Contents

Corporate vs. Business Credit Card: What is the Difference?

Leen Shami

•

•

Corporate credit card vs. a business credit card. You might have heard both terms used interchangeably, but what's the difference?

Primarily, corporate cards are issued to large businesses with many employees, while business credit cards are designed for smaller businesses. Corporate cards generally have higher spending limits and may offer more perks than business cards due to their volume.

This post will cover the main differences so you can decide which card is best for your business.

{{gain-control-banner="/components"}}

What is a Business Credit Card?

A business credit card is a commercial payment solution for companies and businesses. Similar to a personal credit card, business credit cards are used when business-related purchases are made on credit provided by one of the credit card companies.

Banks in the UAE and MENA offer various business credit cards for small, medium, and large companies.

Business credit cards usually offer higher credit limits than personal credit cards and may come with exclusive privileges, such as free travel insurance, concierge services, and air miles.

In the case of small businesses, a personal credit score will play an important role in credit limit approval.

What is a Corporate Credit Card?

A corporate credit card is issued to company employees to help with business expenses. The company will be liable for any debts incurred on the card.

It is important to note that corporate cards are not personal credit cards and should only be used for business purposes.

Financial institutions expect you to spend more with a corporate card than a business card, as the companies that require those cards are usually bigger. Therefore, the company must have a good credit score to qualify. This can come with various perks, such as lower interest rates, extended grace periods, and, most importantly - higher spending limits.

At the same time, there can be some drawbacks, such as:

- Long approval periods due to the nature of the financial product.

- Limited online features for your cards and company spend management.

What is a Pluto Card?

Pluto is MENA's corporate card that helps finance teams take control of their company's expenses while saving their business time & money. While Pluto can't give you a line of credit, you will be able to instantly issue as many business and corporate cards as you need while getting a complete overview of your business's spend management on one dashboard.

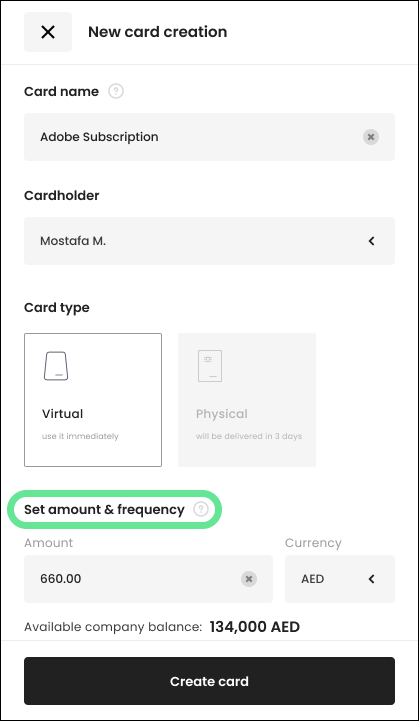

Virtual credit cards

Virtual cards are corporate credit card numbers used for online business-related purchases and contactless payments.

Although there is no physical card, virtual credit cards are great as they are flexible, convenient, and controllable.

With virtual credit cards, you can:

- Issue unlimited virtual credit cards/employee cards;

- Create a virtual credit card within seconds;

- Set employee spending limits to avoid going over budget;

- Generate a one-time use purchase card that deactivates as soon as it is used;

- Set purchases to be made with specific vendors so the card can't be used for other purchases;

Chances are that if you need a virtual credit card at your existing bank, it might take quite some time, and the reporting and limit setting options might not be very user-friendly.

While Pluto cannot provide you with credit cards, we can issue as many virtual cards as you need with just a few clicks:

Physical credit cards

Physical corporate credit cards serve the same purpose as virtual and business credit cards, making payments. Unlike virtual cards, physical corporate credit cards can be used in person to make purchases.

While both virtual and physical credit cards are comparable, the main differences are:

- Physical corporate credit cards may take up to 3 business days to be delivered.

- Virtual cards cannot be used physically.

- Virtual cards are safer for the user, as they cannot be lost or stolen.

Benefits and perks

The benefits and perks differ for business and corporate credit cards and Pluto cards.

Business & corporate credit cards:

- Receive Business reward points for purchases made that can be redeemed for future purchases.

Pluto cards:

- Gain access to over $35,000 in perks and rewards programs

Why are Business Credit Cards and Corporate Credit Cards Different?

Now you know the main difference between business and corporate cards, but let's investigate some of them in more detail.

Expense management tools

Business credit cards are frequently limited to your online banking platform. In the case of corporate credit cards, you may get something slightly better - an enterprise solution.

But from what we have seen, the speed of card issuing or limit changes is usually lacking.

Pluto doesn't give you a credit line, but here is a list of things that Pluto's expense management platform does:

- Unlimited corporate cards (within seconds);

- Set spending limits on corporate cards to avoid going over budget or being overcharged;

- Issue one-time purchase cards that deactivate after being used;

- Real-time transactional data - know what (and where) is being spent in real-time;

- Ability to oversee company financials and receive instantaneous expense reports;

- Automated accounting;

- Sync transactional data to major accounting platforms;

- Simple and quick reimbursements;

- Digitized receipt reconciliation;

- Close books in hours, not days.

