Contents

How to Write a Petty Cash Policy in Four Easy Steps (With Template)

Mohammed Ridwan

•

•

Here’s the difference between a vague and a specific petty cash policy:

Vague: Petty cash can be used for any business-related expenses as needed upon approval.

Specific: Petty cash is used for small, incidental business expenses, such as office supplies, minor equipment purchases (up to $100), business-related meals and entertainment (up to $25 per occurrence), and travel expenses (e.g., tolls, parking fees).

Companies often set vague policies or leave them to employee understanding; after all, having petty cash is about flexibility and saving time. The entire petty cash system sits on the foundation of trust, where a missed receipt isn’t considered a big deal.

However, as the business grows, these missing documents, owing to a lack of structure, cause monetary setbacks and disrupt operations. The finance team pursues the employees for receipts, and the employees struggle to get them submitted on time and the budget goes off the charts.

{{take-pain-banner="/components"}}

What is a Petty Cash Policy?

A petty cash policy is a set of guidelines that govern the management and usage of small amounts of cash for nominal business expenses. It outlines the purpose, authorized expenses, and recordkeeping and replenishment procedures for the petty cash fund.

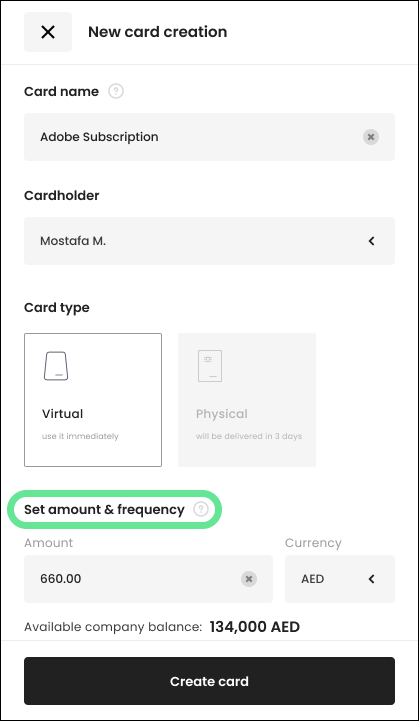

Suppose an employee wants to purchase office supplies. With proper documentation and approval, a policy in place can restrict the use of cash for office supplies and minor expenses up to $50 only. After all, petty cash should be used only when absolutely necessary, for all other larger purchases it is better to use corporate purchasing cards.

Hence, structured petty cash policies and procedures help the business track and control all expenses with proper recordkeeping, enhancing accountability and petty cash management.

4-Step Process to Set Petty Cash Policy and Procedures

Before you set up policies and procedures, assess the need for petty cash and the types of expenses you will cover. This study will become the foundation for your guidelines and provide an estimated figure for petty cash funds.

For example, a transport business’s petty cash expenses include fuel for vehicles, tolls, minor vehicle repairs, and possibly small office supplies for administrative needs. However, a property investment company’s petty cash expenses include office stationery, postage, property maintenance supplies, and likely local travel expenses for property visits or inspections.

Hence, the nature of petty cash expenses will vary based on your business’s specific needs and operations.

Once these fundamentals are clear, you can set your petty cash policies and procedures by following the steps mentioned below.

1. Get Inputs From the Finance Team

Collaborate with the finance team to discuss current processes and challenges. Understand the gaps in existing systems and get feedback for potential improvements and best practices.

For instance, if the finance team struggles with frequent delays in providing employees with adequate cash on time for urgent expenses, you can establish guidelines that they can follow for such instances.

Another common instance is that the finance team struggles with frequent delays in employee reimbursement due to unclear approval processes. You can establish a streamlined approval hierarchy in the policy. It involves specifying designated approvers and setting clear timelines for reimbursement requests, ensuring timely resolution.

Additionally, discuss compliance requirements to create a framework that ensures legal and regulatory standards adherence. This can include provisions such as documenting receipts and carefully reporting cash transactions above a certain threshold to comply with company reporting & auditability requirements.

2. Define Procedures

Create a comprehensive document outlining the workflow of petty cash transactions, including authorizations and documentation.

Define the approval process, specifying who needs to approve different transaction amounts. For instance, your approval policy could look like this:

The routine office supplies purchases under $20 require immediate department supervisor approval, larger expenditures for equipment up to $100 need approval from the finance manager, and any expenses exceeding $100 require executive-level authorization.

Similarly, create a standardized process and template for documenting each transaction, including separate fields for date, amount, purpose, and signatures. Additionally, you could add guidelines, such as submission of a receipt within a week. These measures further help you strengthen the structure and avoid any hassle.

