses

The types of transactions that can be made should be stated clearly in the company credit card policy: work-related expenses only. These include, but are not limited to:

- Meetings with clients

- Work-related travel (e.g., flight ticket, accommodation)

- Educational material

- Software subscriptions

- Legal document expenses

- Business meals

While tending to the above is a good way to ensure company credit cards are being used for business-related expenses, Pluto offers cards that can only be used for specific vendors, such as fuel cards, to avoid mishaps or fraud.

With these policies and procedures in place, employees should note that if an instance occurs where the company credit card is used for non-authorized transactions, personal expenses, or cash withdrawals, they will be faced with disciplinary action.

The disciplinary action could result in the following:

- Cancellation of the company credit card

- Withdrawal of corporate credit cards privileges

- Recovery of funds from employee's salary

- Termination of employee contract

3. Exceptions

In some cases, an employee cardholder may incur an expense that is not usually permitted under the company credit card policy. To be able to do so, the company credit card policy should indicate how the cardholders can apply for an exception and get permission for such expenses.

While doing so, the company should also outline specific transactions that can never be made using the company credit card.

4. Spend Limits

The spending limits on a company credit card usually depend on the employee's job and level of seniority. The company credit card policy should clarify the card's limits when receiving a new card.

In general, businesses can choose to have limits established based on transactions per-item or on a cumulative basis. However, not all employees will have the same spending limits.

With Pluto, you can set spending limits on virtual or physical cards before issuing them to ensure that employee spending stays within their budget.

5. Temporary and Permanent Limit Increase

To get a limit increase on a company credit card, the cardholder must fill out a form stating why they need a limit increase on their card and whether it is a temporary or permanent limit increase. The form will then have to be signed by the employee's manager and sent to the company credit card provider for processing.

Although it is possible, the process of getting a limit increase on a company credit card may take quite some time. Pluto allows managers, administrators, and finance teams to increase limits on virtual or physical company credit cards in seconds.

6. Approval Requests

A company credit card policy must show how approval requests work when using a corporate credit card. Usually, approvers are responsible for reviewing all transactions regularly. By doing so, the following is warranted:

- The transaction or expense adheres to the company credit card policy

- A receipt is attached to the transaction made

- The description of the transaction follows the details mentioned above

Pluto takes the extra mile to automate approval workflows and receipt reconciliation. With Pluto, all approval requests will be made through the Pluto platform, and receipts will be collected through Whatsapp as soon as a transaction is made.

7. Cardholder Responsibilities

Including the cardholder's responsibilities in the company credit card policy is an essential part of the document. The purpose is to describe how employees can ensure they use their cards appropriately.

It's important to include that:

- Cards cannot be used for personal expenses

- Cards must only be used by the cardholder to help avoid fraud

- Cards and PINs must be stored in a safe place

- Cards must be reported as stolen and lost as soon as possible

- Document all expenses and send monthly reports

8. Policy Violations

Employees are expected to comply with the corporate card policy. If the cardholder violates the terms stated, disciplinary action will be taken against the employee.

The disciplinary action can include:

- Face a written warning for violating the corporate credit card policy

- Pay for the expenses yourself if you've used the card for any inappropriate use

- Lose the right to have a corporate credit card if you lose a receipt or violate the policy

- Suspension or termination of employment if you give the company credit card to unauthorized people or abuse the expense limits

- Loss of company card privileges if expenses are not submitted on time

- Legal action and termination can be imposed if prohibited purchases are made using the company credit card

How Can a Corporate Card Policy Prevent Fraud?

Globalization and remote work have increased the risks of card fraud and identity theft. A proper corporate credit card policy will minimize these risks and ensure that your corporate funds are safe.

1. Flexible limits

With Pluto, it is effortless to set card limits in real-time, so decreasing the spending limit when needed can be done in a matter of seconds. This ensures that a card is not over-exposed. If the card details were compromised, the perpetrator would not be able to withdraw any big sums.

2. Limited users

You can see all the cardholders from your Pluto dashboard and create additional cards if needed. This prevents sharing card details between the employees, as it is simply not needed anymore. The cards are used by authorized personnel, who are aware of the proper use and policies - further preventing any potential fraud and leaks.

3. Vendor-specific cards

Pluto allows you to create a card for a particular transaction, purpose, or project. This will enable you to allocate a certain amount of money that can be spent on the card, meaning the risks of any authorized charges, re-bills, or other online scams are non-existent.