Corporate and business card fees

The fees that you might have to pay on corporate and business cards fall into two main categories:

Annual fees

For business and corporate credit cards, annual fees may differ depending on the bank or credit card issuer you choose to move forward with. Typically, the UAE's yearly fees range from 0-800 AED, with 'free for life' being the most popular.

If there are any fees, you can typically waive them by spending a certain amount per year.

Pluto cards do not have any annual fees and are entirely free; however, if you're a large corporation that wants unlimited users, custom ERP integrations, or a dedicated account manager, there will be a monthly subscription fee.

FX fees

Business and corporate credit cards tend to incur FX fees, making it expensive for a company owner, a small business, or a large business to do any transactions outside their domestic currency.

FX fees can be high, and credit card issuers are usually not transparent with the fees that come with them. Typically, fees come in the form of an FX spread and are hidden inside your payment, meaning you might be paying 2-6% for a transaction in a different currency.

Just imagine how much of your spending is in a different currency and take an optimistic 4% fee from that amount. Now multiply it by five years.

Pluto does not charge FX fees, making it the perfect choice for companies or businesses that frequently transact in foreign currencies.

Application & Approval Process

You must wait around two weeks for a business credit card approval. After the approval process, it may take up to 10 business days to receive your business credit card.

With a corporate credit card, the time may vary, but the chances are that you will need to wait more than 5 business days before you get approved.

From our experience, when you need an expense card - you need it on the spot!

Pluto has adopted a KYB & KYC (know your business and client) process that allows us to onboard customers in minutes. After you set up your account, you can start issuing virtual cards and continue your work without halts or limitations.

Corporate vs. Business Credit Cards Pros and Cons

While a corporate credit card and a business credit card may be comparable in some aspects, there are some differences between the two financial products.

Business credit card pros

- Available for most businesses in their standard banking products;

- Standard application process with low business requirements;

Business credit card cons

- Usually limited in numbers, one card is internally shared amongst many employees. That creates bottlenecks in spending and raises various security risks;

- Non-existent (or very limited) spend management platforms to monitor your reporting;

- No virtual cards;

- High FX fees;

Corporate credit card pros

- Higher spending limits;

- Possibility to issue several cards;

- Safe & secure, as information is not being shared;

Corporate credit card cons

- Longer approval process;

- High FX fees;

While the pros and cons for both types of cards may vary, the final decision will be based on the size of your business.

Why Pick Pluto Card for Business and Corporate Users?

As mentioned, Pluto won't give you a line of credit; instead, Pluto provides you with an all-in-one expense management solution.