3. Specify Controls

Once all the fundamental procedures are defined, you set the rules for operating your petty cash system to ensure proper control. Here are some examples:

“If the petty cash fund balance falls below 20% of the initial amount, the designated custodian is responsible for submitting a replenishment request to the finance department. The replenishment should be completed within two business days to ensure the continuous availability of the petty cash fund for essential business needs.”

“Authorized petty cash transactions for office supplies are limited to $25 per occurrence, while minor miscellaneous expenses are limited to $15. Any transactions exceeding these limits require prior approval as per the designated approval process outlined in this policy.”

“To ensure transparency and accountability in the management of petty cash funds, a policy of custodian rotation will be implemented. Every quarter, a new employee will be assigned the responsibility of a petty cash custodian. The outgoing person must provide a comprehensive handover to the incoming custodian to maintain continuity and accuracy in fund management.”

4. Communicate and Review

Share the new petty cash policy with relevant stakeholders and conduct training sessions for employees involved in petty cash transactions.

To assess the effectiveness, establish a monthly audit schedule, in addition to petty cash reconciliation, where the designated team member will verify the log, review the completeness and accuracy of documentation, confirm that the approval process has been followed, etc.

The audit will help you identify potential loopholes, allowing you to modify the policy and procedure for effective petty cash management.

In addition to these audits, implement a tracking system, such as a spreadsheet or an expense management platform, to monitor expenses. While the spreadsheet is a cost-effective solution, a dedicated automation platform will make tracking petty cash in real time easier with complete visibility. Moreover, you will have many more controls and features to oversee your petty cash without spending hours maintaining logs and Excel spreadsheets.

Template for Setting Petty Cash Guidelines

Modify this template and include specific petty cash guidelines to suit your business needs:

Petty Cash Policy and Procedures

1. Purpose

The purpose of this document is to provide clear guidelines for the establishment, management, and usage of the petty cash fund within [Company Name]. The petty cash fund is intended for minor, day-to-day business expenses, facilitating the quick and efficient processing of small transactions.

2. Custodian

The finance department will manage the petty cash fund, with [Designated Employee] serving as the petty cash custodian. The custodian is responsible for secure cash handling, accurate record-keeping, and compliance with company policies.

3. Petty Cash Fund Amount

The initial petty cash fund is set at [Enter Amount], subject to review annually or as business needs dictate. Any adjustments to the fund require approval from [Finance Manager/Authorized Approver].

4. Replenishment

When the petty cash fund balance drops to [Enter Minimum Amount], the custodian must submit a replenishment request to [Finance Manager/Authorized Approver]. These requests should include original receipts and a summary of expenditures.

5. Authorized Petty Cash Expenses

The following types of expenses are authorized for petty cash disbursement:

- Office supplies (e.g., pens, notepads)

- Small equipment purchases (under [Enter Amount])

- Minor business-related meals and entertainment

- Travel expenses (e.g., tolls, parking fees)

6. Unauthorized Expenses

Petty cash funds should not be used for personal expenses, cash advances, or any expenditures unrelated to official business activities. Any unauthorized expenses must be reimbursed by the individual responsible.

7. Recordkeeping

The custodian will maintain a dedicated petty cash log. Each entry should include:

- Date of transaction

- Vendor or payee

- Description of the expense

- Amount

- Receipt verification

8. Receipts

Original receipts for all petty cash transactions must be submitted promptly. Receipts should be attached to the petty cash log and clearly show the date, amount, and nature of the expense.

9. Auditing

The finance department will periodically conduct surprise audits on the petty cash fund to ensure compliance. The custodian is responsible for facilitating the audit process and addressing any discrepancies.

10. Reporting

A monthly summary of petty cash transactions, including the remaining balance and any discrepancies, will be provided to the finance manager. Any significant issues or concerns should be reported immediately.

11. Policy Review

This policy will be reviewed annually by [Finance Manager/Authorized Approver] to assess its effectiveness and relevance. The petty cash custodian can recommend adjustments or issue an official request.

Approval:

[Signature] [Date]

[Name, Title]

[Finance Manager or Authorized Approver]

[Company Name]

Implementing a Foolproof Petty Cash System

To establish a dependable petty cash system, collaborate and automate. Stay in close connection with the finance team to gather feedback and insights. Use solutions like spend management software to automate the petty cash system and get real-time visibility. They provide more structure to your petty cash management and simplify workflows for employees.

In one of our posts, we have covered more about petty cash management and how you can automate it. It will help you understand the nuances and efficiently manage your petty cash.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Vlad Falin

Employee Expense Reimbursement Management: Types & Policies

Business expense reimbursement is one area of spend management that business owners do not always give its due. And yet, nearly every organization will have to reimburse employees for their expenses at some point.