4. No petty-cash

In a bigger organization, petty cash can be an issue as it is easy to defraud. Even when used properly, it is a pain to keep track of. Petty cash is no longer a problem with Pluto corporate cards, particularly when you can issue as many corporate p cards as you need with Pluto seconds (specifically 9 seconds).

The Value of a Corporate Credit Card Policy

Company card policies control employee spending, ensure compliance, and minimize fraud risk. It's even easier to maximize your results by integrating it with Pluto's expense management software.

By integrating with Pluto, you can:

- Issue unlimited corporate cards

- Digitize receipt reconciliation

- Reimburse in seconds

- Review all transactions in real-time

- Approve expenses in an instant

- Minimize the risk of employee fraud

Key Takeaways

A corporate card policy will help you to establish ground rules that will keep things running smoothly but, at the same time, will not limit your employees in their day-to-day work.

Ensure everyone who will have the card is aware of the rules. The great thing about using Pluto is that you can make your corporate card policy very simple, as Pluto has all the tools to manage your spending and keep everything under control.

•

Mohammed Ridwan

Top 6 Expense Management Software for Global Businesses in 2024

You have just received an OTP, and now you are guessing which one of your employees is spending this amount and why. You don’t have time to review it, nor can you delay the payment too much. You neither have control nor visibility. This is the problem of shared corporate cards.

If you want to make it simpler for your employees, invest in expense management software. It is an automation tool to streamline employee-related expenses—reimbursement, petty cash, and corporate cards. In addition, it offers a centralized platform with real-time visibility into how employees spend company money. As a result, the entire cycle of approval and accounting becomes simpler.

In this post, we share the top six expense management software to help you get started.

Top 6 Expense Management Software

Here are six options for expense management software to manage employee-related expenses:

1. Pluto

Pluto is the best platform for managing employee expenses as it streamlines petty cash management, corporate cards, employee reimbursements and account payables. It is trusted by the largest finance and procurement teams in the Middle East, such as Tamara and Petrochem. With Pluto, you can transform reimbursements to get more control and visibility without causing delays or confusion.

Key Features:

- Provides custom no-code approval workflows that adapt to the company's hierarchy for timely and accurate approvals

- Automates receipt capture through optical character recognition (OCR), with the ability to support bulk upload via WhatsApp

- Supports unlimited corporate cards—virtual and physical, with budget controls to maintain expenses within corporate policies

- Offers zero-balance cards, which get funded once the expense is approved

- Ability to add comments and other transaction details to maintain a comprehensive audit log. View-only access is available for external accountants to review financial data without making changes

- Facilitates card-specific policies to make branch and subsidiary-level reimbursements easy

- Gives the option to make mass payments to reimburse employees

- Offers custom expense reports to overview business expenses and spending trends

- Alerts in case of duplicate receipt uploads to avoid fraud and compliance issues

- Integrates with accounting platforms like Netsuite for advanced general ledger (GL) coding and tax tracking

- Provides secure document storage with a five-year audit log and bank-grade encryption

Pricing:

Pros:

- Enables branch and subsidiary-level spend tracking (not offered by other platforms)

- WhatsApp integration to make receipt upload easy

- Offers up to 2% cashback on all non-AED transactions

- Independent PCI DSS Level 1 Certification

Cons:

- Slightly longer onboarding due to a corporate card offering

- Integrates with all other major ERPS except Tally

2. Airbase

Airbase simplifies expense reporting with AI and ML and ensures quick, hassle-free, and smart corporate expense management. It is an automation solution for small to midsize businesses (SMBs) and large enterprises with 100-5,000 employees.

Key Features:

- Offers OCR to populate details, including GL category, date, amount, and purpose

- Ensures compliance by sending reminders and, if needed, locking cards until policies are met

- Facilitates reminders to upload receipts, eliminating the need to chase employees for receipts

- Offers a designated email address to send receipts of virtual card transactions

- Allows custom approval workflows and budget limits for physical cards

- Provides alerts for suspicious activity, enabling quick responses to potential fraudulent purchases

- Enables real-time audit trail with receipts, notes, and documentation for transparency

- Automates expense reimbursements to employees' bank accounts once the expenses are approved

Pricing:

Request the sales team for a custom quote

Pros:

- Flexible to accommodate varying team sizes and user base

- Intuitive and easy to use; no training or previous knowledge required

Cons:

- Slow mobile app; takes time to load pages

- Glitchy SSO-based login

- Not suitable for complex branch-level approvals and expenses

3. Ramp

Ramp is an integrated solution that streamlines expense management with corporate cards, automated expense tracking, and real-time reporting to help teams track expenses. It is a suitable solution for businesses of all sizes.