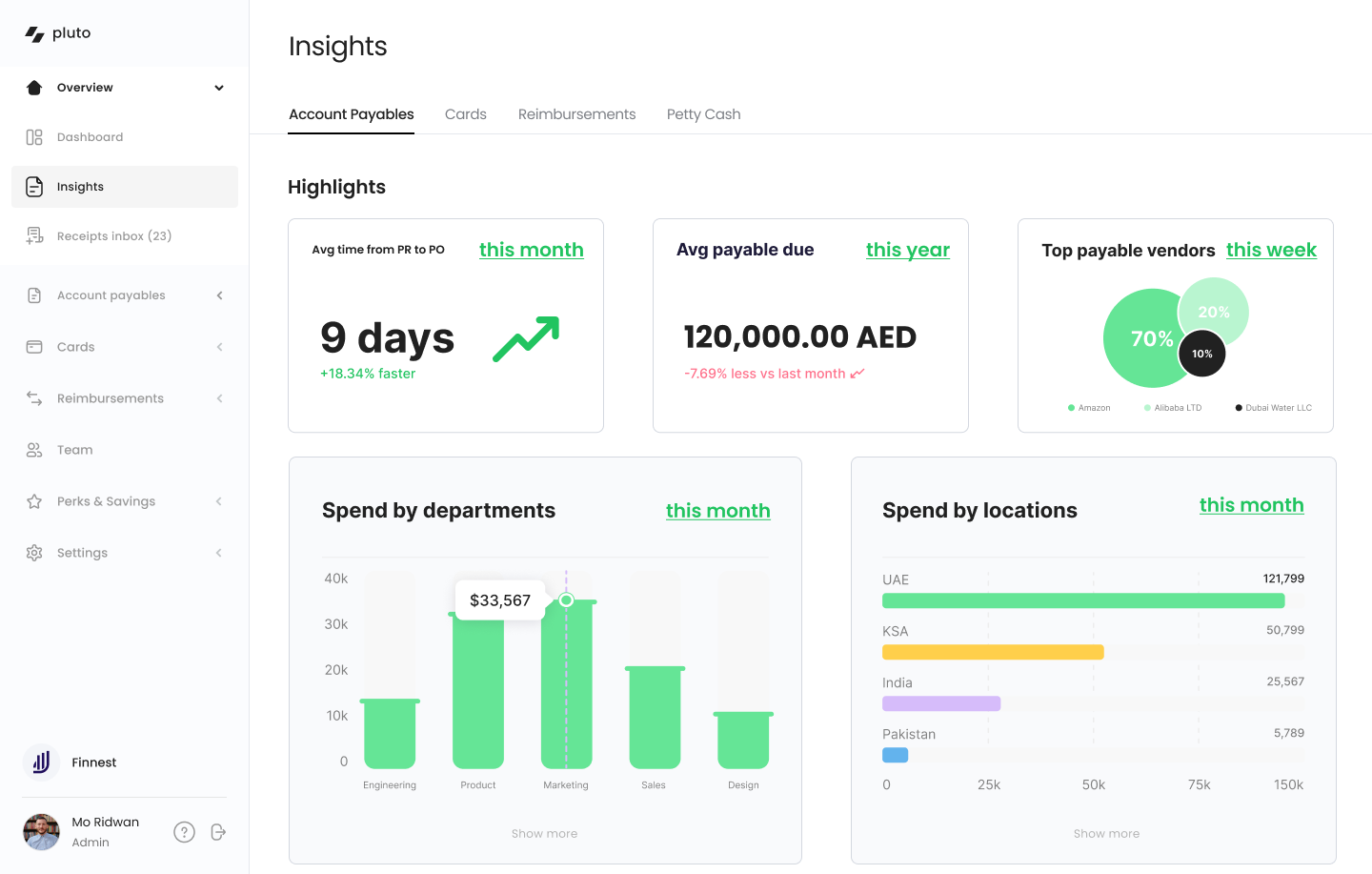

Pluto's spend management platform

- All your business expenses are at your reach on Pluto's dashboard;

- Control over all issued cards and their limits;

- Creation of unlimited virtual cards;

- Real-time expense reporting;

Approval workflow on Pluto

Once you have access to Pluto's expense management dashboard, you'll also be able to set up approval flows and automation.

With Pluto's approval workflow, you can:

- Get visibility and control over your expenses;

- Streamline how you manage your spending;

- Automatically direct approvals to the right employees;

- Create approval flows within departments;

Real-time expense reports

With Pluto cards, you'll gain real-time transactional data on company spending while being able to set strict budget limits.

This will also help you make informed decisions about allocating resources and improving your P&L.

Additionally, you can also set up notifications to be sent to your accounting or finance team whenever a transaction is made. This way, they'll always be in the loop and can take appropriate action if needed.

Which Card is Best for My Business?

The final pick of the card will depend on several factors related to your business.

Industry

The needs of companies based on their industries may differ. Consulting businesses need a flexible card solution with no FX fees, as their employees travel frequently. Digital agencies need multiple virtual cards to onboard new projects and pay for ad networks daily.

Consider the needs relevant to your industry and decide from there. While Pluto is an excellent pick for all industries (as we have a very versatile product), here are some of the use cases that illustrate the needs and how Pluto solves them:

Size

Annual revenue, the number of employees, and spending volume will also come into play when making your decision.

If it is just you or a couple of employees, you may not need many cards (or you might take advantage of Pluto's virtual cards).

On the other hand, if you have a sales team that needs to pay for lunches with prospects every second day, one card in the business owner's name will be problematic!

Control

How much control do you need over your spending? Classic credit cards (be it business or corporate) usually have just a few features that are extensions of your online banking.

In some cases, that might be enough. If there is one card and one person using it - setting limits and monitoring the spending is not an issue.

Pluto comes into play when you have several holders and many cards, as you can set custom limits on cards. Real-time reports of spending suddenly become very important to increase and decrease limits on the go.

Key Takeaways

- Business credit card is the best fit for small business owners; they offer a standardized solution.

- Corporate credit cards are for bigger companies, allowing higher spending and slightly better control.

- Pluto cards (used for all business sizes) can provide unlimited virtual cards and give you access to an all-in-one expense management platform.

FAQ

Does a corporate credit card affect my credit score?

A corporate card is a company's liability and does not affect your credit score, and you will not see them on your personal credit report. Pluto cards do not affect your credit score in any way (as they do not provide loans or credit facilities).

What is the difference between a business and a corporate credit card?

The main difference between small business credit cards is the size of the company that uses them, followed by credit limits and available control features. Pluto provides cards to corporations and businesses through the all-in-one spend management platform.

What is meant by a corporate credit card?

A corporate credit card refers to a card provided by the company to the employee for various business-related expenses.

Is a corporate card the same as a credit card?

Credit cards primarily draw from an approved loan balance, while corporate card programs are just an extension to a dedicated corporate account. But the terms are used interchangeably nowadays.

What is the difference between corporate and domestic credit cards?

A domestic card may refer to a debit card or a card issued by your local bank for your local use. Corporate cards are accepted internationally, at the ATM, or online.

Can a corporate card be used for personal use?

No. By default, corporate cards have to be used for business expenses, which are reported into accounting, but most importantly, it is the company's money on that card. The only exception will be if your company allows it.

What is the advantage of a corporate credit card?

Usually, it comes down to higher spending limiting. Compared to small business credit cards, corporate credit card debt does not usually require a personal guarantee, as the company guarantees it.