Part of the problem is that these expenses can vary significantly, from buying office supplies to traveling or even medical costs. If your business deals with many types of expense reimbursements, you might wonder what you need to cover and how you should handle it.

If you’ve had trouble working out your organization's different business expense reimbursements, or you want to learn more about repayments, you’ve come to the right place.

Today, we’ll take a look at the different types of business expense reimbursements and even share some tips to help you streamline your expense reimbursement process.

{{reimburse-employees="/components"}}

What is expense reimbursement?

A business expense reimbursement is simply the act of paying back an employee for expenses incurred while performing a job for your organization.

Technically, almost any type of expense can qualify as a business expense for the purpose of reimbursement, depending on the reimbursement policies of the business. But to give you a clearer idea, here are some common examples of reimbursable expenses:

- Business travel costs

- Meals and entertainment

- Employee education or training

- Medical expenses

- Gas expenses for a company-issued or private vehicle

- Business supplies or tools

- And other miscellaneous business-related expenses

You could handle these expense reimbursements individually, meaning you review each expense separately, or you could create a policy for employee expense reimbursement.

{{effortlessly-manage-banner="/components"}}

Do I Need to Have an Expense Reimbursement Policy?

You are not required to have an expense reimbursement policy, and in some cases, reimbursing expenses is not even mandatory to begin with. Though that largely depends on the legal framework of your country.

However, since it is customary in the UAE and the MENA region to reimburse employees for expenses, then it would be wise to create guidelines and policies to help you organize and streamline that process.

Creating a policy for reimbursements helps set the right expectations for employees about what qualifies for repayment and enables you to streamline your expense reimbursement process.

With an expense reimbursement policy, your employees will know precisely what they can be reimbursed for, how to request said reimbursement, and how long it would take to receive the funds.

Whether you have a business reimbursement policy or not, you need to have a clear picture of which expenses your employees might incur for your business and how you would go about reimbursing them.

- Is the expense tax deductible?

- Is this a common type of business expense in your industry?

- Do you have a policy in place for this expense?

- Are there any types of emergency purchases that an employee might need to make?

Types of expense reimbursements

Traveling and accommodation

One of the most common types of reimbursement requests is for travel expenses. Gas has been a particular pain point for many businesses in the MENA region due to the rising costs of fuel. Other examples of travel expenses include moving to and from an airport or travel terminal, travel tickets, public and private transportation expenses, car rentals, and lodging.

Office supplies and communication

If your organization relies heavily on digital work, you might need to reimburse your employees for supplies like laptops, tablets, software purchases or subscriptions, training materials, and more.

Also, if your team needs to move around frequently and you need to maintain communication at all times, reimbursing them for their cell phone plans might be necessary. In particular, this applies to teams in sales, marketing, and business development.

Food and entertainment

Business trips typically cover employee meals as reimbursable expenses. As long as the expenses are incurred in the interest of the business, they’re reimbursable.

Other expenses

Medical expenses, such as health insurance, insurance premiums, and tuition, are another form of employee expense that is often reimbursed by companies. If your business deals with these types of expenses, make sure you have a clear policy for handling them.

8 tips to simplify your expense reimbursements

1. Learn what you need to reimburse

Although the legalities of employee reimbursements vary from country to country, it’s traditionally customary for employers to reimburse their employees for expenses incurred on behalf of the company.

It is important to note, however, that your employees cannot claim reimbursements for every purchase made, only those that are specifically tied to your business in some form.

While the specific type of expenses you have to reimburse will vary from industry to industry, you should have a general idea of what costs an employee might have to cover out of pocket in the process of working for you.

- Do they need to travel around in their own vehicle?

- Do you need them to be communicated at all times?

- What kind of equipment do they require?

- Are there any health risks associated with their job?

These types of questions can help you figure out which expenses you will have to deal with. Clear guidelines about what is and isn’t reimbursable will help reduce instances of fraudulent reimbursement requests.

2. Use a spend management platform

With the right expense management software, you would be able to automate and optimize end-to-end workflows throughout your process.

For instance, with a spend management platform like Pluto, employees can use a mobile app to record expenses as they incur them.

In this way, your employees no longer have to save receipts or wait before entering their expenses. Plus, Pluto can automatically assign reports to the right reviewer, making the review and approval process more efficient.

Not only that, but Pluto can also tag the receipt so the categorization of the expense is much easier and reporting is real-time.

In addition to providing digital copies of relevant documents, Pluto can notify your finance team of approvals and deadlines.

3. Spend management platforms enhance collaboration

Pluto’s expense management solutions come with an employee portal so that your finance team can collaborate seamlessly with your employees.

This allows you to save time when you need to discuss any irregularities with their expense reports. Additionally, your employees can use Pluto to check the status of their reimbursement requests.