Key Features:

- Provides corporate cards with the ability to add spending policies to prevent unauthorized or non-compliant expenses

- Facilitates customizable workflows for expense approval

- Enables employees to submit expenses on the go through SMS, mobile app, and integrations with platforms like Gmail and Lyft

- Automates the capture and matching of receipts for every transaction, ensuring accurate expense tracking

- Flags non-compliant expenses, including weekend spend, excessive tipping, and alcohol purchases, reducing the need for manual review

- Provides instant access to real-time spending data, allowing businesses to make timely adjustments before exceeding budgets

- Identifies cost savings opportunities, such as duplicate subscriptions and unused solutions

Pricing:

Offers three pricing packages—free or basic features, $15 per user per month for Ramp Plus, and custom quote for enterprises with features like enterprise ERP integration, custom implementation, and local card issuance.

Pros:

- Unlimited 1.5% cash back on credit card purchases made using their VISA branded cards

Cons:

- Only available to businesses registered in the US

- Doesn’t have a mobile app for Android phones

4. Bill.com

Bill.com simplifies employee expense tracking by providing real-time visibility and customization. It is an expense management solution for SMBs to control all corporate expenses. It streamlines a scattered expense management process with seamless syncing.

Key Features:

- Extends credit limits ranging from $500 to $5 million to control spending within constraints

- Provides custom approval workflows to speed up the approval process with minimal friction

- Offers multiple payment options, including ACH, credit card, check, international wire transfers

- Automates purchase order workflows with the ability to sync and automate two-way matching and three-way matching

- Enables quick coding and sync with accounting systems to streamline expense reconciliation

- Enables automated receipt matching, categorization, and expense reporting, reducing administrative workload

- Offers security features, including the ability to freeze and create corporate cards instantly

- Notifies administrators of each employee's transactions, ensuring timely oversight

Pricing:

Offers a free trial and essentials pack starting at $45 for six standard user roles. Its team and corporate pack are for $55 and $79, respectively. Enterprises need to request a custom quote.

Pros:

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons:

- Customer support is difficult to initiate, slow, and unresponsive

- Glitches in the reimbursement process lead to pending approvals

5. Rydoo

Rydoo is a cloud-based expense management tool that streamlines reimbursement cycles, automates expense flows, and enhances team productivity. It combines the capabilities of an expense tracker and a travel service, enabling you to book flights and hotels. It is suitable for medium-sized businesses that are building international relationships with overseas offices as it supports multiple languages and currencies.

Key Features:

- Supports OCR scanning feature for receipt management

- Automates approval flows for expenses based on company policies

- Assures global compliance by setting up rules, mileage rates, per diems, and tax rates for specific countries and regions. Also provides an advanced rule engine for tailored policies in the admin panel.

- Reimburses employees in their local currency, supporting diverse international operations

- Integrates with popular third-party apps like Dropbox, Slack, Uber, Lyft, and SAP

- Supports accounting software widely used in the European Union, such as Exact Online and E-conomic

- Offers full audit trails for maintaining company policies, IRS compliance, and resource conservation with a 10-year data storage period

Pricing:

Offers a team plan at €8 per user per month with OCR scanning and integrations, growth plan at €10 per user per month adding controls and SAP/Oracle integrations, and enterprise plan with API support and custom pricing for ERP and HR

Pros:

- Makes it easier to add expenses in different currencies and get paid in local currency with multi-currency support

Cons:

- Increases in prices over time leading to significant cost jumps over the years (Source)

- OCR doesn’t work efficiently and requires manual entry

6. Zoho Expenses

Zoho Expense is a travel and expense management solution designed to cater to the needs of growing businesses. Trusted by thousands of businesses across 150+ countries, it is a customizable expense-tracking tool offering a mobile-first approach, automation, and integration capabilities. Its integration with the Zoho suite makes it suitable for SMBs seeking efficient travel and expense management.

Key Features:

- Provides complete control over all stages of employees' business trips—pre-travel approvals, bookings, and post-travel management with a powerful self-booking tool for efficient business travel

- Offers customization and multi-level pre-travel approval flows along with automated visa requests, documentation, and forms

- Supports expense reporting by auto-scanning receipts for automatic expense creation

- Enables simplified approval processes and timely reimbursements

- Integrates with company cards to offer direct card feed retrieval and automated reconciliation

- Facilitates budget creation and comparison with actual spending with customizable rules to restrict overspending

- Provides AI-driven fraud detection for expense audits with country-specific editions for local compliance and mileage rates

- Supports real-time communication with employees through chat, comments, and notifications

- Integrates with leading travel, HRMS, accounting, ERP, and collaboration solutions

Pricing:

Offers flexible pricing plans, starting with a free option and scaling up to $3 per active member per month, $5 per active member per month, and custom enterprise pricing

Pros:

- Adaptable to global taxation regulations

- Easy to set up and deploy, very affordable for SMEs

Cons:

- Limited payment gateway integration options

- Can be a little confusing to learn especially when transitioning from app to desktop

Finding the Right Expense Management Solution

Consider these three factors while choosing the right expense management software — ease of use, security, and flexibility. Choosing the right expense management software can help you start your journey towards a healthy financial ecosystem.