In the case of Pluto's corporate card, we can also add - unlimited virtual cards, real-time team-wide spend control, instantaneous reporting, and no FX fees!

Does a corporate credit card affect my credit score?

No. If the corporate credit card has a credit facility attached to it (it usually does), it is a company liability, not a personal liability. You are given access to a portion of their credit facility that does not fall into the personal loans group, and you do not need to provide personal guarantees.

Can my company require me to put business travel on my own credit card?

No, the company cannot force you to put business expenses on your credit card, but it is sometimes easier for everyone. So, if you agree with that, and the company agrees to reimburse you - it is not a problem.

If you are looking for a better solution, let the Pluto team know, and we will provide you with an easy corporate card platform for your whole team.

Do corporate credit cards require a credit check?

A corporate credit card (in its classical meaning) is attached to a loan facility. To approve this loan facility, banks must do a company credit check.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Leen Shami, Content Marketing Lead

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

.jpg)

•

Vlad Falin

What is Spend Management? Importance, Benefits & Process

In the realm of business operations, effective spend management is crucial for maintaining a healthy financial bottom line. Businesses grappling with inefficient spending control face risks that can substantially impact their financial stability.

For example, poor invoicing practices that cause a delay in payment can lead to contract management issues or, even worse, a lost client for your business. It also might cause issues with some of your preferred suppliers if they feel they’re not being paid on time.

Making a slip-up that disrupts a subscription can mean your company lacks access to critical software or tools until the issue is fixed.

A poor expense report system means charges incurred on your business trip might result in many follow-up questions, so your accounts payable team is on the same page with purchase orders. A system without real-time visibility for spending data is not ideal for any organization and does not make it easy to reduce spend.

Intelligent spend management helps prevent these issues. A business uses spend management to comprehensively track and review organizational-wide spending and purchase orders down to the last dirham.

In this post we will deep dive into spend management and discuss the best ways to properly manage it.

What is spend management?

Spend management refers to the systematic process of tracking, analyzing, and controlling an organization's total expenditure. It encompasses all aspects of business spending, including invoicing, contract management, subscription services, and expense reporting.

The goal of spend management is to enhance financial stability by providing real-time visibility into all financial transactions and purchase orders. This comprehensive approach enables businesses to identify inefficiencies, reduce unnecessary expenses, and maintain strong relationships with suppliers and clients.

The Importance Of Spend Management

Effective spend management is crucial for a company's financial health and operational efficiency. Neglecting careful expenditure tracking or allowing excessive indirect spending can lead to significant revenue loss, risking even the most well-planned business strategies. Managing costs and enhancing efficiency becomes challenging when financial processes are time-intensive and complex.

A report by McKinsey highlights the critical nature of this issue, noting that external spending on suppliers typically represents 40-80% of a company's total expenses. This statistic underscores the vital importance of meticulous spending control. Furthermore, the process of reviewing and optimizing expenditures can have a substantial impact on employee workloads, indicating the far-reaching effects of spend management.

Adopting robust spend management practices enables companies to achieve greater financial stability and avert potential crises. Implementing a system that tracks and monitors all financial transactions ensures that expenditures are fully accounted for, reducing the likelihood of wastage. In summary, efficient spend management is not just about cost control; it is a strategic approach that influences every aspect of a company's operations and contributes significantly to its long-term success.

{{cta-component}}

Advantages Of Digital Spend Management

In this day and age, using an online tool to keep track of your expenses should be a no-brainer. Let’s have a look at some of the main advantages.

1. Insight Into Everyday Expenditures

Where is every dirham your company makes going? If you don’t know, digital spend management will dramatically strengthen financial accountability, budgeting, and expenses. In addition, reporting on where company funds are flowing makes it much simpler to see how different department heads oversee budgets. Read more on how to improve internal control over financial reporting.

2. Stronger Financial Controls

Spend management tools like Pluto, allow you to not only monitor your spending in real-time but also set the limits on the go. In addition to that you can issue cards for departments or individuals, and even focus them on a particular type of usage, such as specific vendors only.

3. Budget optimization

Effective spend management is a great solution to ensure a better-looking budget. Analyzing and managing spending makes it simple to find and cancel unneeded services, negotiate lower prices with new supplier contracts, and never have to pay a late fee again. It will also significantly help your board of directors as they’ll have a simplified, streamlined budget to review and discuss at the start of the year.

Common Spend Management Challenges

It’s easy to pursue spend management practices that hurt your business’s bottom line if you’re not careful. Many ‘traditional’ best practices might not fit companies with remote-first work policies, engage in cutting-edge industries, or have an unorthodox structure.

If your company has a dynamic structure, spend management becomes all the more important to help you keep up with the competition and get the most value out of every dirham spent.

Keep these potential challenges in mind as you pursue spend management practices.

1. Relying On Old Spending Data

Be wary of relying on old budgets or financial data when managing more spend. It’s challenging for leadership to identify problem areas with cash inflows or outflows, when they only have outdated information.