The finance team can also use Pluto to manage costs more efficiently due to its analytical capabilities, real-time reporting and instantaneous spend limit settings.

4. Create a Thorough Expense Reimbursement Policy

When creating your reimbursement policy, you’ll want to make sure that it covers as many angles as possible.

One way to do so is to invite stakeholders from multiple different departments, such as HR, finance, legal, and procurement, to a brainstorming session, as their knowledge will make it easier to draft the policy.

5. Crafting your reimbursement policy

It’s also critical to consider the following when drafting your expense reimbursement policy:

- The specific type of expenses that can be reimbursed

- The process your employees need to follow to submit their expenses, including any proof and supporting documentation

- Whether any allowances will be given for expenses, and how to manage any excess

- The specific time an employee has to submit their expense report

- How the approval process will be handled

- When and how your employees are reimbursed

6. Promote the adoption of the policy

One way to help employees adopt the policy more quickly is by making it readily available to them. The policy should be emailed to your employees or posted on your internal networks.

Employees should be informed when they will receive their payment from the company. You should set up a transparent and clear process to communicate what can be expected in terms of expense reimbursement.

7. Be extra clear about deadlines and payments.

Be sure to let them know how they will receive the payment, such as via direct deposit or check, as well as how they will receive recorded confirmation of the payment made (such as a statement on their paycheque). You can complete this step easily with the help of an online payroll solution.

It is important to keep things running smoothly when it comes to paying employees. By processing reimbursements timely and reliably, you can easily prevent frustration caused by late payments.

Having your employees pay out of their own pockets and not receiving payment back sooner rather than later can cause unnecessary ill feelings toward your company. When you handle reimbursements well, it reflects back on you as a respectable and considerate employer who cares about employees.

8. Make sure your employees follow the deadlines you set

You need to provide employees with deadlines for submitting expense reports, such as one week before their next pay date, so they can be reimbursed and get approval for their claims.

Make sure the expense reports comply with the policy guidelines by giving yourself enough time to review them. By doing so, you can consult with the employee if there are any discrepancies, missing or incomplete documentation, or expenses that do not fall within the policy.

It’s important to submit expense reports on time since certain business expenses are tax deductible.

Optimize your expense reimbursement management process

It’s not enough to know what your expenses are and to create a policy for their reimbursement.

You also need to make sure that your reimbursement process is organized and efficient.

Otherwise, you run the risk of creating bottlenecks if you get slammed by more requests than you can handle. You can avoid this by optimizing the process used to submit reports and their attachments, ensuring all reports are reviewed in a timely manner and processing reimbursements as quickly as possible.

Having put all of this in place, it’s now time for the audit. The importance of audits is particularly important for enterprises and mid-size firms where employees incur large expenses. Auditing your expense reports also helps you identify loopholes in your policy and reduce instances of fraudulent claims.

You can also use audits to analyze your business expenses and identify areas for reduction.

Ensure there is an organized system for expense reimbursement requests

You should ensure that the system your employees need to use to submit their expense reports is easy to use and understand.

Pluto allows the employee to submit all necessary supporting documentation, such as their receipt, the total amount of the purchase, a description of the goods or services purchased, and the date of the transaction.

Use a corporate card or direct deposits to remove the need for reimbursements

A corporate p card is a great way to prevent employees from paying out-of-pocket for business expenses.

You can track your expenses more efficiently and effectively with corporate cards, which provide spending limits that prevent employees from abusing their privileges.

Consider issuing corporate cards only to your regular travelers, or try direct deposits if you’re concerned about the cost.

Alternatively, you can also use direct deposits of reimbursement funds to eliminate the reimbursement process.

Two benefits result from this: One great perk of following either process is that your finance teams will have better visibility into the reimbursement process, making auditing employee expenses easier.

Key Takeaways

- The best way to deal with business expense reimbursements is to have a rock-solid reimbursement policy in place. This way, you can reimburse employees for their costs on your terms.

- Another great way to manage your expenses is to make use of a corporate card to eliminate the reimbursement process altogether, though this might not be feasible for all cases.

- As in many situations, your best option will most likely come in the form of digitization. Using a spend management platform like Pluto, will not only give you much better visibility over your employee spending but also streamline the reimbursement process for you.

.jpg)

•

Vlad Falin

The Complete Travel and Expense (T&E) Management Guide

Travel and expense management is crucial for ensuring that business-related travel expenses are kept in check. However the accurate collection and reporting of all travel-related expenses pose a significant challenge.

As the person in charge of managing your organization's finances, you should be obsessed with making all expense management as efficient as possible in order to save money.

But how can you simplify the travel and expense management process when there are so many moving parts and people involved? By using the right tools for the job.