In the end, what matters are your internal policies and controls that govern the expenses. Because no matter what platform you choose, if there are gaps in your internal control systems, the software will not be able to do the heavy lifting.

If you want more clarity on how you can stop the chaos in your company and manage expenses better, read our detailed post on internal control over financial reporting (ICFR). You can also book a call, and our team will help you better understand the bottlenecks and how you can streamline your expense management.

•

Mohammed Ridwan

How to Write a Petty Cash Policy in Four Easy Steps (With Template)

Here’s the difference between a vague and a specific petty cash policy:

Vague: Petty cash can be used for any business-related expenses as needed upon approval.

Specific: Petty cash is used for small, incidental business expenses, such as office supplies, minor equipment purchases (up to $100), business-related meals and entertainment (up to $25 per occurrence), and travel expenses (e.g., tolls, parking fees).

Companies often set vague policies or leave them to employee understanding; after all, having petty cash is about flexibility and saving time. The entire petty cash system sits on the foundation of trust, where a missed receipt isn’t considered a big deal.

However, as the business grows, these missing documents, owing to a lack of structure, cause monetary setbacks and disrupt operations. The finance team pursues the employees for receipts, and the employees struggle to get them submitted on time and the budget goes off the charts.

{{take-pain-banner="/components"}}

What is a Petty Cash Policy?

A petty cash policy is a set of guidelines that govern the management and usage of small amounts of cash for nominal business expenses. It outlines the purpose, authorized expenses, and recordkeeping and replenishment procedures for the petty cash fund.

Suppose an employee wants to purchase office supplies. With proper documentation and approval, a policy in place can restrict the use of cash for office supplies and minor expenses up to $50 only. After all, petty cash should be used only when absolutely necessary, for all other larger purchases it is better to use corporate purchasing cards.

Hence, structured petty cash policies and procedures help the business track and control all expenses with proper recordkeeping, enhancing accountability and petty cash management.

4-Step Process to Set Petty Cash Policy and Procedures

Before you set up policies and procedures, assess the need for petty cash and the types of expenses you will cover. This study will become the foundation for your guidelines and provide an estimated figure for petty cash funds.

For example, a transport business’s petty cash expenses include fuel for vehicles, tolls, minor vehicle repairs, and possibly small office supplies for administrative needs. However, a property investment company’s petty cash expenses include office stationery, postage, property maintenance supplies, and likely local travel expenses for property visits or inspections.

Hence, the nature of petty cash expenses will vary based on your business’s specific needs and operations.

Once these fundamentals are clear, you can set your petty cash policies and procedures by following the steps mentioned below.

1. Get Inputs From the Finance Team

Collaborate with the finance team to discuss current processes and challenges. Understand the gaps in existing systems and get feedback for potential improvements and best practices.

For instance, if the finance team struggles with frequent delays in providing employees with adequate cash on time for urgent expenses, you can establish guidelines that they can follow for such instances.

Another common instance is that the finance team struggles with frequent delays in employee reimbursement due to unclear approval processes. You can establish a streamlined approval hierarchy in the policy. It involves specifying designated approvers and setting clear timelines for reimbursement requests, ensuring timely resolution.

Additionally, discuss compliance requirements to create a framework that ensures legal and regulatory standards adherence. This can include provisions such as documenting receipts and carefully reporting cash transactions above a certain threshold to comply with company reporting & auditability requirements.

2. Define Procedures

Create a comprehensive document outlining the workflow of petty cash transactions, including authorizations and documentation.

Define the approval process, specifying who needs to approve different transaction amounts. For instance, your approval policy could look like this:

The routine office supplies purchases under $20 require immediate department supervisor approval, larger expenditures for equipment up to $100 need approval from the finance manager, and any expenses exceeding $100 require executive-level authorization.

Similarly, create a standardized process and template for documenting each transaction, including separate fields for date, amount, purpose, and signatures. Additionally, you could add guidelines, such as submission of a receipt within a week. These measures further help you strengthen the structure and avoid any hassle.