2. Over reliance On Manual Mapping

Having to go back at the end of the month to match spending to budgets manually can take an inordinate amount of hours and opens the door to errors and mistakes that can throw off a spend management policy.

Pluto helps to automatically match spend to budgets in real-time, ensuring accounting and finance teams have accurate updates.

3. Harnessing Too Much Technology

Modern financial software can dramatically help your company’s day-to-day operational flow. However, if these solutions do not work together, chaos can ensue which leads to data migration and processing errors. Pluto integrates with your accounting tools, cutting the data flow time significantly.

4. Outdated Processes

The post-COVID world of remote and digital work means your employees might be scattered across the globe and in different time zones. Having to arrange shared corporate cards manually or coordinate team spending with employees in different locations can be tricky. Pluto offers unlimited virtual cards, which allow you to provide a payment channel for any employee anywhere in the world.

How To Improve Your Spend Management Process

Optimizing your spend management process might seem tricky at first glance. Fortunately, small and large businesses often rely on the same core strategies to optimize spending.

1. Rely On Spend Management Software: Pluto can help automatically track expenses, keep abreast of budgeting, and help manage strategic sourcing. CEOs and CFOs then have relevant, real-time data at their fingertips to see where their company is financially.

2. Focus On A Few Payment Methods: Do you have too many company cards in your pocket? It might be time to streamline purchasing methods to help simplify your spend management strategy. For example, your business can dramatically improve expense tracking by asking employees to only use company cards for business expenses instead of asking for their personal cards to be reimbursed.

3. Have An Organized Approval Process: You can clarify your spending process (you might want to check our post on how to create a corporate card policy) by ensuring employees have a clear hierarchy of how and by whom purchases need to be approved. If your team is unclear, they might complicate the payment process by not filing the right reports, which means your financial team could be left in the dark about purchases.

6 Efficient Spend Management Strategy Tips

Your company needs to optimize its spend management strategy to ensure the final results lead to reduced procurement costs, improved efficiency, and streamlined workflows.

Spend management best practices also help improve vendor relationships and communication, procure the optimal goods and services your business needs, and even help you earn volume and early payment discounts due to more effective and simplified financial practices.

Keep the following steps in mind for the best results regardless of your organization’s industry or size.

1. Calculate Expenses

Do you know exactly where employees spend company funds? If not, you’ll need to build a comprehensive list of company expenses, suppliers, and entities where funds are going.

This might quickly become a challenge if you’re in charge of a large business. If so, look to designate specific team members to review employee salaries, utilities, marketing, training, and all other day-to-day expenses to have the most detailed list.

You can’t improve what you do not measure. You can use Pluto to get a firm grip on your expenses. Pluto allows you to monitor and control your expenses so you clearly see how much was spent in which category.

2. Confirm Data

You’ll want to ensure all accrued expense data is accurate and can be cross-checked with receipts and inventory records. Ensuring transaction data is precise, and expense lists are free of duplicates, spelling mistakes, and other mistakes makes the entire spend management process more efficient.

Take this step extremely seriously if your company spend practices have relied on more manual processing methods. Standardization ensures that multiple currencies, formatting differences, and other nuances are accounted for when looking at spend analysis data.

(Goes without saying that when using Pluto this is all pre-done for you!)

3. Categorize Information

While optimal spend management brings all expenditures under a single umbrella to review, your team will still want to categorize expenses into various groups to make reviewing and making adjustments across different departments simpler.

It’s usually best to categorize expenses in multiple ways to understand where money is going. Pluto allows you to categorize expenses both through specialized cards or just by tagging, so everything is nicely grouped together when it is review time.

4. Review Expenses

A well-thought-out process of calculating, verifying, and categorizing spending information will simplify your entire review process when you’re looking at spend data.

You should immediately be able to spot expenses that are anomalies or recurring spending that might be able to be cut out from the start.

Pluto’s dashboard can give you a high level but also a detailed view, so you can clearly identify trends and separate expenses.

5. Devise A Strategy

You’ll want to move decisively once you’ve identified potential changes to spending habits and department budgeting approaches.

It might seem difficult at first glance to start reducing budgets, cutting out vendors, or make other dramatic changes to your company’s budget and expense habits. Rely on good change management practices and your leadership team to cultivate employee and stakeholder buy-in to any adjustments.

6. Practice Good Data Forecasting

Keep updating your expense data as you make a budget and spending adjustments. Doing so keeps your team on top of where funds are going and can help forecast different spending scenarios and how they might impact your business’s bottom line.

Keeping data and information updated becomes particularly important if your expenses grow to ensure financial operations run smoothly. Don’t forget to cultivate supplier relationships if you work with different vendors for optimal inventory management.

Should You Rely On Spend Management Software?

Manually processing expense claims, keeping up with petty cash, and tracking company credit cards can quickly turn inefficient, hinder your company’s financial management, and inhibit the overall procurement process.

In contrast, the right spend analysis solution can aid real-time expense tracking, provide easy-to-read charts and graphs of high-level expenses, and capture and store financial-related documents, so your finance team members are not scrambling to find a receipt or report.