In this guide, you’ll learn the importance of having a good travel and expense management policy, how to make your T&E management more efficient, and what to look for in travel and expense management software.

What is travel and expense management?

Travel and Expense (T&E) management is the process companies follow to monitor and control business travel expenses. T&E management is vital as it affects the company's financial well-being directly by ensuring all travel-related expenses are tracked for tax deduction purposes.

T&E management involves tracking and controlling expenditures such as flights, accommodation, meals, and client entertainment. Effective T&E management ensures that these costs are necessary, reasonable, and aligned with the organization's policies and goals. This management is particularly vital as travel and entertainment expenses can quickly accumulate and become significant financial commitments for businesses.

Why is travel and expense management important?

As a finance professional, you know that cost management and expense reduction are crucial aspects of financial management work. One of the ways you can do this is by tracking all deductible expenses for tax reduction purposes.

And when it comes to the hierarchy of expenses you need to keep track of, those related to corporate travel and entertainment are of particular importance.

According to Mastercard, corporate travel and entertainment expenses have become the second-highest expense category.

But not only does T&E account for a large portion of the business expenses that companies have to deal with, but it’s also been identified as the second most difficult operating cost to control.

That’s why it’s so important that your organization develops and maintains effective T&E management policies, and uses the tools available to simplify T&E management.

The challenges of travel and expense management

Managing travel and expense (T&E) can be a complex task, often fraught with a range of challenges. These challenges can significantly hinder the efficiency and effectiveness of an organization's T&E process. Key challenges include:

1. Limited Fund Access: Employees often face constraints in accessing funds for travel-related expenses, which can lead to delays and complications.

2. Security Risks: The management of expenses, especially in a digital format, raises concerns regarding data security and the risk of financial fraud.

3. Outdated Policies: An organization's T&E policies may become obsolete or fail to align with current business needs and practices, leading to inefficiencies and policy breaches.

4. Lost Reports: Misplaced or lost expense reports can disrupt the reimbursement process, leading to employee dissatisfaction and administrative headaches.

5. Inefficient Bookkeeping: Manual and outdated bookkeeping methods can result in errors and inefficiencies, making it difficult to track and manage expenses accurately.

6. Lack of Spending Visibility: Without clear visibility into T&E spending, organizations struggle to control costs and make informed budgetary decisions.

7. Slow Reimbursement Process: Delays in processing reimbursements can demotivate employees and hinder efficient financial management.

How to make travel and expense management process efficient

1. Review your travel expenses and reimbursements

One of the first things you should do is take a look at your current travel expenses to see if there are any changes to be made.

Business travelers will always need to take trips, but perhaps there are some interactions that could be handled via videoconferencing.

You can also look for ways to minimize the expenses that need to be reimbursed. For instance, by using Pluto corporate cards, you could help eliminate, or at least reduce, the need to reimburse food expenses while giving you better control over them.

2. Examine your travel policy and keep it simple

If you are having trouble with your T&E management, you should take a look at your current travel policies (and if you don’t have one already, you should make that your top priority).

Your T&E policies need to strike a balance between flexibility and strictness. Too flexible and you create waste; too rigid and you limit the ability for people to do their jobs.

A good T&E policy should include the following:

- How travel will be booked

- The process to follow for reimbursement (including what type of supporting documentation is necessary, due dates, and other stipulations).

- Any budget or spending limits, including the specific transportation methods or hotels that can be used.

- Meal allowances.

And you want to keep your policy simple and easy to read. Minimize the jargon, use short paragraphs, and a simple format with bullet points, tables, and clear headings.

You should continuously review your expense policy, particularly as your business expands, to ensure that it’s aligned with any changes in your organization.

3. Go paperless

Your team should be able to access your expense policy from anywhere and at any time. But more than that, you should aim to digitize the expense report process as much as possible.

For instance, implement the ability to submit digital expense reports and capture receipts digitally. Not only will this allow you to get a clearer view of your operations at all times, but it will help simplify your bookkeeping and easily manage receipts.

Pluto has this function!

4. Use travel expense management software

Through effective use of travel and expense management systems, you can consolidate the different scaffolds in your expense process, automate them, and eliminate time-consuming approvals while minimizing, or outright eliminating, human error.

Using Pluto allows you to cut a lot of the fat out of the reimbursement process. Automate reports, data gathering, and approvals for expenses that meet your policies, leaving only those that don’t meet your policies for manual approval.

Furthermore, it can help you detect fraud by auditing your reports for duplicate expenses and any other anomalies.

And through software integration, you can use these different tools to create a unified T&E management process.

5. Top solutions for travel and expense management

There are many tools you can use to make your T&E management more efficient, for instance:

- Pluto Card allows you to issue unlimited virtual cards, create travel specific card limits monitor spending in real-time and most importantly, it allows your employees to reimburse quickly!