3. Specify Controls

Once all the fundamental procedures are defined, you set the rules for operating your petty cash system to ensure proper control. Here are some examples:

“If the petty cash fund balance falls below 20% of the initial amount, the designated custodian is responsible for submitting a replenishment request to the finance department. The replenishment should be completed within two business days to ensure the continuous availability of the petty cash fund for essential business needs.”

“Authorized petty cash transactions for office supplies are limited to $25 per occurrence, while minor miscellaneous expenses are limited to $15. Any transactions exceeding these limits require prior approval as per the designated approval process outlined in this policy.”

“To ensure transparency and accountability in the management of petty cash funds, a policy of custodian rotation will be implemented. Every quarter, a new employee will be assigned the responsibility of a petty cash custodian. The outgoing person must provide a comprehensive handover to the incoming custodian to maintain continuity and accuracy in fund management.”

4. Communicate and Review

Share the new petty cash policy with relevant stakeholders and conduct training sessions for employees involved in petty cash transactions.

To assess the effectiveness, establish a monthly audit schedule, in addition to petty cash reconciliation, where the designated team member will verify the log, review the completeness and accuracy of documentation, confirm that the approval process has been followed, etc.

The audit will help you identify potential loopholes, allowing you to modify the policy and procedure for effective petty cash management.

In addition to these audits, implement a tracking system, such as a spreadsheet or an expense management platform, to monitor expenses. While the spreadsheet is a cost-effective solution, a dedicated automation platform will make tracking petty cash in real time easier with complete visibility. Moreover, you will have many more controls and features to oversee your petty cash without spending hours maintaining logs and Excel spreadsheets.

Template for Setting Petty Cash Guidelines

Modify this template and include specific petty cash guidelines to suit your business needs:

Petty Cash Policy and Procedures

1. Purpose

The purpose of this document is to provide clear guidelines for the establishment, management, and usage of the petty cash fund within [Company Name]. The petty cash fund is intended for minor, day-to-day business expenses, facilitating the quick and efficient processing of small transactions.

2. Custodian

The finance department will manage the petty cash fund, with [Designated Employee] serving as the petty cash custodian. The custodian is responsible for secure cash handling, accurate record-keeping, and compliance with company policies.

3. Petty Cash Fund Amount

The initial petty cash fund is set at [Enter Amount], subject to review annually or as business needs dictate. Any adjustments to the fund require approval from [Finance Manager/Authorized Approver].

4. Replenishment

When the petty cash fund balance drops to [Enter Minimum Amount], the custodian must submit a replenishment request to [Finance Manager/Authorized Approver]. These requests should include original receipts and a summary of expenditures.

5. Authorized Petty Cash Expenses

The following types of expenses are authorized for petty cash disbursement:

- Office supplies (e.g., pens, notepads)

- Small equipment purchases (under [Enter Amount])

- Minor business-related meals and entertainment

- Travel expenses (e.g., tolls, parking fees)

6. Unauthorized Expenses

Petty cash funds should not be used for personal expenses, cash advances, or any expenditures unrelated to official business activities. Any unauthorized expenses must be reimbursed by the individual responsible.

7. Recordkeeping

The custodian will maintain a dedicated petty cash log. Each entry should include:

- Date of transaction

- Vendor or payee

- Description of the expense

- Amount

- Receipt verification

8. Receipts

Original receipts for all petty cash transactions must be submitted promptly. Receipts should be attached to the petty cash log and clearly show the date, amount, and nature of the expense.

9. Auditing

The finance department will periodically conduct surprise audits on the petty cash fund to ensure compliance. The custodian is responsible for facilitating the audit process and addressing any discrepancies.

10. Reporting

A monthly summary of petty cash transactions, including the remaining balance and any discrepancies, will be provided to the finance manager. Any significant issues or concerns should be reported immediately.

11. Policy Review

This policy will be reviewed annually by [Finance Manager/Authorized Approver] to assess its effectiveness and relevance. The petty cash custodian can recommend adjustments or issue an official request.

Approval:

[Signature] [Date]

[Name, Title]

[Finance Manager or Authorized Approver]

[Company Name]

Implementing a Foolproof Petty Cash System

To establish a dependable petty cash system, collaborate and automate. Stay in close connection with the finance team to gather feedback and insights. Use solutions like spend management software to automate the petty cash system and get real-time visibility. They provide more structure to your petty cash management and simplify workflows for employees.

In one of our posts, we have covered more about petty cash management and how you can automate it. It will help you understand the nuances and efficiently manage your petty cash.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use