Pluto has a multitude of features including procurement software and account payable that will help you with spend management and make spend control much easier.

1. Flexibility

Pluto allows you to create cards for various purposes, edit spending limits on the go and monitor your expenses in real time. This allows you to scale up or down depending on what your business needs at any given moment.

2. Powerful Analytics

With Pluto, you will be able to track spending patterns and areas of high expenditure and get real-time insights into your business finances. The powerful analytics will help you make better decisions about where to allocate your resources.

3. Ease Of Use

The main bottleneck of many spend management platforms is that the employees do not use them - as it is just too time-consuming. Not with Pluto! The sleek and user-friendly interface makes expense management a breeze.

4. Simplified Reimbursements

Receipt upload and reimbursements can be quite a burden for the team. Pluto allows you to take pictures of receipts with your phone and just add them to your reimbursements list. With the use of categories and tags, you will be able to both submit and review them in record time!

Key Takeaways For Company Spending

Spend management remains an essential component of all organizations regardless of size. Accountability for every dirham flowing in and out ensures your company maximizes revenue and remains growth-focused, no matter the budget.

You can take the first step today by relying on Pluto and processes to establish control over budgets, track spending, manage payments, cut costs, and boost your financial team’s day-to-day operations and processes.

•

Vlad Falin

The Role of Accounts Payable Automation in Modern Accounting Practices

From receiving goods to clearing payments, it is not a single-click process. Multiple steps in between make the accounts payable process tedious and time-consuming.

You receive goods, match them with purchase orders and invoices, send the invoices for approval, make the payment, and finally, maintain records for bookkeeping. This process alone takes weeks and creates confusion when multiple stakeholders are involved.

Think about purchases above $50,000. There are multiple approvals, and each purchase triggers a unique workflow. Documents are not consolidated, and no one has a clear idea of the payment status.

Thus, accounts payable become chaotic.

Can You Automate Accounts Payable?

To streamline your accounts payable process, you can use tools to automate it. This will simplify bill payments and give you more visibility and control over money.

While it will take time for stakeholders and employees to embrace automation, you can consolidate your scattered pieces on a centralized platform. If you are looking for suitable AP automation tools for your company, check out our list of the top accounts payable automation software.

This post will delve deeper into how you can automate the accounts payable process and how it will help your business.

{{less-time-managing="/components"}}

What is the Accounts Payable Automation Process?

Accounts payable automation uses tools to automate invoice verification, approval workflow, payment processing, and bookkeeping.

Instead of manually organizing, matching, approving, and clearing invoices, the entire process goes on a digital platform to provide visibility and control at each step. So, earlier, employees would spend hours getting approvals and days clearing payments, but now, an automation tool reduces the invoice processing time.

The platform captures and extracts the invoice from emails via optical character recognition (OCR). The invoice goes to the platform with all the critical information, such as purchase order and simplifies three-way matching. A trigger-based approval workflow notifies the stakeholders to approve invoices. The admin gets complete visibility of each step and clears the payment without going through a variety of software.

How to Automate Accounts Payable

Automating accounts payable is as simple as choosing and integrating the right automation software with your existing accounting and procurement software.

The automation software offers visibility into where the money is going and control over the entire process. You can customize the approval workflows and payment gateways and create an ecosystem that supports your procurement process. You can accommodate manual processes and integrate them with other software without going through a complete flip.

With the right automation software, you bring all the critical stages of accounts payable on a centralized platform. Here are the five key steps you can automate:

1. Invoice Management

Manual: The vendor sends an invoice to a dedicated email or a physical copy via fax or mail. The employee receives it and moves from one stakeholder to another for approval. The process is delayed for days if any manager is unavailable. Once the approval is complete, all the documents go to the accounting team, who clears the payment.

Automated: Depending on how the vendor sends the invoice, the automation platform captures the invoice from email or WhatsApp. If you receive a physical invoice, you can upload the invoice, and the system extracts all the vital information via OCR. There's no need to manually enter details or add a general ledger (GL) and taxation code. The system captures, extracts, and consolidates all the invoices.

2. GRN Matching

Manual: The dedicated team receives goods along with the goods receipt note (GRN) and must match it with the invoice and purchase order. This ensures that the specified goods are received as per the purchase order. Manually, this process is prone to errors, leading to discrepancies. It demands accuracy to ensure you receive the correct items in specified quantities.

Automated: Automated software makes this easy by combining all the relevant documents on a single platform. The dedicated team has the invoice and purchase order side by side, making it easy to compare items, purchase orders, and invoices for three-way matching. As a result, spotting discrepancies becomes more manageable, reducing the chances of errors.

3. Approval Workflow

Manual: Once the invoice is received, the employee gets it approved by dedicated managers. Based on the invoice amount, they need more than a single approval. Manually, this means going from one office to another or delving into long threads of email or Slack conversations. It becomes difficult for accounting teams to track approval and clear payments.