- A travel expense tracker can provide you with automated expense reporting and expense tracking.

- You can use a travel management platform that allows your employees to book flights, trains, and hotels and even rent cars from one place.

- Pluto mobile app makes the expense reporting process much simpler for your employees.

- You could take data from Pluto and travel management system directly into your accounting platform to further automate and simplify the T&E management process.

Expense management software for T&E management

One of the best ways to simplify your travel and expense management is by making use of the right T&E management software. However, with the increasing amount of options available, knowing which one fits your company best can be difficult.

Since no two businesses are exactly the same, there won’t be a one-size-fits-all solution. Having said that, you’ll have an easier time choosing between the different options by focusing on the specific features that you need, or at least should consider, in a T&E management platform.

Key features to look for in a travel and expense management software

1. Virtual cards

Pluto gives you the ability to create virtual cards for online purchases. These cards can be generated as single-use or recurring, giving you complete control in terms of how you set up your spending limits.

Virtual cards offer you similar benefits to corporate cards, in the sense that you get full visibility of your expenses and your employees don’t have to pay upfront, but they have the added benefit of being more customizable.

2. Flexible spending limits

Our expense management software can also give you a lot of control and flexibility over the spending limits that you set. Pluto allows you to set specific spending-limits for vendor and change them in real-time online.

This allows you to track expenses for specific countries or cities, while removing the need to manually configure spending limits each time someone makes a trip request.

3. Expense reports and analytics

If you want to make your expense management more efficient, you’ll need accurate data and insights into the spending habits of your employees.

Pluto gives you real-time reporting and analytics, to give your finance teams an easier time combing through all the expense data. For instance, a system with robust reporting capabilities should:

- Categorize expenses and organize reports by expense type

- Reconcile your reports

- Give you spending insights across all your departments

- Keep track of violations of your expense policies

- Provide you with real time spend visibility

By getting a clear picture of your expenses, you’ll have an easier time ensuring policy compliance, preventing fraud, and reducing travel costs.

4. No FX fees and multi-currency functionality

If your employees travel internationally frequently, you’ll want a product that comes with a card that doesn’t have additional fees or surcharges for international purchases.

At Pluto we have 0 FX fees. Furthermore, you’ll have an easier time managing these expenses due to multi-currency functionality automatically converting all transaction information to your country’s currency.

5. Mobile functionality

If you are trying to simplify your expense reporting process for travel expenses, then you need a way to work on those expenses on the go. Pluto’s mobile app would allow your employees to report their expenses right away from any location, while also giving them the ability to submit receipts digitally.

6. Integrated card management

If you opt for a software provider that also offers corporate credit card services, you’ll be able to automatically reconcile expense report entries with your card statements, detect any expense bottlenecks, and generally reduce the chances of fraud or misuse.

Pluto card management software will also give you more control over your corporate spending. Plus, you’ll be able to set and control your spending limits with much more ease.

7. Compatibility with other tools

When it comes to the use of technology in expense management, the more, the merrier.

Pluto can be integrated with your accounting software so that it can automatically populate expense reports and simplify your reimbursement through the use of your organization's accounting data.

Furthermore, by integrating your TEM system with your travel management system you can instantly take the travel booking information and add it to your expense reports.

8. Automated workflows, expense categorization, and tax calculation

The entire point of using travel expense management software is to automate as many processes as possible.

This includes the ability to customize your travel policies and approval workflows, categorize expenses for more straightforward tax calculation, and determine whether they are tax deductible or not.

Furthermore, by categorizing your expenses, you’ll have an easier time complying with the tax regulations of your country.

9. Scalability

One feature that is sometimes overlooked in software platforms is the ability to scale your operations as your company grows. You don’t want to choose a system now only to realize it no longer meets your needs further down the line.

In this regard, Pluto is a great pick as we have the backend to support any business sidez from small teams to enterprise level accounts.

Key takeaways

Effective expense management is all about visibility, flexibility, control, and automation. The most common pain points from T&E management come from outdated policies and manual inputs, which you should seek to update and simplify via means of a robust expense management platform.

When it comes to making your travel and expense management more efficient, the key things to remember are:

- Review and update your policy continuously to ensure it meets the needs of your business and employees.

- Examine your current expenses to look for opportunities to reduce reimbursements and consolidate expenses.

- Use Pluto to automate approval workflows and simplify the expense reporting process.

- Pluto also offers strong reporting capabilities, gives you a lot of flexibility for spending limits, and can be integrated with other tools for maximum effectiveness.

•

Mohammed Ridwan

Guide to Accounts Payable Audit With Step-by-Step Process and Checklist

Your employee receives the vendor invoice and goes to the department manager and procurement department for three-way matching — invoice, purchase order, and goods receipt. Once approved, the finance department prepares to clear the payment. Finally, the accounting department makes the journal entries and updates accounting records. This is an end-to-end accounts payable process.

But it isn't as simple and straightforward. The chances of errors increase with various stakeholders involved. These range from manual data entry mistakes and invoice duplications to missed discounts, late payments, and inaccurate coding. This intricate process further results in unapproved invoices, incomplete documentation, vendor communication gaps, and mismatched purchase orders.

Hence, it becomes imperative to conduct regular checks. The inspections look into the internal processes to identify loopholes and act as an early sign. This post will discuss what an accounts payable audit is and how you can prepare for it.

{{less-time-managing="/components"}}

What is an Accounts Payable Audit?

An accounts payable (AP) audit is a type of accounting audit that investigates a company's accounts payable records, statements, and processes for potential errors, fraud, and non-compliance.

In an AP audit, auditors track AP transactions from beginning to end, including the purchase order, invoice, approval steps, payment, and reconciliation, ensuring that everything has been recorded and documented correctly.

The auditors assess the internal records and documentation for the following:

- Validity - Are all invoices and transactions verified as genuine, preventing payment for unauthorized items?

- Completeness - Are the invoices, purchase orders, and delivery receipts recorded correctly to avoid missing any payments?

- Accuracy - Is every invoice amount cross-checked against corresponding purchase orders and delivery receipts to prevent payment errors?

- Compliance - Are the accounts payable documents compliant with tax and company policies to avoid penalties and ensure ethical financial practices?

Further, the auditors inspect the internal processes for the following:

- Segregation of Duties -Are responsibilities clearly divided to prevent conflicts and maintain a system of checks and balances

- Approvals - Are transaction approval processes in place, ensuring compliance with policies and accountability?

- Access Controls - Are access controls effectively implemented to protect sensitive information, preventing unauthorized access and potential breaches?

By addressing these questions, the auditors find areas to improve and strengthen the accounts payable system. This process provides a thorough picture of financial operations, identifying weaknesses that could affect accuracy, efficiency, and compliance.

How to Conduct an Accounts Payable Audit

Before establishing an audit plan, you need three things to prepare for an accounts payable audit:

1. Stakeholder Input

Schedule meetings with key stakeholders such as finance managers, approvers, and document handlers. Ask for their insights on pain points, challenges, and expectations related to the accounts payable process. Document their feedback and use it to tailor the audit plan. It helps to address specific concerns and improve efficiency.

2. Documents Repository

Conduct a comprehensive review of the current document storage system. Ensure all relevant documents are organized, labeled, and stored in a secure, easily accessible location. If you are using digital AP software for the repository, validate that it has proper version control and is updated.

Checklist of Documents Required

- Vendor Invoices

- Purchase Orders

- Goods/Services Receipts

- Vendor Contracts and Agreements

- Payment Records

- Expense Reports

- Vendor Statements

- Credit Memos

- Internal Controls and Policies

- General Ledger Entries

- Tax Documents

- Bank Reconciliation Statements

- Vendor Information

- Access Logs

- Expense Allocation Documentation

- Documentation of Disputed Invoices

- Employee Authorization Forms

- Proof of Payment

- Inventory Records (if applicable)

- Regulatory Compliance Documentation

3. Access Control

Review and update access controls to restrict access to sensitive financial data. Work with IT and security teams to ensure only authorized personnel can access critical systems and repositories. Also, periodically verify user access levels and promptly revoke access for individuals who no longer require it. This helps maintain a secure and controlled environment.

4-Step AP Audit Procedure

With all the documents ready, inputs gathered, and access shared, you can initiate the AP audit procedure. It includes the following steps:

Audit Plan

Establish an audit plan to define the scope of the audit, specifying the departments and time frame under consideration. Assign audit team members and allocate necessary resources for the audit. Identify potential risks such as errors or compliance issues.

Here is what an audit plan looks like.

Audit Plan

Objective: The primary aim of this audit is to express an opinion on the fairness of XYZ Company's financial statements in accordance with Generally Accepted Accounting Principles (GAAP).

Scope: The audit will cover the financial statements of XYZ Company for the year ended December 31, 20XX, including the balance sheet, income statement, statement of cash flows, and accompanying notes.

Audit Team: The audit team will consist of the lead auditor, staff auditors, and specialists as needed. The team members will be assigned specific tasks based on their expertise and the areas to be audited.

Audit Approach: The audit will be conducted as per the auditing standards and guidelines issued by the relevant regulatory bodies. The approach will include substantive testing, tests of controls, analytical procedures, and other audit procedures as deemed necessary.