Automated: With automated software, each invoice triggers an approval workflow for relevant stakeholders to approve the payments. The admin can create custom no-code workflows based on different if-then rules. For instance, marketing purchases above $50,000 will have more approvals than expenses of $5,000. Also, all the relevant teams will have visibility into the approval status, making it easier to clear payments on time without confusion.

4. Payment Processing

Manual: Once the invoice is approved, the accounting team determines the details and pays via checks, cards, or other payment methods. It takes a few days before the payment is cleared, and the teams need to sync all the information across the accounting software for reconciliation.

Automated: With automation, accounting teams and employees enjoy more flexibility. For instance, Pluto offers corporate cards, payment gateway integration, and a digitization platform for bookkeeping.

- With corporate cards, you can create custom vendor-specific cards with advanced controls to ensure payments are made only for approved vendors.

- Pluto integrates directly with your payment gateways to facilitate payment within the platform.

- If you make payments via checks or other physical modes, Pluto will act as a digital bookkeeping platform. You can enter the payments made on the centralized platform and ensure that all the information is streamlined.

5. Reconciliation

Manual: Reconciliation is the messiest part of accounts payable. Teams must maintain records, manually enter all the details, and sync them across the accounting platforms and ERPs. It is time-consuming, prone to errors, and tricky in case of purchases where one invoice invites multiple tax and GL codes.

Automated: Automation consolidates all the information on a single platform without manual data entry. It uses OCR to extract all the critical information with a feature to upload the invoices in bulk. Further, you can split the transactions to add multiple tax and GL codes to address the audit season rush.

How Accounts Payable Automation Simplifies the Procurement Process

Accounts payable automation is not just for the procurement or the accounting department. It also makes it easier for stakeholders to approve the payments and employees to get timely resources.

Overall, it assists you in bringing together scattered parts of the procurement process. Here are reasons why you must invest in accounts payable automation:

1. Improve Compliance

You get complete visibility and control over your accounts payable. You can create custom workflows to ensure that any purchase that goes against the company policy is rejected. You can also accommodate intricate hierarchies to suit your organization's needs and get timely approvals.

2. Avoid Double Payments

It is usual for teams to end up paying the same invoice twice as no one has visibility into the payment status. It happens when the same invoice is paid twice by different team members or when vendors send the same invoice twice, and both get paid. You can avoid this as the software detects duplicate invoices and gives visibility into the status of invoices. The main dashboard highlights the pending invoices and the ones awaiting approval. It becomes easy to stay on top of all the invoices and avoid errors.

3. Faster Approvals and Matching

You get a trigger-based no-code approval workflow engine where you can create customized workflows to accommodate intricate hierarchies. The software notifies the stakeholders to review and approve the invoices. Since all the information is available on a single dashboard, two-way or three-way matching is a matter of a few minutes. This accelerates the approval process, and payments are disbursed much faster. It improves the vendor relationship without risking over, under, or delayed payments.

4. Better Reconciliation

You get all the relevant documents consolidated on a single platform with the appropriate purchase. Additionally, the software automates the coding and categorization, simplifying the reconciliation process. In case of discrepancies, spotting errors becomes easy. Moreover, with features like locking the approved payments and restricted access for auditing, you can eliminate the chances of fraud or manipulation.

5. Accuracy

You improve the accuracy of your records and GRN matching with all the information streamlined on a single platform. Moreover, as the software relies on OCR, you eliminate the need for manual data entry, reducing the chances of errors. Also, you can integrate the automation software with your accounting platform and ERPs to sync data and ensure consistency across the platforms.

6. Centralized Dashboard

You get a centralized dashboard with all the key information available in a unified place, acting as a single source of truth. Additionally, you get insights that can help in data-driven decision-making to facilitate procurement cost savings. Further, you can view all the awaiting payments and approvals on a dedicated dashboard. You no longer need to run from one platform to another for information as the software integrates with your accounting system.

7. Accessibility

The unavailability of a single person can create bottlenecks in the approval process and block the supply chain. With all the information streamlined on a single platform, each stakeholder can access relevant data for decision-making. So, whether the CEO is traveling or the CFO is not at the office, they can access the details from any corner of the world and avoid disruption in the supply chain.

8. Visibility

You get visibility for each step, each document, and each purchase. You can bring the entire procurement automation on a single platform and track the status in real time. Whether an employee raises a request, gets an invoice, or needs to clear payment, you will stay on top of the information without creating any delays or friction.

Automation is Easy With the Right Software

Adopting automation software isn’t easy, especially for critical processes like accounts payable, which also involve external stakeholders. The top three factors to look for in appropriate software are flexibility, visibility, and integration.

Choose one that integrates with your existing processes and systems and is flexible enough to accommodate complex hierarchies. Instead of focusing solely on the accounting or procurement team, it should cater to all the key stakeholders and make automation easier to adopt.

At Pluto, we aim to bring a balance among the spenders (employees), the savers (finance teams), and the sourcers (procurement teams). Each stakeholder gets visibility, and decision-makers get flexibility. Pluto integrates with your current system and enables you to automate accounts payable without affecting the supply chain.

You can also automate your entire procurement process with Pluto and improve your bottom line. Read more in our procurement automation post.