Materiality Threshold: The materiality threshold for the financial statements is set at $XXX. Any misstatements or discrepancies exceeding this threshold will be considered material.

Risk Assessment: The audit team will conduct a risk assessment to identify and assess the risks of material misstatement in the financial statements. The evaluation will consider both inherent and control risks.

Audit Procedures:

- Cash and Cash Equivalents:

- Confirm bank balances and reconciliations

- Test cash transactions and cutoff procedures

- Review bank statements and related agreements

- Revenue Recognition:

- Test sales transactions and revenue recognition policies

- Review contracts and agreements for completeness and accuracy

- Verify the accuracy of recorded revenue

- Inventory:

- Observe the physical inventory count

- Test inventory valuation methods

- Review inventory turnover and obsolescence

- Accounts Payable:

- Confirm outstanding payables with vendors

- Test completeness and accuracy of recorded payables

- Review payment terms and agreements

- Fixed Assets:

- Verify the existence and valuation of fixed assets

- Test depreciation calculations

- Review additions and disposals

Documentation: All audit procedures, findings, and conclusions will be documented in working papers, including supporting evidence and references to applicable accounting standards.

Reporting: A draft of an audit report will be prepared for management review before issuing the final report. The report will include the auditor's opinion on the financial statements and any relevant disclosures.

Fieldwork

With the audit plan in place, the audit team moves on to a detailed examination of the accounts payable process. Simultaneously, it also engages with key stakeholders to get valuable insights into the practical aspects of the AP process. In this stage, it ascertains the effectiveness of internal processes in safeguarding against potential risks. It performs the following assessments:

- Verify completeness and accuracy of invoices, purchase orders, and payment records

- Match invoices with purchase orders and delivery receipts

- Check for discrepancies in amounts or quantities

- Evaluate the adherence of the approval process to established policies

- Confirm proper authorization before payment processing

- Review vendor master file for accuracy and up-to-date information

- Implement checks to identify and rectify duplicate payments

- Ensure compliance with internal policies, industry regulations, and legal requirements

- Review accruals and prepaid expenses for accurate reflection of the financial statements

- Verify the accuracy of data entry in the financial system

However, an audit team struggles the most with finding the proper documents. Either the internal team fails to provide the specific invoices, purchase requests, and purchase orders, or it gets lost in the pile of documents. This slowdown in the audit process increases the risk of oversight and incomplete scrutiny, compromising accuracy and thoroughness.

The best way to fix this leak is to go for accounts payable automation.

With AP automation, you streamline approvals and payments and create a centralized hub for bookkeeping. Instead of manual record-keeping, the tool automatically captures and extracts all necessary documents. Its integration capabilities ensure consistent data across the organization, simplifying data management and retrieval.

Audit Report

Finally, the audit team prepares a detailed audit report, including an executive summary, methodology, findings, and recommendations. The report provides a comprehensive overview, detailing identified issues and areas of strength.

To read an audit report and implement it effectively, follow these steps:

- Involve the audit committee, executive director, and senior financial staff in reviewing the report.

- Identify significant issues, such as financial conflicts of interest, and address them promptly. Classify minor concerns, such as operational inefficiencies and technological deficiencies, for resolution over several months.

- Consider the list of best practices and custom recommendations provided by the auditors. Use them to plan and prioritize your organization's next steps.

- Evaluate the "scope, nature, and timing" of the audit conducted by the audit team to assess the auditors' efficiency in utilizing resources without redundancy. Explore ways to make the audit process more efficient for the next cycle.

Regardless of the audit cycle, continuously assess and improve auditing procedures. Explore options such as accounts payable automation, process optimizations, and strategic partnerships.

Follow-up

During this stage, the audit team monitors the implementation of recommended changes. It involves continuous communication with stakeholders to address concerns or questions arising from the audit report. The team also ensures that the proposed improvements are effectively integrated into the organization's processes.

Preparing for Your Next Accounts Payable Audit

To make your next audit easier for the auditors and the internal team, address past findings and consider adopting accounts payable automation for efficiency. By addressing previous audit issues, you proactively improve your internal processes by resolving identified issues. It builds a culture of accountability and responsibility, laying the groundwork for a more efficient and effective audit process in the future.

An AP automation software becomes a central hub for the documentation, streamlining the intricate process. Automated document capture and retrieval ensure swift access, minimizing errors. Also, it highlights areas for improvement, enabling the team to address issues beforehand.

As a result, audits become more streamlined, faster, and less stressful, ensuring strict adherence to rules and optimal functionality. We have curated a list of top AP automation software to help you pick the right one. Check the top 7 accounts payable automation solutions that simplify the accounts payable process and audits.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use