•

Leen Shami

What is Pluto Card?

What is Pluto Card?

At Pluto, we believe better expense management should be within everyone's reach. We solve MENA finance teams' pain points by replacing their business credit cards with Pluto corporate cards to help manage their expenses, saving them time and money.

How do we do that?

- {{time-money="/components"}}

Create Unlimited Corporate Cards

When multiple employees have access to one company credit card, it can be difficult for finance teams and business owners to track how much is being spent and where.

The result: everyone texting the CEO or CFO for OTPs during important meetings.

Pluto makes it easy to create and distribute virtual and physical corporate cards to each employee. Not only does this minimize fraud risk, but it also makes expense tracking simpler for finance teams, CFOs, and CEOs.

With Pluto’s unlimited corporate cards, you’ll be able to:

- Create virtual cards in seconds.

- Receive physical cards in 1-2 days.

- Use cards for vendor-specific cases.

- Assign every employee a budgeted corporate card.

Spend Control

Are you running ads at a cost that exceeds your marketing budget? Are you providing new hires with an allowance to cover the costs of their office equipment and software, or do you offer employees additional perks such as a monthly gym stipend?

Pluto gives you the ability to set limits and take control of your company’s business expenses, hassle-free.

With Pluto’s all-in-one expense management platform, you’ll be able to:

- Assign virtual or physical cards with spend limits.

- Allocate a specific budget towards daily, weekly, or monthly expenditures.

- Create a single-use purchase card that automatically deactivates once it is used.

- Control spending for different departments by allotting a budgeted amount to be spent.

Goodbye overspending 👋🏼

Reimburse In Record Time

Reimbursements can be a painful process when the end of the month rolls in. Whether you’re scrambling to find lost receipts, trying to match receipts to their expenses, or organizing them in a document, there’s no easy way.

Drag & drop receipts

Pluto makes it easy for employees to list receipts.

Once a business expense is made by an employee, they’ll be able to drag & drop an image or screenshot of the receipt onto the Pluto dashboard.

Yes, as simple as that.

Easily reconcile receipts

Pluto allows you to seamlessly submit your receipts onto the platform. With Pluto, reconciliation is a breeze.

Once a business expense is made:

- Attach receipts to card transactions with just a few clicks.

- Transactions will automatically be categorized.

Add a memo to every transaction.

Get reimbursed in minutes

Waiting till the end of the month to get reimbursed for out-of-pocket business expenses is no longer necessary!

Pluto gives you the opportunity to get reimbursed in minutes.

Once a reimbursable out-of-pocket expense is made, head to the Pluto dashboard to log the expense and get reimbursed as soon as it is approved.

Get Real-Time Data

Your month-end expense report comes in—and you find that you've spent more money than budgeted. Again.

With Pluto, you can stay on top of your expenses at any given moment.

By getting real-time data, you can view reports of your company’s spending and ensure that your company’s finances are in check.

It's simple, Pluto helps you avoid overspending and keep track of your company's finances in real-time.

So what does this mean for you?

- See transactions happening on your cards in real time.

- Receive notifications about every single card transaction, if needed.

- Collect information on which vendors your company is spending the most money with.

- Identify which employees or departments are spending the most.

- Get an overview of the expenses you have incurred daily or month-to-month.

Pluto allows you to adjust if spending has gone off course—and plop some celebratory balloons if it hasn't 🎊!

Integrate With Other Platforms

Every business has multiple platforms, and we know how important it is for them to talk to each other. Pluto's integrations make it easy to get started and ensure you have all the data you need in one place.

Accounting Integration

Pluto syncs your company's transactional data to the most popular accounting platforms through direct integrations so you can automate your accounting and close books faster.

No more end-of-month mayhem! 😅

Mobile Wallet Integration

With Pluto, you can add your virtual or physical cards to your digital wallet to make transactions seamless and easy.

We support Google Pay, Android Pay, and Samsung Pay.

What Else Does Pluto Offer?

Pluto gives you the opportunity to scale your business, without having to worry about the smaller details.

No FX Fees

Pluto doesn't charge you any foreign transaction fees for using your Pluto corporate card outside of the UAE.

If your business is expanding rapidly and your team is traveling more frequently, you won't have to worry about those pesky charges eating into your profits.

Or if your company needs to pay for subscriptions, contractors, or freelancers in a different country, you can do so without racking up a bill in FX fees.

Remote teams, frequent flyers, or big spenders, we've got you covered!

Accepted Worldwide

Whether your team is distributed, travels a lot, or makes international payments, Pluto’s corporate cards are accepted worldwide.

Advanced Security & Privacy

Pluto is PCI DSS Compliant. We take the safety of your information very seriously; all your data is stored and processed following the highest data protection standards in the industry.

Get Started in Minutes

Pluto's sign-up process takes minutes, not hours. By adopting a KYB and KYC process that can be done within a few clicks, you’ll be making transactions in no time.

- Simple application process.

- No credit history is required.

- Fast approvals.

- Instant card access once approved.

Let us take the hassle out of managing your expenses. Start Using Pluto Today - For Free.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use